Reading Candlestick Charts Crypto

If you want to learn about reading candlestick charts for crypto, then this article is for you. Candlestick charts are a popular way to visualize market data, and they can be especially useful for tracking cryptocurrency prices. In this article, we'll provide an overview of how to read candlestick charts and explain some of the most important features to look for.

How to read candlestick charts for cryptocurrency trading

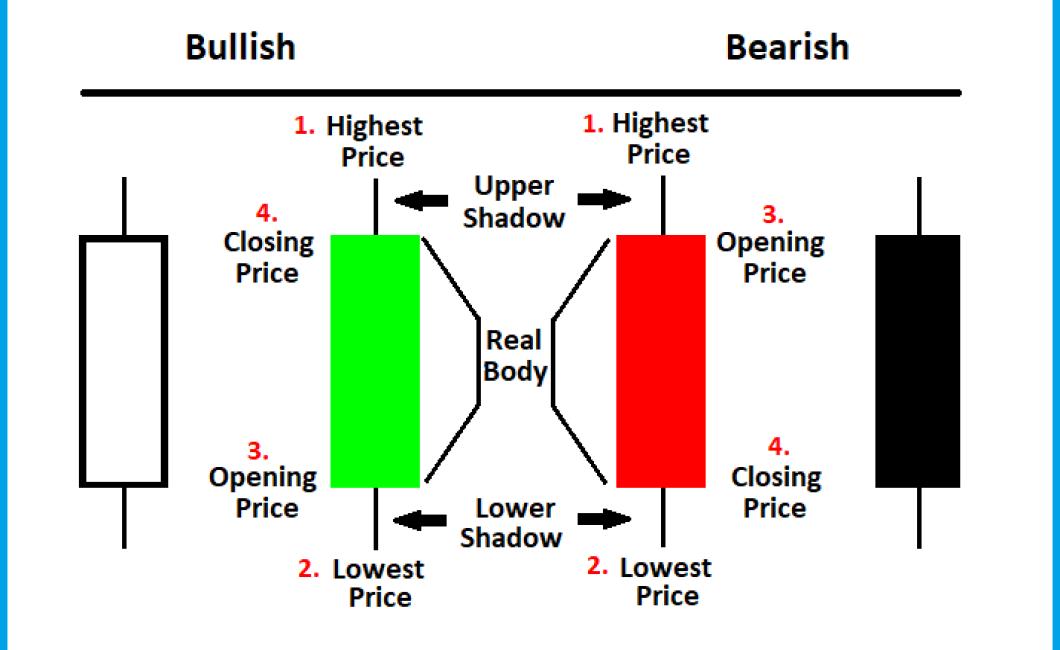

There are a few different ways to read candlestick charts for cryptocurrency trading. One way is to look at the open, high, low, and close prices for each day. You can also look at the volume of each candlestick.

Another way to read candlestick charts is to look for patterns. For example, you might look for a pattern that signals that there is about to be a price increase or decrease.

What do candlestick charts reveal about the crypto market?

Candlestick charts are a visual representation of the price movement of a given cryptocurrency. They display the open, high, low, and close prices for a given period of time. Candlestick charts can be used to identify patterns and trends in the market.

Candlestick charting 101 for cryptocurrency investors

Cryptocurrency investors are always on the lookout for new opportunities, and candlestick charts can be a great way to quickly identify potential trends. Here's a quick guide to using candlestick charts for cryptocurrency investing:

1. Draw the basic candlestick chart on a paper sheet or screen.

2. Plot the opening and closing prices for each day of the trading week.

3. Note any significant movements (up or down) in the prices.

4. Look for patterns (i.e. bullish or bearish) and take note of when they occur.

5. Compare the patterns over time to see if there is a consistent trend.

6. Consider whether you want to trade based on the trends you've identified.

How to identify trends and patterns using candlestick charts

There are a few things you can do with candlestick charts to identify trends and patterns.

First, look at the size of the candles. Are the candles getting bigger or smaller? This could indicate that the price is going up or down, respectively.

Next, look at the color of the candles. Are they all the same color, or are some darker than others? This could indicate that the price is stable, or is moving in a specific direction.

Finally, look at the shape of the candles. Are they all circular, or are some shaped differently? This could indicate that the price is moving in a specific direction, or is changing over time.

Using candlestick charts to predict price movements in the cryptocurrency market

Candlestick charts are a popular tool used to predict price movements in the cryptocurrency market. Candlestick charts are made up of several candlesticks, which are graphical representations of price movement over time.

Each candlestick on a candlestick chart represents a specific price point. The width of each candle shows how much the price has changed from the previous candle. The height of the candle shows how much the price has changed from the opening price of the period.

Candlestick charts can be used to identify patterns in price movement and to predict future price movements. Candlestick charts are especially useful for analyzing short-term price movements.

The benefits of reading candlestick charts for cryptocurrency trading

Candlestick charts are a great way to visualize the price movements of cryptocurrency assets. By understanding how candles work and how to read them, you can improve your trading skills.

Candlestick charts make it easy to see the big picture. They show the total value of an asset over time and provide a visual representation of changes in price.

Candlestick charts can help you identify trends. If you see a pattern in the candle moves, it can help you predict future price movements.

Candlestick charts can help you make informed decisions about when to buy or sell. By understanding what is happening on the chart, you can make better choices about when to enter or exit a trade.

Candlestick charts are a valuable tool for anyone looking to improve their cryptocurrency trading skills. By learning how to read them, you can better understand the underlying mechanics of the market and make more informed decisions.

The importance of candlestick chart analysis for cryptocurrency traders

Candlestick chart analysis is an important tool for cryptocurrency traders. It can help identify patterns and trends in the prices of digital assets.

Candlestick charts are a visual way to track the price of a security over time. They are created by drawing a series of candlesticks on a chart. Each candlestick corresponds to a specific trading day.

The main purpose of candlestick chart analysis is to identify patterns and trends. For example, you may want to look for patterns that indicate when the price of a digital asset is about to rise or fall.

Candlestick charting is also useful for tracking your own investment performance. By looking at the patterns and trends in the prices of digital assets, you can see whether you are making good bets or if you need to take more aggressive positions.

What to look for when analyzing candlestick charts

There are a number of things you should look for when analyzing candlestick charts. These include:

1. The size and shape of the candles.

2. The frequency of candle openings and closings.

3. The direction of the candle movement.

4. The length of the candle’s shadows.

5. The color of the candle.

6. The location of the candle on the chart.

7. The relative width of the candles.

8. The number of candles in a row.

9. The number of candles in a column.

10. Other factors that may be related to the price of the asset, such as news events or technical indicators.

Why every cryptocurrency trader should know how to read candlestick charts

Candlestick charts are one of the most popular ways to track the performance of a cryptocurrency. They display the price movement of a cryptocurrency over time on a simple graph.

The most common type of candlestick chart is the Bollinger Bands indicator. This chart shows the range of prices over a given period of time, usually 20 or 30 minutes.

The horizontal lines on a candlestick chart show the highs and lows of the price over the given period. The width of the bands indicates how much the price changed from one day to the next.

The colors of the bars indicate the type of movement:

Green bars indicate a buy or sell order was placed.

Bar with a white background indicates a market order. This means the order was filled at the best price available at the time.

Gray bar indicates the price at which the order was filled.

The length of each bar corresponds to the volume of trade that took place during that particular period. The longer the bar, the more volume was involved.

The bottom of the candle shows the closing price for that day. The top of the candle shows the opening price for that day.

Candlestick charts can be used to identify patterns in the price movement. For example, you might see a pattern where the price falls sharply after a large buy order is placed, and then rebounds sharply shortly afterwards. This is an indication that someone is trying to take advantage of the price movement and drive it down.

Candlestick charts are also useful for timing your trades. If you see the price moving in a specific direction, you can make a trade before the price moves significantly higher or lower.