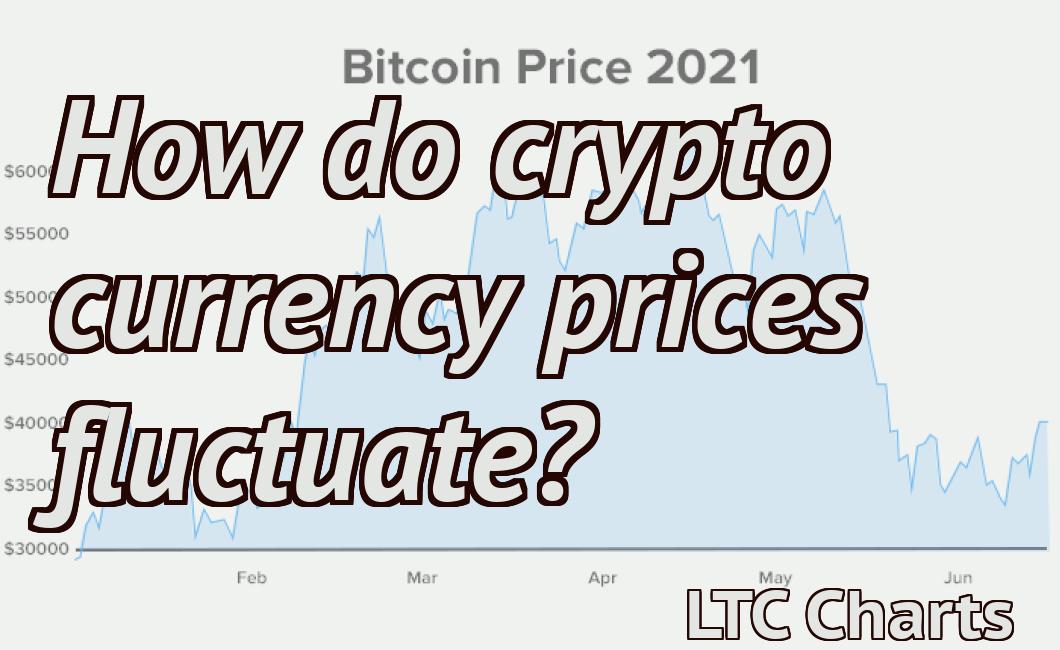

What influences crypto currency prices?

Crypto currency prices are influenced by a variety of factors, including global economic conditions, media coverage, and investor sentiment. In addition, crypto currencies are subject to supply and demand dynamics, as well as regulatory uncertainty.

How Macroeconomic Factors Drive Cryptocurrency Prices

Cryptocurrencies are highly volatile and price-sensitive, meaning that they are susceptible to a wide range of macroeconomic factors. These factors can influence the demand for cryptocurrencies and the price at which they are traded.

Cryptocurrencies are often used as a form of payment for goods and services. When there is increased demand for these currencies, their prices will rise. This is because the demand for cryptocurrencies is inversely related to their supply, meaning that more cryptocurrencies are available to be traded.

Similarly, when there is a decrease in demand for cryptocurrencies, their prices will fall. This is because the demand for cryptocurrencies is inversely related to their availability, meaning that fewer cryptocurrencies are available to be traded.

Cryptocurrencies are also susceptible to political and economic events. When there are major global events that affect the economy, the demand for cryptocurrencies can rise or fall. This is because many people believe that cryptocurrencies are a safe way to store value in an uncertain world.

The Impact of Geopolitical Tensions on Cryptocurrency Markets

Geopolitical tensions have a significant impact on the cryptocurrency markets. Political instability and uncertainty can cause large price swings in cryptos due to the fact that many investors view cryptocurrencies as a safe haven asset.

In recent months, we have seen a number of high-profile events that have sparked global geopolitical tensions. These events include the United Kingdom’s decision to leave the European Union, the US government’s decision to pull out of the Iran nuclear deal, and the North Korean nuclear test.

All of these events have had a significant impact on the cryptocurrency markets, with some coins seeing significant value losses and others seeing significant gains. Cryptocurrencies that are considered to be more vulnerable to global political instability, such as Bitcoin and Ethereum, have seen the biggest price swings.

While geopolitical tensions will always have an impact on the cryptocurrency markets, it is important to keep in mind that this impact is not uniform. Different coins will be affected to different degrees depending on their vulnerability and stability.

How Regulatory Uncertainty Affects Cryptocurrency Prices

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. As of February 2019, there were over 1,500 cryptocurrencies in circulation.

The price of a cryptocurrency is influenced by a number of factors, including regulatory uncertainty. Regulatory uncertainty can arise from a number of sources, including legislative changes, executive orders, regulatory guidelines, or court decisions.

Legislative changes can influence how cryptocurrencies are treated under existing law. For example, the U.S. Congress passed the JOBS Act in April 2012, which made it easier for companies to raise capital by issuing securities through online platforms. The SEC later adopted regulations implementing the JOBS Act, which could impact the way cryptocurrencies are treated.

Executive orders can create new regulations without the need for legislation. For example, President Donald Trump issued an executive order in March 2019 aimed at reducing governmental red tape. The order could have a significant impact on the way cryptocurrencies are treated, as it establishes regulatory standards for agencies.

Regulatory guidelines can provide detailed instructions on how to implement specific regulations. For example, the SEC adopted guidance on how to implement the JOBS Act in 2017.

Court decisions can also have an impact on the way cryptocurrencies are treated. For example, the SEC has brought enforcement actions against individuals and companies for violating securities laws related to cryptocurrencies.

As regulatory uncertainty increases, the price of cryptocurrencies tends to decrease. This is because investors may Fear Uncertainty and sell cryptocurrencies in anticipation of further regulation or legal actions. This cycle can lead to a reduction in the overall value of a cryptocurrency ecosystem.

The role of Media in Shaping Cryptocurrency Prices

Cryptocurrencies are often highly volatile, with prices swinging wildly in price. One of the factors that contributes to this volatility is the role of media in shaping cryptocurrency prices.

Media can play a major role in driving prices up or down. When prices are high, news stories that focus on the benefits of cryptocurrencies can lead to an increase in demand. Conversely, when prices are low, negative news stories can cause people to sell their cryptocurrencies, driving prices down.

Overall, the role of media in shaping cryptocurrency prices is complex and nuanced. However, it is an important factor that should be considered when trying to understand the price of cryptocurrencies.

The Interplay between Traditional Markets and Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Traditional financial markets operate on the principle that buyers and sellers of securities (stocks, bonds, etc.) interact through a process of negotiation and bargaining. In order for buyers to purchase a security from a seller, the seller must require a higher price than what the buyer is willing to pay. Similarly, for sellers to sell a security, they must require a lower price than what the buyer is willing to offer. The intersection of these two prices establishes a market price for the security.

Cryptocurrencies are different from traditional securities in several ways. For one, there is no central authority that regulates or controls the issuance of cryptocurrencies. Additionally, cryptocurrencies are digital and do not have physical forms. This means that there is no intermediary such as a stockbroker or banker who can help ensure that the sale of a security takes place at a particular market price.

Cryptocurrencies are also decentralized, which means that they are not subject to government or financial institution control. As a result, there is less oversight and regulation of cryptocurrencies than there is of traditional securities. This has led to speculation about the legitimacy of cryptocurrencies and the possibility that they may be subject to theft or fraud.

Despite these risks, there are many reasons why investors might want to invest in cryptocurrencies. For one, cryptocurrencies are not subject to government or financial institution control and, as a result, they may be more immune to political or economic instability. Additionally, cryptocurrencies are not subject to inflation and, as a result, their value may remain stable over time.

How Investor Sentiment Impacts Cryptocurrency Prices

Cryptocurrency prices are highly sensitive to investor sentiment. This is because the price of a cryptocurrency is determined by the demand and supply of that cryptocurrency, as well as the overall sentiment of the market.

When investors are bullish on a cryptocurrency, they are likely to buy more of that cryptocurrency in order to increase its value. This drives up the price of that cryptocurrency. Conversely, when investors are bearish on a cryptocurrency, they are likely to sell their holdings in order to decrease its value. This drives down the price of that cryptocurrency.

Overall, investor sentiment is a major determinant of cryptocurrency prices.