Alert On Crypto Prices

The article discusses how crypto prices are volatile and how one should be alert when investing in cryptocurrencies.

Crypto prices on the rise: time to invest?

It’s no secret that the price of cryptocurrencies is on the rise. Some people are convinced that this is just the beginning of a long-term bull run, while others are more cautious and believe that prices are just going through a short-term hype cycle.

There is no easy answer when it comes to investing in cryptocurrencies, as the prices can go up or down quite quickly. That said, if you are looking for an opportunity to make money, it might be worth considering investing in cryptocurrencies now.

There are a few factors to consider when deciding whether or not to invest in cryptocurrencies. First, it’s important to understand what cryptocurrencies are and what they are used for. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

Some of the most well-known cryptocurrencies are Bitcoin, Ethereum, and Litecoin. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous person or group of people who called themselves Satoshi Nakamoto.

Ethereum is a more complex cryptocurrency than Bitcoin and is used to run smart contracts. Smart contracts are computer programs that facilitate, verify, or enforce the negotiation or performance of a contract.

Litecoin is a less popular cryptocurrency than Bitcoin and Ethereum, but it is considered to be more stable than those two coins. Litecoin is based on the Bitcoin blockchain, but it has a faster transaction rate and uses a different mining algorithm than Bitcoin.

Second, it’s important to understand the risks associated with investing in cryptocurrencies. Cryptocurrencies are highly volatile and can go up or down quite quickly. This means that you could make a lot of money one day and lose all of your money the next.

Third, it’s important to understand the legal implications of investing in cryptocurrencies. Most countries have not yet legalized cryptocurrencies and there is no guarantee that they will do so in the future. This means that investing in cryptocurrencies could lead to some legal problems if you get caught.

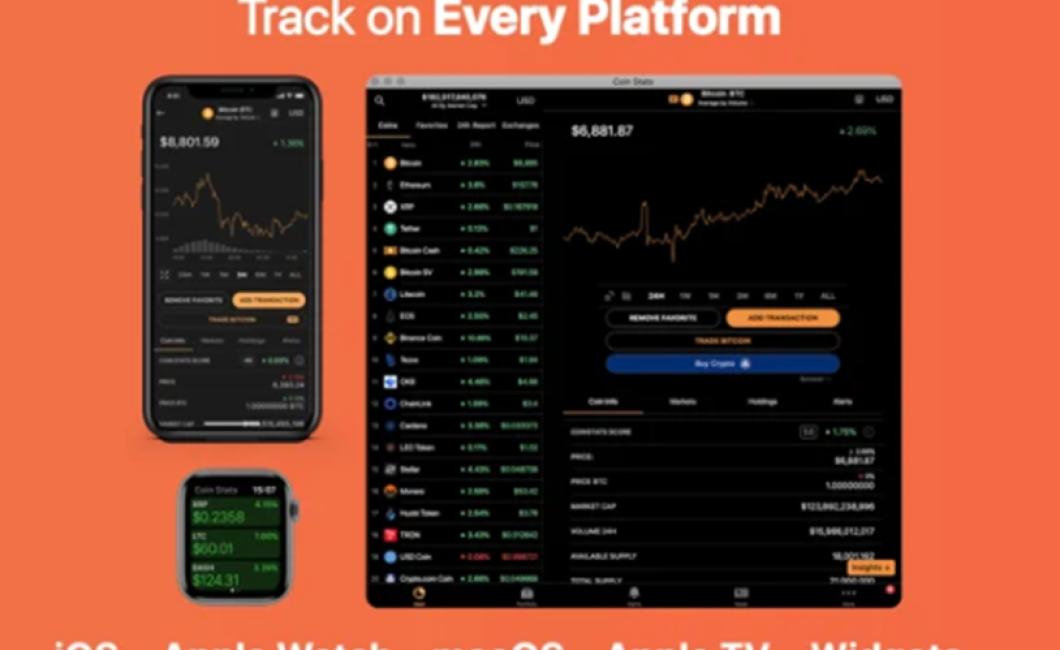

Finally, it’s important to understand how to store and use cryptocurrencies. Cryptocurrencies are not backed by any government or central institution, so they are not insured by traditional financial institutions. This means that you need to be careful about where you store them and how you use them.

All of these factors make investing in cryptocurrencies a high-risk proposition. However, if you are comfortable with the risks, investing in cryptocurrencies could be a good way to make money.

Alert! Crypto prices are volatile

Cryptocurrencies are highly volatile and can be highly sensitive to price changes. Before investing in any cryptocurrency, be sure to do your own research and consult a financial advisor.

What's driving crypto prices up?

Cryptocurrencies are rising in value because there is a large demand for them. People are investing in them because they believe that they will become more valuable in the future. Some reasons that people may believe this are that cryptocurrencies are not subject to the same regulations as traditional currencies, they are not subject to financial institution control, and they can be used to purchase goods and services.

How to profit from rising crypto prices

One way to profit from rising crypto prices is to buy cryptocurrencies when they are low and sell them when they are high. For example, if you buy Bitcoin at $6,000 and sell it at $8,000, you would make a profit of $2,000.

Crypto prices: what to expect in the future

Cryptocurrencies are a relatively new phenomenon, and their prices are highly volatile. That being said, there are a number of factors that can affect the prices of cryptocurrencies, including global economic conditions, news events, and regulatory changes.

Therefore, it is difficult to make reliable predictions about the future prices of cryptocurrencies. However, some experts believe that the prices of cryptocurrencies will continue to rise in the short term, and may eventually become more stable.

How to protect your portfolio from falling crypto prices

There is no one-size-fits-all answer to this question, as the best way to protect your portfolio from falling crypto prices will vary depending on your individual investment strategy and risk tolerance. However, some tips on how to protect your portfolio from falling crypto prices include diversifying your portfolio across a range of different cryptocurrencies and tokens, hedging your investment with cryptocurrency futures or options contracts, and keeping track of the latest news and market conditions surrounding the crypto industry.

When to sell your crypto holdings

If you have a taxable account, sell your crypto holdings when you file your taxes. If you don’t have a taxable account, sell your crypto holdings when you think the price is high enough that you will not lose money.