Crypto prices in USD.

Crypto prices in USD refers to the value of cryptocurrencies in US dollar terms. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often decentralized, meaning they are not subject to government or financial institution control. Their prices are volatile, and can be affected by a variety of factors, including news events, government regulation, and global economic conditions.

Bitcoin, Ethereum, and Litecoin Prices in USD

Bitcoin: $8,343.02

Ethereum: $1,327.89

Litecoin: $246.29

The 3 Most Popular Cryptocurrencies

Bitcoin is the most popular cryptocurrency and it has been around since 2009. Bitcoin is a digital asset and a payment system invented by Satoshi Nakamoto.

Ethereum is second most popular cryptocurrency and it was created in 2015. Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference.

Bitcoin Cash is the third most popular cryptocurrency and it was created in August 2017. Bitcoin Cash is a clone of Bitcoin that has a larger block size limit and faster transaction speed.

How to Read Crypto Prices

Cryptocurrencies are unique in that their prices are determined by supply and demand. The more people that want a cryptocurrency, the more expensive it will be. In order to read cryptocurrency prices, you will need to understand how these prices are determined.

Cryptocurrency prices are determined by supply and demand.

Supply refers to the number of coins that are available for purchase. This number is constantly changing, as new coins are created and old coins are sold.

Demand refers to the amount of people that are willing to buy a cryptocurrency. This number is also constantly changing, as people buy and sell cryptocurrencies.

What Determines Crypto Prices?

Crypto prices are determined by supply and demand. Crypto prices will rise or fall depending on how many people want to buy and sell a particular digital currency.

Why Do Crypto Prices Fluctuate?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

The price of cryptocurrencies is determined by supply and demand. When demand for a cryptocurrency increases, the price will rise. When demand for a cryptocurrency decreases, the price will decline.

How to Invest in Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

There are a number of ways to invest in cryptocurrencies. You can buy them on an exchange, or you can mine them. Mining cryptocurrencies involves solving complex mathematical problems to unlock new coins.

What Are the Risks of Investing in Cryptocurrencies?

There are a few risks associated with investing in cryptocurrencies. The first is the risk of losing money. Cryptocurrencies are volatile and can be highly speculative, which means that they may rise or fall in value quickly. This could mean that you lose money if you invest in them.

Another risk is the risk of being hacked. Cryptocurrencies are vulnerable to cyberattacks, which could lead to the theft of your coins or other personal information. If your cryptocurrency is stolen, you may not be able to get it back or recover any of your losses.

Finally, there is the risk that cryptocurrencies won't actually hold their value. Cryptocurrencies are decentralized, meaning that they are not subject to government or financial institution control. This could mean that they lose value over time due to inflation or other factors.

How to Buy Cryptocurrencies

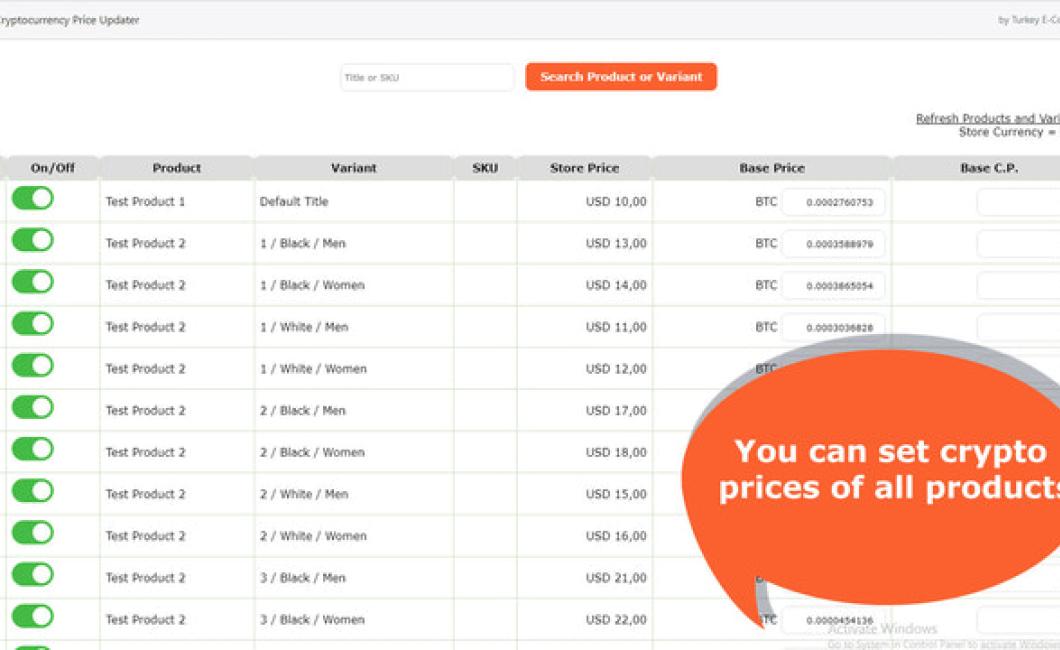

There are a few ways to buy cryptocurrencies. One way is to purchase them from an exchange. Exchanges allow you to buy and sell cryptocurrencies, as well as use them to purchase other cryptocurrencies or fiat currency.

Another way to buy cryptocurrencies is to mine them. Miners are responsible for securing and verifying the blockchain, which is the underlying technology behind cryptocurrencies. When you mine cryptocurrencies, you are rewarded with tokens that you can use to purchase other cryptocurrencies or fiat currency.

What Wallet Should I Use for Cryptocurrencies?

There is no one-size-fits-all answer to this question, as the best wallet for cryptocurrencies will depend on the specific needs of each individual. However, some popular wallets used for cryptocurrencies include the Ledger Nano S and the Trezor.

How to Store Cryptocurrencies Safely

There are a few ways to store cryptocurrencies safely. One way is to use a hardware wallet. Hardware wallets are a type of wallet that stores your cryptocurrencies offline. This means that the cryptocurrencies are not accessible through the internet. Another way to store cryptocurrencies is to use a cryptocurrency exchange. Cryptocurrency exchanges are platforms where you can buy and sell cryptocurrencies. They are also the most common way to get your hands on cryptocurrency.

How to Sell Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To sell cryptocurrencies, you'll need to find an exchange that will trade in your currency. There are a number of exchanges available, but some of the most well-known exchanges include Coinbase, Bitfinex, and Binance. You'll also need to find a wallet to store your cryptocurrencies in. Some popular wallets include Ledger and Trezor.

Taxes and Cryptocurrencies

Cryptocurrencies like Bitcoin are based on cryptography, a process of secure communication. Cryptography is used to protect a message from being intercepted and read by unauthorized people.

Cryptocurrencies are created through a process called mining. Miners are rewarded with new cryptocurrencies for verifying and committing transactions to the blockchain.