Gas prices are crypto.

As the world increasingly moves toward a digital economy, more and more businesses are beginning to accept cryptocurrency as payment. This is especially true in the case of gas prices, which have been steadily rising in recent years. For those who are not familiar with cryptocurrency, it is a digital or virtual currency that uses cryptography for security. Cryptocurrency is decentralized, meaning it is not subject to government or financial institution control. Bitcoin, the most well-known cryptocurrency, was created in 2009. Since then, numerous other cryptocurrencies have been created. Ethereum, Litecoin, and Monero are a few examples. While gas prices continue to rise, those who own cryptocurrency can fill up their tank without having to worry about the cost. That's because crypto can be used to purchase gas at a fraction of the price. In fact, there are a number of gas stations around the world that accept cryptocurrency as payment. So, if you're looking to save money on gas, consider using crypto the next time you need to fill up.

Gas prices are on the rise - is crypto to blame?

There is no definitive answer as to why oil prices are on the rise, with a number of factors potentially contributing. However, some experts have asserted that increased use of cryptocurrencies may be one factor contributing to the increase in oil prices.

Cryptocurrencies are digital or virtual coins that use cryptography to secure their transactions and to control the creation of new units. They can be used as a medium of exchange, a store of value, or a unit of account.

As cryptocurrencies are not backed by any physical asset, their value is derived from the confidence of users and the belief that they will continue to exist in the future. In recent months, there has been an increase in the use of cryptocurrencies, which some analysts have attributed to fears surrounding global economic uncertainty.

As oil is a vital resource used in many industrial processes, an increase in the price of oil could lead to an increase in the price of cryptocurrencies. This would make them less attractive as a medium of exchange, and could lead to their decline in value.

How high gas prices are affecting crypto users

Overall, there is no clear consensus on how high gas prices are affecting crypto users. Some believe that the high gas prices are discouraging people from using cryptocurrencies, while others claim that the high gas prices are actually helping to fuel the growth of the crypto market.

Crypto investors feeling the squeeze as gas prices continue to rise

Cryptocurrencies are seeing a squeeze as gas prices continue to rise, according to Bloomberg.

The price of a gallon of gasoline rose by about 12 cents in the past month, reaching $2.87 on Wednesday. That’s up from around $2.59 a month ago.

Cryptocurrencies are seeing a squeeze as gas prices continue to rise, according to Bloomberg.

The price of a gallon of gasoline rose by about 12 cents in the past month, reaching $2.87 on Wednesday. That’s up from around $2.59 a month ago.

Cryptocurrencies have been seeing a pullback in recent days as the market reacts to rising gas prices, according to CoinMarketCap. The total market capitalization of all cryptocurrencies is currently down about 7 percent since the beginning of the year.

Are gas prices impacting the price of Bitcoin?

There is no evidence that gas prices are impacting the price of Bitcoin.

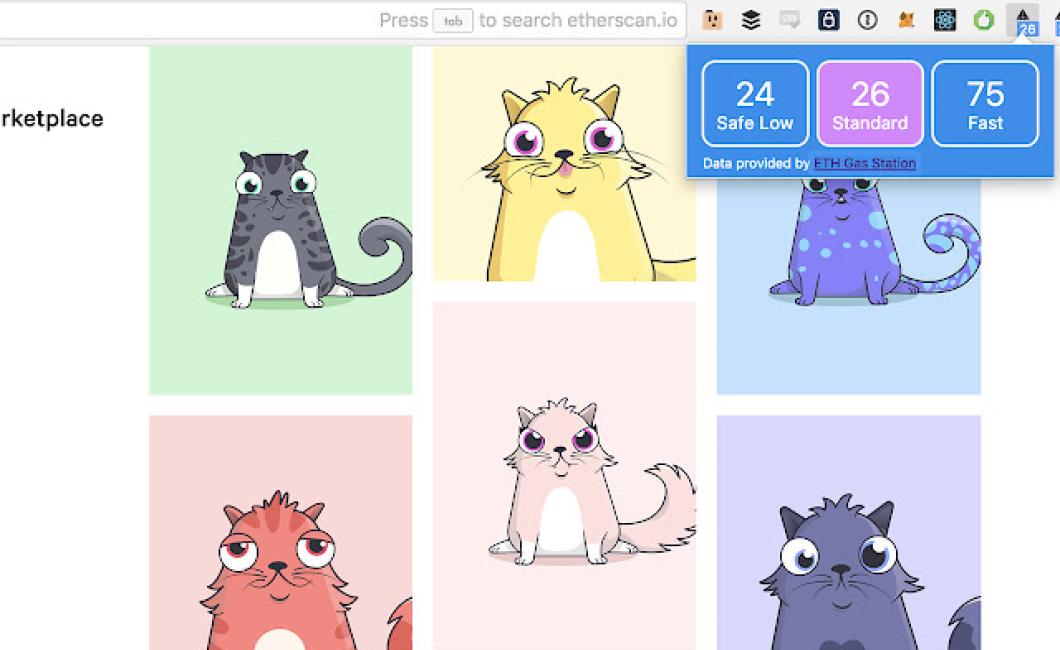

How Ethereum's gas prices are affecting cryptocurrency trading

Ethereum's gas prices are affecting cryptocurrency trading. When someone wants to create a new Ethereum transaction, they need to pay for gas. The cost of gas determines how much processing power is needed to carry out the transaction. The higher the gas price, the more expensive it is to carry out a transaction. This affects the price of Ethereum and other cryptocurrencies.

The rise in gas prices and its impact on the crypto market

The crypto market has been struggling since the beginning of this year and there are many reasons for this. The main reason is that the rise in gas prices has had a big impact on the market.

As you may know, gas is a fee that is charged by miners when they produce new blocks of cryptocurrency. This fee is used to incentivize them to continue mining and ensure that the network remains decentralized.

Gas prices have been on the rise for a while now and they are expected to keep rising in the future. This has had a big impact on the prices of cryptocurrencies, as they are based on the assumption that they will be worth more in the future as a result.

This has led to a lot of people selling their cryptocurrencies in order to buy more stable currencies like the US dollar or the euro. This has also had an impact on the overall market value of cryptocurrencies, as they have become less valuable as a result.

How the increasing cost of gas is impacting cryptocurrency

The increased cost of gas is having a significant impact on the cryptocurrency industry. This is because many of the most popular cryptocurrencies are built on blockchain technology, which requires a lot of processing power to run.

As the cost of gas increases, it becomes increasingly difficult for cryptocurrency companies to maintain their operations. This is especially true for smaller players who may not be able to afford to pay more for their gas fees.

In some cases, this has led to the closure of cryptocurrency companies altogether. For example, the mining company Bitmain announced earlier this year that it would be shutting down its mining operations in China due to the high cost of gas.