Candle Stick Charts Crypto

Candle stick charts are a visual way to track the price movement of cryptocurrencies. Each candlestick represents the price action over a certain period of time, with the thickness of the candlestick representing the trading volume during that time.

How to Use Candle Stick Charts to Trade Crypto

Candle Stick Charts are a great way to track the prices of cryptocurrencies. They can be downloaded and used on a computer or mobile device.

To use a Candle Stick Chart, first find the desired cryptocurrency on the “Cryptocurrencies” tab. The table will list the current price and the 24-hour volume. Scroll down to the “Candle Stick Chart” section and click on the desired currency.

The Candle Stick Chart will open in a new window. To use it, first find the “Start Point” and the “End Point.” The “Start Point” is the price at which the candle was opened. The “End Point” is the price at which the candle was closed.

Next, find the “Interval” and the “Width”. The “Interval” is the time interval between candles. The “Width” is the width of the candle.

Finally, find the “Y-Axis” and the “X-Axis”. The “Y-Axis” is the vertical axis. The “X-Axis” is the horizontal axis.

To plot a new candle, first find the “Start Point” and the “End Point”. The “Start Point” is the price at which the candle was opened. The “End Point” is the price at which the candle was closed.

Next, find the “Interval” and the “Width”. The “Interval” is the time interval between candles. The “Width” is the width of the candle.

Finally, find the “Y-Axis” and the “X-Axis”. The “Y-Axis” is the vertical axis. The “X-Axis” is the horizontal axis.

To plot a new candle, first find the “Start Point” and the “End Point”. The “Start Point” is the price at which the candle was opened. The “End Point” is the price at which the candle was closed.

Next, find the “Interval” and the “Width”. The “Interval” is the time interval between candles. The “Width” is the width of the candle.

Finally, find the “Y-Axis” and the “X-Axis”. The “Y-Axis” is the vertical axis. The “X-Axis” is the horizontal axis.

The Benefits of Candle Stick Charts for Crypto Trading

Candle Stick Charts are a great way to help traders visualize cryptocurrency prices and movements over time. They can be used to identify important trends, spot potential buy and sell opportunities, and monitor overall market sentiment. Candle Stick Charts can also be helpful for technical analysis, as they can help identify support and resistance levels, and analyze chart patterns.

The Different Types of Candle Stick Charts for Crypto Trading

There are three types of candle stick charts for crypto trading:

1. Price candles

2.olid candle sticks

3. Time candles

Price candles are usually used to visualize the movement of a cryptocurrency’s price over a given period of time. A typical price candle chart looks like a bar chart with vertical columns that represent the price of a cryptocurrency at different times.

olid candle sticks are used to visualize the movement of the volume of a cryptocurrency over a given period of time. Each row on an oill candle stick chart corresponds to a specific period of time, and the height of the candle corresponds to the volume of cryptocurrency traded during that period.

Time candles are used to visualize the movement of a cryptocurrency’s price over a given period of time, and the colors of the candles correspond to the different times of day.

The Pros and Cons of Using Candle Stick Charts for Crypto Trading

There are a few pros and cons to using candle stick charts for crypto trading.

Pros

1. They are easy to use.

2. They are fast.

3. They are convenient.

4. They are accurate.

5. They can be used with a variety of platforms.

6. They can be customized to suit your needs.

7. They are affordable.

8. They are portable.

9. They can be used in a variety of locations.

10. They are highly accurate.

11. They can be used with a variety of exchanges.

12. They can be used with a variety of wallets.

13. They are easy to learn.

14. They are easy to track.

15. They are easy to understand.

16. They are easy to use with a wide range of trading strategies.

17. They can be used in a variety of markets.

18. They are easy to customize.

19. They are easy to find online.

20. They are easy to find in stores.

21. They are easy to use with a wide range of indicators.

22. They are easy to read and understand.

23. They are easy to move between platforms.

24. They are easy to export and import data.

25. They can be used with a wide range of software programs.

26. They can be used in a variety of timeframes.

27. They can be used on a wide range of markets.

28. They can be used in a variety of trading strategies.

29. They can be used with a variety of indicators.

30. They can be used with a variety of trading systems.

Cons

1. Candle stick charts may not be suitable for all traders.

2. Candle stick charts may not be suitable for all markets.

3. Candle stick charts may not be suitable for all timeframes.

4. Candle stick charts may not be suitable for all trading strategies.

How to Read a Candle Stick Chart for Crypto Trading

candle stick chart for crypto trading

1. Decide on a cryptocurrency to trade.

2. Look up the price of that cryptocurrency on a popular exchange.

3. Compare the price on the exchange to the candle stick chart.

4. If the cryptocurrency is below the candle stick chart, buy the cryptocurrency.

5. If the cryptocurrency is above the candle stick chart, sell the cryptocurrency.

What do Candlestick Charts Mean for Crypto Traders?

Candlestick charts are a popular tool used by cryptocurrency traders to monitor price movements and identify opportunities. Candlestick charts display the price of a cryptocurrency over a period of time, usually 24 hours.

Candlestick charts are divided into two types: the open and the close. The open candlestick shows the price at the opening of the trading day, while the close candlestick shows the price at the closing of the trading day.

When a candlestick is filled with a white candle, this indicates that the price has reached a high point and is likely to decline. When a candlestick is filled with a red candle, this indicates that the price has reached a low point and is likely to increase.

Candlestick charts can be used to identify patterns, such as when the price is moving in a consistent direction. This can allow you to make informed investment decisions based on your analysis of the chart.

How to Analyze a Crypto Candle Stick Chart

The first step in analyzing a crypto candle stick chart is to understand what the chart is displaying. A crypto candle stick chart is a graphical representation of the movement of a cryptocurrency over a certain period of time.

Cryptocurrency candles are typically represented as a series of circles with the size of the circle reflecting the value of the cryptocurrency at that particular point in time. The size of the circles will gradually decrease as the cryptocurrency moves closer to the bottom of the candle stick chart, while the size of the circles will gradually increase as the cryptocurrency moves closer to the top of the candle stick chart.

The second step in analyzing a crypto candle stick chart is to look for any patterns or trends that may be present. Patterns that may be present include whether the cryptocurrency is moving up or down, how volatile the cryptocurrency is, and how long it has been since the last peak or trough.

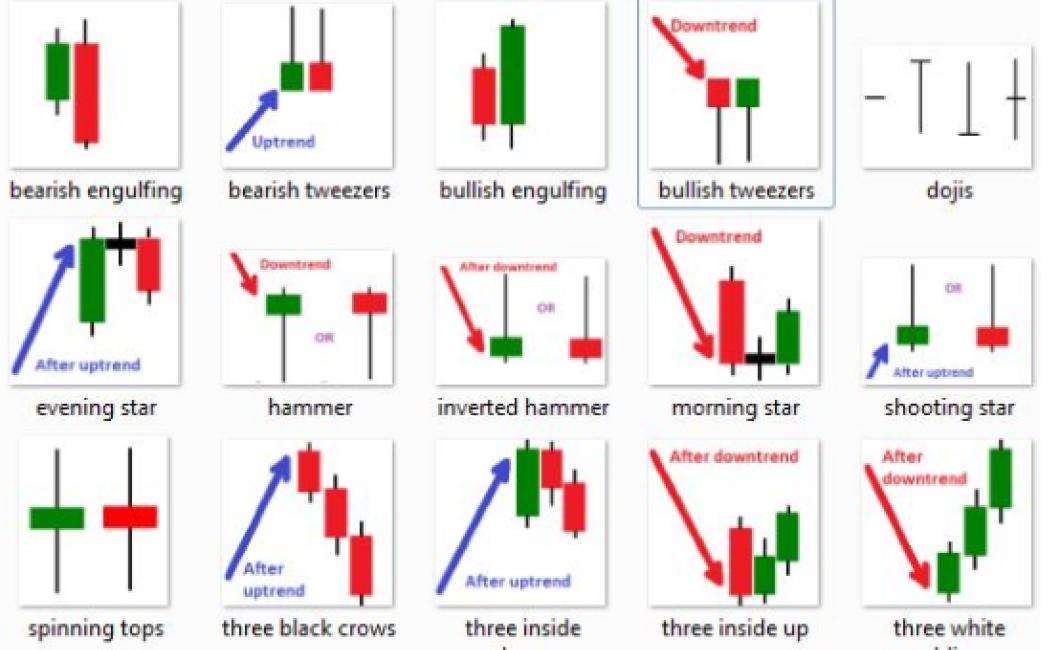

Common candle stick formations for crypto trading

Cryptocurrencies are not just for buying and selling. They can also be used as a way to make an investment. One way to do this is to buy a cryptocurrency and hold on to it. Another way is to trade cryptocurrencies.

When trading cryptocurrencies, it is important to do your research. You need to know what coins are available and what the current market conditions are. You also need to have a trading strategy.

One way to make trading easier is to use candle stick formations. This is a simple strategy that you can use to help you make better decisions when trading cryptocurrencies.

What is a candle stick formation?

A candle stick formation is a pattern that you can see on the charts when you are trading cryptocurrencies. It is made up of a series of short trades.

When you see a candle stick formation, it means that the price of a cryptocurrency is going down. You should buy the cryptocurrency before the price goes down further.

The opposite is also true. When you see a candle stick formation, it means that the price of a cryptocurrency is going up. You should sell the cryptocurrency before the price goes up further.

How to use candle stick formations

To use candle stick formations, you first need to find a cryptocurrency that you want to trade. You can then find the corresponding candle stick formation on the charts.

Next, you need to decide what you want to do with the cryptocurrency once you buy it. You can either hold on to it or sell it.

Finally, you need to wait for the price of the cryptocurrency to go down before you buy it. And you need to wait for the price of the cryptocurrency to go up before you sell it.

How to use support and resistance lines with candlestick charts

To use support and resistance lines with candlestick charts, first find the associated price and time periods. Next, draw a line from the lowest price to the highest price for that time period, and then draw another line from the highest price to the lowest price for that time period. Finally, use the lines as support and resistance levels.

Using Bollinger Bands with Candle Stick Charts in Crypto Trading

Bollinger Bands with Candle Stick Charts are a popular tool used in technical analysis. They can be used to identify when a security is oversold or overbought, and can help you make informed decisions about when to buy or sell.

To use Bollinger Bands with Candle Stick Charts in your crypto trading, first find the appropriate bands width. For example, if you are looking to use Bollinger Bands with Candle Stick Charts to identify when a security is oversold, you would set the width to 2%.

Next, set the center of the candle stick chart to the Bollinger Band width you chose and draw the bands around the chart. The top of the band will be at the top of the candle, and the bottom of the band will be at the bottom of the candle. The width of the band will determine how far from the center of the candle the price is located.

Now, use the two extremes of the band to identify when the security is oversold or overbought. For example, if the security is oversold, the top band will be below the bottom band, and vice versa. When the security is oversold, this means that the price is lower than it should be and is likely to go lower. When the security is overbought, the opposite is true.

Using Fibonacci Retracements with Candle Stick Charts in Crypto Trading

Candlestick charts are a popular way to visualize market action, and they can be used to make informed investment decisions. In this article, we will show you how to use Fibonacci retracements with candle stick charts in order to better predict where the market is headed.

What is a Fibonacci retracement?

Fibonacci retracements are a technical analysis tool that allow investors to identify areas of support and resistance in the market. When used in conjunction with candle stick charts, Fibonacci retracements can provide valuable insight into where the market is headed.

How do Fibonacci retracements work?

Fibonacci retracements are based on the Fibonacci sequence, which is a set of numbers that describe the growth of numbers. The Fibonacci sequence starts with 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on. These numbers can be used to calculate Fibonacci retracements, which is a technical analysis tool that helps investors identify areas of support and resistance in the market.

When used in conjunction with candle stick charts, Fibonacci retracements can provide valuable insight into where the market is heading. For example, if you are looking to buy stocks in a certain sector of the market, you may want to use a Fibonacci retracement to help you identify where the market is likely to stop your investment.

How to use Fibonacci retracements with candle stick charts

To use Fibonacci retracements with candle stick charts, first you will need to create a chart of the stock or cryptocurrency you are interested in. Then, you will need to add a Fibonacci retracement indicator to the chart. The Fibonacci retracement indicator will allow you to calculate Fibonacci retracements for the stock or cryptocurrency you are interested in.

Once you have added the Fibonacci retracement indicator to the chart, you will need to input the values for the Fibonacci retracement. The values you need to input will depend on the type of chart you are using. For example, on a candlestick chart, you will need to input the value for the bottom of the candle and the value for the top of the candle. On a bar chart, you will need to input the value for the bar’s closing price.

Once you have input the values for the Fibonacci retracement, you will need to look at the chart and see where the market is likely to stop your investment. For example, if you are looking to buy stocks in a certain sector of the market, you may want to look for an area of support or resistance that is located near the Fibonacci retracement values you have input.

Tips and Tricks for Using Candle Stick Charts in Crypto Trading

There are a few tricks and tips for using candle stick charts in crypto trading.

1. Use candles to indicate the strength of a trend.

If you see a candle that is significantly taller than the others, it may mean that the trend is strong and that you should buy on the breakout. Conversely, if a candle is significantly shorter than the others, it may mean that the trend is weakening and that you should sell on the breakout.

2. Use candles to predict where the next buy or sell point will be.

If you see a candle that is close to the bottom of the chart, it may mean that the next buy point will be at the bottom of the next candle. Conversely, if you see a candle that is close to the top of the chart, it may mean that the next sell point will be at the top of the next candle.

3. Use candles to identify support and resistance levels.

If you see a candle that is close to a support level, it may mean that the support level is strong and that you should buy on the breakout. Conversely, if you see a candle that is close to a resistance level, it may mean that the resistance level is strong and that you should sell on the breakout.