Crypto Ico Prices

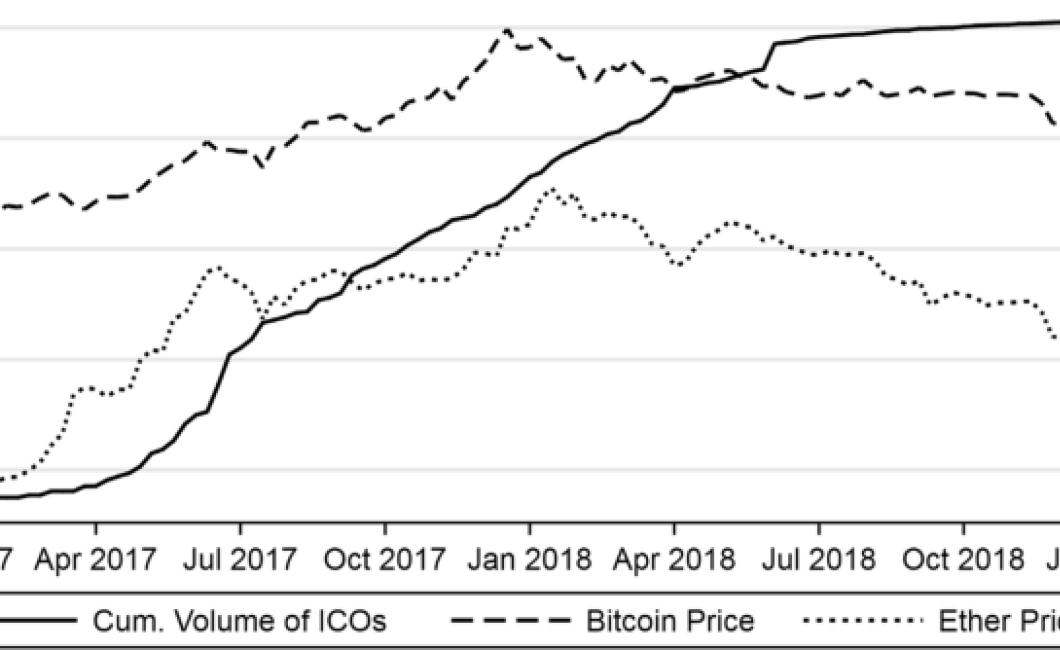

Prices for cryptographic ICOs have been on the rise in recent years. This is due to the increasing popularity and acceptance of cryptocurrencies as a whole. The ICO market has become one of the most active and lucrative markets in the cryptocurrency space. There are a few factors that have contributed to the rise in ICO prices. One of the main reasons is the increasing demand for cryptocurrencies. As more and more people become aware of and invest in cryptocurrencies, the prices of ICOs will continue to go up. Another factor that has played a role in the rising prices of ICOs is the increasing regulation of the cryptocurrency space. As governments and financial institutions begin to take notice of and regulate the industry, investors will be more confident in investing in ICOs. This will lead to even higher prices for these digital assets. The ICO market is still in its early stages and there is a lot of potential for growth. With the right mix of factors, the prices of ICOs could continue to surge in the coming years.

ICO Prices for Top 10 Cryptocurrencies

1. Bitcoin

2. Ethereum

3. Bitcoin Cash

4. Litecoin

5. EOS

6. Tron

7. Cardano

8. NEO

9. IOTA

10. Dash

How Much do ICOs Cost?

Initial coin offerings (ICOs) are a new way for startups to raise money. In an ICO, a company sells a new cryptocurrency, usually in exchange for bitcoin or Ether.

The cost of an ICO depends on the project, but typically ranges from $10,000 to $200,000.

What is the Average ICO Price?

There is no one definitive answer to this question. ICO prices vary greatly from project to project, and can change rapidly throughout the course of a given ICO.

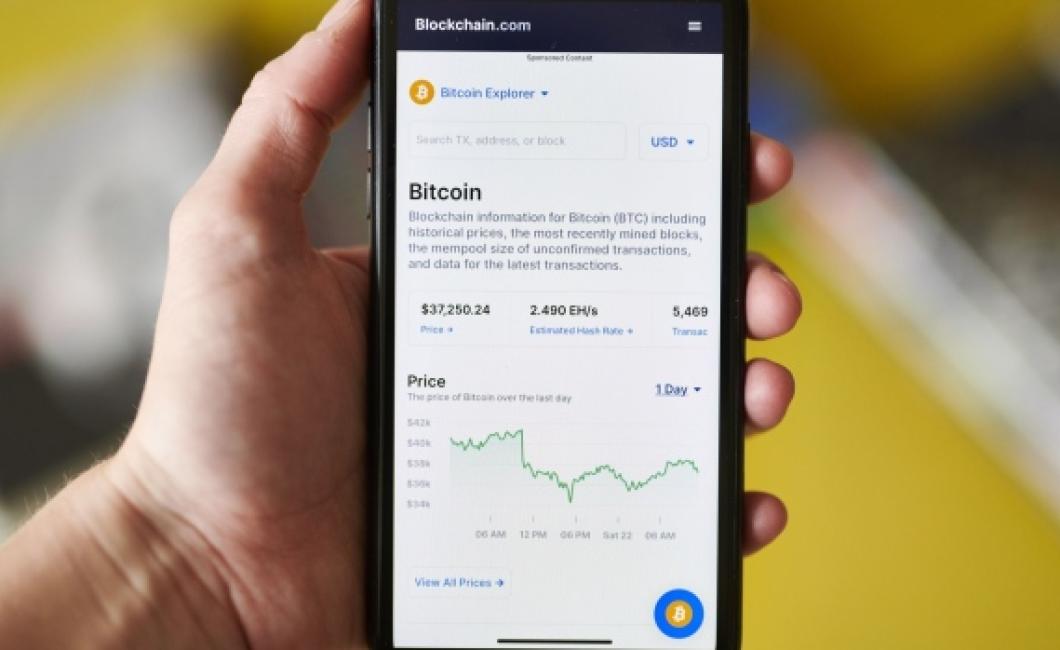

How to Find ICO Prices

There are a few ways to find ICO prices. You can use online resources, such as websites that list upcoming ICOs, or search for specific tokens or coins on cryptocurrency exchanges. You can also use a cryptocurrency price tracking tool, such as CoinMarketCap.

How to Read an ICO Price Chart

The first step in reading an ICO price chart is to determine the timeframe for the chart. There are two types of ICO price charts: short-term and long-term.

Short-term ICO price charts show the prices for a specific day, week, or month. Long-term ICO price charts show the prices for a specific year, quarter, or month.

After determining the timeframe, you need to identify the key indicators on the chart. These indicators include the price, volume, and market cap.

Next, you need to compare the ICO price chart to other similar charts. This will help you determine whether the ICO is overvalued or undervalued.

If the ICO is undervalued, you should buy the token. If the ICO is overvalued, you should sell the token.

What do ICO Prices Mean?

ICO prices are the initial coin offerings (ICOs) of new cryptocurrencies and tokens. They are determined by the amount of money that investors are willing to put up for a particular cryptocurrency or token.

How to Use ICO Prices to Make Investment Decisions

ICO prices are a useful tool for investors to use when making investment decisions. By understanding how ICO prices work, investors can make informed decisions about whether or not to invest in a particular ICO.

When looking at ICO prices, investors should keep in mind the following:

1. The Initial Coin Offering (ICO) is an event where a new cryptocurrency or token is created and sold to the public.

2. ICO prices are determined by the demand for the tokens being offered.

3. ICO prices can change rapidly, and may not always reflect the underlying value of the tokens.

4. Investing in an ICO may be risky, and investors should do their own research before making any decisions.

What are the Risks of Investing in ICOs?

The risks of investing in ICOs are high, as the market is still relatively new and there is a lot of speculation involved. Additionally, many ICOs are scams and don't actually have any real products or services to offer.

5 Tips for Analyzing ICO Prices

1. Look at the number of tokens issued. The more tokens issued, the more expensive the token.

2. Look at the market cap. The larger the market cap, the more valuable the token.

3. Look at the circulating supply. The smaller the circulating supply, the more valuable the token.

4. Look at the team behind the project. The more experienced and reputable the team, the more likely the project is to succeed.

5. Look at the whitepaper. If the whitepaper is well written and informative, it will help investors make an informed decision about whether or not to invest in the project.