Crypto Charts With Rsi

This article discusses various crypto charts with RSI indicators. It explains what RSI is and how it can be used to make better informed decisions when trading cryptocurrencies. The article includes several charts with RSI indicators to illustrate how they can be used.

How to Use Crypto Charts with RSI

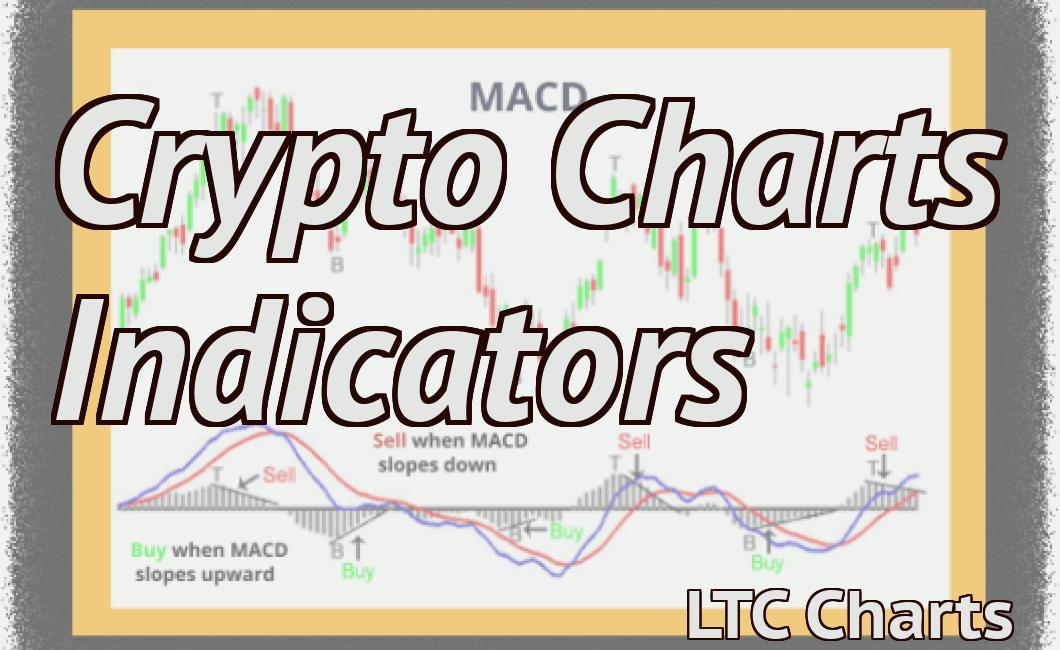

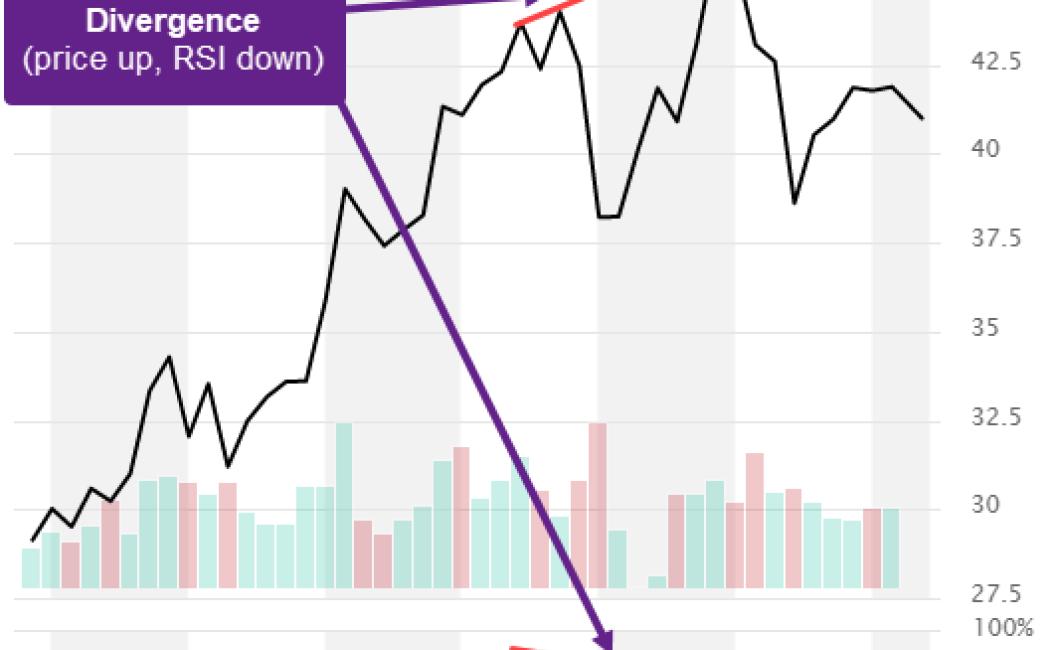

RSI (Relative Strength Index) is a technical indicator that measures the performance of a security. It is composed of two moving averages, the 50-day and the 200-day. The RSI oscillates between 0 and 100. When the RSI is above the 50-day moving average, it is considered bullish, and when it is below the 200-day moving average, it is considered bearish.

To use RSI with crypto charts, first find the 50-day and 200-day moving averages on the chart. Next, compare the RSI value to these moving averages. If the RSI is above the 50-day moving average, it is considered bullish, and if the RSI is below the 200-day moving average, it is considered bearish.

The Benefits of Using Crypto Charts with RSI

Crypto charts are a great way to help you understand the trends in the cryptocurrency market. They can help you spot potential buying and selling opportunities, and can also help you track the overall trend of the market.

There are a number of benefits to using crypto charts with RSI.

First, crypto charts can help you identify whether the market is in a bull or bear trend. This is important because it can help you decide when it is appropriate to buy or sell cryptocurrencies.

Second, crypto charts can help you determine whether the market is overvalued or undervalued. This is important because it can help you decide when it is appropriate to sell your cryptocurrencies.

Third, crypto charts can help you identify whether the market is in a consolidation phase. This is important because it can help you decide when it is appropriate to buy more cryptocurrencies.

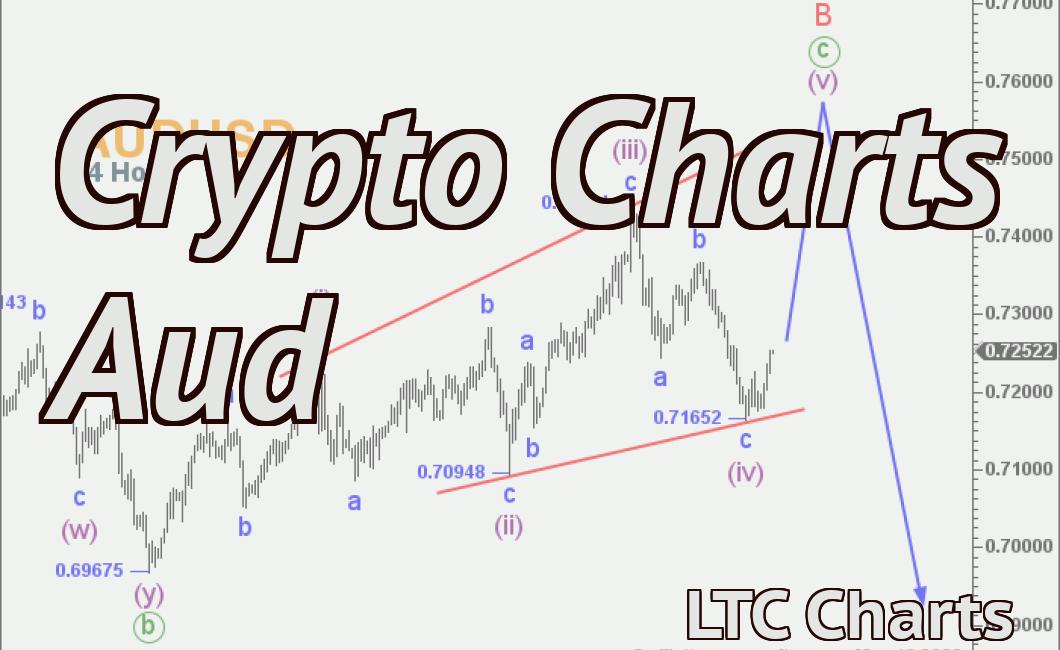

Fourth, crypto charts can help you identify what factors are driving the market. This is important because it can help you determine which cryptocurrencies to invest in.

The Best Crypto Charts with RSI

The Relative Strength Index (RSI) is a technical indicator used to measure the performance of a stock, index, or commodity. The RSI oscillates between 0 and 100. A reading above the 50 mark indicates that the asset is overbought and could fall, while a reading below the 50 mark suggests that the asset is oversold and could rise.

The Most Popular Crypto Charts with RSI

The most popular crypto charts with RSI are the Bitfinex Bitcoin Price Index, the Binance Coin Price Index, and the Ethereum Price Index.

The Top Crypto Charts with RSI

Here are the top crypto charts with RSI indicators.

1. Ethereum Classic (ETC)

2. Ripple (XRP)

3. Bitcoin Cash (BCH)

4. Tron (TRX)

5. EOS (EOS)

Why Use Crypto Charts with RSI

RSI is a technical analysis indicator used to measure the overbought and oversold conditions of a security. It can also be used to identify opportunities for short-term stock market investment.

Cryptocurrencies are highly volatile and can rise and fall in price rapidly. This makes it difficult to predict their future movement. This is where RSI comes in.

RSI is a technical analysis indicator that helps investors identify overbought and oversold conditions in the market. When the RSI is below the 30-level, this is considered an oversold condition. On the other hand, when the RSI is above the 70-level, this is considered an overbought condition.

When the RSI is in an oversold condition, this suggests that the market is too bullish and is likely to fall. In contrast, when the RSI is in an overbought condition, this suggests that the market is too bearish and is likely to fall.

Therefore, when the RSI is in an oversold condition, it is a good time to sell stocks. Conversely, when the RSI is in an overbought condition, it is a good time to buy stocks.