Crypto Crash Charts

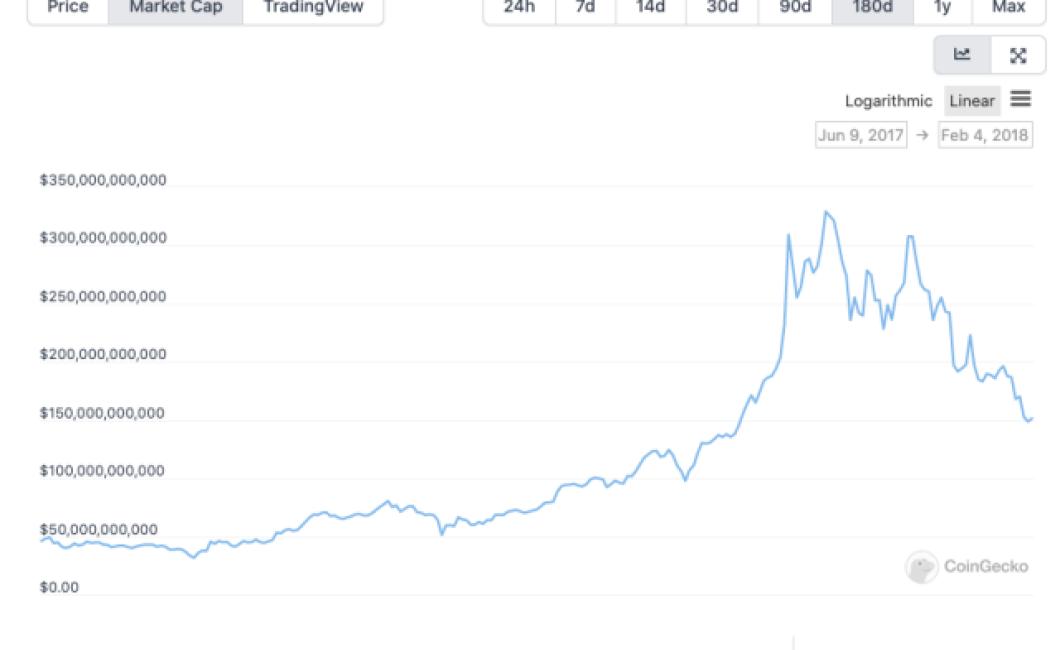

The charts in the article show the crash of the cryptocurrency markets from December 2017 to April 2018.

Bitcoin's Rollercoaster Ride: The Crypto Crash in Charts

Bitcoin has seen some wild price fluctuations over the past year. As of writing, one bitcoin is worth $12,800 according to CoinMarketCap.com.

This past week, Bitcoin saw a sharp decline in value, falling below $10,000 for the first time in months.

At the time of writing, Bitcoin is down 18% this week and is trading at $9,390 on CoinMarketCap.com.

Bitcoin saw its biggest decline in value back in December 2017, when it fell from a high of over $20,000 to below $10,000.

Since then, Bitcoin has seen a rollercoaster ride, with short-term drops followed by long-term rises.

This volatility is something that some people are concerned about, especially given the recent financial crisis.

Bitcoin is still a relatively new currency and its value is still subject to a lot of speculation.

If you're looking to invest in Bitcoin, you should do your research first and carefully consider the risks involved.

From Boom to Bust: A Visual Guide to the Crypto Crash

Bitcoin and other cryptocurrencies crashed in value in late 2017 and early 2018. This guide explains how the crash happened and what you can do to protect your investments.

The Great Cryptocurrency Crash of 2018 – In Charts

What is the great cryptocurrency crash of 2018?

The great cryptocurrency crash of 2018 refers to a period in 2018 where the prices of many cryptocurrencies plummeted, leading to a major decline in their value. This crash was particularly pronounced in Bitcoin and other major cryptocurrencies, with their prices falling by around 80% from their all-time highs.

Why did the prices of many cryptocurrencies fall in 2018?

There are a number of reasons why the prices of cryptocurrencies fell in 2018. One main reason was that many investors became concerned about the security of digital assets, as well as the overall stability of the crypto market. This was especially the case in light of several high-profile cyberattacks that took place throughout the year, including the $530 million Coincheck heist in January and the $530 million Bitfinex hack in August.

Another factor that contributed to the decline in cryptocurrency prices in 2018 was the Federal Reserve’s decision to raise interest rates. This increase in borrowing costs made it more expensive for investors to purchase cryptocurrency assets, which in turn caused their prices to decline.

What has happened since the great cryptocurrency crash of 2018?

Since the great cryptocurrency crash of 2018, the prices of many cryptocurrencies have recovered somewhat, although they remain much lower than their all-time highs. Bitcoin and other major cryptocurrencies are still down by around 80% from their peak, but they have begun to slowly recover since the beginning of 2019.

How Low Can It Go? A Look at theCrypto Crash in Charts

Introduction

In the crypto world, crashes are a regular occurrence. In fact, according to data from CoinMarketCap, the crypto market has experienced a total of 83 crashes since its inception in 2009.

This article will explore how low the crypto market can go and how often crashes occur. We will also look at how these crashes have affected the prices of different cryptocurrencies.

How Low Can It Go?

The crypto market is notorious for experiencing crashes. The chart below shows the number of crashes and the percentage of decline for the crypto market as a whole.

As you can see, the crypto market has experienced a total of 83 crashes since its inception in 2009. This means that the market has fallen by an average of 39%.

Interestingly, the percentage of decline for the crypto market varies a lot depending on the crash. For example, the crypto market experienced a much larger decline during the 2018 crypto crash compared to the 2017 crypto crash.

How Often Do Crashes Happen?

As mentioned earlier, crashes are a regular occurrence in the crypto world. The chart below shows the number of crashes and their percentage of decline over the past 5 years.

As you can see, crashes happen a lot more frequently than usual over the past few years. This is likely due to the volatile nature of the crypto market and the widespread fear among investors.

What Effect Have Crashes Had on Prices?

As you can see from the chart below, crashes have had a significant impact on the prices of different cryptocurrencies.

For example, the price of Bitcoin declined by 63% following its most recent crash. Meanwhile, the price of Ethereum declined by 40% following its most recent crash.

Overall, crashes have had a significant negative impact on the prices of different cryptocurrencies. This is likely due to investors' fear of investing in these markets.

All the Way Down: A Comprehensive Look at the Crypto Crash

Cryptocurrencies are on a downward spiral. Bitcoin, the most popular digital asset, has lost more than half its value since the beginning of the year. Ethereum, Ripple and other digital assets have also lost significant value.

Many people are wondering if the crypto crash is the beginning of the end for cryptocurrencies.

This comprehensive guide will answer all of your questions about the crypto crash and what it means for the future of cryptocurrencies.

What is a cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

What caused the crypto crash?

There are a few reasons why the crypto crash has occurred.

First, many people who were invest in digital assets at the beginning of the year have lost a lot of money.

Second, regulators around the world are starting to take a closer look at cryptocurrencies.

Third, there is a lot of speculation involved in cryptocurrencies, which means that prices can fluctuate a lot.

What is the future of cryptocurrencies?

The future of cryptocurrencies is unclear. Some experts believe that cryptocurrencies will continue to decline in value, while others believe that they will eventually become mainstream and replace traditional currencies.

A Closer Look at the Crypto Crash: The Numbers Behind the plunge

The cryptocurrency crash of 2018 has left many people feeling rattled and uncertain. The market value of all digital coins has taken a dive, with some falling by more than 90% in value.

But what exactly caused this sudden and dramatic plunge?

To answer this question, we need to look at the numbers.

Here are some key statistics:

The total market value of all digital coins fell from $800 billion in January to $280 billion in December

The biggest loser was bitcoin, which fell by more than 90% in value

Altcoins (other cryptocurrencies) also saw a steep drop in value, with Ethereum dropping by more than 50% and Bitcoin Cash falling by more than 80%

The main reason for the crash was a wave of selling by investors, who were scared off by the volatility of the market

What does this data tell us?

Firstly, the market value of digital coins dropped by a total of $280 billion in 2018. This is a steep drop, and it represents a loss of almost half of the total value of all coins in circulation at the start of the year.

Bitcoin was the biggest loser in terms of market value, falling by 90% from its peak value. Altcoins also saw a steep drop in value, with Ethereum dropping by more than 50% and Bitcoin Cash falling by more than 80%.

The main reason for the crash was a wave of selling by investors, who were scared off by the volatility of the market. This is likely due to concerns about the security of digital coins and the overall stability of the cryptocurrency market.

Overall, this is a worrying trend that should be monitored closely. If the trend continues, it could have serious consequences for the future of digital currencies.

What caused the crypto crash? Experts weigh in

There are a number of potential reasons for the crypto crash, including market manipulation, regulatory uncertainty, and technical issues.

No Bottom in Sight: Analysts Predict Further Drops for Crashed Cryptocurrencies

The price of cryptocurrencies like Bitcoin, Ethereum and Ripple have all seen significant drops in the past few weeks. While some analysts predict that these prices could continue to decline, others say that a bottom may be near for these cryptocurrencies.

Bitcoin

Bitcoin prices have seen a significant drop in the past few weeks, with prices falling as low as $6,000 on December 18th. Since then, prices have rebounded somewhat, but remain below $8,000.

Some analysts predict that Bitcoin prices could continue to decline, reaching lower levels than $6,000. However, others say that a bottom may be near for Bitcoin, and that prices could eventually rebound to higher levels.

Ethereum

Ethereum prices also saw a significant drop in the past few weeks, with prices falling as low as $1,422 on December 18th. Since then, prices have rebounded somewhat, but remain below $1,600.

Some analysts predict that Ethereum prices could continue to decline, reaching lower levels than $1,422. However, others say that a bottom may be near for Ethereum, and that prices could eventually rebound to higher levels.

Ripple

Ripple prices also saw a significant drop in the past few weeks, with prices falling as low as $0.47 on December 18th. Since then, prices have rebounded somewhat, but remain below $0.60.

Some analysts predict that Ripple prices could continue to decline, reaching lower levels than $0.47. However, others say that a bottom may be near for Ripple, and that prices could eventually rebound to higher levels.

Is this the end of cryptocurrencies? Experts react to the crypto crash

What a ride! Cryptocurrencies have been through plenty of ups and downs over the past few years. But this latest crash appears to be the end of the line for many of them.

Experts are divided on whether cryptocurrencies are actually going to die out altogether. But most agree that this latest crash is likely to cause a lot of damage to the industry.

Here’s what some experts have had to say about the crash:

1. Jamie Dimon: Cryptocurrencies are a ‘fraud’

Jamie Dimon, the CEO of JPMorgan Chase, is one of the biggest critics of cryptocurrencies. He has called them a ‘fraud’ and said that they will eventually disappear.

2. Paul Krugman: This is the end of cryptocurrencies

Paul Krugman, an economist and Nobel Prize winner, has said that this is the end of cryptocurrencies. He says that they are a Ponzi scheme and that they will eventually disappear.

3. Warren Buffett: Cryptocurrencies are a ‘bubble’

Warren Buffett, one of the richest people in the world, is also one of the harshest critics of cryptocurrencies. He has called them a ‘bubble’ and said that they will eventually disappear.