Charts Patterns Crypto

If you're interested in trading cryptocurrencies, then you need to be aware of charts patterns. Cryptocurrency prices are highly volatile, and charts can help you spot trends and make better-informed trading decisions. In this article, we'll take a look at some of the most important chart patterns for cryptocurrency trading.

charts patterns crypto: the most popular patterns and how to spot them

In this post, we will look at the most popular crypto chart patterns and how to spot them. We will also provide a few examples of these patterns and how they have performed in the past.

1. Head-and-shoulders

This is one of the most popular crypto chart patterns. It consists of a upwards trend followed by a sudden decrease in price, which is usually followed by a new upwards trend. This pattern can be identified by looking for a sudden increase in price followed by a decrease, and then a new increase in price.

2. Triangle

The triangle pattern is another common crypto chart pattern. It consists of a downward trend, an upwards trend, and then a downwards trend again. This pattern can be identified by looking for three consecutive phases: an increase in price, a decrease in price, and then an increase in price.

3. Broadening out

Broadening out is another common crypto chart pattern. It consists of an increase in price followed by a decrease in price, which is followed by an increase in price. This pattern can be identified by looking for an increase in price that is greater than the previous increase in price.

4. Head-and-shoulders reversal

A head-and-shoulders reversal is another common crypto chart pattern. It consists of a downwards trend followed by a upwards trend, which is followed by a downwards trend. This pattern can be identified by looking for a decrease in price that is greater than the previous decrease in price.

charts patterns crypto: what do they mean and how to trade them

There are a lot of different types of charts, and each one can have different meanings. Here are some examples of charts that are used in cryptocurrency trading:

1. MACD

The MACD is a popular technical analysis indicator that shows the relationship between a security's price and its moving average. When the MACD is positive, this means that the security's price is increasing, and when the MACD is negative, this means that the security's price is decreasing.

2. Bollinger Bands

Bollinger Bands are another popular technical analysis indicator that shows the volatility of a security's price. When the Bollinger Bands are tight (near the middle of the range), this means that the security's price is relatively stable, and when the Bollinger Bands are wide (near the edges of the range), this means that the security's price is more volatile.

3. RSI

The RSI is a technical analysis indicator that shows how much a security's price is overbought or oversold. When the RSI is oversold, this means that the security's price is too low relative to its historical prices, and when the RSI is overbought, this means that the security's price is too high relative to its historical prices.

4. Fibonacci Retracements

Fibonacci retracements are a type of technical analysis tool that shows how a security's price has trended over time. When a security's price reaches a Fibonacci retracement (a specific number of percentage points above or below the original price), this often indicates that the security is about to trend again.

charts patterns crypto: a beginner's guide

Crypto charts patterns can help traders identify potential opportunities and predict future trends. This guide will focus on explaining crypto chart patterns and providing a few examples.

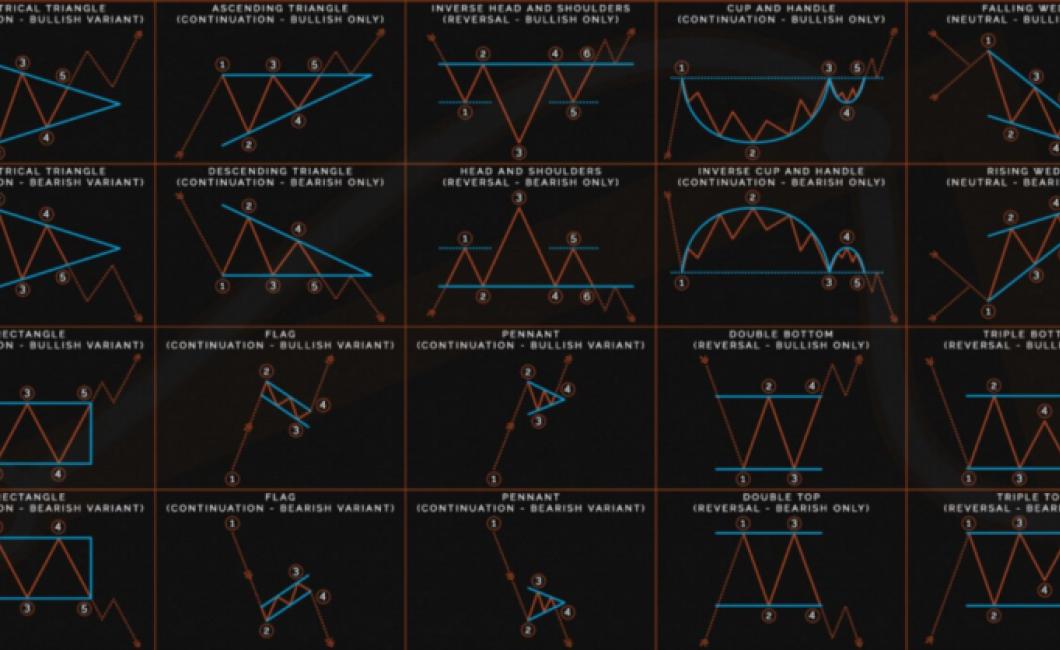

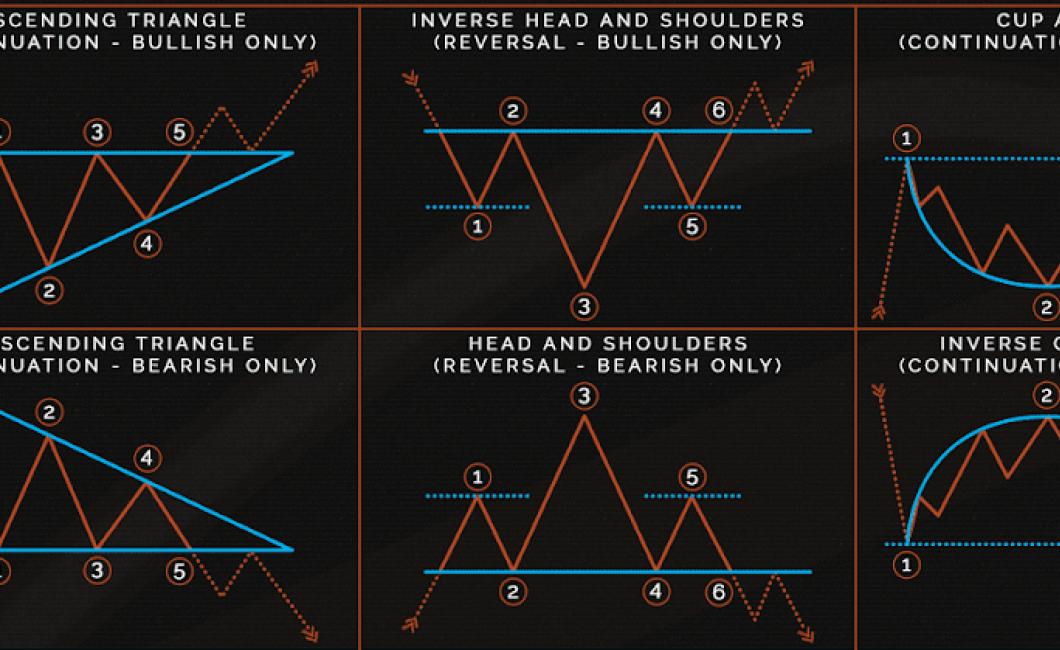

Crypto chart patterns can be broken down into three main categories: continuation, divergence and consolidation.

Continuation patterns indicate that the price of a cryptocurrency is likely to continue moving in the same direction. An example of a continuation pattern is a symmetrical triangle, which indicates that the price of a cryptocurrency is likely to continue moving in a similar direction.

Divergence patterns indicate that the price of a cryptocurrency is likely to move in different directions. An example of a divergence pattern is a head-and-shoulders pattern, which indicates that the price of a cryptocurrency is likely to move in opposite directions.

Consolidation patterns indicate that the price of a cryptocurrency is likely to remain relatively stable. An example of a consolidation pattern is a pennant, which indicates that the price of a cryptocurrency is likely to remain relatively stable for a period of time.

charts patterns crypto: 3 common mistakes traders make

There are three common mistakes traders make when trading cryptocurrencies:

1. Trying to time the market – This is one of the most common mistakes traders make. Trying to predict when the market will go up or down is a fool’s errand. The market will move in unpredictable ways, and predicting when it will happen is impossible.

2. Focusing on one coin at a time – When trading cryptocurrencies, it’s important to diversify your portfolio. Trying to focus on only one coin can lead to big losses if that coin falls in price. Instead, invest in a variety of cryptocurrencies so you have a better chance of earning profits.

3. Not having enough money invested – One of the biggest mistakes traders make is not having enough money invested in their portfolio. If you don’t have enough money invested, you’ll likely lose money whenever the market goes down. Instead, make sure to have a sufficient amount of money invested in your portfolio so you can weather any market volatility.

charts patterns crypto: top 10 tips for successful trading

1. Do your own research. Don’t just follow somebody else’s opinion.

2. Always be prepared for the unexpected.

3. Don’t get emotionally attached to a coin or a market trend.

4. Take a step back and analyze the situation.

5. Be patient. Don’t trade impulsively.

6. Make smart decisions. Don’t overreact to the news.

7. Use technical analysis to forecast future trends.

8. Stay disciplined. Don’t get carried away with trading.

9. Have a plan for every situation.

10. Be patient and stay focused on your goals.

charts patterns crypto: how to read chart patterns like a pro

Cryptocurrencies are a new asset class that can be volatile and complex. To make sense of these charts, it can be helpful to understand chart patterns.

A chart pattern is simply a recognizable trend that can be used to predict future price action. The most basic chart pattern is the head-and-shoulders pattern, which is characterized by two peaks in price and a valley between them. Other common chart patterns include the doji candle, which is a pattern of indecisive price action, and the triangle, which is a pattern of rising and falling prices.

To identify chart patterns, it can be helpful to study historical data and look for patterns that have been repeated over and over again. For example, if you see a pattern of rising prices followed by a fall, that might be a sign that the market is about to go down. If you see a pattern of falling prices followed by a rise, that might be a sign that the market is about to go up.

Once you’ve identified a chart pattern, it can be helpful to analyze the details of the pattern to determine whether it’s likely to continue. For example, if the pattern is a head-and-shoulders pattern, you might look for signs that the peak is going to be higher than the previous peak or that the valley is going to be deeper than the previous valley.

chart patterns crypto: an essential guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. As of February 2018, there were over 1,500 cryptocurrencies in circulation, with a total market value of over $270 billion.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. More than 100 million people are estimated to use cryptocurrencies worldwide.