Define Crypto Charts

A crypto chart is a graphical representation of data relating to cryptocurrency prices, market capitalization, or other trading activity. Charts can be used to visualize market trends, identify opportunities for trading or investing, and track the performance of a portfolio.

Crypto Charts: What They Are and How to Use Them

Crypto charts are a way to track the price of cryptocurrencies over time. They can be used to find information such as the market capitalization, the 24-hour trading volume, and the percentage change in value over the past day or week.

To use a crypto chart, first find the currency you're interested in. You can do this by looking for the currency's symbol on Coinmarketcap.com or by using a cryptocurrency exchange. Once you've found the currency, click on its symbol on the Coinmarketcap.com page.

Next, open a new web browser window and go to Coinmarketcap.com's Cryptocurrencies page. On this page, you'll see a list of all the cryptocurrencies available. Find the cryptocurrency you're interested in and click on its symbol.

Now, you'll see a chart that shows the price of the cryptocurrency over time. To view more detailed information about the chart, click on the data points that interest you. For example, if you're interested in the market capitalization of the cryptocurrency, you'll see this information at the top of the chart.

Cryptocurrencies are volatile and can be subject to sudden changes in price. So it's important to carefully consider what information you're looking for when using a crypto chart. If you need help understanding how to use a crypto chart, consult a financial advisor.

How to Read and Understand Crypto Charts

To read and understand crypto charts, you first need to understand what a cryptocurrency chart is and how it works. A cryptocurrency chart is a visual representation of the price of a cryptocurrency over time. Cryptocurrency charts can be used to track the performance of a cryptocurrency, to identify patterns in the price of a cryptocurrency, and to predict future market movements.

Cryptocurrencies are traded on a number of different exchanges and can also be bought and sold on a number of different online platforms. The price of a cryptocurrency can be affected by a number of different factors, including global economic conditions, news events, and technical analysis.

To read and understand crypto charts, you first need to understand what a cryptocurrency chart is and how it works.

The Different Types of Crypto Charts and Their Uses

Crypto charts are a valuable tool for understanding the performance of various cryptocurrencies. The types of crypto charts available and their uses vary, but all charts can provide insights into a cryptocurrency’s price movement and performance.

Crypto chart types can include:

1. Chart of the day

This type of chart shows the latest price movements for a given cryptocurrency over a 24-hour period. This is useful for tracking short-term price movements.

2. Chart of the week

This type of chart tracks the latest price movements for a given cryptocurrency over a seven-day period. This is useful for tracking longer-term trends.

3. Chart of the month

This type of chart tracks the latest price movements for a given cryptocurrency over a 30-day period. This is useful for tracking longer-term trends and analyzing market sentiment.

4. Chart of the year

This type of chart tracks the latest price movements for a given cryptocurrency over a 12-month period. This is useful for tracking longer-term trends and analyzing market sentiment.

5. Volume chart

This type of chart shows the amount of cryptocurrency traded over a given period of time. This can be helpful in tracking trends in cryptocurrency trading activity.

6. Price chart

This type of chart shows the price of a given cryptocurrency over a given period of time. This can be helpful in tracking trends in cryptocurrency trading activity.

What do Candlestick Charts Mean for Crypto Traders?

Candlestick charts are a popular way to visualize price data. They show the price of a security over time, with the width of the bars representing the duration of the period. For example, a candlestick with a long body and a small top represents a period of high price activity, while a candlestick with a short body and large top represents a period of low price activity.

Crypto traders use candlestick charts to identify patterns in price movement. For example, they may look for bullish or bearish candles to determine whether the price is heading in the right direction. They can also use them to predict where the price is likely to go next.

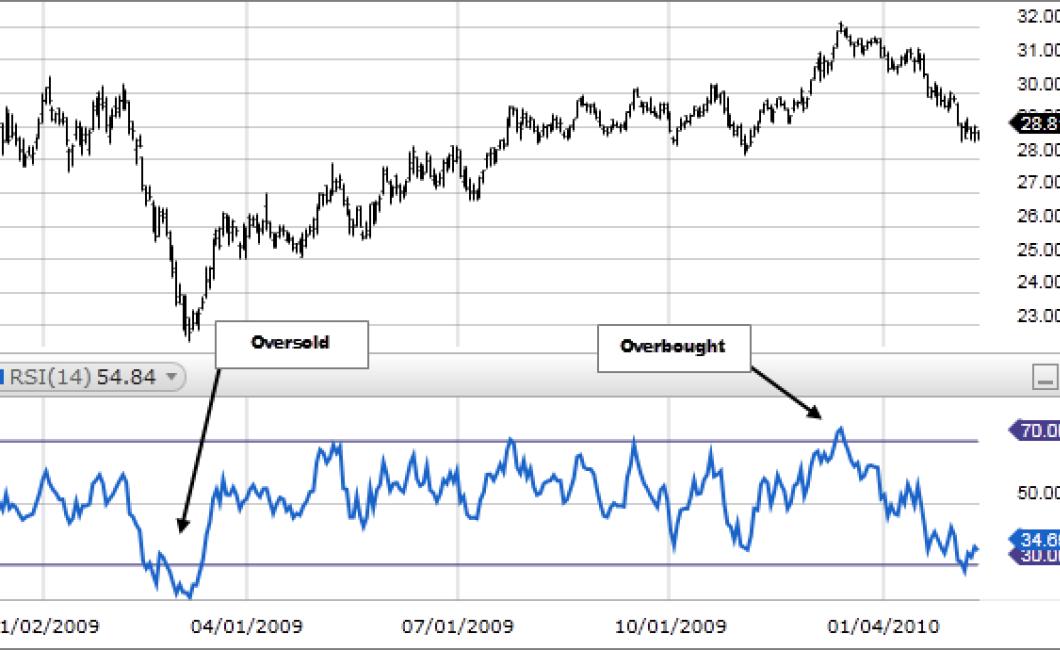

How to Use Technical Analysis with Crypto Charts

Technical analysis is the use of charts and other technical indicators to predict future price movements. Crypto charts can be used to track prices of digital assets, but can also be used to identify patterns and trends in price movements.

When using technical analysis with crypto charts, it is important to understand the different types of charts and indicators. The most common types of charts used in technical analysis are trend charts, candlestick charts, and volume charts.

1. Trend Charts

Trend charts are used to identify whether a cryptocurrency is moving up or down in price. They are typically created by plotting the price of a cryptocurrency over time on a graph.

To create a trend chart, you will first need to gather your data. You can find this information by visiting a cryptocurrency exchange and scanning the order books for transactions. You can also find this information by using a trading bot.

Once you have your data, you will need to plot it on a chart. To do this, open a charting platform such as TradingView and paste your data into the appropriate grid. You will then need to plot the prices over time and identify any patterns.

2. Candlestick Charts

Candlestick charts are used to identify patterns in price movements. They are created by plotting the prices of a cryptocurrency over time on a graph and highlighting the changes in price.

To create a candlestick chart, you will first need to gather your data. You can find this information by visiting a cryptocurrency exchange and scanning the order books for transactions. You can also find this information by using a trading bot.

Once you have your data, you will need to plot it on a chart. To do this, open a charting platform such as TradingView and paste your data into the appropriate grid. You will then need to plot the prices over time and identify any patterns.

3. Volume Charts

Volume charts are used to identify whether a cryptocurrency is gaining or losing popularity. They are created by plotting the number of transactions over time on a graph.

To create a volume chart, you will first need to gather your data. You can find this information by visiting a cryptocurrency exchange and scanning the order books for transactions. You can also find this information by using a trading bot.

Once you have your data, you will need to plot it on a chart. To do this, open a charting platform such as TradingView and paste your data into the appropriate grid. You will then need to plot the number of transactions over time and identify any patterns.

How to Find Support and Resistance Levels in Crypto Charts

When you are looking to trade crypto, it is important to be familiar with support and resistance levels. Support and resistance levels are simply lines on a chart that show where a particular price point occurs often. When a price moves above or below a support or resistance level, it indicates that buyers or sellers are supporting or resisting the move, respectively.

To find support and resistance levels in crypto charts, first identify the price point you want to analyze. Then, look for the nearest support or resistance level. The closer the support or resistance level is to the price point you identified, the more likely it is to be supported or resisted. If the price moves past the support or resistance level, it indicates that there is strong demand for the asset at that price point. If the price moves below the support or resistance level, it indicates that there is strong supply for the asset at that price point.

Using Fibonacci Retracement Levels in Crypto Charts

In the world of cryptocurrency trading, Fibonacci retracement levels are a popular tool for analyzing price movements. Fibonacci retracement levels can be used to identify potential support and resistance levels in the market.

To use Fibonacci retracement levels in your cryptocurrency trading analysis, follow these steps:

1. Start by setting up your technical indicators. This will include your basic price charts and Fibonacci retracement levels.

2. Once your indicators are setup, plot a Fibonacci retracement level on your chart at the point in time when you believe the price reached a low.

3. Plot a Fibonacci retracement level on your chart at the point in time when you believe the price reached a high.

4. Compare the two Fibonacci retracement levels to see if there is any potential support or resistance at that point in time.

5. Use this information to make informed decisions about where to buy and sell cryptocurrency.