How to read stock and crypto charts.

This article will teach you how to read stock and crypto charts so that you can make better investment decisions. You will learn about different chart types and what information they can provide. You will also learn how to use technical analysis to identify trends and make predictions about future price movements.

For the Average Investor: How to Read Stock Charts

When looking at stock charts, the average investor should focus on several key factors. These factors include:

1. The open, high, low, and close prices for the stock

2. The volume of shares traded for the stock

3. The trend of the stock

4. The direction of the candle stick

The first thing an investor should do is look at the open, high, low, and close prices for a stock. This will give an idea of where the stock has been trading and what the price range is.

Next, an investor should look at the volume of shares traded for the stock. This will give an idea of how active the stock market is for the particular company.

The third factor to consider is the trend of the stock. This will help determine if the stock is trending up or down.

The fourth and final factor to consider is the direction of the candle stick. This will help determine if the stock is moving in a positive or negative direction.

How to Read a Stock Chart for Beginners

The first step in reading a stock chart is to understand what information is displayed.

The vertical axis indicates price, with the higher numbers indicating higher prices. The horizontal axis indicates the number of shares outstanding.

The red line is the stock's price movement over time. The green line is the stock's moving average, which helps smooth out day-to-day price fluctuations.

The blue line is the stock's Bollinger Bands indicator, which shows volatility over the past few days. The red and blue lines can also be used to identify buy and sell signals, respectively.

How to Read Stock Charts: A Tutorial for Beginners

When you're looking at stock charts, it can be a little confusing as to what each line means. In this tutorial, we're going to break down each line on a stock chart and explain what it represents.

The Y-Axis:

The Y-axis is a horizontal line that represents the price of a stock over time. The X-axis is a vertical line that represents the number of shares of the stock.

The Line in the Middle:

The middle line is called the "midpoint of the trend." This line is usually red or green, depending on the direction of the trend. The closer the midpoint is to the left or right side of the chart, the more pronounced the trend is.

The Bottom Line:

The bottom line is called the "bottom of the channel." This line is usually blue or black, depending on the direction of the channel. The closer the bottom line is to the top or bottom of the chart, the more pronounced the channel is.

How to Read and Understand Stock Charts

To read and understand stock charts, you need to understand two key concepts: the price chart and the volume chart.

The price chart shows the price of a security over time. The higher the price, the more valuable the security. The volume chart shows the number of shares traded in a security over time. The higher the volume, the more popular the security.

When you are looking at a stock chart, it is important to understand what factors are affecting the price and volume. Some common factors that affect stock prices and volume are economic indicators (such as unemployment rates or inflation rates), company news, and technical indicators (such as stock prices moving up or down in correlation with other stocks).

To make sense of stock charts, it is helpful to understand the different types of charts that are available. There are candlestick charts, line charts, area charts, and trend charts. Each type of chart has its own advantages and disadvantages.

Candlestick charts are the simplest type of chart and are best for analyzing short-term changes in stock prices. Candlestick charts show the price of a security over time as a series of candlesticks (a short, fat candle with a narrow top and bottom). Each candlestick is filled with either a green (buying) or red (selling) candle. The color of the candle tells you how much the price of the security changed from the previous candlestick.

Line charts are better for analyzing long-term trends in stock prices. They show the price of a security over time as a series of lines connecting the current price with the prices of previous points in time. The lines can be straight or curved, and they can be drawn on any type of graph.

Area charts are better for visualizing large amounts of data. They show the price of a security over time as a series of squares or rectangles. Each square or rectangle is filled with the price of a security at one point in time. The size of the square or rectangle indicates the amount of money that was invested in that security at that particular point in time.

Trend charts are good for tracking long-term trends in stock prices. They show the percentage change in stock prices over time as a series of lines connecting the current price with the prices of previous points in time.

How to Use Stock Charts to Make Better Investment Decisions

Stock charts are a great way to help make better investment decisions. When looking at stock charts, it is important to understand what information is displayed and how to use it.

In general, stock charts display three different types of data:

1) The current price of a stock

2) The percentage change in the stock's price over the past day, week, month, or year

3) The total number of shares traded in a given period

When looking at stock charts, it is important to understand the different types of data that is displayed. The current price of a stock is the most important statistic to look at. This statistic tells you how much money the stock is worth at the moment. The percentage change in the stock's price over the past day, week, month, or year is also important. This statistic shows you how much the stock's price has changed since the last time that it was charted. The total number of shares traded in a given period is also important. This statistic tells you how many shares of the stock have been traded over the past day, week, month, or year.

Overall, stock charts are a great way to help make better investment decisions. By understanding the different types of data that is displayed on a stock chart and using it to make informed decisions, investors can be sure that they are making the best possible choices for their portfolio.

The Basics of Reading Stock Charts

Reading stock charts is an important part of day trading. Stock charts show the movement of a company's stock price over time.

You can use stock charts to find out where the stock is headed and what the stock's current price is. You can also use stock charts to find out if the stock is overvalued or undervalued.

To read a stock chart, you first need to understand the different types of indicators that are used in stock charts.

There are three types of indicators used in stock charts: moving averages, MACD, and Bollinger Bands.

Moving averages are a type of indicator that shows the average price of a stock over a specified period of time. MACD is an indicator that shows the movement of a stock's price over a given period of time. Bollinger Bands are a type of indicator that shows the volatility of a stock's price over a given period of time.

You can also use trend lines to help you understand the direction of a stock's price.

How to Read Candlestick Charts

Candlestick charts are used to show the performance of a security over time. Each candlestick chart is composed of four sections: the open, high, low, and close. The open is the first candlestick, and shows the price of the security at the beginning of the chart. The high is the second candlestick, and shows the price of the security at the peak of its trading range. The low is the third candlestick, and shows the price of the security at the trough of its trading range. The close is the fourth candlestick, and shows the price of the security at the end of the chart.

The first thing to do when reading a candlestick chart is to identify the pattern. Patterns can be bullish or bearish, and will usually have specific criteria that must be met in order for them to be identified. Once a pattern has been identified, you can start to read the chart in order to understand what is happening.

For example, if the open candlestick is bullish, then you would expect the next candlestick to be higher than the previous one. If the open candlestick is bearish, then you would expect the next candlestick to be lower than the previous one.

In order to read a candlestick chart effectively, you need to become familiar with the different types of candlesticks. The four candlesticks that are used in candlestick charts are the candle, the hammer, the anvil, and the V-shape.

The candle is used to show a small movement in price.

The hammer is used to show a large movement in price.

The anvil is used to show a moderate movement in price.

The V-shape is used to show a retracement in price.

How to Read Bar Charts

The first step in reading bar charts is to identify the type of bar chart. There are three main types of bar charts: column, line, and area.

Column Bar Charts

Column charts show data in a simple, vertical format. Each column represents a different category of data. The height of the column corresponds to the number of times the category was represented in the data.

Line Bar Charts

Line charts are similar to column charts, but they show data in a horizontal format. Lines represent the relationships between different categories of data. The height of the line corresponds to the magnitude of the relationship.

Area Bar Charts

Area charts show data in a shape that resembles an area. The size of the area corresponds to the number of times the category was represented in the data.

How Do I Read a Stock Chart?

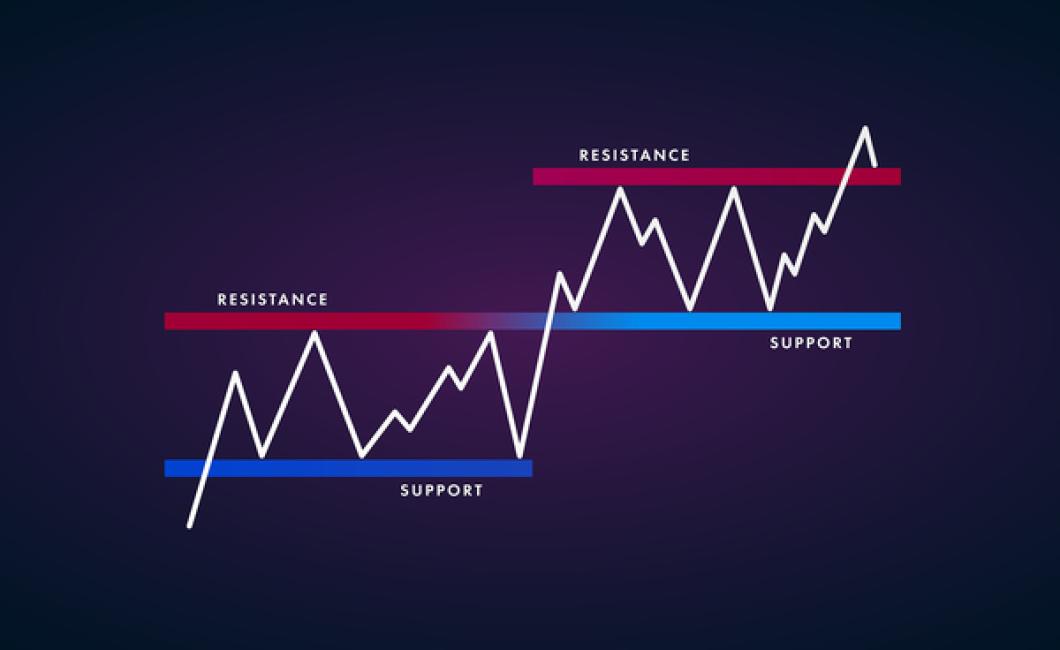

The most common way to read a stock chart is to look for peaks and valleys. Peaks indicate that the stock is gaining in value, and valleys indicate that the stock is losing value. When you see a peak, look for where the stock price crossed the peak. If it's above the peak, the stock is likely going to continue to go up in value. If it's below the peak, the stock is likely going to go down in value. When you see a valley, look for where the stock price crossed the valley. If it's below the valley, the stock is likely going to continue to go down in value. If it's above the valley, the stock is likely going to go up in value.

What is a Stock Chart and How do You Read it?

A stock chart is a graphical representation of the movement of a security's price over time. The vertical axis shows the price of the security at different points in time, while the horizontal axis shows the change in price.

How toAnalyze aStockChartbeforeYouBuyorSell

There are a few things you should look for when analyzing a stock chart before buying or selling.

Price: The price of a stock is one important factor to consider when analyzing a stock chart. The higher the price, the more valuable the stock is.

Volume: The volume of a stock is also important to consider when analyzing a stock chart. The higher the volume, the more active the stock is.

Engagement: The engagement of a stock on the market is also important to consider when analyzing a stock chart. The higher the engagement, the more interested people are in buying and selling the stock.

If You're Going to Trade Stocks, You Need to Know How to Read These 4 Types of Charts

1. Price-Volume Charts

Price-volume charts show how often a stock is traded and how much volume is involved in those transactions. When the volume rises above the average, it may indicate that there is strong interest in the stock. Conversely, when the volume falls below the average, it may signal that there is weak interest in the stock.

2. Moving Averages

Moving averages help you identify trends in a stock's price over time. When the moving average crosses over a certain price point, it may indicate that the price is moving higher or lower than average.

3. Bollinger Bands

Bollinger bands are a type of technical indicator that help you determine whether a stock is overvalued or undervalued. When the Bollinger band touches the bottom line on the chart, it may indicate that the stock is overvalued, and when the band touches the top line, it may indicate that the stock is undervalued.

4. Volume-Weighted Average Price

Volume-weighted average price (VWAP) is a technical indicator that helps you determine whether a stock is overvalued or undervalued. When the volume of a stock increases, the VWAP may rise as well. Conversely, when the volume of a stock decreases, the VWAP may fall.