Candlestick Charts For Crypto

Candlestick charts are a type of financial chart used to track price movements in the market. They are often used by traders to make decisions about when to buy or sell cryptocurrencies. Candlestick charts show the open, high, low, and close prices for a given period of time. They can be used to track price movements over time, or to identify patterns that may predict future price movements. Candlestick charts are a valuable tool for any trader who wants to make informed decisions about when to buy or sell cryptocurrencies.

Introduction to Candlestick Charts for Crypto

Candlestick charts are a popular way to visualize data in the cryptocurrency and digital asset markets. Candlestick charts are used to display price information for individual assets, as well as the relative prices of assets over time.

Candlestick charts are created by drawing a series of vertical columns and horizontal lines, each representing a certain period of time. The height of the candlestick corresponds to the price of the asset during that particular period. The colors of the candlestick correspond to the type of information being displayed (e.g. green for positive values, and red for negative values).

Candlestick charts can be used to analyze various aspects of the cryptocurrency and digital asset markets. They can be used to identify patterns in price movement, and to predict future price movements. Candlestick charts can also be used to identify opportunities in the market, and to make informed investment decisions.

How to Use Candlestick Charts for Crypto

Candlestick charts are one of the most popular types of charts used in trading and investing. Candlestick charts are made up of two types of bars: the open and the close. The open bar indicates the price of a security at the beginning of the trading day, while the close bar indicates the price of the security at the end of the trading day.

Candlestick charts can be used to visualize a security's performance over a specific period of time. For example, you can use candlestick charts to track the performance of a stock over the course of a day, week, or month. Candlestick charts can also be used to analyze the performance of a particular asset class over time.

To use candlestick charts for cryptocurrency trading, you first need to create a chart with the appropriate time period. You can then use the open and close prices of each security to calculate the volume and average price per share for that security. You can also use this information to calculate the percentage change in value for that security over the course of the given time period.

Candlestick charts can be used to make a variety of investment and trading decisions. For example, you can use candlestick charts to determine when it is worth investing in a particular security or asset class. You can also use candlestick charts to identify when a security is experiencing an uptrend or downtrend.

Candlestick charts are an effective way to visualize and analyze the performance of a security over a specific period of time. If you're looking to use candlestick charts for cryptocurrency trading, be sure to familiarize yourself with the basics of candlestick charting before diving into more complex analysis techniques.

The Benefits of Candlestick Charts for Crypto

Candlestick charts are one of the oldest and most popular forms of technical analysis used in the world of cryptocurrency. They are simple to understand and provide an overview of the price action over a given period of time.

Candlestick charts are particularly useful for gauging short-term price movements and can be used to identify opportunities and make trading decisions.

Some of the benefits of using candlestick charts include:

1. Candlestick charts make it easy to see the overall trend of a cryptocurrency over time.

2. Candlestick charts are a great way to identify potential buying and selling opportunities.

3. Candlestick charts can help you identify patterns and signals in the price action.

4. Candlestick charts can help you make informed decisions when trading cryptocurrencies.

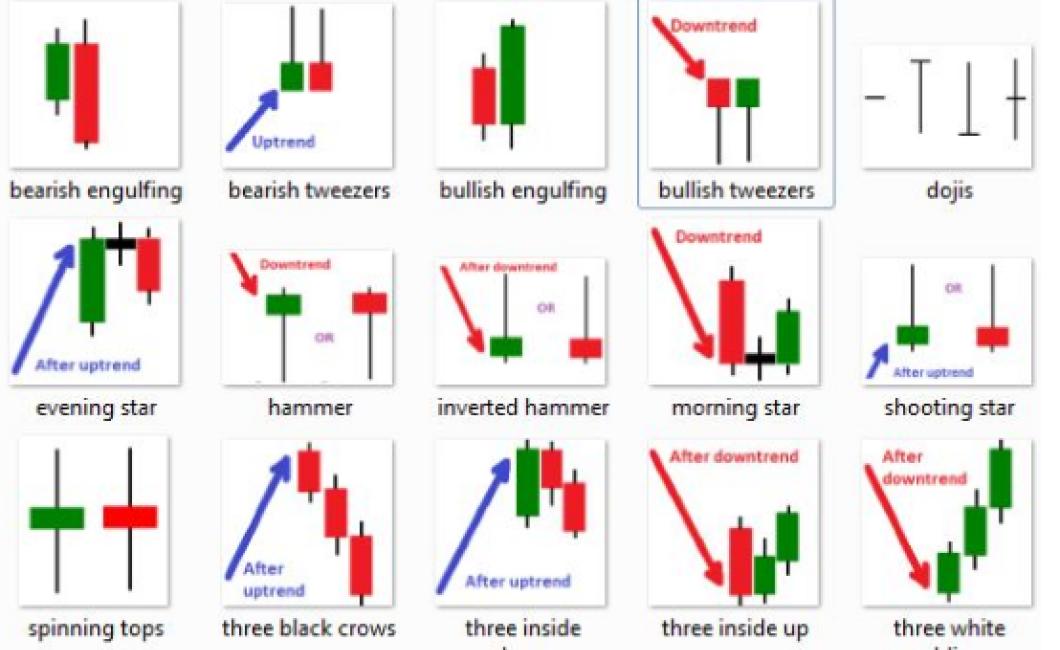

The Different Types of Candlestick Charts for Crypto

There are many types of candlestick charts for crypto trading, and the most popular ones are the bullish and bearish candlestick charts.

Bullish Candlestick Chart

A bullish candlestick chart shows an uptrend in the price of a cryptocurrency, and a bullish candle is usually filled with green or blue colors, indicating that the price is increasing. A bearish candlestick chart shows a downtrend in the price of a cryptocurrency, and a bearish candle is usually filled with red or black colors, indicating that the price is decreasing.

Bearish Candlestick Chart

A bearish candlestick chart shows a downtrend in the price of a cryptocurrency, and a bearish candle is usually filled with red or black colors, indicating that the price is decreasing. A bullish candlestick chart shows an uptrend in the price of a cryptocurrency, and a bullish candle is usually filled with green or blue colors, indicating that the price is increasing.

The History of Candlestick Charts for Crypto

The history of candlestick charts for crypto begins with the early days of Bitcoin. Back then, people used word of mouth to share information about the new digital currency. So, it was difficult to track its prices.

One of the first people to create a candlestick chart for Bitcoin was Japanese financial blog reporter, JP Koning. In his blog post, "A Visual Look at Bitcoin's Price Volatility," JP Koning used candlestick charts to show how Bitcoin's price has fluctuated over the years.

Since then, candlestick charts have become a popular way to track cryptocurrency prices. They're simple to create and can be used to visualize how a cryptocurrency's price is changing over time.

candlestick charts are still widely used to track cryptocurrency prices today.

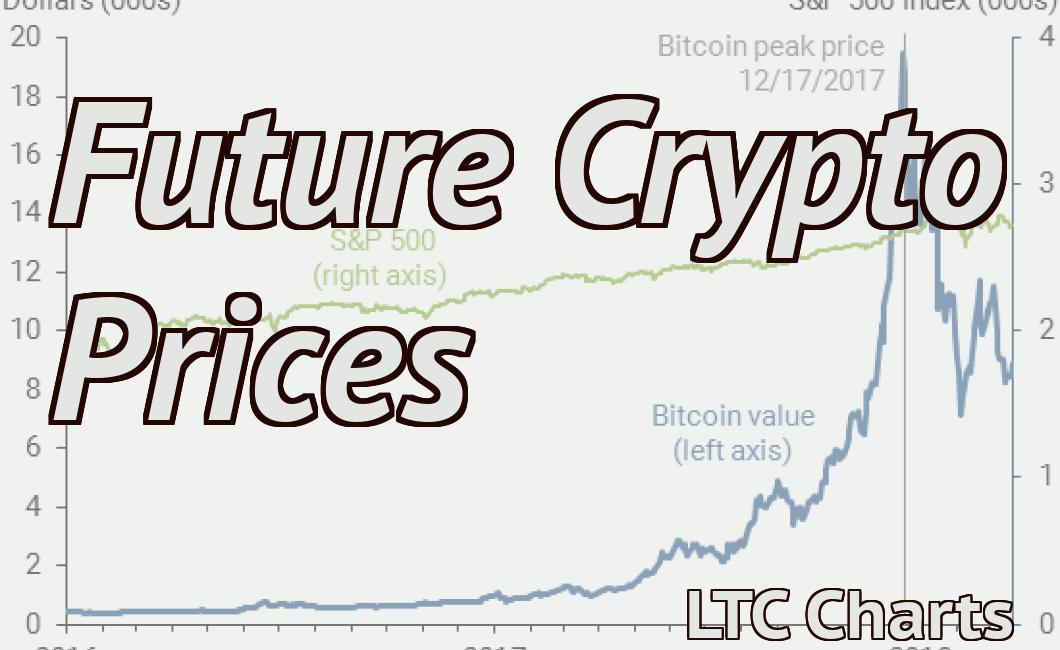

The Future of Candlestick Charts for Crypto

Candlestick charts are a popular tool for traders and investors, and they remain an important part of the cryptocurrency market. However, there are some questions about the future of candlestick charts for crypto.

One question is whether or not they will continue to be used as the primary tool for analyzing cryptocurrency markets. Some people believe that they are not as accurate as other types of charts, and that they may be replaced by more accurate methods in the future.

Another question is whether or not candlestick charts will remain popular among casual investors. Many people are not experienced traders, and they may find it difficult to understand how candlestick charts work. If more sophisticated investors begin to use candlestick charts less frequently, this could potentially lead to their decline in popularity.

FAQs About Candlestick Charts for Crypto

1. What is a candlestick chart?

A candlestick chart is a graphical representation of stock prices that shows the open, high, low, and close prices for individual securities. Candlestick charts are useful for analyzing short-term price movements.

Pros & Cons of Using Candlestick Charts for Crypto

Pros

Candlestick charts are easy to understand and use.

They can be used to track the performance of a cryptocurrency over time.

Candlestick charts can provide a graphical representation of price action.

Candlestick charts can be used to identify patterns in price movement.

Candlestick charts can be used to generate buy and sell signals.

Candlestick charts can help traders make better investment decisions.

Cons

Candlestick charts can be sensitive to price movements.

Candlestick charts may not be suitable for all traders.

Candlestick charts may not be accurate when tracking very volatile cryptocurrencies.

10 Tips For Using Candlestick Charts For Crypto

1. Use candlestick charts to help you understand how the market is trading.

2. Use candlestick charts to help you identify trends in the market.

3. Use candlestick charts to help you make buying and selling decisions.

4. Use candlestick charts to help you keep tabs on your portfolio.

5. Use candlestick charts to help you understand what the future holds for the market.