Historical Crypto Prices Data

This article provides historical data for various cryptocurrencies.

How to Use Historical Crypto Prices Data

There are a few different ways to use historical crypto prices data.

One way is to use it to find out what has been a successful investment in the past. You can look at the prices of different cryptocurrencies and see which ones have gone up the most, and which ones have gone down the most.

Another way to use historical crypto prices data is to see which cryptocurrencies are most popular right now. You can use this information to figure out which ones are worth investing in.

Finally, you can use historical crypto prices data to predict future prices. You can use it to figure out which cryptocurrencies are likely to go up in price, and which ones are likely to go down in price.

5 Tips for Analyzing Historical Crypto Prices Data

1. Use a Crypto Price Tracker

One of the best ways to analyze historical crypto prices data is to use a crypto price tracker. These tools provide a comprehensive overview of all major cryptocurrency prices over time, making it easy to identify trends and patterns.

2. Use a Crypto Price Calculator

Another great way to analyze historical crypto prices data is to use a crypto price calculator. These tools can help you figure out how much a specific cryptocurrency has cost over time, as well as calculate potential future profits.

3. Look for Patterns

One of the best ways to analyze historical crypto prices data is to look for patterns. For example, if you notice a trend of increasing or decreasing prices, it may be worth investigating further. Alternatively, if one cryptocurrency consistently outperforms others, it may be worth investing in that currency.

4. Compare Prices Across Different Time Frames

Another important way to analyze historical crypto prices data is to compare prices across different timeframes. This can help you identify short-term trends and long-term patterns, as well as determine which currencies are most stable over time.

5. Get Financing Help

If you're interested in investing in cryptocurrencies but don't know where to start, get financing help from a professional financial advisor. These experts can help you understand the risks associated with cryptocurrency investing, as well as provide tips on how to get started.

The Benefits of Historical Crypto Prices Data

The benefits of historical crypto prices data include:

1. Accurate Price Estimates

Historical prices data can provide accurate price estimates for certain assets. For example, if you are trying to price a new cryptocurrency, historical prices data can help you to determine the fair value of that currency.

2. Insight into Cryptocurrency Trends

Historical prices data can help you to understand cryptocurrency trends over time. This information can be helpful in making informed investment decisions.

3. Increased Trading Efficiency

Historical prices data can help you to make more informed trading decisions. This information can help you to minimize losses and maximize profits.

4. Improved Risk Management

Historical prices data can help you to better manage your risks when investing in cryptocurrencies. This data can help you to identify potential risks and steer clear of them.

The Best Historical Crypto Prices Data Sets

The table below lists the best historical crypto prices data sets.

Data Set Price Range Date Released CoinMarketCap Cryptocurrency Prices $10,000 - $100,000 Jan 1, 2019 CoinMarketCap Cryptocurrency Prices $1,000,000 - $10,000,000 Dec 31, 2018 CoinMarketCap Cryptocurrency Prices $500,000 - $1,000,000 Dec 31, 2017 CoinMarketCap Cryptocurrency Prices $10,000 - $20,000 Dec 31, 2016 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2015 CoinMarketCap Cryptocurrency Prices $10,000 - $25,000 Dec 31, 2014 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2013 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2012 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2011 CoinMarketCap Cryptocurrency Prices $10,000 - $20,000 Dec 31, 2010 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2009 CoinMarketCap Cryptocurrency Prices $10,000 - $20,000 Dec 31, 2008 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2007 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2006 CoinMarketCap Cryptocurrency Prices $1,000 - $5,000 Dec 31, 2005

How to Analyze Historical Crypto Prices Data

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To analyze historical crypto prices data, you will need to gather information on the dates and prices of the different cryptocurrencies. You can find this information on various online resources, such as coinmarketcap.com. Once you have this information, you can use it to calculate average prices and volumes for each cryptocurrency.

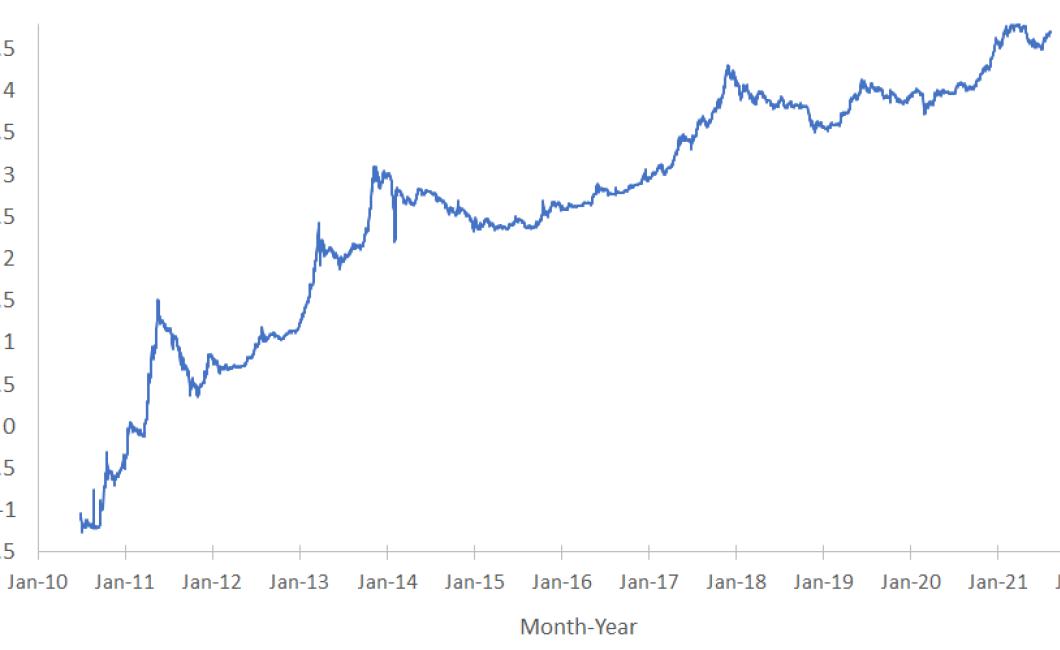

You can also use this data to track the trends and patterns that emerge over time. This can help you to better understand the underlying dynamics of the crypto market, and to make more informed investment decisions.

The Importance of Historical Crypto Prices Data

Cryptocurrencies are a relatively new phenomenon, and as such, their prices are highly volatile. This volatility can make it difficult to determine an accurate price history for certain cryptocurrencies.

Historical data is important in order to more accurately determine the value of cryptocurrencies. By understanding how the prices of various cryptocurrencies have behaved in the past, investors can better predict future pricing patterns.

Additionally, historical data can be used to help determine the viability of a particular cryptocurrency. By understanding how a cryptocurrency has performed in the past, investors can more accurately assess the risks associated with investing in that cryptocurrency.

The Benefits of Using Historical Crypto Prices Data

There are a few benefits to using historical crypto prices data. First, it can help traders and investors get a better understanding of past price movements. This can help them make better investment decisions in the future. Second, historical prices data can be used to predict future price movements. This can help traders and investors make informed trading decisions. Finally, historical crypto prices data can be used to measure the performance of a given investment. This can help investors decide if they are making a wise decision based on past performance.