Free Rsi Crypto Charts

Looking for a way to stay up-to-date on all the latest cryptocurrency prices? Then look no further than the free Rsi Crypto Charts app! This convenient app provides users with real-time data on dozens of different digital currencies, including Bitcoin, Ethereum, Litecoin, and more. Not only that, but the app also features a variety of different chart types so you can visualize the data in whatever way you prefer. Whether you're a casual investor or a serious trader, the Rsi Crypto Charts app is a must-have tool for anyone interested in the world of cryptocurrencies!

The Benefits of Using Free RSI Crypto Charts

There are many benefits to using free RSI crypto charts. One of the most important benefits is that they can help you to identify potential areas of investment opportunity. By monitoring the RSI indicator, you can quickly and easily detect when a cryptocurrency is overvalued or undervalued. This can help you to make informed investment decisions.

Another important benefit of using free RSI crypto charts is that they can help you to monitor your portfolio. By tracking the RSI indicator, you can quickly and easily identify when a cryptocurrency is in over or undervalued condition. This can help you to make informed investment decisions.

Finally, free RSI crypto charts can also help you to identify potential trends. By monitoring the RSI indicator, you can quickly and easily identify when a cryptocurrency is in a bullish or bearish trend. This can help you to make informed investment decisions.

How Free RSI Crypto Charts Can Help You Make Better Trading Decisions

Crypto charts are an essential part of any trader’s toolkit. They can help you identify trends and spot potential buying and selling opportunities.

But what if you don’t have access to reliable, free crypto charts?

That’s where free RSI crypto charts come in handy.

RSI is a technical indicator that can help you identify overbought and oversold conditions in a digital currency.

When the RSI is above the 70 level, it signals that the cryptocurrency is overbought. And when the RSI falls below the 30 level, it signals that the cryptocurrency is oversold.

So how can you use free RSI crypto charts to make better trading decisions?

Here are a few tips:

1. Use RSI to identify oversold conditions.

When the RSI falls below 30, this signals that the cryptocurrency is oversold and may be ready for a rally. Similarly, when the RSI is above 70, this indicates that the cryptocurrency is overbought and may be headed for a downtrend.

2. Watch for signs of a reversal.

If the RSI falls below 30 but then rallies back above the 30 level, this may signal a reversal in the market. Conversely, if the RSI rallies above 70 but then falls back below the 70 level, this may indicate that the market is about to decline.

3. Look for support and resistance levels.

When the RSI crosses a support or resistance level, this may signal a buying or selling opportunity. For example, if the RSI crosses the 30 level but then falls back below it, this may indicate that the market is weak and could decline further. Conversely, if the RSI crosses the 70 level but then drops back below it, this may signal that the market is strong and could experience a pullback.

4. Use other indicators to complement RSI.

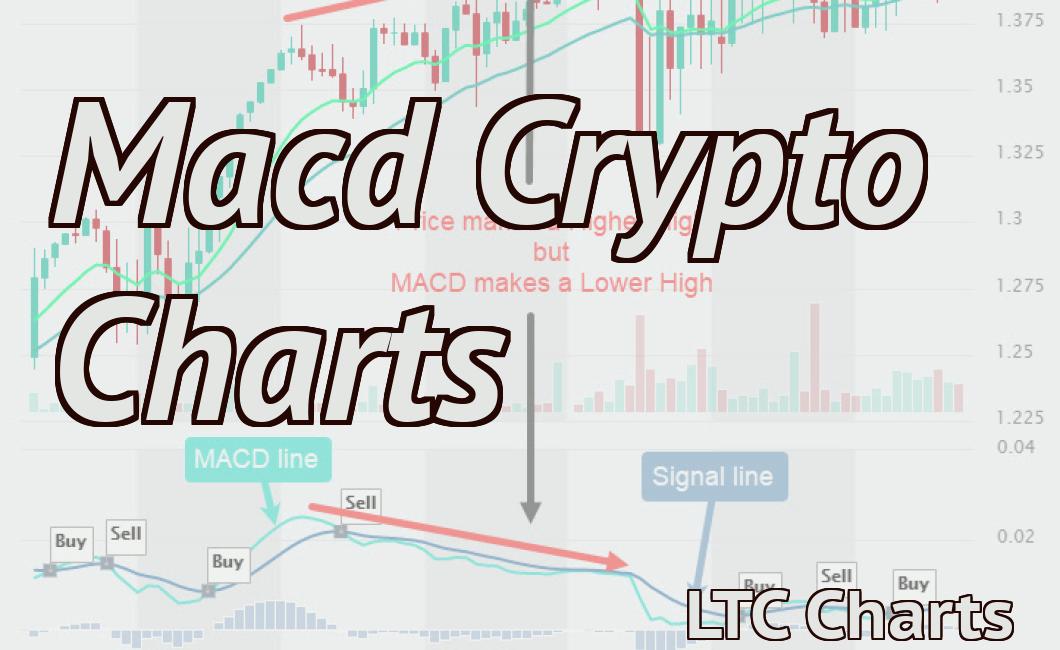

While RSI is an important technical indicator, it’s not the only one that matters when it comes to trading cryptocurrencies. Other indicators, such as MACD and Bollinger Bands, can also help you make better trading decisions.

The Advantages of Free RSI Crypto Charts Over Other Charting Tools

There are many advantages to using free RSI crypto charts over other charting tools.

1. They are easy to use.

RSI crypto charts are easy to use, making them a great choice for traders who are new to cryptocurrency trading. Simply select the asset you want to track, and RSI will automatically calculate the current price and RSI levels.

2. They are accurate.

RSI crypto charts are accurate, meaning that they will provide you with reliable information about the current state of the cryptocurrency market.

3. They are user-friendly.

RSI crypto charts are user-friendly, meaning that even non-technical traders can use them to make informed decisions about the state of the cryptocurrency market.

4. They are easy to interpret.

RSI crypto charts are easy to interpret, meaning that you can quickly understand how the current state of the cryptocurrency market affects the value of your investment.

Why You Should Use Free RSI Crypto Charts to Stay Ahead of the Market

RSI is a popular technical indicator that can be used to help predict future market movements. By keeping track of RSI levels, investors can better understand the current state of the market and make informed investment decisions.

Here are three reasons why you should use free RSI crypto charts to stay ahead of the market:

1. RSI Provides Insights into the Strength of a Market Momentum

RSI is a technical indicator that helps investors understand the current state of a market. When the RSI is above the 50-line (the line in the middle of the chart that indicates overbought and oversold conditions), it signals that the market is in a positive momentum. Conversely, when the RSI is below the 50-line, it signals that the market may be in a downward momentum.

By monitoring RSI levels, investors can stay ahead of the market and make informed investment decisions.

2. RSI Can Provide Insights into Future Price Movement

When RSI is above the 50-line, it suggests that investors are buying into the market. Conversely, when RSI is below the 50-line, it suggests that investors are selling into the market.

By monitoring RSI levels, investors can stay ahead of the market and make informed investment decisions.

3. RSI Can Signal impending Market Correction

RSI is a technical indicator that can signal impending market corrections. When RSI is above the 50-line, it suggests that the market is in an overbought condition. Conversely, when RSI is below the 50-line, it suggests that the market is in an oversold condition.

When RSI is above the 50-line, it suggests that investors are buying into the market. Conversely, when RSI is below the 50-line, it suggests that investors are selling into the market.

By monitoring RSI levels, investors can stay ahead of the market and make informed investment decisions.

What Free RSI Crypto Charts Can Do for Your Trading Strategy

RSI is a technical indicator that is used to identify oversold and overbought conditions in a market. When used in conjunction with other indicators, it can help you time the entry and exit of a trade.

When used in a trading strategy, RSI can be used to help determine when to sell or buy a security. RSI can also be used to time the entry and exit of a trade.

When used in conjunction with other indicators, RSI can help you time the entry and exit of a trade.

How to Use RSI Crypto Charts

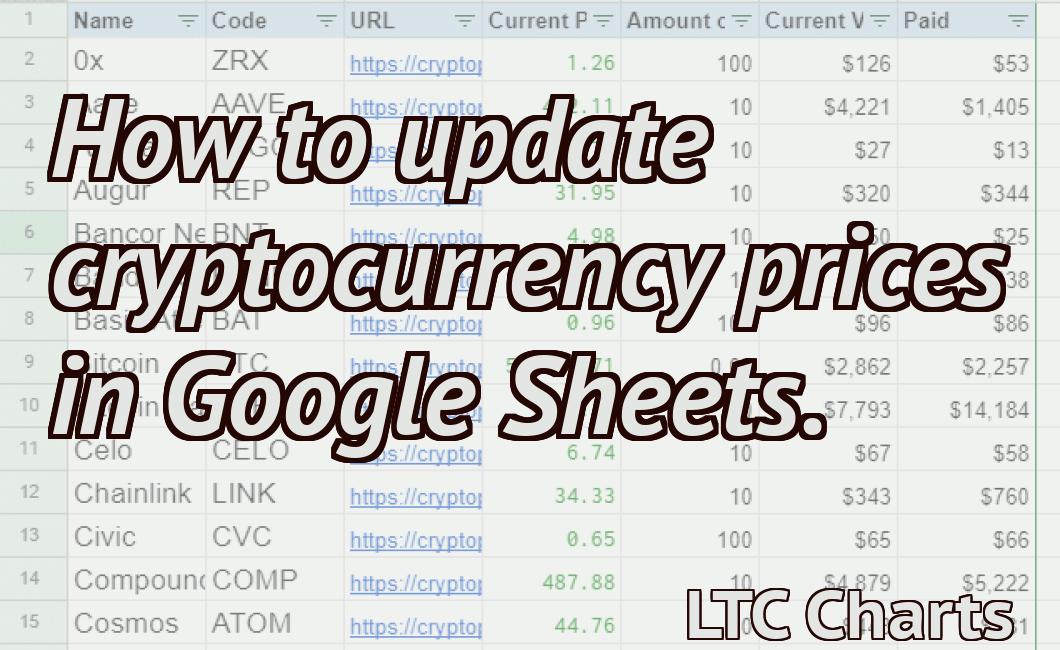

To use RSI crypto charts, you will first need to open a charting platform. Once you have opened the chart, you will need to find the RSI indicator. To find the RSI indicator, search for “RSI” on your chosen platform.

Once you have found the RSI indicator, you will need to select it. To select the RSI indicator, double-click on it. This will open the RSI settings page. On this page, you will need to set the timeframe for the RSI chart. You can choose between 1 day, 1 week, or 1 month.

After you have set the timeframe, you will need to set the drawing level for the RSI chart. To do this, click on the drop-down arrow next to “Drawing Level” and select “Low”, “Mid”, or “High”.

After you have set the drawing level, you will need to set the scale for the RSI chart. To do this, click on the drop-down arrow next to “Scale” and select “Percentage” or “Not Percentage”.

Finally, you will need to set the color for the RSI chart. To do this, click on the drop-down arrow next to “Color” and select “Green”, “Yellow”, or “Red”.

When you have finished setting up the RSI chart, you will need to click on the “Run Chart” button. This will run the RSI chart and show you the current values for the indicator.

How to Use RSI Crypto Charts for Trading Strategy

When using RSI crypto charts for trading strategy, you will first need to identify when the market is overbought or oversold. To do this, you will need to use other indicators to help you identify these conditions.

Once you have identified when the market is overbought or oversold, you will need to use RSI to time your entry and exit into a trade. To do this, you will need to use the drawing level and scale settings on the RSI chart.

You will also need to use the color setting on the RSI chart to help you identify when the market is reaching a high or low point.

Finally, you will need to use other indicators to help you make your trade decisions. For example, you could use volume or supply and demand indicators to help you decide when to buy or sell a security.

How to Get the Most Out of Free RSI Crypto Charts

There are a few things to keep in mind when using free RSI crypto charts.

The first is that the charts are designed to help you identify potential areas of price appreciation or decline. As such, they should not be used as sole guidance when making investment decisions.

Secondly, it's important to note that the charts are not a guarantee of future success. Rather, they are a tool that can help you identify opportunities. So don't put all your eggs in one basket by relying on the charts alone.

Finally, it's always best to do your own research when it comes to investing. So if you have any questions about how to use free RSI crypto charts, feel free to ask in the comments section below.

Making the Most of Free RSI Crypto Charts

The first step in making the most of free RSI crypto charts is to identify the key indicators you need to track. Once you know what to look for, you can easily find the right RSI crypto chart to help you make informed trading decisions.

Some key indicators to track include:

RSI (14)

MACD (12, 26, 9, 3)

Stochastic (8, 14, 26)

The first step is to identify the key indicators you need to track. Once you know what to look for, you can easily find the right RSI crypto chart to help you make informed trading decisions.

Getting the Most Out of Your Free RSI Crypto Charts

There are a few things that you can do to get the most out of your free RSI crypto charts.

1. Use them to help you track your portfolio performance.

RSI can be a helpful tool when it comes to tracking your portfolio performance. By using RSI to compare the prices of different assets, you can see if there are any patterns that emerge. This can help you make better investment decisions.

2. Use them to identify potential market trends.

By looking at the RSI values of different assets, you can identify potential market trends. This can help you make more informed investment decisions.

3. Use them to help you determine when to sell an asset.

RSI can also be used to determine when to sell an asset. By watching the RSI values of an asset, you can see if it is reaching a point of overvaluation or overbought. This can help you make better investment decisions.