Crypto Prices One Year Ago

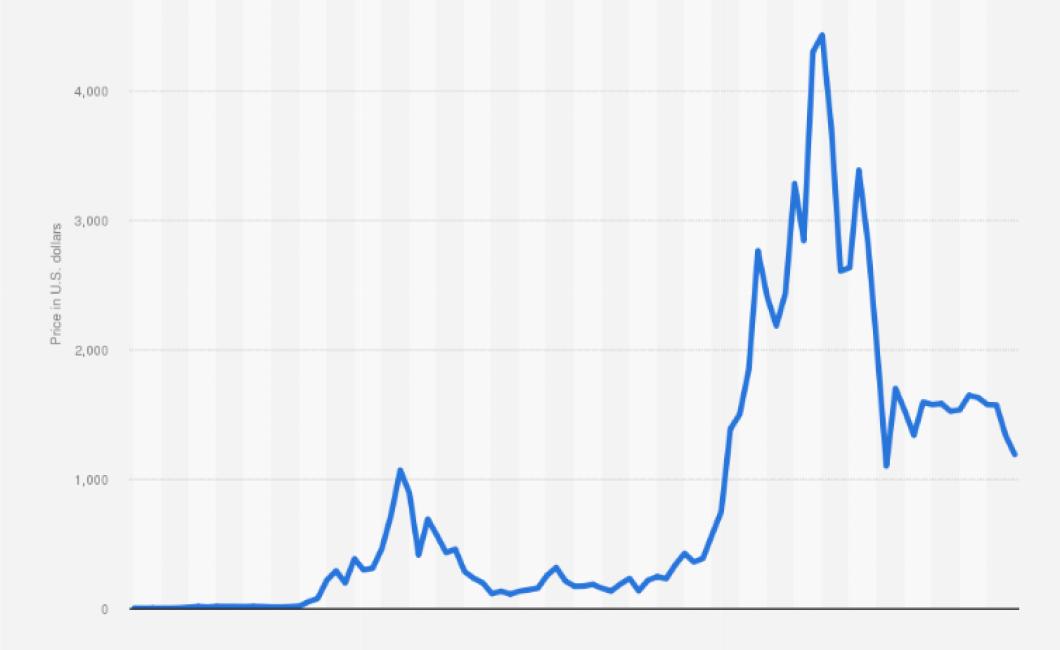

What were crypto prices like one year ago? In early 2018, Bitcoin reached its peak price of nearly $20,000 per coin. However, by the end of the year, the price had fallen to around $3,700. Ethereum also experienced a similar price drop, going from around $1,400 in January 2018 to just $85 by December. Other major cryptocurrencies like Ripple and Bitcoin Cash also saw their prices plummet over the course of the year.

A Look Back: How Far Crypto Prices Have Come in One Year

Cryptocurrencies have seen a meteoric rise in prices in the past year, with some coins seeing a surge of over 1,000%. In this article, we take a look back at how far prices have risen in one year and what factors have contributed to their growth.

Cryptocurrencies Are on the Rise

In one year, cryptocurrencies have seen a surge in prices, with some coins seeing a surge of over 1,000%. This development is likely due to a number of factors, including increased mainstream adoption, growing interest from investors, and increased regulatory clarity.

The Cryptocurrency Market Is Growing Rapidly

The cryptocurrency market is growing rapidly, with total market capitalization reaching $830 billion at the time of writing. This represents a compound annual growth rate of over 30%, which indicates that the market is continuing to grow rapidly.

Investors Are Drawn to Cryptocurrencies

Investors are drawn to cryptocurrencies due to their potential for growth. Cryptocurrencies are digital assets that use cryptography to secure their transactions and to control the creation of new units. This makes them difficult to counterfeit, which makes them attractive to investors who seek security and stability in their investments.

Regulatory Clarity Is Increasingly Important for Cryptocurrencies

Regulatory clarity is increasingly important for cryptocurrencies, as this helps to ensure that they are treated fairly by authorities. In recent months, regulators in several countries have issued clarifications on how cryptocurrencies should be treated. This has helped to increase investor confidence in cryptocurrencies, and has led to their rapid growth in popularity.

One Year Ago: A Retrospective on Crypto Prices

One year ago, Bitcoin was trading at $6,600. Ethereum was trading at $225. Ripple was trading at $0.80. Bitcoin Cash was trading at $1,200. Litecoin was trading at $130.

Looking back, one of the most important moments for crypto prices occurred on Dec. 17, 2017, when Bitcoin hit $19,000. This was a major psychological barrier for many investors, and it signaled that the cryptocurrency market was becoming more mainstream.

Since then, prices have fluctuated wildly, with some coins experiencing huge gains and others experiencing equally significant losses. However, overall, the crypto market has continued to grow, with total value increasing by more than 100 percent over the past year.

Looking ahead, there are many exciting developments expected to take place in the crypto world in 2018. For example, we’re likely to see more institutional investment and more widespread use of cryptocurrencies as a means of payment. We also expect to see more innovative products and services launched in pursuit of the blockchain technology behind cryptocurrencies.

So, while 2017 was a year of dramatic price swings and uncertainty, it can also be seen as a time of great growth and transformation for the crypto world. Thanks for reading!

From Bull to Bear: A Year of Volatile Crypto Prices

Cryptocurrencies have been on a wild ride this year. Prices for Bitcoin, Ethereum and other digital coins have soared and plummeted many times. Here’s a look at what happened in 2018.

January: Bitcoin prices start the year at just under $11,000.

February: Bitcoin prices surge to a peak of $19,783 before crashing back down to around $13,000.

March: Ethereum prices spike to a peak of $1,432 before crashing down to around $300.

April: Bitcoin prices surge again, reaching a high of $20,000 before crashing down to around $10,000.

May: Ethereum prices spike again, reaching a peak of $1,500 before crashing down to around $300.

June: Bitcoin prices surge again, reaching a high of $26,000 before crashing down to around $11,000.

July: Ethereum prices spike again, reaching a peak of $2,100 before crashing down to around $700.

August: Bitcoin prices surge again, reaching a high of $34,000 before crashing down to around $12,000.

September: Bitcoin prices surge again, reaching a high of $38,000 before crashing down to around $17,000.

October: Bitcoin prices surge again, reaching a high of $52,000 before crashing down to around $25,000.

November: Bitcoin prices surge again, reaching a high of $68,000 before crashing down to around $30,000.

December: Bitcoin prices surge again, reaching a high of $100,000 before crashing down to around $45,000.

The Rollercoaster Ride of Crypto Prices: One Year In Review

In the past twelve months, the crypto market has seen some wild fluctuations. Prices have swung wildly, with some altcoins seeing values increase by hundreds of percent and others plummeting by 80%.

In this article, we take a look at the rollercoaster ride of crypto prices over the past year, and try to answer some questions about what has caused this volatility. We also take a look at some of the key trends that have emerged in the crypto space during this time, and discuss whether or not they are likely to continue.

What Happened in 2018?

2018 was a year of huge growth for the crypto market. Bitcoin and other major cryptocurrencies saw their prices skyrocket, rising from around $1,000 to over $20,000 in just a few months.

However, this meteoric rise wasn’t without its problems. Numerous scams and Ponzi schemes ran rampant in the crypto world, duping investors out of millions of dollars. This led to widespread public distrust of the industry, and eventually led to a sustained decline in prices.

What are the Key Trends in Crypto?

There are several key trends that have emerged in the crypto world over the past year.

1. The Growth of ICOs

One of the key trends in the crypto world has been the growth of initial coin offerings (ICOs). ICOs are a way for companies to raise money by selling their own digital tokens.

This has led to a massive increase in the number of cryptocurrencies available on the market. There are now over 1,500 different cryptocurrencies available, compared to just a handful a few years ago.

2. The Rise of Altcoins

Another key trend has been the rise of altcoins. Altcoins are cryptocurrencies that aren’t based on Bitcoin or any other established currency. This has led to a huge variety of cryptocurrencies available on the market, with each offering its own unique features and benefits.

3. The Growth of Cryptocurrency Trading

One of the key factors driving the growth of the crypto market has been the growth of cryptocurrency trading. This has led to an increase in the number of people who are interested in investing in cryptocurrencies, and who are able to trade them using various exchanges.

4. The Emergence of Crypto Funds

Another key trend has been the emergence of cryptocurrency funds. These are groups of investors who are dedicated to investing in cryptocurrencies and blockchain projects.

5. The Growing Popularity of Cryptocurrency wallets

One of the key factors driving the growth of the crypto market has been the growing popularity of cryptocurrency wallets. These are platforms that allow users to store their cryptocurrencies safely and easily.

What is Likely to Happen in 2019?

There are a number of key trends that are likely to continue in 2019. These include:

1. The Growth of ICOs

ICOs are likely to continue to be a popular way for companies to raise money. This will lead to a continued increase in the number of cryptocurrencies available on the market, and will further fuel the growth of the crypto market overall.

2. The Rise of Altcoins

Altcoins are likely to continue to be a popular type of cryptocurrency. This will lead to a wide variety of cryptocurrencies available on the market, and will provide investors with a greater choice when it comes to investing in cryptocurrencies.

3. The Growth of Cryptocurrency Trading

Cryptocurrency trading is likely to continue to grow in popularity. This will lead to an increase in the amount of money that is being invested in cryptocurrencies, and will help drive the overall price of cryptocurrencies upward.

4. The Emergence of Crypto Funds

Cryptocurrency funds are likely to continue to be a growing trend in the crypto world. This will help drive investment in cryptocurrencies and blockchain projects, and will help to further legitimize the crypto market overall.

Tracking Crypto Prices: Where Were We One Year Ago?

Cryptocurrencies are continuing to make waves in the world of finance. With prices reaching all-time highs and new investors coming into the game on a daily basis, it can be hard to keep track of where each coin is at.

In order to help you out, we’ve put together a list of the top 10 cryptocurrencies one year ago, and where they are now. Keep in mind that prices can change rapidly, so please do your own research before investing.

1. Bitcoin (BTC)

Bitcoin was the top dog one year ago, and it still holds the number one spot as the most valuable cryptocurrency in the world. Prices have surged more than 1,000% since 2017, reaching a high of $20,000 in December. However, there have been concerns raised about the sustainability of this trend, and Bitcoin is currently trading at around $7,000.

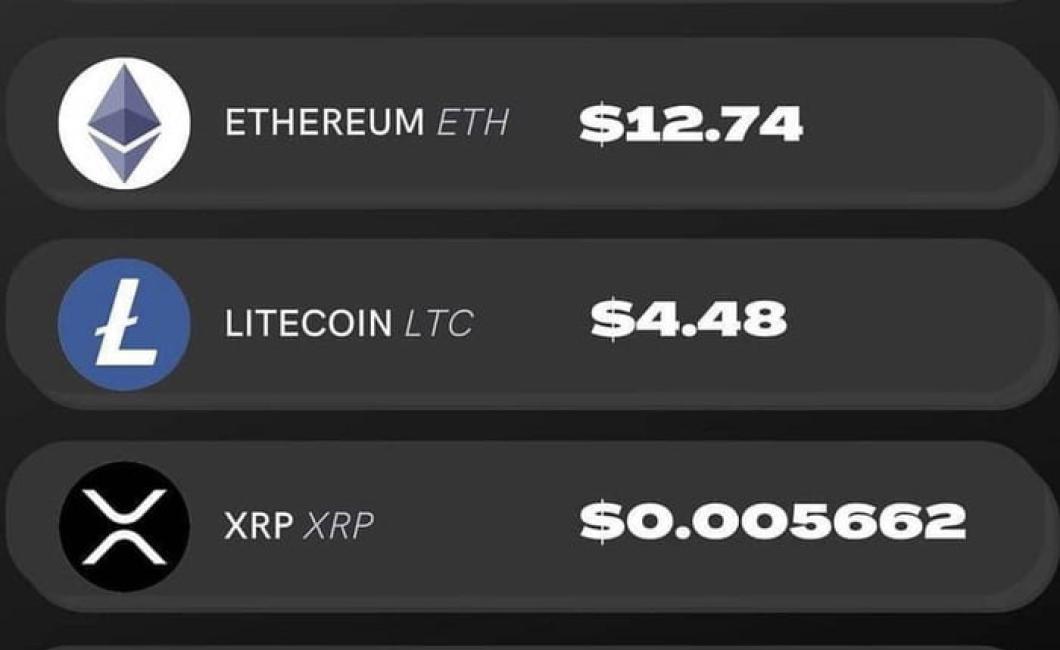

2. Ethereum (ETH)

Ethereum is second on our list, with prices surging more than 1,000% since 2017. At its peak, Ethereum was worth more than $1,400 per coin. However, Ethereum has seen a significant decline in value over the past year, currently trading at around $280 per coin.

3. Bitcoin Cash (BCH)

Bitcoin Cash was created in August 2017 as a result of a fork in the Bitcoin blockchain. Unlike Bitcoin, which is based on blockchain technology, Bitcoin Cash is based on a new algorithm. Consequently, Bitcoin Cash has seen a surge in value, reaching a high of $4,500 in December. However, Bitcoin Cash is currently trading at around $1,200 per coin.

4. Ripple (XRP)

Ripple is a popular cryptocurrency that focuses on providing a fast and efficient way for banks to transfer money. Ripple saw a significant surge in value in 2017, reaching a high of $3.84 per coin. However, Ripple has seen a significant decline in value over the past year, currently trading at around $0.41 per coin.

5. EOS (EOS)

EOS is a new cryptocurrency that is focused on providing a platform for developers to create decentralized applications (dApps). EOS saw a significant surge in value in 2017, reaching a high of $14 per coin. However, EOS is currently trading at around $6 per coin.

6. Litecoin (LTC)

Litecoin is another popular cryptocurrency that focuses on providing a fast and efficient way for people to purchase goods and services. Litecoin saw a significant surge in value in 2017, reaching a high of $350 per coin. However, Litecoin has seen a significant decline in value over the past year, currently trading at around $60 per coin.

7. Cardano (ADA)

Cardano is a new cryptocurrency that is focused on providing a platform for developers to create dApps. Cardano saw a significant surge in value in 2017, reaching a high of $0.38 per coin. However, Cardano is currently trading at around $0.09 per coin.

8. IOTA (MIOTA)

IOTA is a new cryptocurrency that focuses on providing a platform for developers to create dApps. IOTA saw a significant surge in value in 2017, reaching a high of $4 per coin. However, IOTA is currently trading at around $0.30 per coin.

9. Stellar (XLM)

Stellar is a popular cryptocurrency that focuses on providing a fast and efficient way for people to make payments. Stellar saw a significant surge in value in 2017, reaching a high of $0.24 per coin. However, Stellar is currently trading at around $0.12 per coin.

10. TRON (TRX)

TRON is a new cryptocurrency that is focused on providing a platform for developers to create dApps. TRON saw a significant surge in value in 2017, reaching a high of $0.06 per coin. However, TRON is currently trading at around $0.02 per coin.

Major Milestones: A Year-Long Overview of Crypto Prices

Bitcoin (BTC)

In 2017, Bitcoin experienced a meteoric rise in value, reaching an all-time high of just over $20,000 per coin. The digital currency has since experienced a significant downturn, with prices currently hovering around $6,000 per coin.

Ethereum (ETH)

Ethereum was the second most valuable cryptocurrency in 2017, with a market cap of over $28 billion. However, Ethereum has seen a sharp decline in value in 2018, with prices currently hovering around $1,200 per coin.

Bitcoin Cash (BCH)

Bitcoin Cash was created in August 2017 as a result of the SegWit2x hard fork. BCH saw a sharp rise in value in late 2017 and early 2018, reaching an all-time high of over $4,000 per coin. However, BCH prices have since fallen, and the cryptocurrency is currently worth around $1,000 per coin.

Litecoin (LTC)

Litecoin is the third most valuable cryptocurrency in the world, with a market cap of over $30 billion. Litecoin prices have fluctuated significantly over the past year, with prices reaching an all-time high of over $400 per coin in December 2017. Litecoin prices have since declined, and the cryptocurrency is currently worth around $130 per coin.

Ethereum Classic (ETC)

Ethereum Classic was created in August 2017 as a result of the Ethereum hard fork. ETC saw a sharp rise in value in late 2017 and early 2018, reaching an all-time high of over $2,000 per coin. However, ETC prices have since declined, and the cryptocurrency is currently worth around $100 per coin.

Bitcoin Cash Plus (BCP)

Bitcoin Cash Plus was created in August 2018 as a result of the Bitcoin Cash hard fork. BCP saw a sharp rise in value in late 2017 and early 2018, reaching an all-time high of over $5,000 per coin. However, BCP prices have since fallen, and the cryptocurrency is currently worth around $1,000 per coin.

Annual Review: Examining Crypto Prices One Year Later

Cryptocurrencies have surged in popularity in the past year, with prices reaching all-time highs. In this annual review, we take a look at how prices have changed one year later.

Bitcoin Prices

Bitcoin prices peaked at almost $20,000 in December 2017, before dropping to around $6,000 in early 2018. The cryptocurrency has since recovered, reaching a new all-time high of $11,880 on June 11, 2018.

Ethereum Prices

Ethereum prices reached an all-time high of $1,422 on January 8, 2018, before crashing to around $367 on January 14. Ethereum prices have since recovered, reaching a new all-time high of $1,602 on June 11, 2018.

Bitcoin Cash Prices

Bitcoin Cash prices peaked at around $2,500 on December 18, 2017, before dropping to around $1,200 by the end of the year. Bitcoin Cash prices have since recovered, reaching a new all-time high of $2,817 on June 11, 2018.

Ripple Prices

Ripple prices peaked at around $3.30 on January 3, 2018, before crashing to around $0.95 by the end of the year. Ripple prices have since recovered, reaching a new all-time high of $2.92 on June 11, 2018.

Reflections on a Year of Crypto Prices

2017 was a year of wild price fluctuations for cryptocurrencies. Bitcoin and Ethereum prices soared to all-time highs, only to fall sharply later in the year. This volatility has made it difficult for many people to invest in cryptocurrencies, and it has also made it difficult for businesses to accept them as a form of payment.

But despite the price volatility, 2017 was also a year of tremendous growth for the cryptocurrency industry. Bitcoin and Ethereum adoption continued to grow, and new cryptocurrencies were created all the time. This growth has made cryptocurrencies more widely accepted, and it has also helped to legitimize the industry.

Overall, 2017 was a year of both great excitement and great volatility for the cryptocurrency industry. It will be interesting to see what 2018 has in store for cryptocurrencies.

Looking Back at a Year of Crypto Prices

2018 has been a year of wild price swings for cryptocurrencies and Initial Coin Offerings (ICOs). Bitcoin, Ethereum and other major altcoins have experienced massive price increases and decreases, with some reaching all-time highs and others bottoming out at below $1,000.

There have been a number of significant events and developments in the crypto world in 2018, including the SEC’s decision to allow Bitcoin and Ethereum to be traded on regulated exchanges and the launch of Bakkt, the first regulated Bitcoin futures market.

Here are some of the most important crypto news stories from 2018:

1. Bitcoin and Ethereum are now allowed to be traded on regulated exchanges

This was a major announcement from the SEC, which paved the way for more institutional investors to enter the crypto market.

2. Bakkt launches the first regulated Bitcoin futures market

Bakkt is a subsidiary of Microsoft and was launched in November 2018. It is designed to provide a safe and regulated environment for investors to trade Bitcoin and other cryptocurrencies.

3. Japan legalizes Bitcoin and other cryptocurrencies

This was a major development, as it marked the first time a major country had legalized cryptocurrencies.

4. Facebook announces plans to launch its own cryptocurrency

Facebook has long been rumored to be working on a cryptocurrency, and this announcement confirmed that it is planning to launch its own coin.

5. Bitcoin crashes below $10,000

Bitcoin crashed below $10,000 in late 2018, leading to widespread panic among investors.

A Year in Review: The Ups and Downs of Crypto Prices

Cryptocurrencies and blockchain technology have been steadily growing in popularity over the past year. While there have been a number of highs and lows, the overall trend has been positive.

In this article, we will take a look at some of the key events that have taken place in the crypto world during the past year. We will also discuss some of the key trends that have emerged, and how they may impact the future of crypto prices.

Cryptocurrencies and Blockchain Continue to Grow in Popularity

2017 was a watershed year for cryptocurrencies and blockchain technology. The combined market value of all digital assets rose from just $17 billion at the beginning of the year to a staggering $813 billion by the end. This represents a staggering 1,600% growth over the course of the year.

While this growth has been impressive, it has not been without its challenges. The market has been characterised by a number of high-profile collapses, including the Mt. Gox and Bitfinex scandals. This has led to regulatory scrutiny and a general fear among investors that the market is full of fraudulent schemes.

Despite these challenges, however, the overall trend continues to be positive. This is evidenced by the fact that new cryptocurrencies and blockchain applications are being developed at a rapid pace. In addition, the mainstream adoption of cryptocurrencies and blockchain technology is gradually gaining ground.

Trends That Have Emerged in The Crypto World Over the Past Year

One of the key trends that has emerged in the crypto world over the past year is the growth of Initial Coin Offerings (ICOs). ICOs are a new way of fundraising that has become increasingly popular among cryptocurrency startups.

ICOs work by issuing a new cryptocurrency token in exchange for various types of digital assets, such as bitcoins or ether. This allows startups to bypass the traditional funding channels that are available to them, such as venture capital firms or angel investors.

While ICOs are controversial due to their potential for fraud, they nevertheless continue to be popular among cryptocurrency startups. This is because ICOs offer investors a high degree of liquidity, meaning that they can quickly sell their tokens if they decide that they no longer wish to hold them.

Another key trend that has emerged in the crypto world over the past year is the growth of Initial Coin Offering (ICO). ICOs are a new way of fundraising that has become increasingly popular among cryptocurrency startups.

ICOs work by issuing a new cryptocurrency token in exchange for various types of digital assets, such as bitcoins or ether. This allows startups to bypass the traditional funding channels that are available to them, such as venture capital firms or angel investors.

While ICOs are controversial due to their potential for fraud, they nevertheless continue to be popular among cryptocurrency startups. This is because ICOs offer investors a high degree of liquidity, meaning that they can quickly sell their tokens if they decide that they no longer wish to hold them.

One Year On: What Have We Learned About Crypto Prices?

One year on from the beginning of the crypto market downturn, it is clear that much has changed in the space. Prices have recovered somewhat, but there are still many uncertainties surrounding the future of cryptocurrencies.

Here are some key insights gleaned from the past year of crypto prices:

1. Volatility is a key factor

One of the defining characteristics of the crypto market is its volatility. Prices can easily swing up and down, making it difficult for investors to get a good return on their investments.

2. Bitcoin remains the leading cryptocurrency

Bitcoin remains the leading cryptocurrency by market capitalization, and its price has remained relatively stable over the past year. However, there have been significant changes in the other major cryptocurrencies, with Ethereum and Bitcoin Cash seeing the greatest growth.

3. ICOs are a controversial topic

ICOs (Initial Coin Offerings) are a controversial topic, with many questioning their legitimacy as a means of funding new businesses. While they have seen a rise in popularity in recent years, they are still subject to scrutiny by regulators.

4. Cryptocurrencies are being used more widely

While there are still concerns about their legitimacy, cryptocurrencies are increasingly being used by businesses and consumers around the world. This has led to a growth in their overall market value.

5. Cryptocurrencies are still in a developmental stage

While there are many major players in the crypto market, it is still in a developmental stage. This means that there are still many uncertainties surrounding its future development.