cryptocurrency daily prices

The cryptocurrency daily prices page provides a snapshot of the day's prices for all major cryptocurrencies.

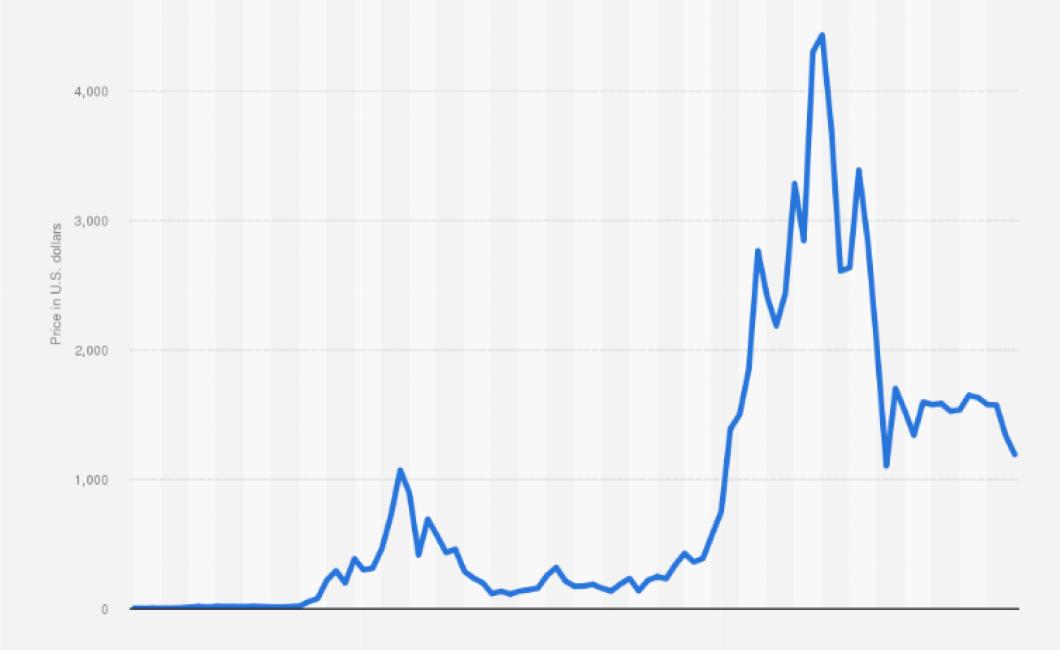

Crypto Currency Prices Soar as Investors Flock to New Asset Class

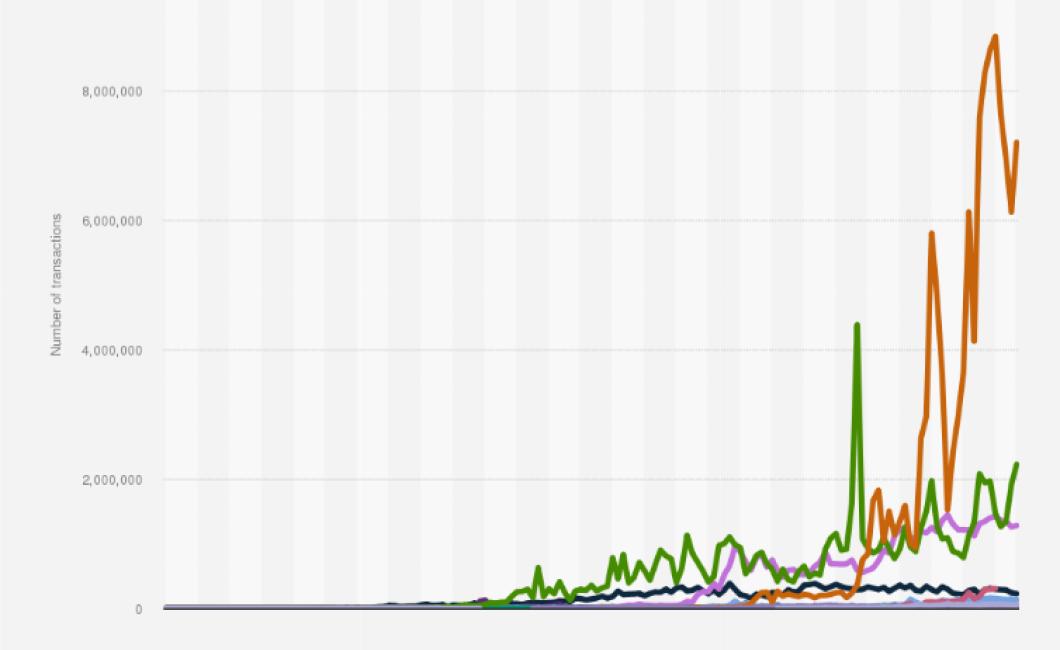

Cryptocurrencies are on the rise, and investors are flocking to this new asset class. Bitcoin prices have surged by more than $2,000 in the past week, and altcoins are also seeing substantial increases.

Bitcoin is the most well-known cryptocurrency, but there are a variety of others available. Ethereum is a popular altcoin, and it has seen a significant increase in value in recent weeks. Ripple is another altcoin that is seeing a lot of attention from investors.

There are a number of reasons why cryptocurrencies are doing well. First, many people see them as a safer investment than traditional assets. Second, they are seen as a potential medium of exchange for some products and services. And finally, they are often seen as a way to avoid government regulation.

Cryptocurrencies are still in their early stages, and there is a lot of volatility in the market. However, they are likely to continue to grow in popularity and value over the coming years.

Crypto Currency Daily Prices: Bitcoin, Ethereum, Litecoin, Ripple, and More

Bitcoin

As of Sep. 22, the price of Bitcoin was $6,562.

Ethereum

As of Sep. 22, the price of Ethereum was $471.

Litecoin

As of Sep. 22, the price of Litecoin was $194.

Ripple

As of Sep. 22, the price of Ripple was $0.92.

How to Read Crypto Currency Prices: A Beginner's Guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

5 Tips for Understanding Crypto Currency Prices

1. Understand what a cryptocurrency is. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

2. Understand how cryptocurrencies are traded. Cryptocurrencies are bought and sold on digital exchanges like Coinbase, Bitstamp and GDAX. You can also buy cryptocurrencies directly from other people.

3. Understand how cryptocurrencies are mined. Cryptocurrencies are created as a result of a process called mining. Miners combine special software with powerful computers to solve complex mathematical problems. As they solve these problems, they are awarded cryptocurrency units.

4. Understand the risks associated with cryptocurrencies. Like any investment, there are risks associated with investing in cryptocurrencies. These risks include the risk of losing money if you don’t understand how cryptocurrencies work, the risk of being hacked, and the risk of not being able to find a reliable source of cryptocurrency.

5. Understand that cryptocurrencies are not legal tender. Cryptocurrencies are not legal tender, which means that they cannot be used to purchase goods and services.

Why Do Crypto Currency Prices Fluctuate?

Cryptocurrency prices are characterized by rapid fluctuations in price. This is due to a number of factors, including the supply and demand for cryptocurrency, global economic conditions, and news events.

3 Reasons Why Crypto Currency Is the Future of Money

Cryptocurrencies are the future of money. Here are three reasons why:

1. They're secure: Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them more secure than traditional currencies, which are vulnerable to theft and fraud.

2. They're efficient: Cryptocurrencies are designed to be secure and efficient, which means they can be exchanged quickly and easily without the need for a middleman.

3. They're transparent: Every transaction on a blockchain is public, which makes it easy for anyone to see how much money is being transferred and to whom. This transparency makes cryptocurrencies more reliable and trustable than traditional currencies.

The Pros and Cons of Investing in Crypto Currency

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Some of the benefits of investing in cryptocurrencies include:

-Cryptocurrencies are global and decentralized. This means they are not subject to government or financial institution control.

-Cryptocurrencies are immune to financial institution censorship.

-Cryptocurrencies are safe and secure. They are not subject to inflation or devaluation.

-Cryptocurrencies are anonymous. Your identity and financial information are not associated with your cryptocurrency holdings.

-Cryptocurrencies are fast and efficient. Transactions are processed quickly and without fees.

-Cryptocurrencies are accessible to everyone. You do not need a special level of expertise to invest in them.

However, some of the potential drawbacks of investing in cryptocurrencies include:

-Cryptocurrencies are volatile. Their value can change rapidly, which makes them risky investments.

-Cryptocurrencies are not regulated by governments or financial institutions, which makes them vulnerable to fraud and manipulation.

-Cryptocurrencies are not backed by any physical assets, so their value is dependent on market sentiment.

How to Invest in Crypto Currency: A Beginner's Guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

5 Risks of Investing in Crypto Currency

There are a number of risks associated with investing in cryptocurrencies. Some of the more common risks include:

1) The price of a cryptocurrency can be volatile, which could lead to losses.

2) Cryptocurrencies are not regulated or backed by any government or institution, which makes them susceptible to volatility and price fluctuations.

3) Cryptocurrencies are not subject to taxation, which could lead to significant losses if the value of a cryptocurrency falls.

4) Cryptocurrencies are not insured by the traditional financial system, which means that they may be risky to invest in.

5) Cryptocurrencies are not subject to the same consumer protections as traditional currencies, which could lead to losses if the cryptocurrency is fraudulently used.

What You Need to Know Before Investing in Crypto Currency

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.