Understanding Crypto Prices

Investors have a lot of questions when it comes to cryptocurrency. How do prices move? What factors influence them? Is crypto a good investment? In this article, we take a look at some of the key factors that influence cryptocurrency prices. Cryptocurrency prices are influenced by a variety of factors, including media hype, government regulation, and market demand. Media coverage can create "FOMO" (fear of missing out), leading investors to buy in and push prices up. Government regulation can also have a big impact, as we've seen with China's crackdown on ICOs (initial coin offerings). Finally, market demand is a key factor, as investors are always looking for the next big thing. These are just a few of the factors that influence crypto prices. Understanding how they work can help you make better investment decisions.

How crypto prices are determined

Price determination of cryptocurrencies is a complex process that takes into account supply and demand, as well as other factors. Cryptocurrencies are often traded on cryptocurrency exchanges, where buyers and sellers negotiate a price. The price of a cryptocurrency can be affected by a number of factors, including news, technical indicators, and global events.

The role of market demand in crypto prices

Market demand is one of the most important factors in determining the price of cryptocurrencies. Market demand is determined by the number of people who are interested in buying a cryptocurrency and the amount of available supply. The more people who are interested in buying a cryptocurrency, the higher its price will be. Conversely, the lower the number of people who are interested in buying a cryptocurrency, the lower its price will be.

The impact of news on crypto prices

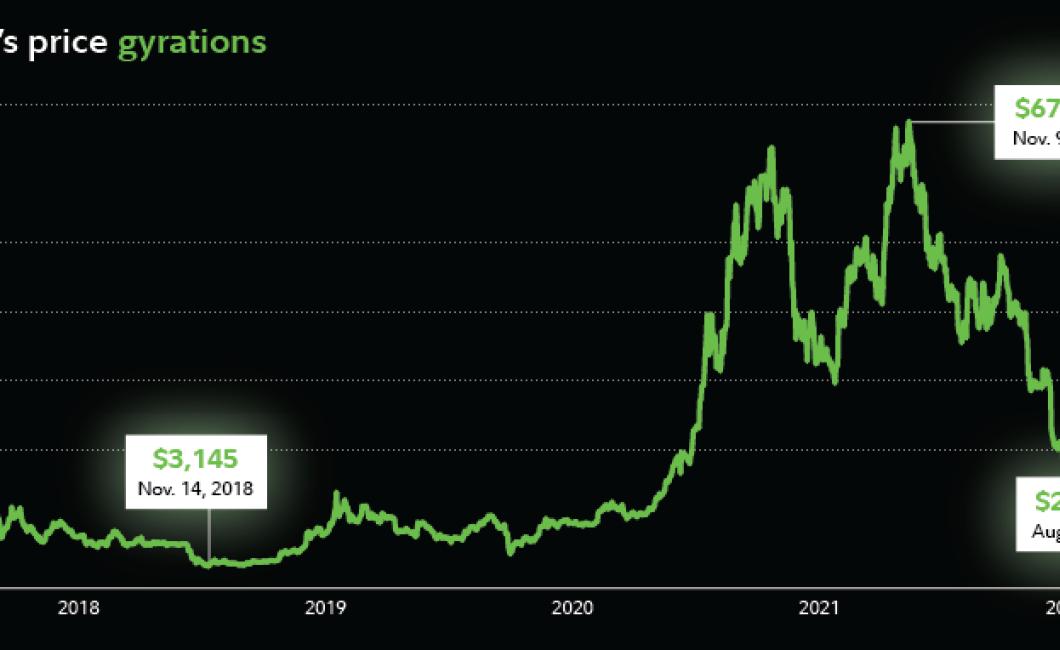

Cryptocurrencies are often highly volatile and tend to react quickly to news. This can have a major impact on prices, as traders may choose to sell off their holdings in response to announcements, or buy more in anticipation of future price rises.

In the aftermath of the Brexit vote, for example, the value of many cryptocurrencies plummeted as investors fled the market. Bitcoin, the largest and most well-known cryptocurrency, lost around half its value in just over two days.

This volatility can be tough for newcomers to the market, who may find it difficult to stay consistent with their investment plans when prices are changing so rapidly. For seasoned traders, however, this volatility is an opportunity to make quick profits by buying and selling at the right time.

The relationship between supply and demand for cryptos

The relationship between supply and demand for cryptos can be summarized as follows:

When there is more demand for a crypto than there is available supply, the value of that crypto will increase. This is because people will want to buy it in order to increase its value. Conversely, when there is more supply than demand, the value of that crypto will decrease. This is because people will want to sell it in order to decrease its value.

How emotions affect crypto prices

Many crypto traders believe that emotions affect crypto prices. This is because many people buy and sell cryptocurrencies based on their feelings, rather than looking at the facts.

This can lead to mistakes, as emotions can sometimes override logic. For example, someone may buy a cryptocurrency because they believe it is going to rise in value, even though the evidence suggests that it is not likely to do so.

This can lead to huge losses when the price of the cryptocurrency falls, as the buyer has now invested more money than they originally intended to.

The importance of technical analysis in understanding crypto prices

The importance of technical analysis in understanding crypto prices cannot be overemphasized. Technical analysis is an essential tool for traders and investors that can help them identify trends and provide valuable insights into potential price movements.

Technical analysis can help traders to identify key support and resistance levels, as well as other important market indicators. By understanding these indicators, traders can make better investment decisions and protect themselves from potential losses.

Technical analysis is also an effective way to gauging sentiment in the market. When sentiment is positive, traders may see increased buying activity, while negative sentiment may lead to sell-offs.

Why some cryptos are more expensive than others

Cryptocurrencies are more expensive than fiat currencies because they are not regulated and have a higher potential for volatility.