Crypto Charts With Candles

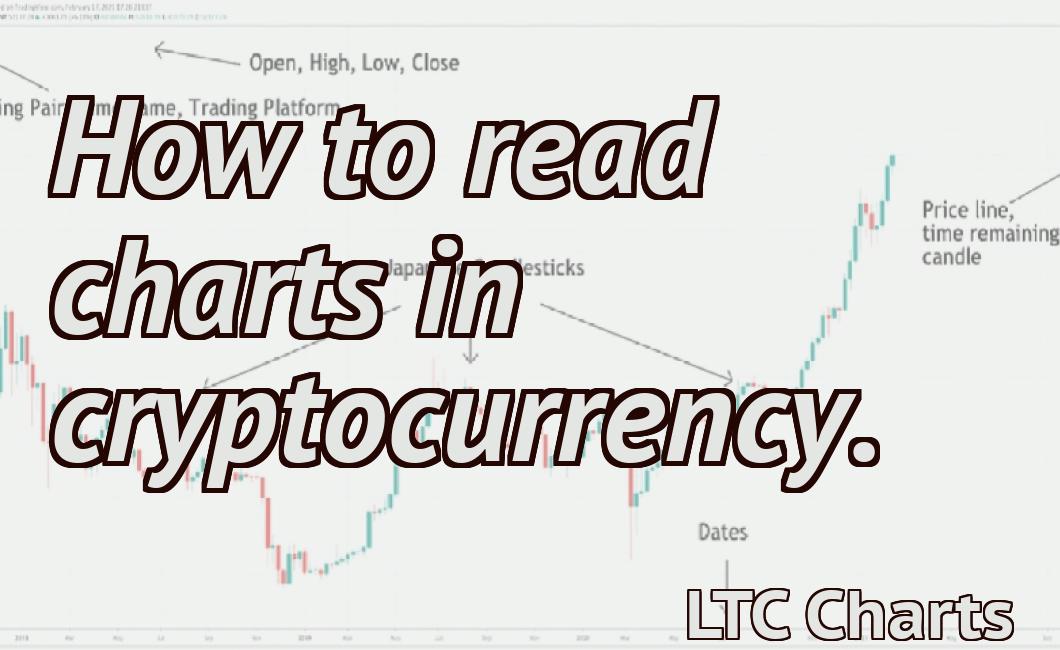

This Crypto Charts With Candles article provides a basic introduction to reading cryptocurrency charts with candlesticks. It covers the basic terminology and concepts involved in reading candlestick charts, and provides a step-by-step guide to reading them.

Crypto charts: The basics of using candlesticks to trade cryptocurrencies

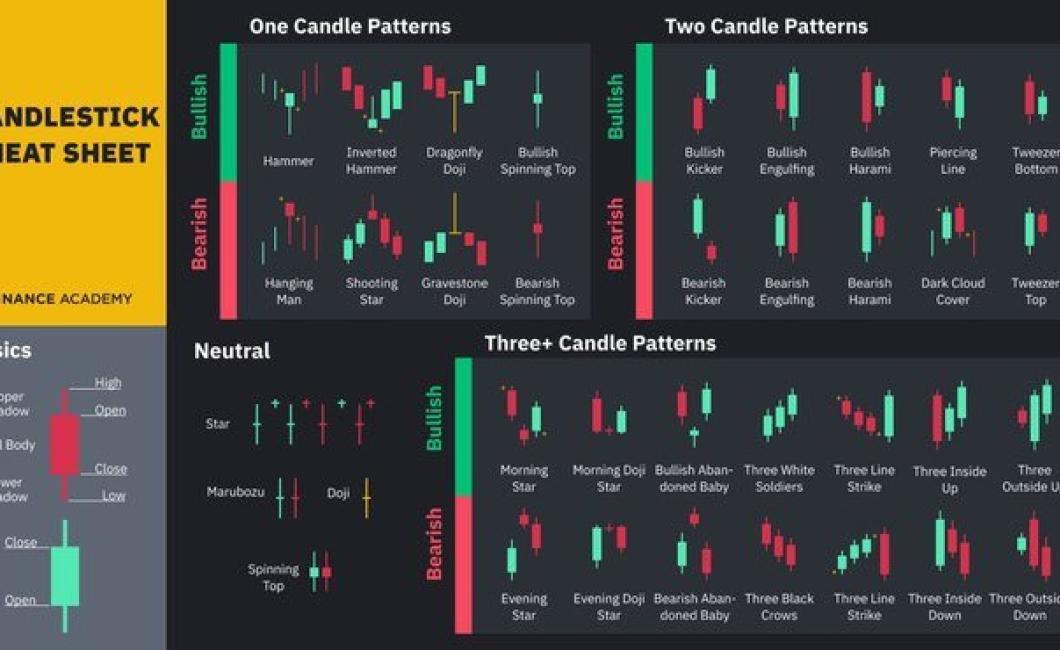

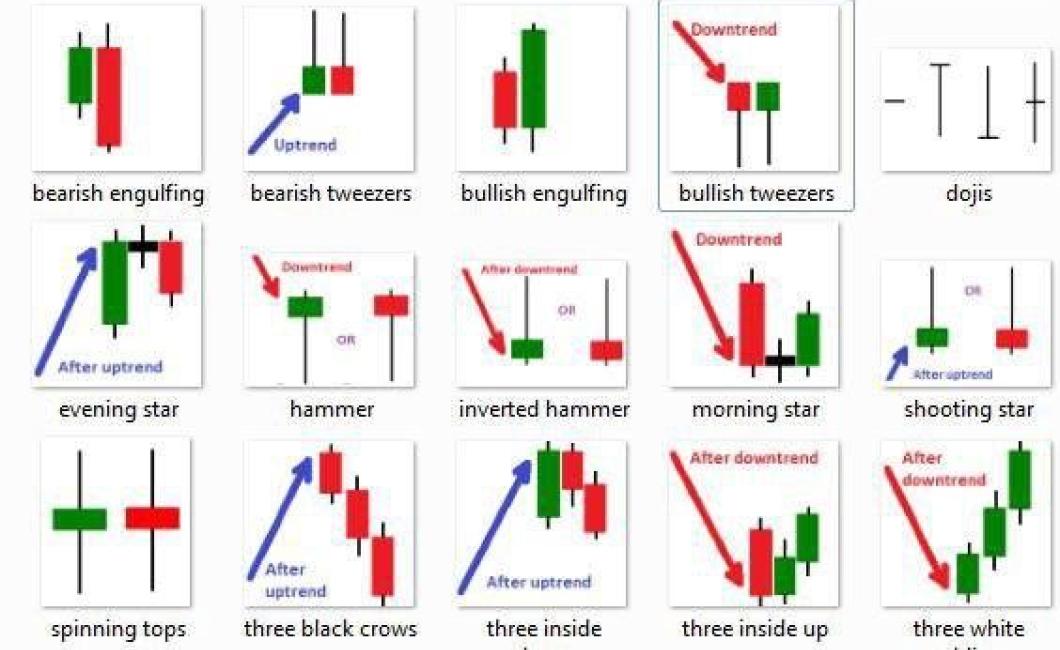

Candlesticks are a great way to visualize price movements over time on a chart. Candlesticks help you to identify patterns and determine whether the market is trending up or down.

To use candlesticks, first identify the open and close prices for the day's trading. Next, draw a vertical line between the two prices. Finally, plot the candlesticks on the chart according to the open, high, low, and close prices for that day.

The following are basic candlestick tips:

-When the open price is higher than the close price, the candle is in the "H" position.

-When the open price is lower than the close price, the candle is in the "L" position.

-When the close price is higher than the open price, the candle is in the "W" position.

-When the close price is lower than the open price, the candle is in the "U" position.

Trading crypto with candlesticks: what you need to know

Candlesticks are a graphical representation of price movements over time. They can be used to identify patterns and trends in the market.

When you are trading crypto, you need to be aware of the different types of candlesticks. The most common type of candlestick is the "hammer", which is used to indicate a strong buying or selling pressure.

Other types of candlesticks include the "hand", which is used to show a gradual change in demand, and the "hourglass", which is used to indicate a gradual change in supply.

You also need to be aware of the different timeframes that candlesticks are used in. The "minute" timeframe is used to show short-term price movements, while the "hour" timeframe is used to show long-term price movements.

How to read crypto charts with candlesticks

To read crypto charts with candlesticks, first find the open, high, and low prices for the day. Then, look for the candlestick that corresponds to the highest price. It should be colored in green. The next candlestick should be colored in red, and so on.

A beginner's guide to using candlestick charts for crypto trading

Candlestick charts are a popular way to visualize price movements in cryptocurrencies. They're simple and easy to use, making them a great choice for beginner traders. Here's a guide on how to use candlestick charts for crypto trading.

1. Open a trading account and create a buy or sell order.

2. On the candlestick chart, locate the cryptocurrency you want to trade.

3. Draw a horizontal line from the current price to the bottom of the candlestick.

4. Draw a vertical line from the current price to the top of the candlestick.

5. Look for patterns in the candle's width, height, and open and close prices.

6. If you see a pattern, make a buy or sell decision based on that pattern.

The essentials of crypto charting: using candlesticks

and MACD

Crypto charting is the process of using technical indicators to monitor the price of a cryptocurrency. Candlesticks are used to display the open, high, low, and close prices for a given period of time, while the MACD is used to indicate the overall trend of the market.

Trading cryptocurrencies: a guide to using candlestick charts

Candlestick charts are a great way to understand the behavior of cryptocurrencies. They allow you to see what is happening on a day-to-day basis, and can help you make informed decisions about whether or not to buy or sell a cryptocurrency.

To use candlestick charts, first find the timeframe that best suits your needs. Some cryptocurrencies have daily, weekly, or monthly charts, while others have hourly, daily, or weekly charts. Once you have chosen the timeframe, find the candlestick chart type. There are three types of candlestick charts: open, high, and low.

Open candlestick charts show the price of a cryptocurrency at the opening of the trading day. High candlesticks indicate that the price was higher than the previous day's open, and low candlesticks indicate that the price was lower than the previous day's open.

Weekly candlestick charts show the price of a cryptocurrency over a seven-day period. Daily candlestick charts show the price of a cryptocurrency over a 24-hour period.

Hourly candlestick charts show the price of a cryptocurrency over a one-hour period.

How to trade crypto with candlestick charts

To trade crypto with candlestick charts, follow these steps:

1. Open a trading account with a reputable broker or exchange.

2. Deposit your desired cryptocurrency into your account.

3. Buy or sell the cryptocurrency at the desired price point.

4. Keep an eye on the candlestick charts to see how the markets are moving.

A beginner's guide to cryptocurrency trading with candlestick charts

Candlestick charts are a popular way to visualize price movements on cryptocurrency exchanges.

1. Choose a cryptocurrency exchange that offers candlestick charts.

2. Open a new account on the exchange.

3. Deposit Bitcoin or other supported cryptocurrency into your account.

4. Purchase Ethereum or another supported altcoin on the exchange.

5. Trade Ethereum for Bitcoin or other supported cryptocurrency.

6. Close your position and withdraw your Bitcoin or other supported cryptocurrency.

Using candlestick charts for cryptocurrency trading

Candlestick charts are a great way to visually represent the movement of a cryptocurrency over time. They show the highs and lows of the price over a given period of time, as well as the percentage change.

To create a candlestick chart, you first need to gather the data you need. This can be done by reading the cryptocurrency's price history page on a public blockchain or by using a cryptocurrency trading platform.

Once you have the data, you need to create a chart. To do this, you will first need to select the timeframe you would like to represent. This will be either daily, weekly, or monthly.

Next, you will need to choose the type of candlestick you would like to use. There are three types of candlesticks: open, high, and low. Open candlesticks indicate the current market price, while high and low candlesticks indicate the highest and lowest prices during the given timeframe.

Finally, you will need to configure the chart's settings. This will include the color of the candlesticks, their size, and the type of line they will be represented by.

How to read crypto charts: a guide for beginners

Crypto charts are a great way to track the performance of digital assets.

There are a few things you need to keep in mind when reading crypto charts:

1. Don’t get overwhelmed! It can be hard to follow all the different indicators and values on a crypto chart, but don’t worry – with some practice, you will be able to understand what is going on.

2. Always remember that crypto charts are not a guarantee of future success or failure. Just like any other investment, it is important to do your own research before making any decisions.

3. Finally, always remember that crypto charts are volatile – so be prepared for sudden changes in prices.

Crypto charting 101: an introduction to using candlesticks

and OHLC bars

Candlesticks and OHLC bars are two of the most common types of charts used to track cryptocurrency prices. Candlesticks display the price action over a given period of time, while OHLC bars show the volume of transactions over that same period.

Candlesticks

Candlesticks are composed of a series of vertical bars that indicate the price movement over a given time period. The width of each bar corresponds to the amount of change in price over that period.

The opening and closing prices of each candlestick are also indicated on the chart. The color of the candlestick corresponds to the market sentiment at the time of its creation. For example, green candlesticks indicate positive sentiment, and red candlesticks indicate negative sentiment.

OHLC Bars

OHLC bars show the volume of transactions over a given period of time. The width of each bar corresponds to the number of transactions executed during that period. The color of the bar indicates the market sentiment at the time of its creation. For example, blue bars indicate positive sentiment, and red bars indicate negative sentiment.

OHLC bars can be useful for quickly identifying trends in the cryptocurrency market.