How to read crypto charts: red is sell.

If you're new to the world of cryptocurrency, you may be wondering how to read crypto charts. Here's a quick guide: red is sell. When you're looking at a crypto chart, the price is typically represented by a line. If that line is moving up, it means the price is rising; if it's moving down, the price is falling. And if the line is red, that means it's time to sell. Of course, there's a lot more to reading crypto charts than just that, but this is a good starting point. For more detailed information, check out our other articles on the subject.

How to read crypto charts: the basics

Cryptocurrencies are created as a way to make payments without the need for a central authority. Transactions are verified by a network of computers, and once verified, the cryptocurrency is added to the blockchain. Cryptocurrency prices are based on supply and demand, and can be volatile.

To read crypto charts, you first need to understand what they're representing. Crypto charts typically show the price of a cryptocurrency over time, and can show things like price changes, volume, and market capitalization.

To interpret the data on a crypto chart, you need to know what each column represents. The first column is the date, and the second column is the price of the cryptocurrency. The next two columns are the volume and market capitalization of the cryptocurrency. The last column is the percentage change from the previous date.

For example, on the below crypto chart, the price of Bitcoin is shown over time (in green), the volume (in blue), and the market capitalization (in yellow). The percentage change from the previous date is also shown (in purple), which shows that Bitcoin has increased in value by 62% since the beginning of the month.

How to read crypto charts like a pro

Cryptocurrency charts are a great way to track the progress of a cryptocurrency. Here are a few tips to help you read crypto charts like a pro:

1. Look for trends

The first step in reading crypto charts is identifying trends. Look for patterns in the data and try to decipher what is happening. For example, if a cryptocurrency is falling in price, it is likely that there is a trend present. If the price is consistently dropping, it may be time to sell.

2. Look at the overall market trend

Next, take a look at the overall market trend. Are all cryptocurrencies declining or rising in value? This will help you determine whether or not you should invest in a particular cryptocurrency.

3. Compare prices to determine value

Finally, compare prices to determine the value of a cryptocurrency. Use a calculator to figure out how much money you could make if you sold off your holdings.

How to read crypto charts for beginners

Cryptocurrencies are a digital asset class that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on digital exchanges and can also be used to purchase goods and services. The price of a cryptocurrency is determined by supply and demand on the exchanges.

To read crypto charts for beginners, start by understanding what a cryptocurrency chart is. A cryptocurrency chart is a visual representation of the price of a cryptocurrency over time. You can see the value of a cryptocurrency over time, as well as the volume of transactions.

To read crypto charts for beginners, you need to understand the following concepts:

Cryptocurrency: A digital asset class that uses cryptography to secure their transactions and to control the creation of new units.

A digital asset class that uses cryptography to secure their transactions and to control the creation of new units. Exchange: A place where you can buy and sell cryptocurrencies.

A place where you can buy and sell cryptocurrencies. Price: The value of a cryptocurrency at a given moment.

The value of a cryptocurrency at a given moment. Volume: The number of transactions that have taken place on an exchange in a given period of time.

How to read crypto charts: a step-by-step guide

Cryptocurrencies are a type of digital asset. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services.

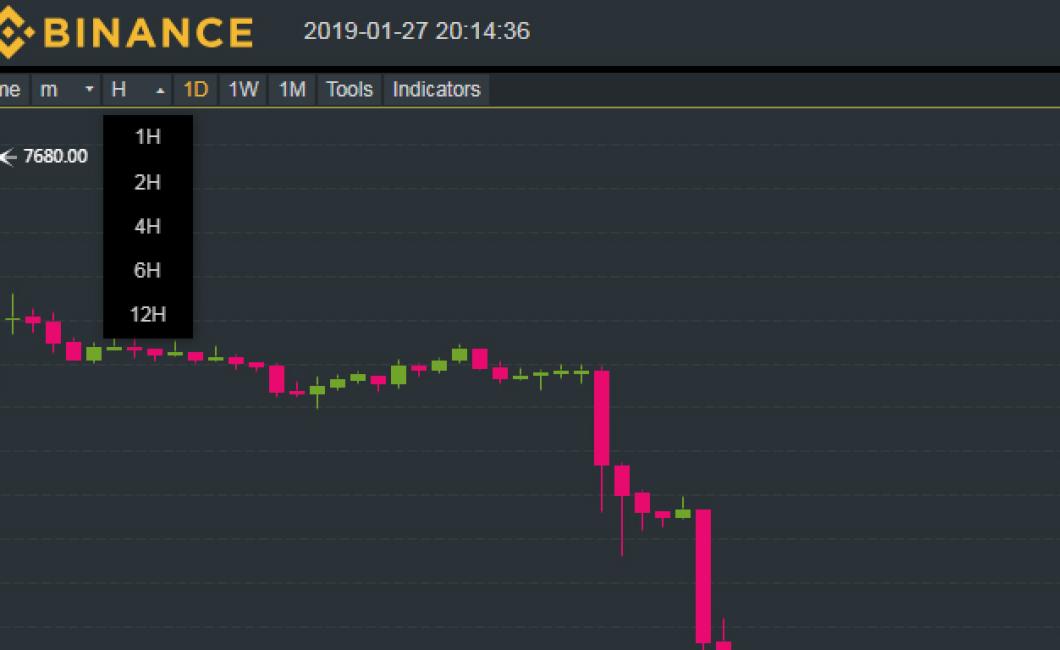

To read crypto charts, you first need to understand what a cryptocurrency chart is. A cryptocurrency chart is a visual representation of the price of a cryptocurrency over time. The most popular types of cryptocurrency charts are candlestick charts and line charts.

Candlestick charts are used to display the price of a cryptocurrency over time. Candlestick charts use a simple format: each candle represents a point in time. The size of the candle corresponds to the price of the cryptocurrency at that point in time.

Line charts are used to display the price of a cryptocurrency over time. Line charts use a simple format: each line represents a day’s worth of data. The color of the line corresponds to the value of the cryptocurrency at that point in time.

How to read crypto charts: what you need to know

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, first created in 2009, is the most well-known cryptocurrency.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrencies are often volatile, which means their prices can change quickly. This makes it difficult to invest in them without also understanding how they work.

To make sense of cryptocurrencies’ charts, you need to understand three concepts: the trend, the support/resistance levels, and the Fibonacci retracements.

1. The trend

Cryptocurrencies are often traded on decentralized exchanges, which means that prices are determined by a collective group of buyers and sellers.

Cryptocurrencies are often traded in markets with high volume, which makes it difficult to determine when a market has shifted. To determine a cryptocurrency’s trend, you need to look at the cumulative volume (the total amount of buying and selling) over a given period of time.

2. The support/resistance levels

Cryptocurrencies are often traded on decentralized exchanges, which means that prices are determined by a collective group of buyers and sellers.

Cryptocurrencies are often traded in markets with high volume, which makes it difficult to determine when a market has shifted. To determine a cryptocurrency’s support/resistance levels, you need to look at the price at which a cryptocurrency has been trading for a given period of time and see if it has hit a particular level of support or resistance.

3. The Fibonacci retracements

Cryptocurrencies are often traded on decentralized exchanges, which means that prices are determined by a collective group of buyers and sellers.

Cryptocurrencies are often traded in markets with high volume, which makes it difficult to determine when a market has shifted. To determine a cryptocurrency’s Fibonacci retracements, you need to look at the price at which a cryptocurrency has been trading for a given period of time and see if it has followed a particular pattern.

How to read crypto charts: an essential guide

Cryptocurrency charts are essential for understanding the dynamics of the market. There are different types of crypto charts, and each offers a different way of looking at the data.

Before you can understand how to read crypto charts effectively, you need to know what they are. A crypto chart is a graphical representation of the price movements of a cryptocurrency over time. It can be used to track the performance of a particular cryptocurrency, to predict future price movements, and to identify patterns in price movement.

There are different types of crypto charts, each with its own set of benefits and drawbacks. The most common types of crypto charts are candlestick charts, line charts, and bar charts.

Candlestick charts are the most popular type of crypto chart and are used to track the performance of a cryptocurrency over time. Candlestick charts display the price movements in the form of candlesticks. Each candlestick is composed of two parts: the body and the shadows. The body represents the value of the cryptocurrency at the time the candlestick was created, while the shadows represent the volume of trade that took place at that moment.

Line charts are another common type of crypto chart and are used to display the trend of a cryptocurrency over time. Line charts show the price movement as a series of lines that connect the different points in time. The height of each line indicates the value of the cryptocurrency at that point in time.

Bar charts are used to display the volume of trade in a cryptocurrency over time. Bar charts display the volume of a cryptocurrency as a series of bars. The height of each bar indicates the volume of trade that took place at that moment.

How to read crypto charts: the ultimate guide

Cryptocurrency charts are becoming increasingly popular with traders and investors. For those new to crypto trading, or unfamiliar with how to read charts, this guide will provide the basics.

When trading cryptocurrencies, it is important to understand how to read crypto charts. A crypto chart is a visual representation of the price movement of a cryptocurrency over time.

Cryptocurrencies are often traded on decentralized exchanges (DEX), which means that there is no central authority or broker who can manipulate the prices. This makes it difficult to predict prices, which is why crypto charts are useful.

Cryptocurrencies are often traded on decentralized exchanges (DEX), which means that there is no central authority or broker who can manipulate the prices. This makes it difficult to predict prices, which is why crypto charts are useful.

Cryptocurrency charts show the price movement of a cryptocurrency over time on a scale of hours, days, weeks, or months. The size of the chart will indicate the magnitude of the movement. The color of the line will indicate the direction of the movement.

For example, if the line on a crypto chart is green, this means that the price of the cryptocurrency has been increasing over time. If the line is blue, this means that the price of the cryptocurrency has been decreasing over time.

It is important to keep in mind that crypto charts are not always accurate. They are a visual representation of what is happening in the market, and are not necessarily indicative of future events.

Cryptocurrencies are volatile, and prices can change rapidly. Therefore, it is important to use caution when trading cryptocurrencies. Always consult a financial advisor before making any investment decisions.

How to read crypto charts: a beginner's guide

Cryptocurrencies are becoming increasingly popular, with many people interested in investing in them. To make the most of your investment, it's important to understand how to read crypto charts.

Cryptocurrencies are traded on decentralized exchanges, which means that there is no central authority that regulates or censors the market. This makes it difficult to predict the prices of cryptocurrencies, as there is no underlying asset or currency that can be analyzed.

Cryptocurrencies are often traded on decentralized exchanges, which makes it difficult to predict the prices.

To make sense of crypto charts, you first need to understand what a cryptocurrency is. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges, which makes it difficult to predict the prices.

To make sense of crypto charts, you first need to understand what a cryptocurrency is. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges, which makes it difficult to predict the prices.

To make sense of crypto charts, you first need to understand what a cryptocurrency is. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

How to read crypto charts: a quick and easy guide

There is no one definitive way to read crypto charts, as the strategies and techniques that work for one person may not work for another. However, here are some tips that may help you get started:

1. Look at the trend.

The first step is always to look at the trend of the market. This will help you determine whether or not the price is going up or down, and how long this trend may last.

2. Check the volume.

Next, you should check the volume of the market. This will give you an idea of how liquid the market is and whether or not there is a lot of buying or selling happening.

3. Look for support and resistance levels.

Finally, you should look for support and resistance levels. These are markers that indicate where the market is likely to stop moving in either direction and may provide a better entry point for a trade.

How to read crypto charts in under 5 minutes

Cryptocurrency charts are a great way to get an overview of the market, but can be difficult to understand. Here are five tips to help you read crypto charts quickly and easily:

1. Look for trends.

One of the most important things to look for on a crypto chart is whether there are any trends. This can be done by looking at the price over time, looking at how many coins are in circulation, or checking how many transactions have been made.

2. Check the technical indicators.

Technical indicators can also be helpful in gauging the health of the market. Some of the most common technical indicators include the RSI ( Relative Strength Index ), MACD (Moving Average Convergence Divergence ), and SMA (Simple Moving Average ).

3. Use volume to your advantage.

Volume can be an indicator of investor interest in a particular coin or market. When there is high volume, it is often an indication that there is a lot of buying and selling taking place. This can help you identify good prices to buy or sell at.

4. Watch for price changes.

When you are looking at a crypto chart, it is important to pay attention to the price changes. This can help you identify when a coin is about to go up or down, and allows you to get in early before the price goes higher or lower.

5. Don't be afraid to ask for help.

If you find yourself struggling to understand a crypto chart, don't hesitate to ask for help from your friends or online communities. There are plenty of people who are willing to help out, and they will likely be more than happy to share their expertise.

How to read crypto charts: a simple and easy guide

First, you will need to install a crypto trading platform. There are a number of popular platforms available, including Kraken, Binance and Bitfinex. Once you have installed the platform, you will need to create an account. Next, you will need to find a cryptocurrency you want to trade. You can search for a cryptocurrency by its name, ticker symbol or market capitalization. Once you have found a cryptocurrency, you will need to open a position. To open a position, you will need to find the buy and sell prices for the cryptocurrency. You can find the buy and sell prices by clicking on the “buy” and “sell” buttons on the trading platform. Finally, you will need to place your order. To place your order, you will need to enter the buy and sell prices, as well as the amount of cryptocurrency you want to buy or sell.

How to read crypto charts: a quick guide

Cryptocurrencies are a new and volatile investment, and can be risky. Before investing in any digital asset, please consult a financial advisor.

Cryptocurrencies are traded on decentralized exchanges, which makes them difficult to track. Some popular methods of tracking cryptocurrencies include CoinMarketCap and Livecoin.

Cryptocurrencies are often traded as pairs, which means one unit of a cryptocurrency is usually linked to another unit of the same or a different cryptocurrency. For example, Bitcoin is often traded with Ethereum.

To read crypto charts, you'll need to understand some technical terms. These include:

Volatility: The volatility of a cryptocurrency is the degree to which its price changes over time.

The volatility of a cryptocurrency is the degree to which its price changes over time. Circulation: The circulation of a cryptocurrency is the number of coins that have been created and are available for use.

The circulation of a cryptocurrency is the number of coins that have been created and are available for use. Price: The price of a cryptocurrency is the amount of money that you would receive if you sold it today.

The price of a cryptocurrency is the amount of money that you would receive if you sold it today. Market cap: The market cap of a cryptocurrency is the total value of all the coins in circulation.