Candles In Crypto Charts

Candles In Crypto Charts is an article that looks at the use of candlestick charts in the cryptocurrency market. It discusses how these charts can be used to track price movements and predict future prices. The article also includes a tutorial on how to read and interpret candlestick charts.

Bitcoin candles: what do they mean for traders?

Bitcoin candles are graphical representations of the price of bitcoin over time. They can be used by traders to track the price of bitcoin over different periods of time.

Ethereum candles: what do they mean for traders?

Ethereum candles are a popular way to track the price of Ethereum. They show the price of Ethereum over a period of time, and can be used to help traders make informed decisions about whether or not to buy or sell Ethereum.

Litecoin candles: what do they mean for traders?

Litecoin candles are a technical analysis tool that allow traders to track the price movement of Litecoin over time. Candle stick charts are a simple way to visualize price movements and can be used to identify potential trading opportunities.

Bitcoin Cash candles: what do they mean for traders?

Candles on the Bitcoin Cash (BCH) price chart indicate that the price is currently below the $2,000 support level. This could lead to a potential decline in the BCH price, although it is still too early to say for certain.

If the price falls below the $2,000 support level, this could indicate that the market is bearish and that demand for BCH is waning. In this scenario, traders could expect to see the BCH price decline further towards the $1,800 support level.

On the other hand, if the BCH price continues to rise above the $2,000 support level, this could indicate that the market is bullish and that demand for BCH is increasing. In this scenario, traders could expect to see the BCH price rise further towards the $3,000 support level.

Ripple candles: what do they mean for traders?

Ripple candles are a technical analysis tool that traders can use to predict the direction of the price of a cryptocurrency. They are created by drawing a candle with a long body and a short tail. The long body represents the increase in price, while the short tail represents the decrease in price.

Stellar candles: what do they mean for traders?

Stellar candles are a technical analysis indicator used to measure the strength of a cryptocurrency's price movement. They are created when a cryptocurrency's price falls below a certain threshold, and then rises above that same threshold again.

EOS candles: what do they mean for traders?

A lot of people use EOS candles to help them make trading decisions. A candle is simply a chart that shows the price of a specific asset over a specific period of time.

When you see a candle with a long white stem, this means that the price of the asset was higher at the beginning of the period and lower at the end. When you see a candle with a short white stem, this means that the price of the asset was higher at the end of the period and lower at the beginning.

This information can be helpful when trying to figure out whether or not to buy or sell an asset. For example, if you see a long white stem candle indicating that the price of an asset is going up, it might be a good idea to buy the asset. If you see a short white stem candle indicating that the price of an asset is going down, it might be a good idea to sell the asset.

Cardano candles: what do they mean for traders?

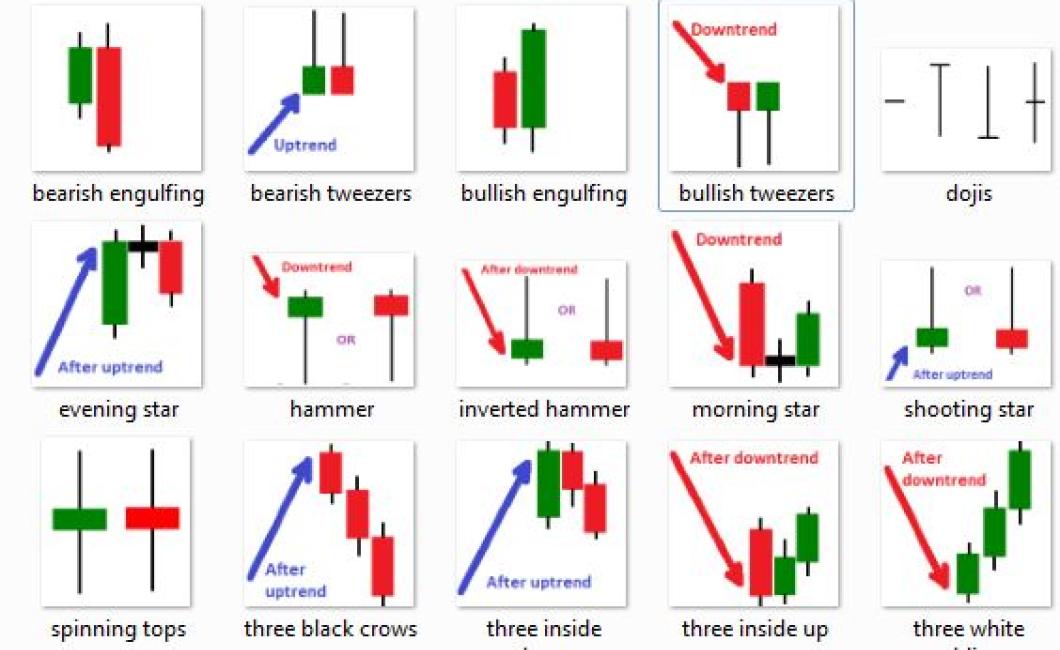

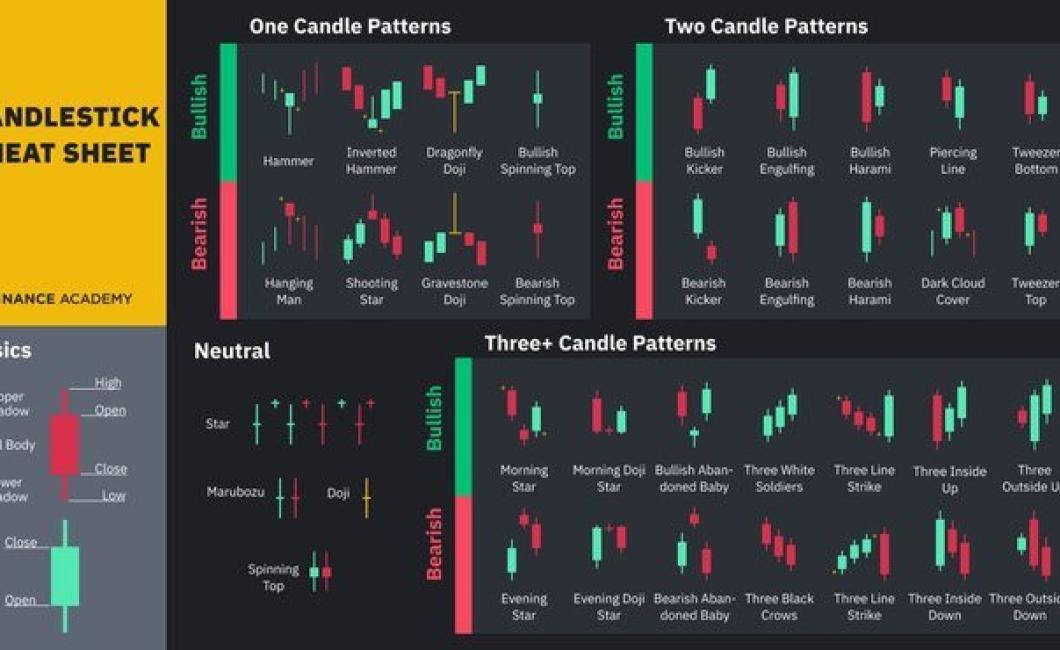

A candle is a technical analysis indicator that shows a trend in the price of a security or commodity. When a security or commodity's price moves up or down, the candle will show either an up or down trend.

Many traders use candles to identify trends and make informed trading decisions. When analyzing a stock, for example, a trader might look at the number of candles that have been green (meaning the price has gone up) and the number of candles that have been red (meaning the price has gone down). This information can help the trader determine whether the stock is in an uptrend or a downtrend.

NEO candles: what do they mean for traders?

NEO candles are a visual indicator of how bullish or bearish traders believe the NEO market is at the moment. A NEO candle will either be filled with green or red, which indicates whether traders believe that the NEO price will rise or fall in the near future.

IOTA candles: what do they mean for traders?

Candles on the IOTA tangle represent transactions that have been completed, but have not been included in the latest block. Because the tangle is a distributed ledger, it is constantly growing and contracting, meaning that the number of candles can change at any time.

Because the IOTA network is decentralized, it is not subject to the same rules as traditional financial institutions. This means that traders need to be aware of the implications of changes in the candle count in order to make informed decisions about their investments.

The most important thing to remember is that the candle count is not a guaranteed indicator of the health of the IOTA network. In fact, there have been numerous occasions where the candle count has changed dramatically, but the IOTA network has remained stable.

TRON candles: what do they mean for traders?

Tron candles are indicative of a trend reversal in the cryptocurrency market. When the candle is red, this indicates that the market is bearish and prices are dropping. Conversely, when the candle is green, this indicates that the market is bullish and prices are rising. When traders see a Tron candle forming, they will often sell their cryptocurrencies and buy other assets to take advantage of the reversal.