Crypto Prices In 2030

Crypto Prices In 2030: A Look Ahead With the crypto industry still in its infancy, it’s impossible to know exactly where prices will be in 2030. However, there are a few factors that could have a significant impact on prices. Scalability: One of the biggest challenges facing cryptocurrencies is scalability. At present, most cryptocurrencies can only handle a limited number of transactions per second. This is not enough for widespread adoption. If cryptocurrencies can’t solve the scalability issue, they may never reach their full potential. Regulation: Another factor that could affect prices is regulation. So far, governments have taken a hands-off approach to regulation. However, this could change in the future. If governments crack down on cryptocurrencies, it could have a negative impact on prices. Adoption: The last factor to consider is adoption. Cryptocurrencies still have a long way to go before they’re widely accepted. If more businesses and individuals start using cryptocurrencies, it could lead to an increase in prices.

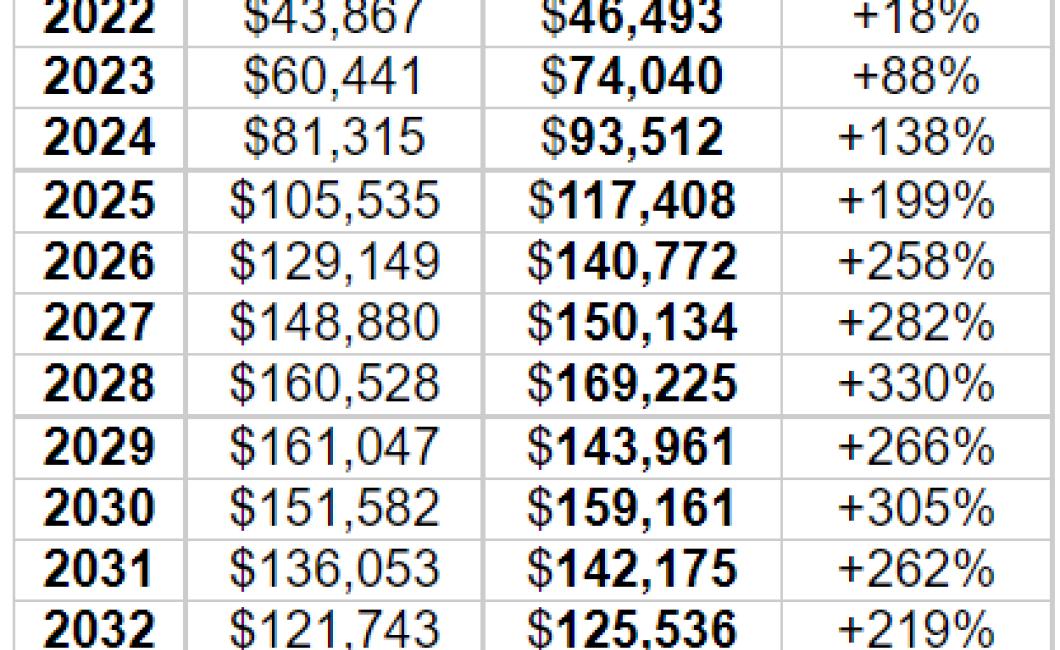

How high will crypto prices go in 2030?

Cryptocurrencies are still in their early stages and there is no telling how high prices will go in 2030. However, one thing is for sure- the technology underlying cryptocurrencies is here to stay and prices are only going to continue to rise.

What will trigger the next big crypto price surge?

There is no one answer to this question as there are a variety of factors that could trigger a price surge in the crypto market. Some popular reasons for crypto prices to surge include news of a new blockchain project, a large institutional investment into the market, or a major regulatory change that benefits the crypto sector.

Are we headed for another crypto crash?

Cryptocurrencies have been in a steep decline since the beginning of the year. Bitcoin, the largest and most well-known cryptocurrency, has lost more than half of its value since January. There are a number of theories as to why this is happening, but some people believe that a crypto crash is inevitable.

How to spot the next big crypto winner

There is no guaranteed way to spot the next big crypto winner, but following a few key tips can help increase your chances of success.

1. Research the latest trends

Keeping up to date with the latest crypto trends is essential if you want to make successful investment decisions. By monitoring popular social media platforms, forums, and other sources, you’ll be able to stay ahead of the curve and capitalize on the latest trends.

2. Look for coins with high potential

One of the most important factors you need to consider when investing in cryptocurrencies is their potential. By looking for coins with high potential, you’ll be increasing your chances of success.

3. Do your own research

Never rely solely on the opinions of others when it comes to making investment decisions. Instead, do your own research and choose coins based on sound technical analysis. This will help you avoid common mistakes and increase your chances of success.

Why crypto prices will continue to rise

Cryptocurrencies are decentralized, secure digital assets that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they are a form of digital asset that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are unique in that they are a form of digital asset that uses cryptography to secure its transactions and to control the creation of new units.

Cryptocurrencies are not tied to any government or central bank and their value is based on supply and demand. Although there are many Bitcoin and Ethereum variants, the most popular is Bitcoin. Bitcoin has been on a tear this year, increasing in value by more than 1,200%. Ethereum is also up significantly, increasing by more than 1,500%.

There are many reasons why cryptocurrencies are soaring in value. One reason is that people are becoming more interested in them as a form of investment. Another reason is that cryptocurrencies are not subject to government or central bank control and can be used to purchase goods and services.

The 5 most promising cryptos for 2030

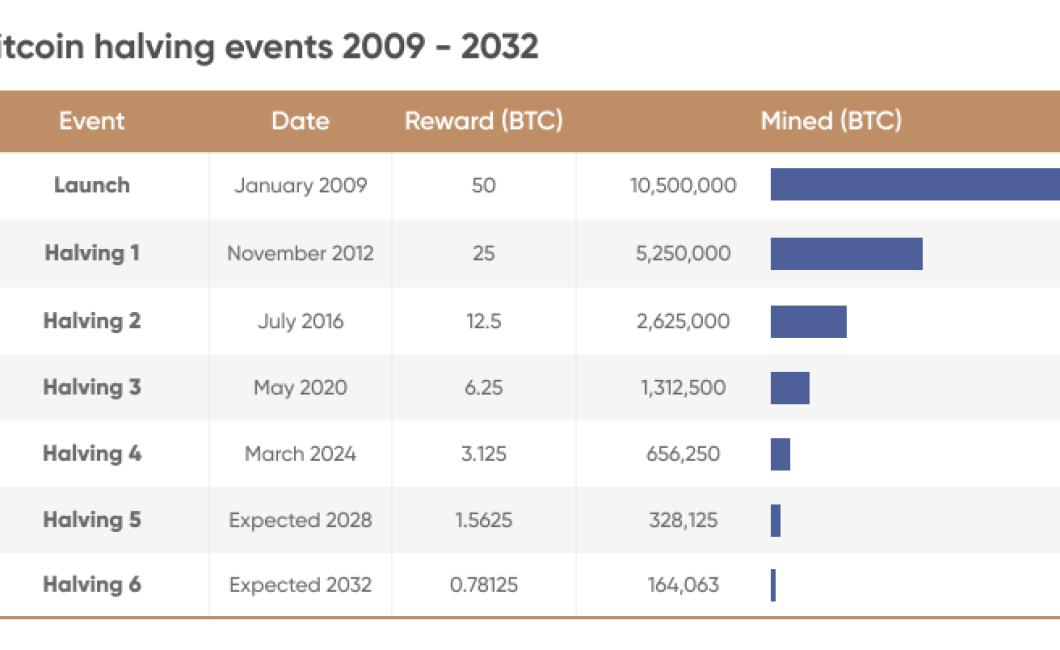

Bitcoin

Bitcoin has been reigning supreme as the number one cryptocurrency for a long time now. It’s still a popular choice, with a growing user base and a high trading volume. There are plenty of reasons to believe that Bitcoin will continue to be a popular choice in 2030.

Ethereum

Ethereum is another popular cryptocurrency that’s been around for a while. It has a growing user base and a high trading volume. Ethereum is also gaining traction as a platform for hosting decentralized applications. This could give it an advantage over other cryptocurrencies in 2030.

Litecoin

Litecoin is another popular cryptocurrency that’s been around for a while. It has a growing user base and a high trading volume. Litecoin is also gaining traction as a platform for hosting decentralized applications. This could give it an advantage over other cryptocurrencies in 2030.

Ripple

Ripple is a new cryptocurrency that’s been gaining attention lately. It has a growing user base and a high trading volume. Ripple is also gaining traction as a platform for transferring money internationally. This could give it an edge over other cryptocurrencies in 2030.

Bitcoin cash

Bitcoin cash is another new cryptocurrency that’s been gaining attention lately. It has a growing user base and a high trading volume. Bitcoin cash is also gaining traction as a platform for transferring money internationally. This could give it an edge over other cryptocurrencies in 2030.

How to invest in crypto for the long term

Cryptocurrencies are notoriously volatile and can be very risky investments. However, there are ways to invest in crypto for the long term that can provide a higher potential return than traditional investments.

Some of the most common long-term strategies for investing in crypto include:

1. Buying a cryptocurrency index fund

One option is to buy a cryptocurrency index fund, which tracks the performance of a selected group of cryptocurrencies. These funds are typically offered by investment firms and can provide investors with a diversified exposure to the market.

2. Holding a cryptocurrency

Another option is to hold a cryptocurrency, which may provide a higher potential return than buying or trading cryptocurrencies. This approach is riskier than investing in a cryptocurrency index fund, as there is greater potential for price volatility. However, if you are comfortable with the risk, holding a cryptocurrency may be the best option for the long term.

3. Investing in ICOs

Another option is to invest in ICOs. ICOs are a new way of raising money through the sale of cryptocurrency tokens. They have become popular in recent years because they offer investors exposure to new and innovative blockchain-based projects. However, ICOs are high-risk investments, and there is a risk that the projects will not live up to expectations. Only invest in ICOs if you are prepared to take the risk.

4. Trading cryptocurrencies

Finally, another option is to trade cryptocurrencies. This approach can be more volatile than investing in a cryptocurrency index fund or holding a cryptocurrency, but it may offer the highest potential return. It is important to be aware of the risks involved in trading cryptocurrencies, and to do your own research before investing.

Why you should ditch fiat and go all-in on crypto

There are a number of reasons why you should ditch fiat and go all-in on crypto.

1. Fiat is slow and outdated

Cryptocurrencies are incredibly fast and efficient compared to traditional fiat systems. Transactions can be completed in seconds, rather than minutes or hours, and there is no need for hefty fees or waiting periods.

2. Fiat is centralized and vulnerable to hacks

Cryptocurrencies are decentralized, meaning they are not subject to the whims of any single institution or government. This makes them much more secure and resistant to hacks or manipulations.

3. Fiat is volatile and prone to crashes

Cryptocurrencies are inherently volatile, meaning their value can go up or down a lot over short periods of time. This can be risky and unpredictable, making it difficult to invest in them long-term.

4. Fiat is not accessible to everyone

Cryptocurrencies are not only fast and efficient, but they are also easily accessible to anyone with an internet connection. This makes them a more inclusive form of money, catering to a wider range of users.

5. Fiat is inflationary

Bitcoin and other cryptocurrencies are deflationary, meaning their value will decrease over time as new units are created. This is a more sustainable system than fiat, which is prone to inflationary trends.