How To Tell Price From Volume Candlestick On Crypto Charts Minute By Minute

This article provides readers with a step-by-step guide on how to tell the price from volume candlestick on crypto charts minute by minute. By following the simple instructions provided, readers will be able to quickly and easily identify the price information from the volume candlestick on any crypto chart.

How to Tell Price from Volume Candlestick on Crypto Charts Minute by Minute

Volume Candlestick is a technical analysis tool that is used to measure the change in the price of a security over a given time period. The volume data is collected from various exchanges and is updated in real-time. Volume Candlestick can be used to determine if the price is rising or falling, and whether the trend is positive or negative.

To use Volume Candlestick on a Crypto Chart, first find the 24-hour volume graph. Once you have found this graph, click on the "Volume" label in the top left corner of the graph. This will open the Volume Candlestick window.

Next, find the " Open " and " High " values in the Volume Candlestick window. The " Open " value is the highest point reached during the given 24-hour period, while the " High " value is the highest point reached during the given day.

" and " " values in the Volume Candlestick window. The " " value is the highest point reached during the given 24-hour period, while the " " value is the highest point reached during the given day. Next, find the " Low " and " Close " values in the Volume Candlestick window. The " Low " value is the lowest point reached during the given 24-hour period, while the " Close " value is the lowest point reached during the given day.

" and " " values in the Volume Candlestick window. The " " value is the lowest point reached during the given 24-hour period, while the " " value is the lowest point reached during the given day. Finally, compare the " Open ", " High ", " Low ", and " Close " values to see if there have been any changes in price. If there have been changes, then you can use these values to help determine the direction of the trend.

The Relationship Between Price and Volume in the Cryptocurrency Market

Price and volume are two important factors that traders and investors use to measure the health of a cryptocurrency market. Price is the amount of money that a cryptocurrency is worth on a given day, while volume is the number of transactions that take place in a given period of time.

Price and volume are usually inversely related. That is, when price is high, volume tends to be low, and vice versa. This is because when prices are high, people are more likely to sell their cryptocurrencies, while when prices are low, people are more likely to buy them. Volume reflects how active the market is and is an indicator of how confident investors are in the future of the cryptocurrency.

It's important to keep in mind that price and volume are not always correlated. For example, Bitcoin prices can be very high or very low, but volume can be relatively low. This is because many people are not interested in buying or selling Bitcoin, so there is little activity on the market.

How to Use Candlesticks to Read Price and Volume Information

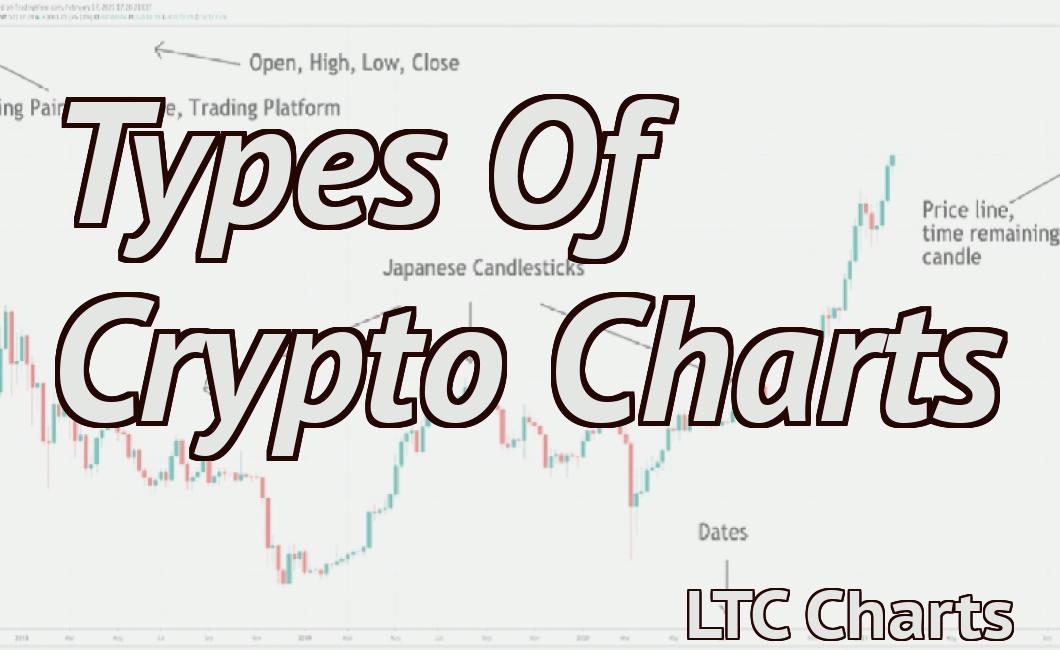

There are two types of candlesticks you will see in financial charts: the open and the close.

The open candlestick indicates the price at which the stock opened the trading day. The close candlestick indicates the price at which the stock closed the trading day.

To read price and volume information, use the open and close prices to determine the range of prices over the course of the day. Use this range to figure out how much volume was traded during that time period.

How to Analyze Candlesticks for Price and Volume Data

The candlestick chart is a graphical representation of the price and volume data for a particular security or commodity. The candlestick chart can be used to identify patterns in price and volume data, and to make trading decisions.

To analyze candlestick data, you first need to identify the open, high, low, and close prices for the security or commodity. You can also identify the volume at these prices. Next, you need to identify any patterns that appear in the data. For example, you might notice that the open, high, and low prices tend to move together, or that the volume at the close of the day is typically higher than the volume at other points in the day.

You can use these patterns to make trading decisions. For example, you might decide to buy the security or commodity when the open, high, and low prices are close together, and to sell the security or commodity when the open, high, and low prices are different from each other.

What Do Candlesticks Reveal About Price and Volume?

Volume is an important indicator of price movement. When the number of candles showing open, high, and low prices increases, this suggests that demand for the asset is strong and that the price is likely to rise. Conversely, when the number of candles decreases, this suggests that demand for the asset is weak and that the price is likely to fall.

How Can Candlesticks Help You Understand Price and Volume Movements?

Candlesticks are a visual representation of price and volume movements over time. They are most commonly used to analyze the behavior of stocks, but can also be used to analyze other financial instruments.

A candlestick is composed of two parts: the body and the handle. The body is the filled part of the candlestick, and the handle is the empty part. The width of the body is typically greater than the width of the handle, and the height of the candlestick is typically greater than the height of the handle.

The opening and closing prices for a security are represented by the body of the candlestick. The length of the candlestick indicates the magnitude of the opening or closing price. The position of the candle within the candlestick indicates the volume of trade for that security.

For example, in the image above, the Candle #1 represents the opening price for Apple Inc. (AAPL) on February 10, 2019. The Candle #2 represents the closing price for Apple Inc. on February 11, 2019. The Candle #3 represents the volume of trade for Apple Inc. on February 10, 2019. The Candle #4 represents the volume of trade for Apple Inc. on February 11, 2019.

Using Candlesticks to Get a Better Understanding of Price and Volume

Candlesticks can be used to get a better understanding of price and volume. Volume is the total number of shares traded during a given time period, while price is the average price of a share during that time period. Candlesticks can help to show how the price and volume of a security change over time.

To use candlesticks, first find the open, high, low, and close prices for the security you are interested in. Next, find the volume for the day at each of these prices. Finally, draw the candlestick for that day.

The following example shows the price and volume of Intel (INTC) over a five-day period. On January 2, the stock opened at $26.50 and had a volume of 1,617,000 shares traded. The next day, the stock opened at $27.50 and had a volume of 1,924,000 shares traded. The third day, the stock opened at $28.00 and had a volume of 2,294,000 shares traded. The fourth day, the stock opened at $28.50 and had a volume of 2,534,000 shares traded. The fifth day, the stock opened at $29.00 and had a volume of 2,771,000 shares traded.