Crypto. Charts

This article provides an overview of the different types of charts used in cryptocurrency trading. It discusses the advantages and disadvantages of each type of chart, and provides guidance on when to use each type.

Decrypting the crypto charts: what do they mean and how to read them

Cryptocurrencies are often traded on exchanges and can be highly volatile. Cryptocurrencies are also often used as payment methods, so their prices can also be affected by news or events.

Cryptocurrencies are often traded on exchanges and can be highly volatile. Cryptocurrencies are also often used as payment methods, so their prices can also be affected by news or events.

Cryptocurrencies are a digital asset class that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are a digital asset class that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on exchanges and can be highly volatile. Cryptocurrencies are also often used as payment methods, so their prices can also be affected by news or events.

Cryptocurrencies are a digital asset class that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

A beginner's guide to crypto chart analysis

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. The price of a cryptocurrency is determined by supply and demand on decentralized exchanges, as well as by the institutional buying and selling of cryptocurrencies.

To make informed investment decisions, it is important to understand the basic concepts of cryptocurrency chart analysis. A cryptocurrency chart can help you identify trends, assess the performance of a cryptocurrency over time, and make informed trading decisions.

In this beginner's guide, we will outline the basics of cryptocurrency chart analysis and provide a few examples of how you can use a cryptocurrency chart to your advantage.

What is a cryptocurrency chart?

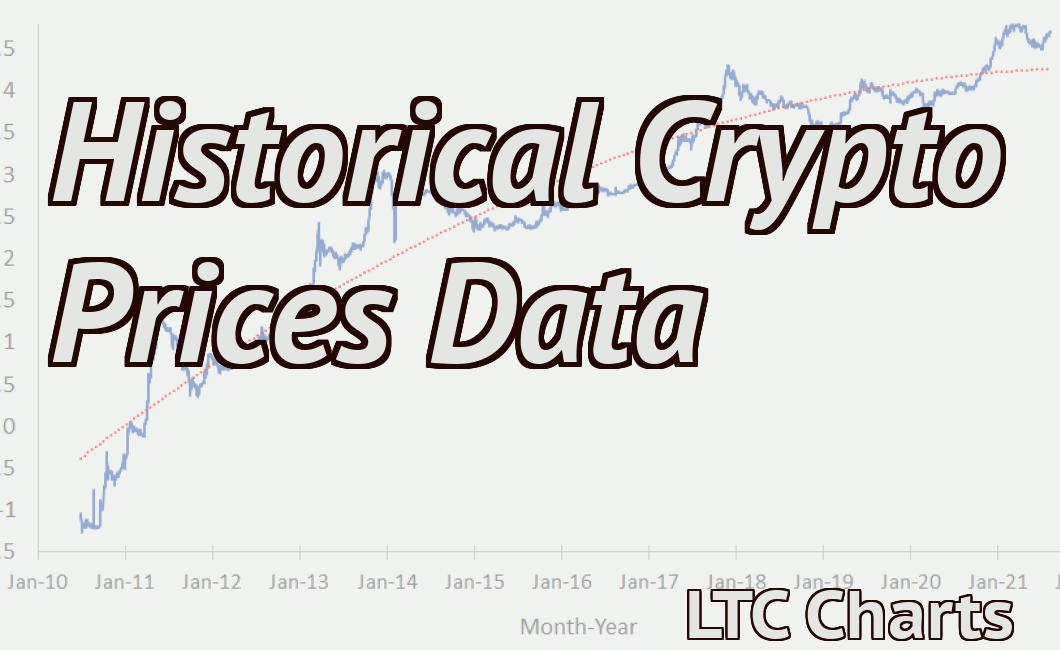

A cryptocurrency chart is a graphical representation of the price of a cryptocurrency over time. Cryptocurrency charts are popular among cryptocurrency traders and investors because they can help you identify trends, assess the performance of a cryptocurrency over time, and make informed trading decisions.

Cryptocurrency charts are usually displayed as a series of curves or graphs. Each curve corresponds to a specific period of time (e.g. 24 hours, 7 days, 1 month, 3 months, 6 months, 1 year). The height of each curve corresponds to the value of the cryptocurrency at that particular point in time.

How can I use a cryptocurrency chart to my advantage?

One of the most popular uses of cryptocurrency charts is trend analysis. Trend analysis is the process of identifying whether a cryptocurrency is experiencing a positive or negative trend. By identifying trends, you can better predict the future performance of a cryptocurrency.

Another use of cryptocurrency charts is assessing the performance of a cryptocurrency over time. By looking at the performance of a cryptocurrency over different periods of time, you can better understand how it has performed relative to other cryptocurrencies. This information can help you make informed trading decisions.

The most important crypto charts and what they tell us

1. Bitcoin (BTC)

Bitcoin is the largest and most well-known cryptocurrency in the world. It has been around since 2009 and is currently the world’s foremost digital currency.

Bitcoin is a decentralized currency that operates on a blockchain network. This allows for transparency and security. Bitcoin has been increasing in value steadily over the years and is currently worth around $10,000.

2. Ethereum (ETH)

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference.

Ethereum is growing rapidly in popularity and value. It is currently worth around $1,000.

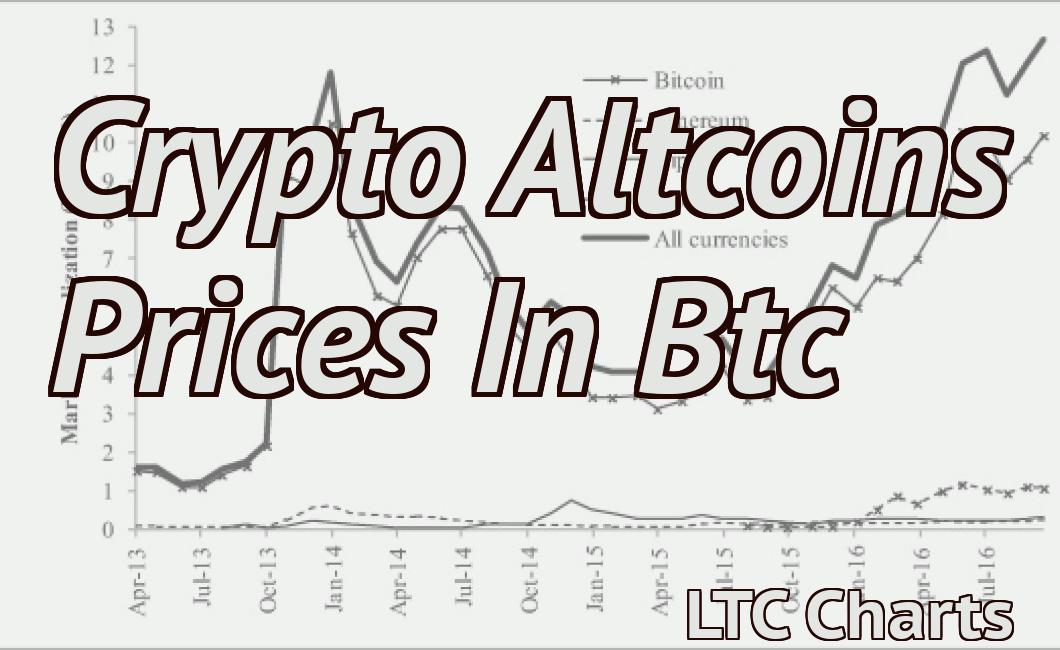

3. Litecoin (LTC)

Litecoin is a peer-to-peer digital currency that enables instant payments to anyone in the world. It was created in 2011 by Charlie Lee, an electrical engineering student at MIT.

Litecoin is growing in popularity and value and is currently worth around $100.

4. Bitcoin Cash (BCH)

Bitcoin Cash is a new version of Bitcoin that was created in August 2017. It is a decentralized platform that operates on a blockchain network.

Bitcoin Cash has been increasing in value steadily over the years and is currently worth around $2,000.

Technical analysis of the top 5 cryptocurrencies

Bitcoin (BTC)

Bitcoin is the most valuable cryptocurrency in the world and is used for transactions across the globe. It has a market capitalization of $135 billion as of June 2019.

Ethereum (ETH)

Ethereum is the second most valuable cryptocurrency in the world and is used for transactions across the globe. It has a market capitalization of $115 billion as of June 2019.

Bitcoin Cash (BCH)

Bitcoin Cash is the third most valuable cryptocurrency in the world and is used for transactions across the globe. It has a market capitalization of $103 billion as of June 2019.

Litecoin (LTC)

Litecoin is the fourth most valuable cryptocurrency in the world and is used for transactions across the globe. It has a market capitalization of $72 billion as of June 2019.

Ripple (XRP)

Ripple is the fifth most valuable cryptocurrency in the world and is used for transactions across the globe. It has a market capitalization of $60 billion as of June 2019.

Crypto chart patterns: what to look for and how to trade them

Crypto chart patterns are a way to identify trends in the cryptocurrency market. They can be used to predict future prices, and to make profitable trades.

There are many different crypto chart patterns, but some of the most common include:

Head and Shoulders

The Head and Shoulders pattern is a bullish pattern that consists of two peaks that are usually located at about the same price point. The first peak is called the head, and the second peak is called the shoulders.

If you buy near the head of the pattern, you will likely make a healthy return. If you sell near the shoulders, you may still make a profit, but it will be smaller than if you had bought near the head of the pattern.

The Elliott Wave Principle

The Elliott Wave Principle is a technical analysis principle that says that there are recurring waves in the market. These waves are usually identified by their crest (the highest point of the wave), trough (the lowest point of the wave), and intermediate (in-between) points.

The Elliott Wave Principle can be used to predict future prices, and to make profitable trades. It is important to understand how the Elliott Wave Principle works, and to use it correctly, in order to make successful trades.

Fibonacci Retracement

The Fibonacci Retracement is a technical analysis tool that helps you identify where the market has been trading over the past. The Fibonacci Retracement is based on the Fibonacci sequence, which is a series of numbers that relate to growth and mathematical proportions.

The Fibonacci Retracement can be used to predict future prices, and to make profitable trades. It is important to understand how the Fibonacci Retracement works, and to use it correctly, in order to make successful trades.

How to use moving averages to trade cryptocurrencies

The simplest way to use moving averages is to use them as a timing tool. When you see a moving average cross over a particular price point, that may be a sign that the price is about to change direction.

To use moving averages as a timing tool, first find the moving average you want to use. For example, if you are looking to trade Bitcoin, you would use the 10-day moving average. Next, find the current price of Bitcoin and compare it to the moving average. If the moving average is crossed over the current price, that may be a sign that the price is about to change direction.

Trading cryptocurrencies with Bollinger Bands

One popular strategy for trading cryptocurrencies is to use Bollinger Bands. Bollinger Bands are a technical analysis tool that helps traders identify when a cryptocurrency is overvalued or undervalued. When a cryptocurrency is overvalued, the Bollinger Bands will be tight, indicating that the price is likely to drop. Conversely, when a cryptocurrency is undervalued, the Bollinger Bands will be wide, indicating that the price is likely to rise.

Using Bollinger Bands to trade cryptocurrencies can help you avoid large losses if the price of a cryptocurrency drops significantly. Conversely, using Bollinger Bands can help you make profitable trades if the price of a cryptocurrency rises significantly.

Using Fibonacci retracements in cryptocurrency trading

One of the most popular Fibonacci retracements in cryptocurrency trading is the 50% Fibonacci retracement. This is a Fibonacci retracement that takes the price of a cryptocurrency and divides it by the price of the previous Fibonacci retracement.

This can be useful when trying to determine whether or not a cryptocurrency is headed for a significant price increase or decrease. For example, if the price of a cryptocurrency falls below the 50% Fibonacci retracement, this may be an indication that the price is likely to continue falling. Conversely, if the price of a cryptocurrency exceeds the 50% Fibonacci retracement, this may be an indication that the price is likely to continue rising.