Crypto exchanges have different prices.

Different cryptocurrency exchanges offer different prices for the various coins and tokens that they list. This can be due to a number of factors, such as the exchange's trading volume, the liquidity of the market, and the fees that the exchange charges.

Why Do Crypto Exchanges Have Different Prices?

Crypto exchanges have different prices because they charge different fees for different services. For example, Coinbase charges a 2.7% fee for buying and selling cryptocurrencies, while Binance charges a 0.1% fee for all transactions.

How to Find the Best Price on a Crypto Exchange

There is no one definitive answer to this question. However, there are some general tips that can help you find a good price on a crypto exchange.

First, make sure that you have a good understanding of the different types of cryptocurrencies and how they work. This will help you determine which exchanges offer the best prices for the coins that you are interested in buying or selling.

Second, try to find an exchange that is reputable and has a good reputation. This will ensure that your funds are safe and that the exchange is reliable.

Finally, consider factors such as fees, trading volumes, and available coins. Some exchanges offer lower fees than others, and may have more active trading volumes.

How Exchanges Set Prices for Cryptocurrencies

Cryptocurrencies are traded on exchanges, which set prices for the digital coins. Bitcoin, Ethereum, and Litecoin are all traded on various exchanges.

The Impact of Exchange Rates on Cryptocurrency Trading

Exchange rates are one of the most important factors affecting cryptocurrency trading. When exchanging one cryptocurrency for another, the rate at which the two currencies are exchanged is important.

The higher the exchange rate, the more expensive it is to switch currencies. Conversely, a lower exchange rate makes it cheaper to trade between cryptocurrencies.

Cryptocurrencies are typically traded against fiat currencies, such as the US dollar or the euro. However, there are also exchanges where cryptocurrencies are traded against other cryptocurrencies.

When exchanging one cryptocurrency for another, it is important to consider the overall market cap of the two currencies. This is because the larger the market cap, the more valuable the currency.

Another important factor to consider when exchanging cryptocurrencies is the total supply of the two currencies. If there are a large number of coins available for trading, the exchange rate will be higher than if there are few coins available.

How to Use Crypto Exchanges to Get the Best Price

Cryptocurrencies are a new and exciting way to invest, but it can be difficult to find the best price. You can use a crypto exchange to find the best price for your coins.

Before you start using a crypto exchange, make sure you have a digital wallet where you can store your coins. You will need to have your wallet address and the unique code for your coins.

To use a crypto exchange, first find the exchange that you want to use. There are many exchanges available, so it can be difficult to find the right one.

Once you have found the exchange, sign in. You will need to enter your wallet address and the unique code for your coins. You will also need to provide your email address so that you can receive notifications about new transactions.

Next, you will need to search for the coins that you want to buy. You can buy coins using a variety of methods, including fiat currency, BTC, ETH, and LTC.

You will need to find the price for the coins that you want to buy. You can use the exchange's search engine to find the best price. Alternatively, you can use the exchanges' live marketplaces to find the best price.

Once you have found the best price, you will need to deposit the coins into your digital wallet. You will need to provide your email address so that you can receive notifications about new transactions.

Finally, you will need to buy the coins from your digital wallet. You can do this by entering the unique code for the coins and the amount of coins that you want to buy.

You can also sell the coins that you have bought from your digital wallet. You will need to find a buyer and provide them with the unique code for the coins and the amount of coins that you want to sell.

The Pros and Cons of Using a Crypto Exchange

Crypto exchanges offer a number of benefits over traditional exchanges. Chief among these are the ability to buy and sell cryptocurrencies instantly, access a wider range of coins than is available on most centralized exchanges, and the freedom to conduct transactions in a variety of currencies.

However, crypto exchanges are not without their disadvantages. Most notably, they are often more volatile than centralized exchanges, and may not be available in all countries. Additionally, crypto exchanges are not necessarily regulated and may be vulnerable to theft or cyberattack.

The Benefits of Shopping Around for the Best Price on a Crypto Exchange

There are a number of benefits to shopping around for the best price on a crypto exchange. One of the most important benefits is that you can get a better deal on the exchange if you deal with multiple exchanges.

Another benefit is that you can find an exchange that is better suited for your needs. For example, if you are looking for a more user-friendly exchange, then you may want to look for an exchange that has a lower trading fee.

Finally, shopping around for the best price on a crypto exchange can also save you money in the long run. For example, if you are able to find an exchange that has a lower trading fee, then you will likely end up making more money in the long run.

How to Avoid Getting Ripped Off When Trading Cryptocurrencies

There are a few things you can do to help avoid getting ripped off when trading cryptocurrencies.

1. Do Your Research

Before trading cryptocurrencies, do your research to make sure that the coin you are buying or selling is a good investment. Make sure to understand the technical indicators and how they can impact the price of the coin.

2. Consider Trading With a Professional

If you are not experienced in trading cryptocurrencies, consider trading with a professional. They will be able to help you understand the market better and protect you from potential scams.

3. Use a Trading Platform That is Safe and Secure

Make sure to use a safe and secure trading platform. There have been reports of exchanges being hacked, so it is important to use a platform that is reliable and has a good security policy.

The Dangers of using Inferior Cryptocurrency Exchanges

There are a few dangers that come with using inferior cryptocurrency exchanges. The first is that these exchanges are not regulated, meaning that they may not be as safe as more reputable exchanges. Additionally, these exchanges may not have the same levels of security as more reputable exchanges, meaning that your coins may be at risk if you store them on these platforms. Finally, these exchanges may not have the same level of liquidity as more reputable exchanges, meaning that it may be difficult to find a good price for your coins.

How to Pick a Reliable Crypto Exchange

There are a few things to keep in mind when selecting a reliable crypto exchange. The first is security. Cryptocurrency exchanges are often targeted by hackers, so it is important to choose an exchange that has strong security measures in place. second is customer service. It is important to choose an exchange that has responsive customer service if you need help with your account or transactions. Finally, it is important to choose an exchange that has a good reputation. research the track record of the exchange before signing up.

Trustworthy Crypto Exchanges - A Buyer's Guide

If you're looking to invest in cryptocurrency, then you're in luck. There are a ton of trustworthy exchanges out there that make it easy to buy and sell bitcoin, Ethereum, and other altcoins.

Here are five of the most trustworthy exchanges available:

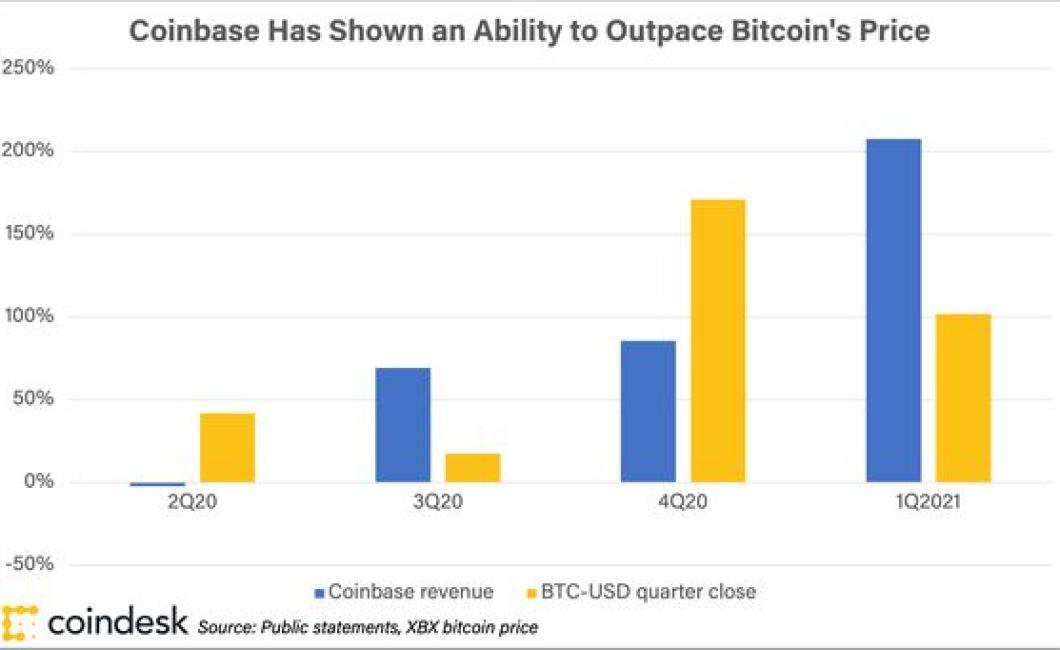

1. Coinbase

Coinbase is one of the most popular exchanges out there. It offers a user-friendly interface and has been verified by the Financial Industry Regulatory Authority (FINRA).

2. Bitfinex

Bitfinex is another well-known exchange. It offers a user-friendly interface and has been verified by the FINRA.

3. Binance

Binance is a relatively new exchange that has quickly become one of the most popular options. It offers a user-friendly interface and has been verified by the Chinese government.

4. Kraken

Kraken is another well-known exchange that has a user-friendly interface. It has been verified by the FINRA.

5. Gemini

Gemini is a new exchange that is quickly gaining popularity. It offers a user-friendly interface and has been verified by the New York State Department of Financial Services.

12 Tips For Finding the Best Price on a Crypto Exchange

1. Do your research.

Before making any exchange decisions, it’s important to do your research. Exchange reviews, online forums, and social media will all be useful resources when trying to find the best deal on a particular platform.

2. Compare fees and features.

When looking for the best price on an exchange, it’s important to compare fees and features. Some exchanges may have lower fees, but lack some of the more important features, such as 24/7 support or advanced trading tools.

3. Consider location and availability.

Some exchanges are located in more popular countries, while others are available in a wider range of locations. Consider the location of the exchange and the availability of its products.

4. Compare user reviews.

User reviews can be a helpful resource when comparing different exchanges. Look for exchanges with high ratings from verified users.

5. Compare exchange rates.

When comparing exchange rates, it’s important to consider the currency pair you’re interested in trading. Some exchanges may offer better prices for certain currencies than others.

6. Use a reputable broker.

When trading cryptocurrencies, it’s important to use a reputable broker. Brokers provide the security and peace of mind necessary for successful trading.

7. Perform a security check.

Before trading cryptocurrencies, it’s important to perform a security check. This includes verifying your account information and ensuring that your personal information is secure.

8. Make sure you understand the risks involved.

Cryptocurrencies are volatile and can be risky, so it’s important to understand the risks involved before making any investment decisions.

9. Be prepared to lose money.

Cryptocurrencies are speculative investments, and there is a risk of losing money if you don’t understand how cryptocurrency trading works.