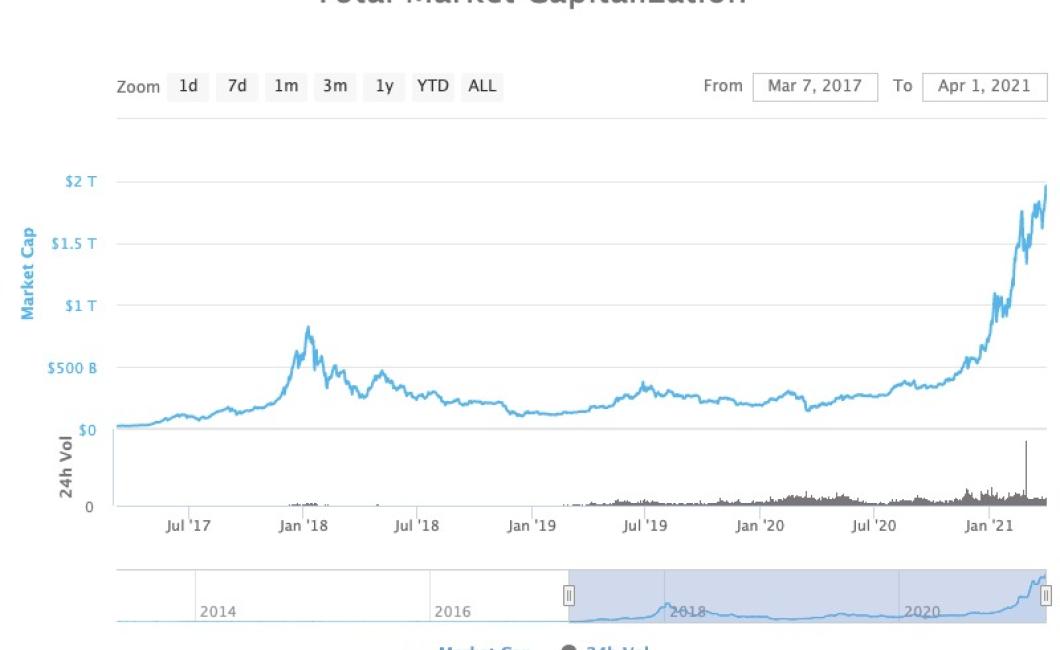

Crypto Market Capitalization Charts

This article contains a variety of charts that show the total market capitalization for cryptocurrencies. The data is sourced from CoinMarketCap.com.

crypto market capitalization charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. As of February 2018, there were a total of 1,410 cryptocurrencies in circulation, according to CoinMarketCap.

The first cryptocurrency, Bitcoin, was created in 2009 by an unknown person or group of people under the name Satoshi Nakamoto. Bitcoin is open-source software and has been released under a peer-to-peer license. The number of Bitcoin transactions per day has grown exponentially, reaching over 1 million in December 2017.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin is the most popular cryptocurrency and has been the largest one by market capitalization for several years. Other popular cryptocurrencies include Ethereum, Ripple, and Bitcoin Cash.

The current state of the crypto market

The current state of the crypto market is in a state of flux. A lot has happened since the highs seen in December 2017 and January 2018. The prices of some cryptocurrencies have fallen by 80% or more, while others have increased in value by hundreds of percent. In this article, we will take a look at the current state of the crypto market, and discuss some of the reasons why it is in a state of flux.

The main reason why the crypto market is in a state of flux is because a lot of new investors have entered the market in recent months. This has caused the prices of many cryptocurrencies to increase rapidly, without any real underlying value. Many of these new investors are simply looking to make a quick profit, and are not interested in the long-term potential of the cryptocurrency market.

Another reason why the crypto market is in a state of flux is because a lot of major cryptocurrency exchanges have been hacked in recent months. This has caused a lot of investors to lose their money, and has made it difficult for new investors to enter the market.

Overall, the current state of the crypto market is in a state of flux because a lot of new investors have entered the market, and a lot of major cryptocurrency exchanges have been hacked. This is likely to continue for a while, as there is no real underlying value to the cryptocurrencies in the market.

How much has been invested in cryptos so far

There is no one answer to this question as the total amount invested in cryptos is constantly changing and evolving. However, according to CoinMarketCap, as of September 25, 2018, the total market capitalization of cryptocurrencies was $814.1 billion. This indicates that there has been a considerable amount of investment in cryptos thus far.

The top 10 cryptos by market cap

1. Bitcoin

2. Ethereum

3. Bitcoin Cash

4. Litecoin

5. EOS

6. Ripple

7. Cardano

8. IOTA

9. NEO

10. TRON

How market cap determines a crypto's price

The market cap of a crypto is the total value of all its outstanding tokens. This value is determined by multiplying the number of tokens in circulation by the price of one token.

Why Bitcoin is still the king of cryptos

Bitcoin is still the king of cryptos because it is the most popular and well-known cryptocurrency. Bitcoin has been around for over 10 years and has experienced relatively few price fluctuations. Bitcoin also has a large user base, which gives it more credibility and stability.

Ethereum and other altcoins on the rise

Bitcoin, Ethereum and other altcoins have been on the rise in recent weeks, with some analysts predicting they could hit $10,000 by the end of the year.

Ethereum is up more than 20% in the past month and is now worth more than $1,000. Bitcoin has seen a similar increase and is now worth more than $7,000.

Altcoins are becoming more popular as investors seek to diversify their portfolios. Bitcoin and Ethereum are both decentralized digital currencies that are not subject to government or financial institution control.

Litecoin and other coins to watch out for

Bitcoin Cash

Bitcoin Cash, or BCH, is a new cryptocurrency that was created in August 2017. It is based on the original Bitcoin blockchain but has a larger block size. This means that BCH can more easily process transactions than Bitcoin.

BCH is controversial because it was created as a spin-off of the Bitcoin blockchain. This has led to a lot of rivalry between the two communities.

Bitcoin Gold

Bitcoin Gold, or BTG, is a new cryptocurrency that was created in October 2017. It is based on the original Bitcoin blockchain but has a different mining algorithm than Bitcoin. This means that BTG can be more difficult to mine than Bitcoin.

BTG is controversial because it was created as a spin-off of the Bitcoin blockchain. This has led to a lot of rivalry between the two communities.

Litecoin

Litecoin, or LTC, is a new cryptocurrency that was created in October 2011. It is based on the original Bitcoin blockchain but has a much smaller block size. This means that LTC can more easily process transactions than Bitcoin.

Litecoin is popular because it is more affordable than Bitcoin and has a faster transaction speed.

How to read crypto market capitalization charts

Crypto market capitalization charts show the total value of all cryptocurrencies in circulation. Bitcoin and Ethereum are the two most valuable cryptocurrencies, with a combined market capitalization of over $300 billion.

10 things you need to know about crypto market caps

1. Crypto market caps are important for tracking the growth of crypto investments.

2. Bitcoin is the largest and most well-known cryptocurrency in the world.

3. Ethereum is the second largest cryptocurrency by market cap.

4. Other well-known cryptocurrencies include Litecoin, Ripple, and Bitcoin Cash.

5. Cryptocurrencies are not regulated by governments, but by a decentralized network of code.

6. Bitcoin and Ethereum are traded on digital exchanges and can also be used to purchase goods and services.

7. Cryptocurrencies are not backed by any physical assets, but by trust in the code that backs them.

8. Cryptocurrencies are volatile, which means their values can change quickly.

9. Cryptocurrencies are not subject to traditional financial regulations, so they may be risky for investors.

10. Cryptocurrencies are still in their early stages, so there is much to learn about them.

The difference between market cap and price

A market cap is a measure of the total value of a company's outstanding stock. It is calculated by multiplying the number of shares outstanding by the price per share.

A price is the amount that a buyer is willing to pay for a good or service. It is expressed in dollars and is determined by supply and demand.

Why market capitalization is important

Market capitalization is important because it measures a company's stock price relative to the total value of its outstanding shares. A company with a high market capitalization is considered to be more valuable than a company with a low market capitalization.