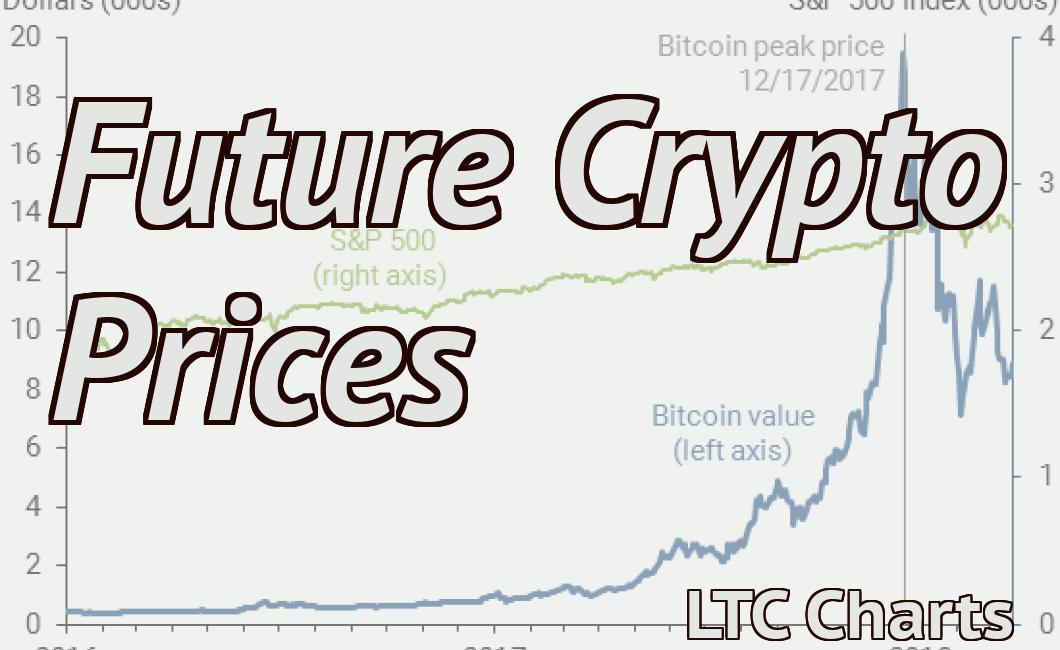

View Multi Charts Crypto

Looking at the cryptocurrency market from multiple perspectives can be helpful in trying to determine which direction prices may move in the future. The "View Multi Charts Crypto" article provides an overview of how to do this by looking at different types of charts.

Crypto charts: view the top 12 digital currencies

Bitcoin

Bitcoin is the world’s first and most popular cryptocurrency. It was created in 2009 by an unknown person or group of people under the name “Satoshi Nakamoto”. Bitcoin is a digital asset and a payment system: it is not backed by any government or central bank, and is independent of any single country’s economy. Bitcoin is traded on decentralized exchanges and can also be used to purchase goods and services.

Ethereum

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference. Ethereum is similar to Bitcoin, but it offers more features and capabilities. For example, Ethereum allows users to create their own tokens and decentralized applications. Ethereum is also faster than Bitcoin, and it has a larger market cap.

Litecoin

Litecoin is a cryptocurrency that was created in 2011 by Charlie Lee. Like Bitcoin, Litecoin is a digital asset and a payment system: it is not backed by any government or central bank, and is independent of any single country’s economy. Litecoin is traded on decentralized exchanges and can also be used to purchase goods and services.

Bitcoin Cash

Bitcoin Cash is a cryptocurrency that was created in August 2017. Bitcoin Cash is a digital asset and a payment system: it is not backed by any government or central bank, and is independent of any single country’s economy. Bitcoin Cash is traded on decentralized exchanges and can also be used to purchase goods and services.

EOS

EOS is a cryptocurrency that was created in 2018. EOS is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference. EOS is similar to Ethereum, but it offers more features and capabilities. For example, EOS allows users to create their own tokens and decentralized applications. EOS is also faster than Ethereum, and it has a larger market cap.

How to read crypto charts: a beginner's guide

As with most things in life, there's a lot to learn when it comes to understanding and using cryptocurrency charts. This guide will help you get started, and will cover the most important aspects of reading crypto charts.

Cryptocurrency charts are a great way to see how a particular cryptocurrency is performing over time. By looking at the prices and volumes of different cryptocurrencies, you can get a sense for how popular they are and what trends are happening.

There are a few key things to keep in mind when looking at cryptocurrency charts:

1. Always make sure to check the time frame of the chart. Charts are often presented in a time frame ranging from hours to entire months. Make sure to look at the time frame of the chart to get the most accurate information.

2. Pay attention to the price and volume data. These are the two most important pieces of information when it comes to reading crypto charts. The price data shows you how much money is being spent on a particular cryptocurrency, and the volume data tells you how many transactions are taking place on a given day.

3. Be aware of trends. Trends can be important when it comes to understanding how a cryptocurrency is performing. If you see a particular cryptocurrency behaving in a particular way, it may be worth investigating further.

4. Use caution when making investment decisions. Always be cautious when making investment decisions, and never invest more than you are willing to lose.

These are just a few key things to keep in mind when reading cryptocurrency charts. There is a lot to learn, but with a little practice, you can become an expert in cryptocurrency trading.

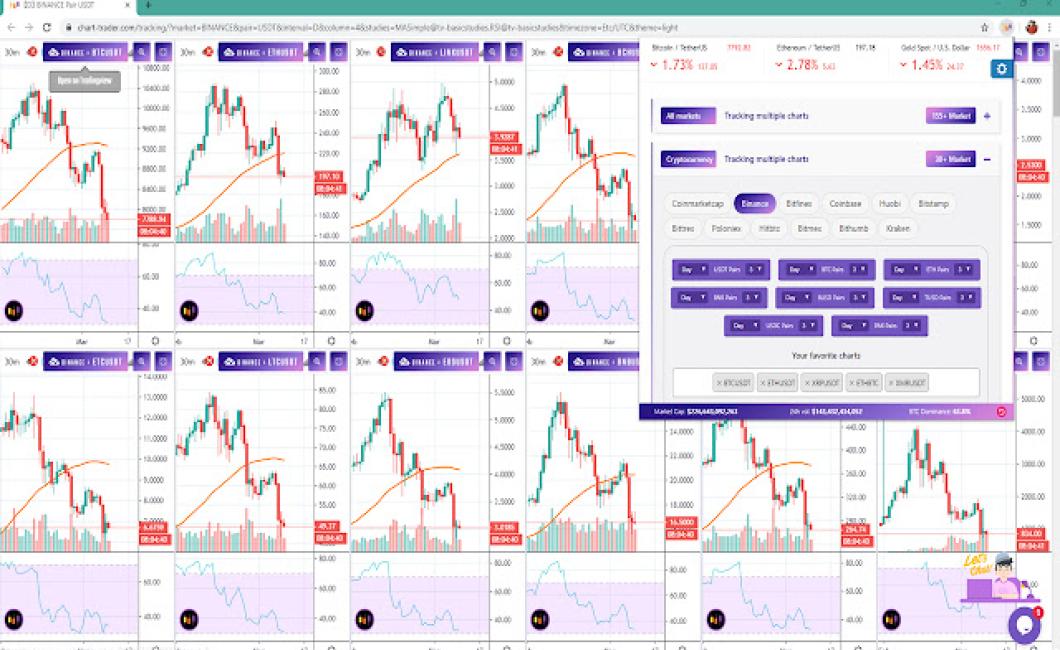

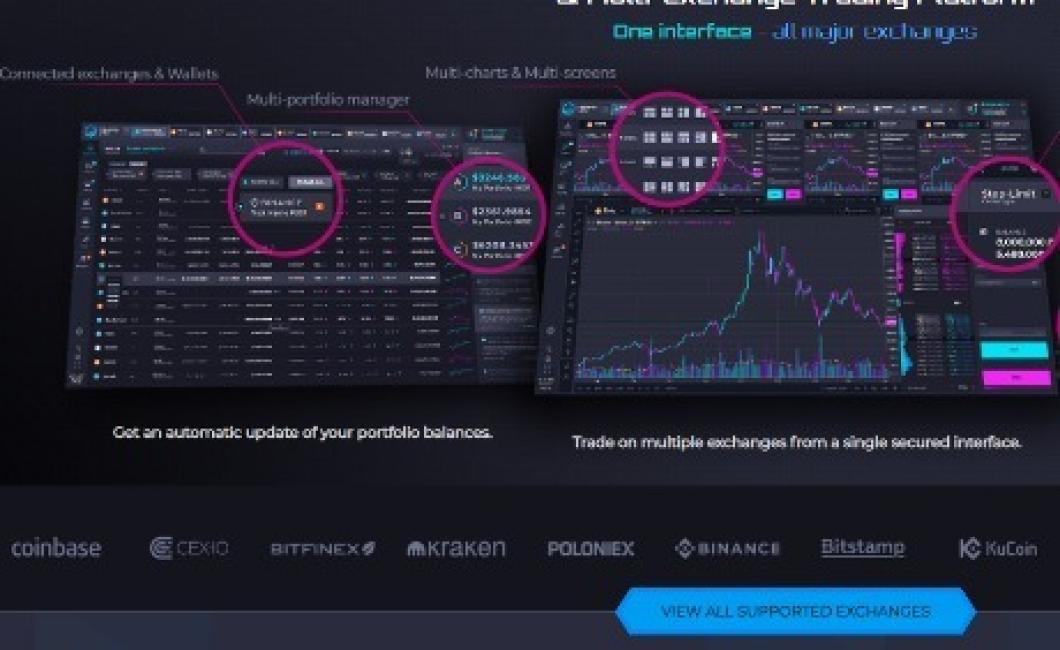

The best crypto charting tools for technical analysis

Now that you know what crypto trading is and what it involves, you might be wondering which crypto trading tools are the best for technical analysis.

There are a few different types of crypto trading tools that can be used for technical analysis, and each one has its own strengths and weaknesses.

Here are the five best crypto trading tools for technical analysis:

1. Tradingview

Tradingview is a popular crypto trading platform that offers a variety of features for technical analysis. It includes a charting tool that lets you visualize your portfolio’s performance over time, as well as a variety of other tools for analyzing market data.

One of the main benefits of Tradingview is that it’s extremely user-friendly. Anyone can start using it without any prior experience, and it’s also quite comprehensive.

However, Tradingview is not perfect. It can be a bit slow in some cases, and it doesn’t offer as many options as some of the other platforms.

2. Coinigy

Coinigy is another popular crypto trading platform that offers a wide range of features for technical analysis. Its charting tool is especially impressive, as it allows you to see your portfolio’s performance in real time and make detailed trade decisions.

One downside of Coinigy is that it can be a bit slow in some cases. Additionally, it doesn’t offer as many options as Tradingview.

3. Kraken

Kraken is one of the most popular crypto trading platforms on the market, and it offers a wide range of features for technical analysis. Its charting tool is particularly impressive, as it allows you to see your portfolio’s performance in real time and make detailed trade decisions.

One downside of Kraken is that it can be quite expensive, and it doesn’t offer as many options as some of the other platforms.

4. Bitfinex

Bitfinex is one of the largest crypto trading platforms on the market, and it offers a wide range of features for technical analysis. Its charting tool is especially impressive, as it allows you to see your portfolio’s performance in real time and make detailed trade decisions.

One downside of Bitfinex is that it can be quite expensive, and it doesn’t offer as many options as some of the other platforms.

5. Poloniex

Poloniex is one of the oldest and most popular crypto trading platforms on the market, and it offers a wide range of features for technical analysis. Its charting tool is especially impressive, as it allows you to see your portfolio’s performance in real time and make detailed trade decisions.

One downside of Poloniex is that it can be quite slow in some cases, and it doesn’t offer as many options as some of the other platforms.

The most popular crypto charting patterns

There are a number of popular crypto charting patterns that traders use to identify opportunities. Some common patterns include:

1. Bull and Bear Markets

A bull market is a period of time where the prices of cryptocurrencies are rising. During a bull market, investors are likely to buy cryptocurrency assets, driving up the prices. Conversely, a bear market is a period of time where the prices of cryptocurrencies are falling. During a bear market, investors are likely to sell cryptocurrency assets, driving down the prices.

2. Ascending and Descending Waves

Ascending waves are periods of time where the prices of cryptocurrencies are rising in a linear fashion. During an ascending wave, the prices of cryptocurrencies tend to increase steadily over time. Conversely, descending waves are periods of time where the prices of cryptocurrencies are falling in a linear fashion. During a descending wave, the prices of cryptocurrencies tend to decrease steadily over time.

3. Head and Shoulders

Head and shoulders is a popular crypto charting pattern that identifies a situation where the prices of two cryptocurrencies are trading at significantly different levels. If the prices of the two cryptocurrencies trade above the head and shoulders pattern, this suggests that there is an opportunity for investors to buy the lower-priced cryptocurrency. Conversely, if the prices of the two cryptocurrencies trade below the head and shoulders pattern, this suggests that there is an opportunity for investors to sell the higher-priced cryptocurrency.

How to use moving averages to trade cryptocurrencies

Moving averages are a technical analysis tool that can be used to identify potential trends in a security or currency market. Once a moving average is identified, it can be used to help predict future price movements.

To use moving averages to trade cryptocurrencies, first find a pair of moving averages that you believe will provide the best indication of future price movements. For example, if you believe that the 5-day moving average will provide a better indication of future price movements, then you would start trading with prices based on the 5-day moving average.

Once you have found a pair of moving averages that you believe will provide the best indication of future price movements, you need to determine the direction of the trend. If you believe that the moving average is pointing towards the up trend, then you would buy cryptocurrency based on the moving average and sell cryptocurrency based on the moving average when the trend turns downwards. Conversely, if you believe that the moving average is pointing towards the down trend, then you would sell cryptocurrency based on the moving average and buy cryptocurrency based on the moving average when the trend turns upwards.

Technical analysis of the top 12 cryptos

Bitcoin (BTC)

Bitcoin is the top cryptocurrency by market capitalization and by total supply. It has remained at the top of the list for the past two years. Bitcoin is a decentralized digital asset and payment system, invented by Satoshi Nakamoto.

Ethereum (ETH)

Ethereum is the second most popular cryptocurrency after Bitcoin. It is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference.

Litecoin (LTC)

Litecoin is the third most popular cryptocurrency after Bitcoin and Ethereum. It is a peer-to-peer digital asset and payment system, similar to Bitcoin but with some enhancements. It is very fast and has low transaction fees.

Bitcoin Cash (BCH)

Bitcoin Cash is a new cryptocurrency that was created in August 2017. It is a spin-off of Bitcoin and is based on the original Bitcoin protocol. Bitcoin Cash has higher transaction speeds and lower fees than Bitcoin.

Ripple (XRP)

Ripple is a digital asset and payment system that operates on a network of nodes. It is similar to Bitcoin but has a different mining algorithm and uses a different blockchain. Ripple has been growing rapidly in popularity and has been listed on several major exchanges.

EOS (EOS)

EOS is a new cryptocurrency that was created in June 2018. It is based on the Ethereum platform but uses a new blockchain. EOS has been growing rapidly in popularity and has been listed on several major exchanges.

NEO (NEO)

NEO is a new cryptocurrency that was created in 2014. It is based on the blockchain technology of Ethereum but has a different operating system. NEO has been growing rapidly in popularity and has been listed on several major exchanges.

IOTA (MIOTA)

IOTA is a new cryptocurrency that was created in 2015. It is based on the blockchain technology of Ethereum but uses a different distributed ledger technology. IOTA has been growing rapidly in popularity and has been listed on several major exchanges.

The best indicators for cryptocurrency trading

Different people have different opinions on what the best indicators for cryptocurrency trading are. However, some of the most commonly used indicators are the MACD, SMA, and RSI.

The MACD is a technical indicator that measures the difference between two moving averages. The MACD is usually used to identify trends in prices.

The SMA is an indicator that measures the average price of a security over a period of time. The SMA is often used to identify oversold and overbought conditions in markets.

The RSI is an indicator that measures the volatility of a security. The RSI is often used to identify whether a market is trending or not.

Fibonacci retracements in cryptocurrency trading

When trading cryptocurrency, it is important to be aware of Fibonacci retracements. This is a technical analysis tool that can help you identify potential buying and selling opportunities.

Fibonacci retracements are based on the Fibonacci sequence, which dates back to 1202 AD. The Fibonacci sequence is a series of numbers that add up to the Fibonacci number, which is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and 55.

The first number in the Fibonacci sequence is 0, and the second number is 1. The next number in the sequence is 1 plus the previous number, which is 1.5 in this case. The next number in the sequence is 2, and the next number is 1.5 plus the previous number, or 2.6 in this example. The next number in the sequence is 3, and the next number is 2.6 plus the previous number, or 4.

The next number in the sequence is 5, and the next number is 4.6 plus the previous number, or 7. The next number in the sequence is 8, and the next number is 7 plus the previous number, or 14. The next number in the sequence is 13, and the next number is 14 plus the previous number, or 29. The next number in the sequence is 21, and the next number is 29 plus the previous number, or 56. The next number in the sequence is 34, and the next number is 56 plus the previous number, or 127. The next number in the sequence is 55, and the next number is 127 plus the previous number, or 210.

The Fibonacci sequence can be used to find support and resistance levels in financial markets. When looking for buying opportunities, you would look for levels of the Fibonacci sequence that have been tested and have held up. When looking for selling opportunities, you would look for levels of the Fibonacci sequence that have been tested and have failed.

Using support and resistance levels to trade cryptos

Cryptocurrencies are often traded on support and resistance levels. These levels indicate where buyers and sellers are willing to buy and sell cryptocurrencies, respectively. When a cryptocurrency is below the support level, buyers are more likely to buy the cryptocurrency, and when it is above the resistance level, sellers are more likely to sell.

Japanese candlesticks and cryptocurrency trading

Cryptocurrency trading is a highly speculative activity. There is a high degree of risk involved and you could lose all your money. Before you start trading, you should ensure you are aware of all the risks involved.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are traded on exchanges, which are websites where you can buy and sell them. The price of a cryptocurrency is determined by supply and demand.

Trading cryptocurrencies with MACD

If you are looking to trade cryptocurrencies using the MACD, then you will first need to calculate the MACD indicator. To do this, you will need to open a trading account with a broker and then find a cryptocurrency that you wish to trade.

Once you have found the cryptocurrency, you will need to open a position in it by buying a certain amount of it. After you have bought the cryptocurrency, you will then need to calculate the MACD indicator. To do this, you will need to find the 25-day moving average of the price of the cryptocurrency and then use that number to calculate the MACD.

After you have calculated the MACD, you will then need to use that number to trade the cryptocurrency. For example, if the MACD indicates that the cryptocurrency is about to go up in price, then you would sell it. Conversely, if the MACD indicates that the cryptocurrency is about to go down in price, then you would buy it.

RSI and other oscillators in crypto trading

There are a number of different oscillators that can be used in crypto trading. RSI is one of the most popular and widely used oscillators. Other oscillators that can be used include MACD, stochastic indicators and Fibonacci retracement levels.