Crypto Charts Technical Analysis

This article looks at the technical analysis of crypto charts. It discusses the different types of charts and how to interpret them. It also looks at some of the common indicators used in technical analysis.

How to Read Crypto Charts for Beginners

Cryptocurrencies are an interesting investment, but can be difficult to understand for beginners. This guide will show you how to read crypto charts for beginners so that you can get a better understanding of the market.

First, you need to understand what a cryptocurrency is. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges, which allow buyers and sellers to trade with each other without the need for a third party. The most popular cryptocurrency trading platforms are Bitfinex, Binance, and Coinbase.

Next, you need to understand how to read crypto charts. A crypto chart is a graphical representation of the price of a cryptocurrency over time. The color of the bars indicate the price trend (green for up, red for down), and the width of the bar indicates the volume of trades.

Cryptocurrency charts can be difficult to understand, so it is important to have a basic understanding of technical analysis before you start trading. Technical analysis is the study of price patterns and indicators to predict future trends. There are a number of different indicators that can be used to analyze crypto charts, but some of the most common include the Bollinger Bands, MACD, and RSI.

If you want to learn more about cryptocurrency trading, we recommend reading our beginner’s guide to cryptocurrency trading.

A Beginner's Guide to Technical Analysis of Cryptocurrency Charts

Technical analysis is the study of price patterns and indicators to predict future price movements. Technical analysis can be used to identify trends and reversals in the price of a cryptocurrency, and can help you make informed investment decisions.

When analyzing cryptocurrency charts, it's important to keep in mind the following concepts:

Volatility – Cryptocurrencies are highly volatile and their prices can fluctuate rapidly. This means that chart patterns may not hold up over time, and that sudden changes in price may occur without warning.

Volume – Cryptocurrencies are typically traded in large volumes, which affects chart patterns. High volume indicates that there is widespread interest in the cryptocurrency, while low volume indicates that the market is unstable or illiquid.

Trend – A trend is a long-term pattern that appears in the price of a cryptocurrency. When analyzing a chart, it's important to look for signs of a trend (for example, an upward or downward trend), and to determine how strong the trend is.

Here are some tips for using technical analysis to analyze cryptocurrency charts:

1. Look for identifying patterns.

When analyzing cryptocurrency charts, it's important to look for identifying patterns. For example, if you see a pattern of prices increasing or decreasing in an unpredictable manner, this may indicate that there is a trend present.

2. Identify support and resistance levels.

When analyzing cryptocurrency charts, it's important to identify support and resistance levels. These are zones where the price of a cryptocurrency has failed to break past in the past, and may signify potential obstacles for future price movements.

3. Use indicators to predict future price movements.

There are a number of popular indicators that can be used to predict future price movements. For example, the RSI (Relative Strength Index) is often used to identify oversold or overbought conditions in the market, while the MACD (Moving Average Convergence Divergence) is used to identify potential trend reversals.

Crypto Chart Technical Analysis for beginners

The crypto chart is a technical analysis tool that can help you understand the behavior of a particular cryptocurrency over time.

The most important thing to keep in mind when using the crypto chart is to always consult with a financial advisor before making any investment decisions.

Here are some tips to help you get started:

1. Look at the overall trend of the coin.

2. Check the price action to see if there are any major spikes or dips.

3. Study the technical indicators to get an idea of where the coin is likely headed.

4. Compare the coin to other cryptocurrencies to get an idea of its relative value.

An Introduction to Technical Analysis of Cryptocurrency Charts

Technical analysis is the study of price patterns and indicators to predict future movement in securities markets. Technical analysts use a variety of tools, including charting, to identify potential buying and selling opportunities.

Cryptocurrency charts are unique because they display a constantly updating graph of price and volume. Cryptocurrency prices are always moving up or down, and so technical analysis can be very useful in predicting future movements.

There are a few key things to look for when analyzing cryptocurrency charts:

1. MACD and EMA

The MACD is a technical indicator that shows how much the cryptocurrency is moving up or down. The EMA indicates the trend direction and is usually in the same place as the MACD.

2. Volume

Volume is an important indicator because it shows how active the market is. When there is a lot of activity, it's usually a good sign that there are buying and selling opportunities available.

3. RSI

The RSI is a technical indicator that shows how overvalued or undervalued the market is. When the RSI is high, it means that the market is overvalued and there's a risk of a bubble. When the RSI is low, it means that the market is undervalued and there's a potential for a crash.

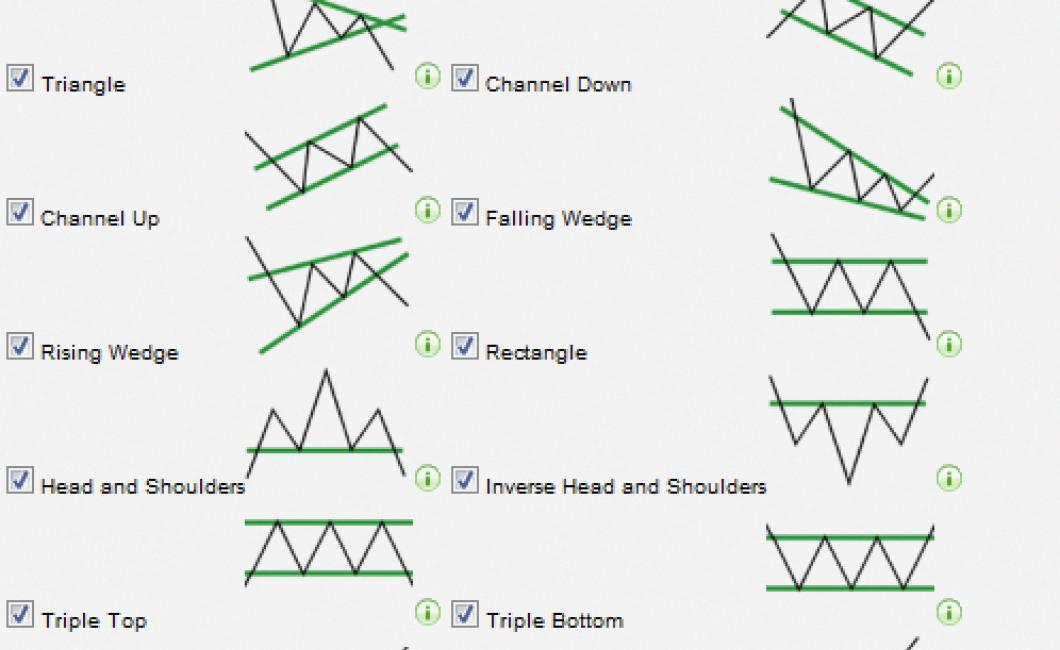

4. Chart patterns

Chart patterns are specific signals that show whether the market is about to go up or down. Some common chart patterns include head-and-shoulders (H&S), triangles, and channels.

Once you've identified some key indicators, it's important to use your own judgment when trading cryptocurrency. Always do your own research before making any decisions.

How to do Technical Analysis of Crypto Charts

Technical analysis is the practice of analyzing financial charts in order to identify trends and patterns. Technical analysis can help you make informed investment decisions by helping you identify overvalued and undervalued assets.

To do technical analysis of crypto charts, you'll first need to identify the indicators you want to use. Some common indicators include:

The Relative Strength Index (RSI)

The MACD

The VIX

When analyzing these indicators, it's important to keep in mind that they are only indicators and not guarantees of future success. Instead, they should be used as tools to help you make informed investment decisions.

Once you have identified the indicators you want to use, you'll then need to study the charts. In order to do this, you'll need to understand how to read charts and understand the various technical indicators. Once you have a basic understanding of how to read charts, you'll then be able to identify trends and patterns.

Overall, technical analysis is a helpful tool for making informed investment decisions. By using the right indicators and studying the charts, you can help identify overvalued and undervalued assets.

The Basics of Technical Analysis for Cryptocurrency Charts

Technical analysis is the study of price patterns and indicators to predict future movements. Technical analysis can be used on any asset, but is especially useful for cryptocurrencies because they are largely unregulated and there is a high degree of speculation.

There are a number of technical analysis indicators that can be used to predict the future movement of a cryptocurrency. Some of the most common include the price chart, moving averages, and Fibonacci retracements.

A price chart is a visual representation of the price of a cryptocurrency over time. It shows the highs and lows of the price over a period of time and can be used to identify trends.

Moving averages are a type of technical analysis indicator that indicate the average price over a given period of time. They are used to identify trends and can help determine when the price is over or undervalued.

Fibonacci retracements are a type of technical analysis indicator that can be used to identify possible trends in a cryptocurrency's price. They are based on the Fibonacci sequence, which is a mathematical sequence that describes the growth of numbers. When using Fibonacci retracements, traders can identify areas where the price has recently trended and attempt to predict future movements.

A Guide to Interpreting Cryptocurrency Charts

Cryptocurrency charts are a great way to get an overview of a digital currency’s performance. Just like stock charts, cryptocurrency charts can help you spot trends and make informed investment decisions.

To get the most out of cryptocurrency charts, it’s important to first understand how they work. Cryptocurrency charts are made up of two types of data: price and volume.

Price is the amount of a cryptocurrency that has been exchanged hands over a given period of time. Volume is the total amount of currency that has been exchanged over a given period of time.

When looking at cryptocurrency charts, it’s important to keep these two data points in mind. Volume is always greater than price, and it’s important to watch for sudden spikes or dips in volume. This is often a sign that there’s a lot of buying or selling going on, and that can lead to big changes in price.

Another thing to watch for on cryptocurrency charts is trendlines. A trendline is a line that shows how a cryptocurrency’s price has fluctuated over time. If the price is moving up or down along a trendline, that means there’s been consistent demand for the coin and that it’s likely to continue moving in that direction.

Finally, it’s important to remember that cryptocurrency charts are always open to interpretation. They aren’t meant to provide precise information about a digital currency’s performance. Instead, they’re meant to provide a general overview of the market conditions.

How to Use Technical Analysis to Trade Cryptocurrencies

Technical analysis is a form of analysis used to understand the behavior of a financial asset, such as a stock or cryptocurrency, over time. It involves examining past prices and movements to try to identify patterns that can help you make informed decisions about whether to buy or sell a security.

1. Use a cryptocurrency tracker to keep tabs on prices and movements.

There are a number of cryptocurrency trackers available online, which will allow you to keep track of the prices of different cryptocurrencies and monitor their overall movements. This can help you stay informed about potential opportunities to buy or sell cryptocurrencies, based on changes in price and market sentiment.

2. Use technical indicators to gauge the health of a cryptocurrency market.

Some popular technical indicators used to gauge the health of a cryptocurrency market include the MACD indicator (moving average convergence divergence/divergence), RSI (relative strength index), and the OBV (overbought/oversold) indicator. By using these indicators, you can identify whether a cryptocurrency market is in a healthy or weak state, and make informed decisions about whether to buy or sell.

3. Use charting software to visualize prices and trends.

Charting software can help you visualize the price movements of a cryptocurrency over time, and identify any trends that may be affecting the market. This can help you make informed decisions about whether to buy or sell, based on the current state of the market.

What Is Technical Analysis and How Can It Help You Trade Bitcoin & Ethereum?

Technical analysis is the use of charts and other technical indicators to help predict future price movements. Technical analysts believe that by understanding how a specific currency or asset is behaving technically, they can better predict where it is likely to go in the future. This information can then be used to make informed trading decisions.

Technical analysis can be used to predict the future course of a cryptocurrency or asset by looking at its historical price movements and chart patterns. By doing this, you can get a better understanding of how and why the currency or asset is behaving the way it is. This information can then be used to make more informed trading decisions.

Technical analysis is not infallible - it is only as good as the data that is used to support it. However, by using sound technical analysis techniques, you can get a good understanding of how a currency or asset is likely to behave in the future. This information can then be used to make informed trading decisions.