Korean Crypto Market Prices

The Korean crypto market prices are some of the lowest in the world. The average price of Bitcoin in Korea is $3,700, which is less than half the global average price. Ethereum is also much cheaper in Korea, trading at around $120. These low prices are due to a number of factors, including the Korean won being a relatively weak currency and the Korean government's crackdown on cryptocurrency trading.

Korean Crypto Market Prices: A Comprehensive Guide

The Korean Crypto Market is one of the most active and popular markets in the world for cryptocurrencies. As of September 2018, the market capitalization of all cryptocurrencies in Korea was $27.5 billion.

This guide will provide you with a comprehensive overview of the Korean Crypto Market and its prices.

What Is the Korean Crypto Market?

The Korean Crypto Market is a market that deals with cryptocurrencies and other digital assets. It is one of the most active and popular markets in the world for cryptocurrencies.

As of September 2018, the market capitalization of all cryptocurrencies in Korea was $27.5 billion. This makes it the fourth largest cryptocurrency market in the world.

The Korean Crypto Market is also one of the most regulated markets in the world. The country has a strict anti-money laundering and anti-fraud policy. This means that all cryptocurrency transactions in Korea are monitored and recorded.

What Are the Prices of Cryptocurrencies in the Korean Crypto Market?

The prices of cryptocurrencies in the Korean Crypto Market are highly volatile. This means that they can change rapidly and often.

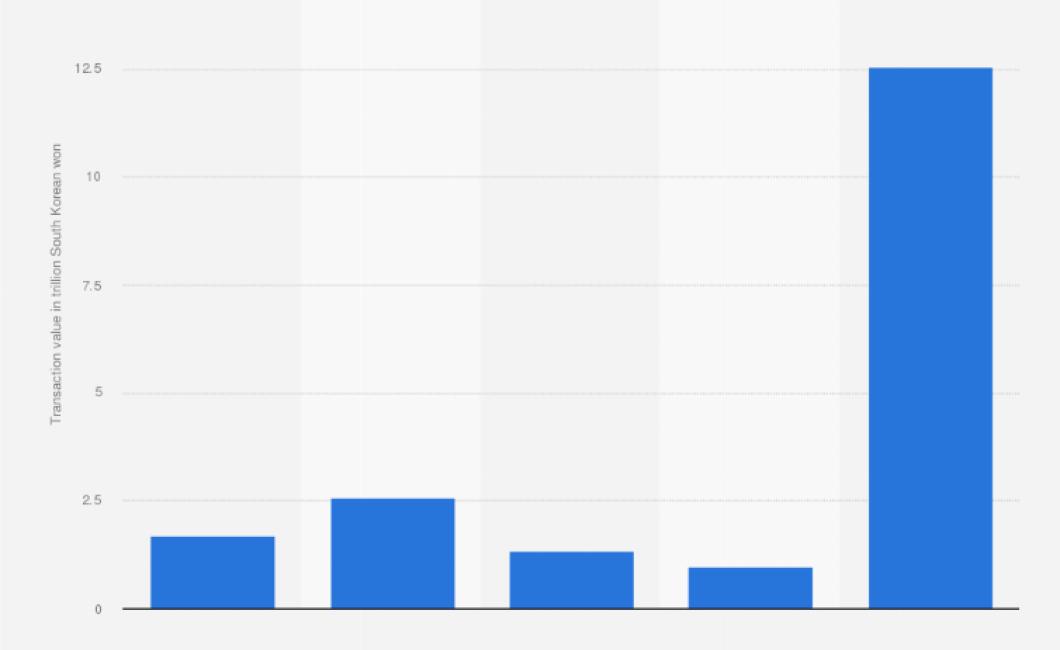

As of September 2018, the prices of the top five cryptocurrencies in the Korean market were as follows:

Bitcoin: $6,788.27

Ethereum: $4,895.71

Bitcoin Cash: $2,846.61

Litecoin: $1,386.10

Tether: $1.00

These prices vary constantly and can be very volatile. They can also change very quickly, often within a few minutes or hours.

This volatility makes it difficult to predict the prices of cryptocurrencies in the Korean Crypto Market. However, over the long term, the prices of cryptocurrencies in the Korean market tend to trend upwards.

How Does the Korean Crypto Market Compare to Other Markets?

The Korean Crypto Market is one of the most active and popular markets in the world for cryptocurrencies. As of September 2018, the market capitalization of all cryptocurrencies in Korea was $27.5 billion.

This makes it the fourth largest cryptocurrency market in the world. The Korean Crypto Market is also one of the most regulated markets in the world. The country has a strict anti-money laundering and anti-fraud policy. This means that all cryptocurrency transactions in Korea are monitored and recorded.

This makes it one of the safest markets for cryptocurrency transactions. The only other market that comes close to being as safe and regulated as the Korean Crypto Market is Japan.

How Does the Korean Crypto Market Compare to Other Countries?

The Korean Crypto Market is one of the most active and popular markets for cryptocurrencies. As of September 2018, the market capitalization of all cryptocurrencies in Korea was $27.5 billion.

This makes it the fourth largest cryptocurrency market in the world. The Korean Crypto Market is also one of the most regulated markets in the world. The country has a strict anti-money laundering and anti-fraud policy. This means that all cryptocurrency transactions in Korea are monitored and recorded.

This makes it one of the safest markets for cryptocurrency transactions. The only other market that comes close to being as safe and regulated as the Korean Crypto Market is Japan.

How to Trade Cryptocurrencies in Korea

There is no one-size-fits-all answer to this question, as the trade of cryptocurrencies in Korea will vary depending on the specific exchange you choose to use and the specific cryptocurrencies you are trading. However, some tips on how to trade cryptocurrencies in Korea include:

1. Make sure you are using a reputable exchange. There are a number of exchanges available in Korea, but only a few of them are considered to be reliable and safe. Make sure you research which one is right for you before signing up.

2. Do your research. It is important to do your research before trading cryptocurrencies in Korea, as there are a number of risks associated with trading them. Make sure you understand the risks involved and take appropriate precautions.

3. Know when to buy and sell. When trading cryptocurrencies in Korea, it is important to know when to buy and sell. Don’t overbuy or sell too quickly, as this can lead to losses. Wait until the price is right and then make a purchase.

4. Use a trading bot. If you are not comfortable trading cryptocurrencies yourself, you can use a trading bot to help you. Trading bots are a great way to get started with trading cryptocurrency, and they can help you make better decisions.

The State of the Korean Crypto Market

The Korean crypto market is currently experiencing a stable growth. More and more people are beginning to invest in the crypto market, which is good news for the industry as a whole. However, there are still some challenges that need to be addressed before the crypto market can truly take off.

One of the biggest challenges facing the Korean crypto market is regulatory uncertainty. There is a lot of confusion about which regulations apply to the crypto market, and this makes it difficult for investors to know what to do. This uncertainty is likely to continue until the government comes up with a clear regulatory framework.

Another issue that is hampering the growth of the Korean crypto market is the lack of liquidity. There is a limited number of exchanges that are currently trading cryptocurrencies, which means that there is not enough liquidity in the market. This is preventing investors from being able to get rid of their cryptocurrencies easily.

However, despite these challenges, the Korean crypto market is still growing rapidly. This suggests that there are plenty of opportunities for investors to make profits. If you are interested in investing in the Korean crypto market, you should definitely do your research first.

The ins and outs of the Korean crypto market

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Since then, there have been hundreds of other cryptocurrencies created, many of which use different cryptography and blockchain technologies.

The Korean crypto market is one of the most active in the world, with a total market value of over $30 billion as of early January 2019. Cryptocurrencies are mainly traded on digital exchanges, and some are also accepted as payment for goods and services.

All you need to know about the Korean crypto market

The Korean crypto market is one of the most active and developed in the world. It has a population of over 50 million people, making it one of the most populous countries in the world with a high demand for digital assets.

The Korean government has been supportive of digital currencies and blockchain technology, and this has led to the development of a robust crypto market. The market is divided into three main trading platforms: Bithumb, Coinone, and Korbit.

There are a number of major exchanges that operate in the Korean market, including Bithumb, Coinone, Korbit, and Upbit. These exchanges offer a wide range of cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

The Korean crypto market is highly volatile, and prices can change rapidly. However, overall it is one of the most developed and active crypto markets in the world.

From Bitcoin to Ethereum: A beginner's guide to trading in Korea

Bitcoin is the first cryptocurrency, a concept that was discussed in the late 90s. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin was created in 2009 by an unknown person or group of people under the name Satoshi Nakamoto.

The different faces of the Korean crypto market

There are a few different faces of the Korean crypto market. Just like in any other market, there are those who are bullish and those who are bearish, but there are also those who are cautiously optimistic about the future of cryptocurrencies and blockchain technology.

1) The early adopters

The early adopters in the Korean crypto market are typically those who are most bullish about the future of cryptocurrencies and blockchain technology. They see the potential for cryptocurrencies and blockchain to revolutionize the way we handle money and transactions.

2) The speculators

The second group of people in the Korean crypto market are the speculators. They are typically more bearish about the future of cryptocurrencies and blockchain technology, viewing them as a means of making quick profits.

3) The believers

The third group of people in the Korean crypto market are the believers. They believe that cryptocurrencies and blockchain technology have the potential to revolutionize the way we handle money and transactions, and they are willing to invest in them even though they may be bearish about their future.

A tale of two markets: Comparing Korea's crypto market with the rest of the world

Korea has a long history of blockchain and cryptocurrency innovation, and the country has been at the forefront of the crypto market since its inception.

The Korea Exchange (KEX) is the nation’s leading stock exchange for trading cryptocurrencies and other digital assets. In March 2018, the KEX became the first exchange in the world to list a blockchain-based security – the KCS.

As of September 2018, the total market value of all cryptocurrencies was $355.5 billion, with Bitcoin accounting for 54.1% of the total value.

In comparison, the global market capitalization of all cryptocurrencies was $811.5 billion as of September 2018. Bitcoin accounted for 58.9% of the total value.

The Korean crypto market is significantly larger than the global market, and there are a number of reasons for this.

First, the regulatory environment in Korea is relatively favorable for cryptocurrency and blockchain innovation.

Second, the population of Korea is highly mobile, and there is a significant number of Koreans who are interested in using cryptocurrencies and blockchain technology.

Third, the Korean government is supportive of cryptocurrency and blockchain innovation, and has made a number of significant moves to support the growth of the crypto market.

Overall, the Korean crypto market is thriving, and there is a lot of potential for continued growth in the future.

How Seoul became a hotbed for cryptocurrency trading

There are a few reasons why Seoul has become a hotbed for cryptocurrency trading.

For one, the Korean government has been relatively tolerant of cryptocurrencies and their underlying blockchain technology. This has led to a number of cryptocurrency exchanges setting up shop in the country, as well as a burgeoning bitcoin and other altcoin market.

Moreover, South Korea is one of the world’s most wired countries, with almost every resident having access to high-speed internet. This has made it easy for investors to get access to a wide range of cryptocurrency prices and news, as well as to conduct automated trading.

Finally, the country’s large population and affluent middle class has made it a prime target for Initial Coin Offerings (ICOs), which are a popular way for start-ups to raise money by issuing their own digital tokens.

As cryptocurrencies continue to gain popularity, it’s likely that Seoul will continue to be a major player in the market.

The rise of cryptocurrency trading in South Korea

Cryptocurrency trading has been on the rise in South Korea over the past year, with the market now worth around $27 billion. This has led to a number of exchanges opening up in the country, with some of the biggest names being Bithumb, Upbit and Coinone.

The popularity of cryptocurrency trading in South Korea is likely due to a number of factors. Firstly, the country has a high population of cryptocurrency enthusiasts, with many people looking to get involved in the market as soon as possible. Secondly, the country has some of the most liberal financial regulations in the world, which makes it a favourable environment for cryptocurrency trading.

There are a number of risks associated with cryptocurrency trading, however, and investors should always ensure that they are fully aware of the risks before investing. This is particularly important in South Korea, where there have been a number of cases of fraud and scams involving cryptocurrency trading.

Why South Korea is a key player in the global cryptocurrency market

South Korea is a key player in the global cryptocurrency market. The country is home to some of the largest exchanges in the world, and is one of the most active countries when it comes to trading and investing in cryptocurrencies.

South Korea has been particularly supportive of cryptocurrencies and blockchain technology, and has been working to develop its own digital currency called the “Korean Won”. The Korean Won will be based on blockchain technology and will be used to pay for goods and services in the country.

How the Korean cryptocurrency market is changing the way we trade

Cryptocurrencies are changing the way we trade. They’re also changing the way we think about money and how it works.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin was the first and most well-known cryptocurrency. Bitcoin is a digital token that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is decentralized, meaning it is not subject to government or financial institution control.

Since Bitcoin’s creation in 2009, there have been dozens of other cryptocurrencies created. These cryptocurrencies are all different, but they all use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are not backed by anything physical. They are created and held by individuals or organizations like banks or governments. However, unlike traditional currencies, which are controlled by governments, cryptocurrencies are controlled by their users. This means that cryptocurrency holders can vote with their wallets to decide how the currency is used.

Cryptocurrencies are also changing the way we think about money. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin was the first and most well-known cryptocurrency. Bitcoin is a digital token that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is decentralized, meaning it is not subject to government or financial institution control.

Since Bitcoin’s creation in 2009, there have been dozens of other cryptocurrencies created. These cryptocurrencies are all different, but they all use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are not backed by anything physical. They are created and held by individuals or organizations like banks or governments. However, unlike traditional currencies, which are controlled by governments, cryptocurrencies are controlled by their users. This means that cryptocurrency holders can vote with their wallets to decide how the currency is used.

Cryptocurrencies are also changing the way we think about money. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin was the first and most well-known cryptocurrency. Bitcoin is a digital token that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is decentralized, meaning it is not subject to government or financial institution control.

Since Bitcoin’s creation in 2009, there have been dozens of other cryptocurrencies created. These cryptocurrencies are all different, but they all use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are not backed by anything physical. They are created and held by individuals or organizations like banks or governments. However, unlike traditional currencies, which are controlled by governments, cryptocurrencies are controlled by their users. This means that cryptocurrency holders can vote with their wallets to decide how the currency is used.

Cryptocurrencies are also changing the way we think about money. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin was the first and most well-known cryptocurrency. Bitcoin is a digital token that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is decentralized, meaning it is not subject to government or financial institution control.

Since Bitcoin’s creation in 2009, there have been dozens of other cryptocurrencies created. These cryptocurrencies are all different, but they all use cryptography to secure their transactions and to control the creation of new units.