Correlayion Charts Crypto

A correlation chart is a graphical representation of how two or more variables move in relation to each other. In the financial world, correlation charts are used to measure the degree to which asset prices move in tandem. For example, if two stocks tend to move up and down together, they would have a high correlation. In the cryptocurrency world, correlation charts can be used to measure the degree to which different digital assets move in relation to each other. This can be helpful for investors looking to diversify their portfolios. For example, if Bitcoin and Ethereum tend to move in opposite directions, an investor might want to consider owning both to hedge their risk.

How to use Correlation Charts to trade Crypto

A correlation chart is a graphical representation of the relationship between two variables. The variables can be prices, volumes, or any other pair of data points.

When you are looking to trade cryptocurrencies, you will want to use correlation charts to help you identify which cryptos are correlated with each other.

For example, if you are looking to trade Bitcoin and Ethereum, you would want to look at the correlation between the two currencies. If they are highly correlated, then it is likely that they will move together.

However, if Bitcoin and Ethereum are not correlated, then it is possible that one currency will move while the other remains relatively stable.

There are a number of tools available online that can help you create correlation charts. Some of the more popular tools include Coinigy and CoinMate.

Using Correlation Charts to predict Crypto prices

Cryptocurrencies are famously volatile, and it can be difficult to determine when and where prices will change. One way to try and make sense of this volatility is to use correlation charts.

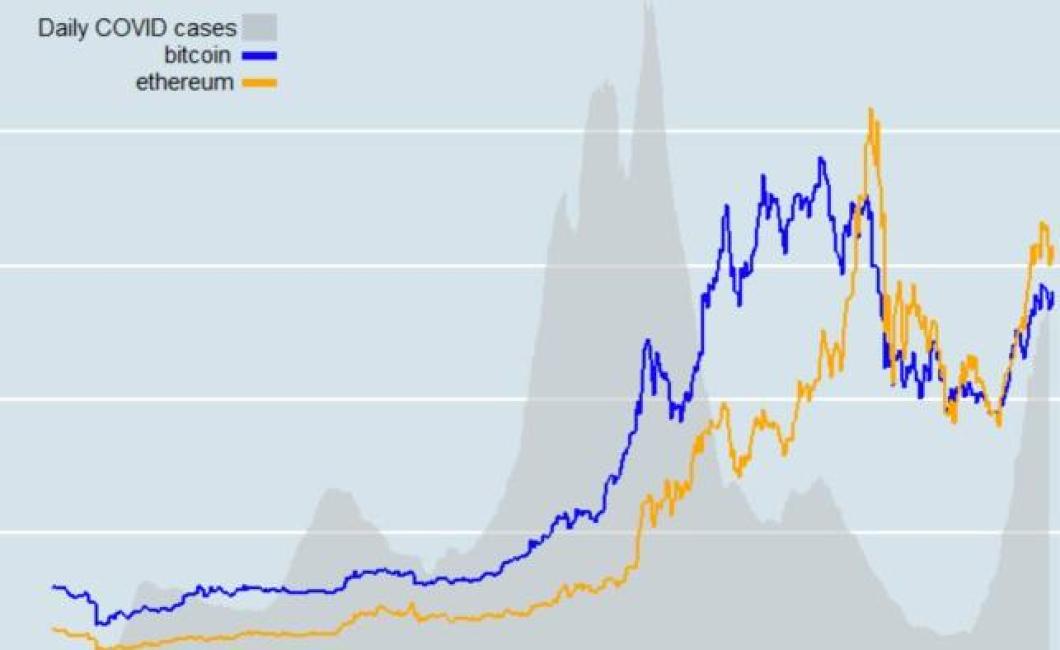

A correlation chart is a graphical representation of the correlation between two variables. In this example, we are using the correlation between the price of Bitcoin and the price of Ethereum.

Looking at the chart, it is evident that Ethereum and Bitcoin are highly correlated. The correlation coefficient is 0.92, which means that 92% of the variation in Ethereum’s price is explained by the variation in Bitcoin’s price. This means that, for example, if the value of Bitcoin goes up, the value of Ethereum is likely to go up as well.

This correlation can be useful when predicting the prices of cryptocurrencies. If we know that Ethereum and Bitcoin are highly correlated, we can use that information to predict the prices of other cryptocurrencies. For example, if we know that the price of Ethereum is going to go up, we can expect the price of Bitcoin to go up as well.

How to read Correlation Charts for Crypto trading

A correlation chart is a visual representation of the correlation between two variables. It can be used for a variety of purposes, such as trading analysis.

To use a correlation chart for crypto trading, you first need to identify the two variables you are interested in. In this example, we are interested in the correlation between the price of Bitcoin and the price of Ethereum.

Next, you need to plot the data on the chart. In this example, we are plotting the prices of Bitcoin and Ethereum against each other.

Finally, you need to look for patterns in the data. In this example, we are looking for any correlations between the two variables. We are also looking for any patterns that may suggest which direction the markets are likely to move in.

What do Correlation Charts tell us about Crypto?

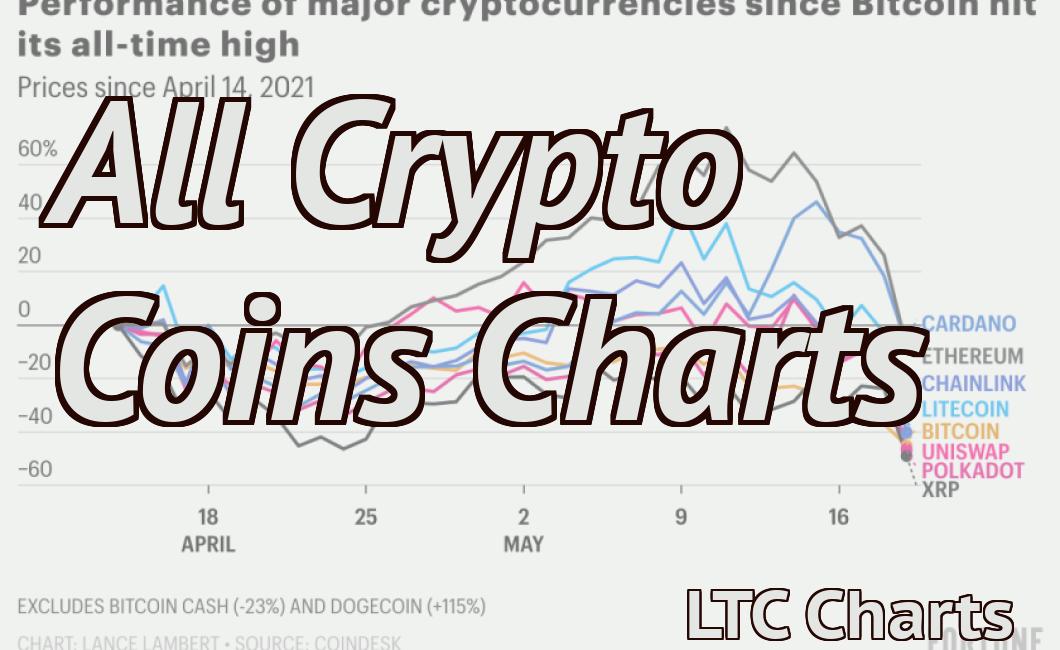

Cryptocurrencies are correlated with each other. That means that when one cryptocurrency goes up in price, others tend to go up as well.

How can Correlation Charts help us trade Crypto?

Correlation charts can help us trade Crypto by helping us identify which cryptocurrencies are most correlated with each other. This can help us determine which cryptocurrencies are likely to move together and which ones are likely to move apart.

What is the relationship between Correlation Charts and Crypto?

Cryptocurrencies are based on cryptography, a branch of mathematics that provides security and privacy for data. Cryptography is used to secure transactions and to control the creation of new units of currency.

Why are Correlation Charts important for Crypto trading?

Correlation charts are important for crypto trading because they can help traders better understand the relationship between different cryptocurrencies. By understanding the correlation between cryptocurrencies, traders can better predict which cryptocurrencies will rise and fall in value.