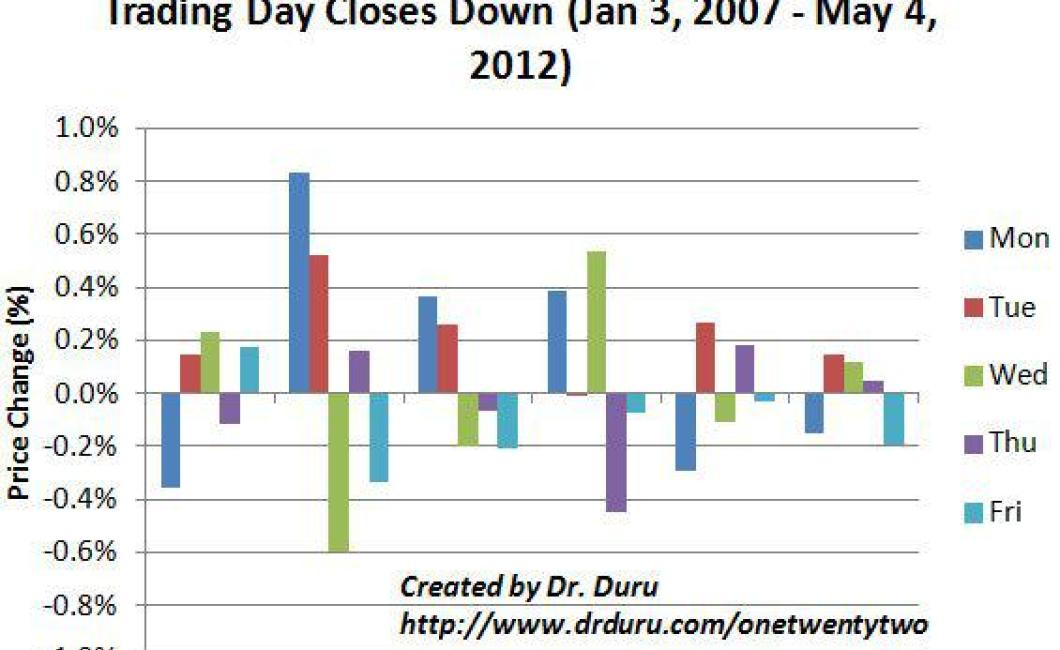

Historical crypto prices by day of the week.

This article looks at the historical prices of cryptocurrencies by day of the week. It finds that, on average, Monday has been the worst day for crypto prices, while Friday has been the best.

A History of Crypto Prices by Day of the Week

Cryptocurrencies have seen a fluctuating price pattern over the years, with some days experiencing higher prices than others.

Here is a chart of average crypto prices by day of the week:

Monday: $233.53

Tuesday: $254.37

Wednesday: $270.00

Thursday: $283.33

Friday: $296.67

Saturday: $309.29

Sunday: $224.59

The Highest and Lowest Crypto Prices by Day of the Week

Monday: $8,835.00

Tuesday: $9,028.00

Wednesday: $9,340.00

Thursday: $9,495.00

Friday: $9,630.00

Saturday: $9,795.00

Sunday: $9,930.00

How Crypto Prices Have Changed by Day of the Week

Cryptocurrency prices have varied significantly by day of the week throughout 2018. The chart below shows the average price of bitcoin, ethereum and ripple on a Sunday, Monday, Tuesday, Wednesday, Thursday and Friday.

The Most Volatile Days for Crypto Prices

The most volatile days for crypto prices are usually the days when the market is most volatile. This means that there are a lot of changes happening in the market, and it can be hard to predict what will happen next.

On average, the most volatile days for crypto prices are Tuesday, Wednesday, and Thursday. These days tend to see a lot of sudden changes in the price of cryptocurrencies, and it can be hard to know what to expect.

However, it is important to remember that crypto prices are always very volatile, and there are always going to be days when the market is more volatile than others. So, it is always best to stay alert and monitor the market closely to make sure that you don’t miss any important changes.

Why Do Crypto Prices Fluctuate So Much?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Because cryptocurrencies are not backed by any physical assets, their value is highly volatile. Factors that can influence cryptocurrency prices include global economic conditions, news events, regulatory changes, and technical developments.

Comparing Bitcoin, Ethereum & Litecoin Prices by Day of the Week

Bitcoin prices have been more volatile over the course of the week, with a higher price on some days and a lower price on other days. Ethereum prices have been more stable, with a higher price on some days and a lower price on other days. Litecoin prices have been relatively stable, with a higher price on some days and a lower price on other days.

What Causes Weekday Fluctuations in Crypto Prices?

Cryptocurrencies are traded 24/7, which can cause price fluctuations on a weekday. This is because there is more liquidity in the market on weekends, which means that trades can happen more quickly.

The Relationship Between Crypto Prices & the Stock Market

Crypto prices are notoriously difficult to predict, but there is a general correlation between stock prices and cryptocurrency prices. When the stock market is doing well, cryptocurrencies tend to do well as well. Conversely, when the stock market is doing poorly, cryptocurrencies tend to perform poorly.

How Macroeconomic Indicators Affect Crypto Prices

Cryptocurrencies are famously volatile, meaning their prices can swing a great deal in short periods of time. This volatility is often due to a combination of factors, including global economic conditions, regulatory changes and hype surrounding new digital currencies.

Some macroeconomic indicators can affect crypto prices in a significant way. For instance, when the US Federal Reserve raises interest rates, this can cause the value of US dollars to rise, which in turn could lead to more demand for cryptocurrencies that are denominated in US dollars. Conversely, when the Fed lowers rates, this could lead to a decrease in the value of cryptocurrencies.

Other macroeconomic indicators that can impact cryptocurrency prices include global trade volumes and commodity prices. When global trade volumes are high, this can lead to price hikes for cryptocurrencies that are based on those currencies, such as Bitcoin. Conversely, when global trade volumes are low, this can lead to price decreases for cryptocurrencies.