What is driving crypto prices?

Bitcoin and other cryptocurrency prices have been on the rise in recent months, driven by a variety of factors. One is increased interest from institutional investors, who see cryptocurrencies as a potential hedge against inflation. Another is growing demand from retail investors, who view them as an alternative to traditional assets such as stocks and bonds. Finally, there is speculation that a major cryptocurrency exchange may soon list Bitcoin futures, which would make it easier for investors to trade Bitcoin.

The Psychology behind Crypto Prices

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

The Economics of Crypto Prices

Cryptocurrency prices are a very important aspect of the overall economics of blockchain technology. Cryptocurrencies are built on a blockchain technology, which is a distributed ledger that allows for secure and transparent transactions. Cryptocurrencies are based on a decentralized network, which means they are not subject to government or financial institution control.

Cryptocurrencies are built on a blockchain technology, which is a distributed ledger that allows for secure and transparent transactions.

Cryptocurrencies are built on a blockchain technology, which is a distributed ledger that allows for secure and transparent transactions. Cryptocurrencies are built on a blockchain technology, which is a distributed ledger that allows for secure and transparent transactions. Cryptocurrencies are built on a blockchain technology, which is a distributed ledger that allows for secure and transparent transactions.

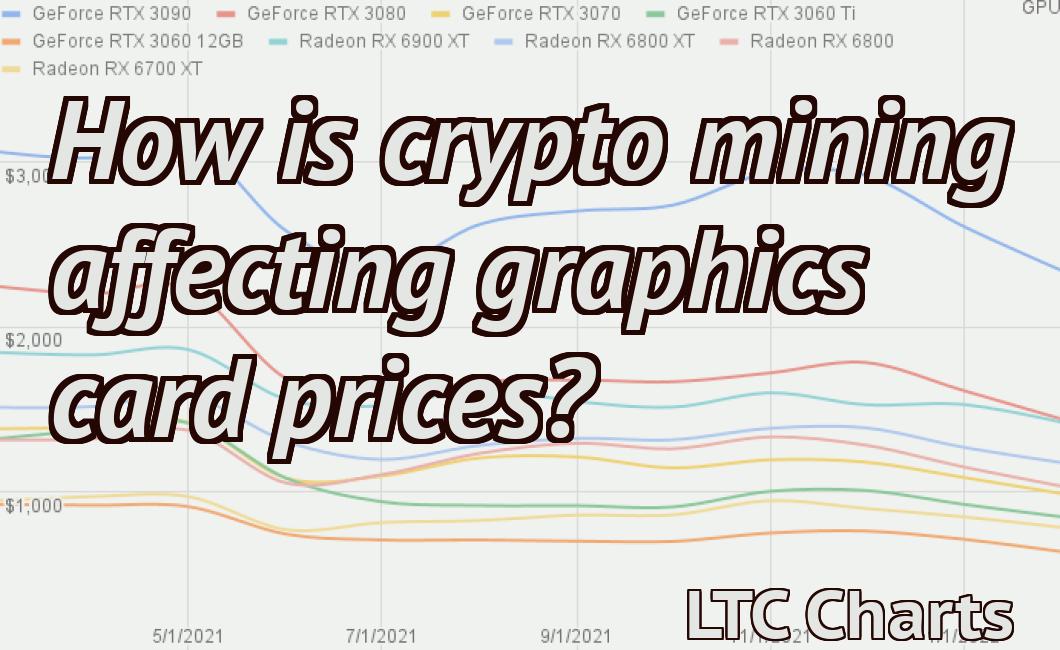

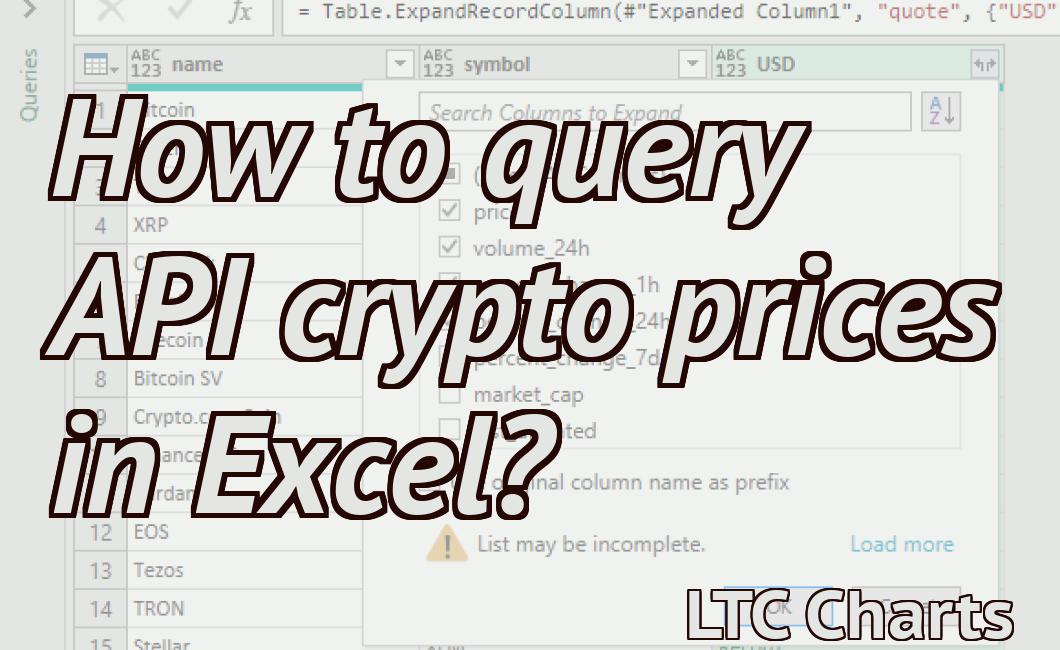

The Technology of Crypto Prices

Cryptocurrencies are traded on a variety of exchanges and can be bought and sold with a variety of currencies. Prices for cryptocurrencies are determined by supply and demand, and can change rapidly.

The Sociology of Crypto Prices

Cryptocurrencies are a form of digital asset that uses cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. While there is no guarantee that cryptocurrencies will continue to be valuable, their popularity has resulted in increasing prices.

There is a lot of speculation surrounding cryptocurrency prices, and there is no single answer to why prices rise or fall. Factors that can influence prices include global economic conditions, news events, and innovations in the cryptocurrency ecosystem.

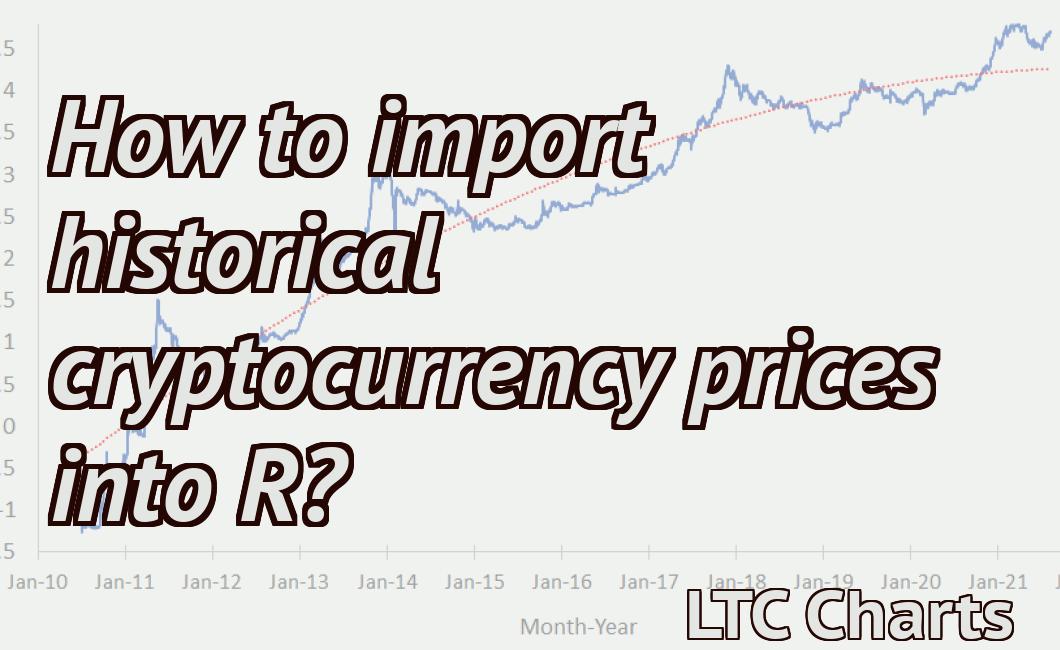

The History of Crypto Prices

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin was the first decentralized cryptocurrency, created in 2009. Since then, many other cryptocurrencies have been created, including Ethereum, Bitcoin Cash, Litecoin, and Dash. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

The Future of Crypto Prices

Just as the future of any technology is uncertain, so too is the future of crypto prices. Cryptocurrencies are still in their early stages, and there is a lot of uncertainty about how they will develop in the future.

Some experts believe that cryptocurrencies will become more widespread and more accepted over time, while others believe that they will eventually lose their value and become worthless. It is difficult to predict which direction the prices of cryptocurrencies will take in the future, but it is possible that they could continue to rise or fall in value unpredictably.

The Manipulation of Crypto Prices

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies can be volatile and their prices can change quickly. This volatility makes it difficult for investors to predict the value of cryptocurrencies. Some people use cryptocurrencies to purchase goods and services, while others use them as an investment.

The Regulation of Crypto Prices

Cryptocurrencies are not regulated by any central authority and so their prices are not subject to government approval or manipulation. Prices are determined by supply and demand, and so are free from the interference of third parties.

The Wild West of Crypto Prices

Cryptocurrencies have been on a tear in recent months, with prices soaring hundreds of percent. The reasons for this are still somewhat mysterious, but it seems that many people believe that cryptocurrencies are the new gold.

One of the main attractions of cryptocurrencies is their decentralized nature. This means that they are not subject to the control of any single institution or individual. This has led to a Wild West-type environment where prices can be extremely volatile.

For example, Bitcoin prices rose from around $6,000 to over $19,000 in just a few months in late 2017. However, this was followed by a sharp decline, with prices eventually returning to around $10,000.

This volatility can be very dangerous for those who are not prepared for it. For example, if you were hoping to use your cryptocurrency holdings to purchase a physical asset, then you might find that the value has plummeted by the time you are able to do so.

This volatility also makes it difficult for governments and other financial institutions to regulate cryptocurrencies. This is because it is difficult to assess the value of a digital asset and determine whether it is worth imposing sanctions or taking other regulatory action.

However, despite these risks, there are also a number of reasons why investors are attracted to cryptocurrencies. For example, they are relatively safe investments, as there is no risk of losing all of your money.

Additionally, there is the potential for big profits if the price of a cryptocurrency increases significantly. This is because you can sell your holdings at a higher price than you purchased them for.

However, it is important to be aware of the risks involved in investing in cryptocurrencies. Make sure that you are fully aware of the risks and understand how to protect yourself if things go wrong.