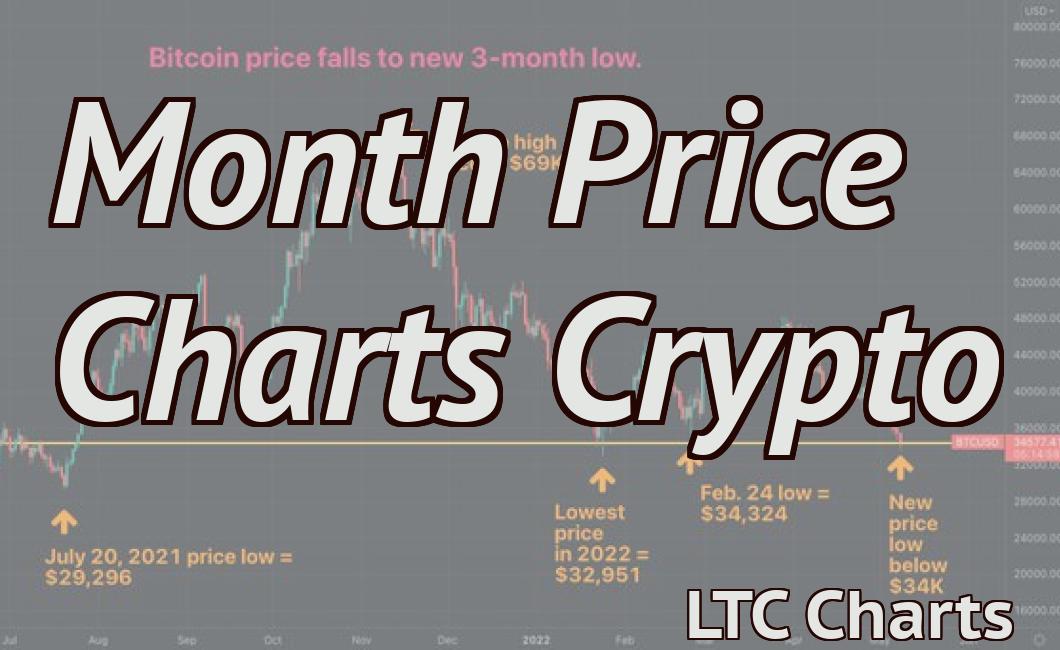

How to read the crypto charts.

This article will teach you how to read the crypto charts so that you can make informed decisions when trading cryptocurrencies. You will learn about the different types of charts and their usefulness in predicting price movements. You will also learn how to identify key support and resistance levels.

How to Read the Crypto Charts

Cryptocurrencies are often traded on digital exchanges and can be volatile. The prices of cryptocurrencies can change rapidly and unexpectedly.

To make it easier to follow the prices of cryptocurrencies, some websites display them as charts. Cryptocurrencies are often traded on digital exchanges and can be volatile. The prices of cryptocurrencies can change rapidly and unexpectedly.

To make it easier to follow the prices of cryptocurrencies, some websites display them as charts. Cryptocurrencies are often traded on digital exchanges and can be volatile. The prices of cryptocurrencies can change rapidly and unexpectedly.

To make it easier to follow the prices of cryptocurrencies, some websites display them as charts.

A Beginner's Guide to Reading Crypto Charts

Cryptocurrencies are a new and exciting asset class that is growing in popularity. As with any new investment, there are a few things that you need to do in order to make sure that you are getting the most out of your investment.

One of the most important things that you need to do is to understand how to read crypto charts. By understanding how to read crypto charts, you will be able to better understand how the various cryptocurrencies are performing and which ones are worth investing in.

Below we will outline some of the most important things to look for when reading crypto charts. We will also provide some tips on how to use crypto charts to make better investment decisions.

Cryptocurrency Charts: What to Look For

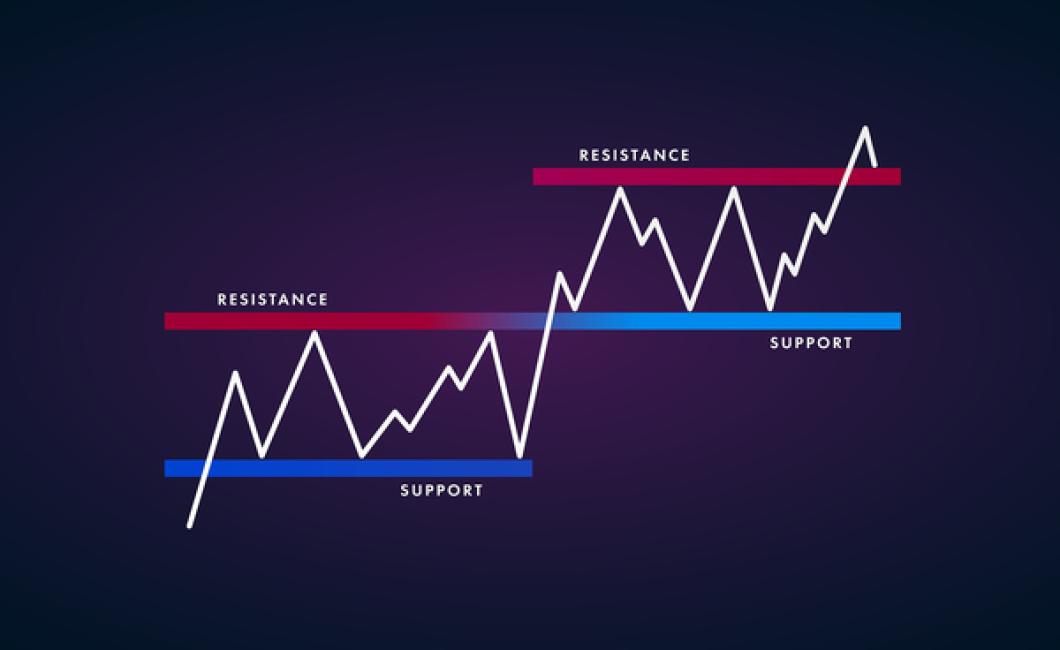

When looking at crypto charts, the first thing that you will want to look for is the overall trend. This includes looking at the overall trend lines, candlesticks, and other patterns.

Another important thing to look for on crypto charts is the volatility. This includes looking at the percentage changes, daily changes, and other measures of volatility.

Finally, you will want to look at the news events that may have impacted the value of the cryptocurrencies. This includes things like regulatory changes, major announcements from the companies that produce the cryptocurrencies, and other events.

Cryptocurrency Charts: Tips on How to Use Them

When using crypto charts, it is important to remember that they are not always accurate. Instead, they are designed to help you make better investment decisions.

One way that you can use crypto charts to make better investment decisions is by looking at the long-term trends. This includes looking at the overall trend lines, candlesticks, and other patterns.

Another way that you can use crypto charts is by looking at the volatility. This includes looking at the percentage changes, daily changes, and other measures of volatility.

Finally, you can use crypto charts to monitor news events that may have impacted the value of the cryptocurrencies. This includes things like regulatory changes, major announcements from the companies that produce the cryptocurrencies, and other events.

The Basics of Reading Crypto Charts

Crypto charts are graphical representations of cryptocurrency prices. They can be used to identify trends, assess market sentiment, and make informed investment decisions.

Charting tools allow you to view the current price of a cryptocurrency, as well as its historical price movements. Crypto charts can be used to compare the performance of different cryptocurrencies, and to forecast future prices.

Cryptocurrency prices are often highly volatile, and can change rapidly. It is important to be aware of potential risks when trading cryptocurrencies, and to maintain a healthy degree of skepticism.

How to Read a Crypto Chart

To read a crypto chart, first identify the currency you are interested in. You can find this information on the left-hand side of the chart, next to the price bar.

Next, identify the type of chart you are viewing. There are three main types of crypto charts: line, histogram, and candlestick.

Line charts show the current price of a crypto asset, as well as its historical price movements. Histogram charts display the distribution of prices over time, and can be useful for detecting trends. Candlestick charts show the changes in price over a given period of time, typically in candlesticks (one candlestick for each hour).

Finally, identify the indicators you are interested in. These indicators can include the Bollinger Band, MACD, and RSI.

Bollinger Band is a volatility indicator that shows the width of the Bollinger Band. MACD is a momentum indicator that shows the difference between two moving averages. RSI is a Relative Strength Index that measures the magnitude of candle moves.

Reading Crypto Charts

When reading a crypto chart, it is important to understand the various indicators that are displayed.

Bollinger Band

The Bollinger Band is a volatility indicator that shows the width of the Bollinger Band. The Bollinger Band is typically set at two standard deviations from the price. When the Bollinger Band is wide, this indicates that prices are volatile, and may be prone to sudden swings.

MACD

The MACD is a momentum indicator that shows the difference between two moving averages. The MACD is typically set at two levels: the MACD Line (the blue line), and the MACD Signal (the red line). The MACD Line indicates the trend direction, while the MACD Signal indicates whether the trend is strong or weak.

RSI

The RSI is a Relative Strength Index that measures the magnitude of candle moves. When the RSI is high, this indicates that the market is bullish, and is likely to experience strong price movements in the near future. When the RSI is low, this indicates that the market is bearish, and is likely to experience weak price movements in the near future.

How to Interpret the Data on Crypto Charts

Cryptocurrencies are volatile and can be quite unpredictable. It is important to understand what the data on a particular cryptocurrency chart means before making any investment decisions.

Cryptocurrency prices are determined by supply and demand. The supply is the total number of coins that will ever be created, and the demand is the number of people who are willing to buy coins.

Cryptocurrencies are often traded on exchanges, and the price of a coin can change quickly based on the actions of other users. So, it's important to look at the entire cryptocurrency chart and not just the price.

Here are some tips for interpreting cryptocurrency charts:

1. Look at the overall trend.

The trend on a cryptocurrency chart shows whether the price is going up or down. If the trend is up, the price is likely going to continue going up. If the trend is down, the price is likely going to continue going down.

2. Check the price action.

The price action on a cryptocurrency chart tells you what is happening in the market at that moment. The most important thing to look for is whether the price is rising or falling. You can also look at the volume to see how active the market is.

3. Compare the prices of different cryptocurrencies.

When you are looking at cryptocurrency charts, it is important to compare the prices of different coins. This will help you to understand how the market is performing and which coins are doing well.

What do the Different Lines on a Crypto Chart Mean?

The different lines on a crypto chart show the price of a digital asset over a certain period of time. The lines can be broken down into three groups: the green line, the blue line, and the red line.

The green line is the price at which the asset was traded at the beginning of the period. The blue line is the price at which the asset was traded at the end of the period. The red line is the price at which the asset was traded at the peak of its price.

How to Use Crypto Charts to Make Better Trading Decisions

Crypto charts are a great way to make better trading decisions. Crypto charts show the price of a cryptocurrency over time, allowing you to see how the price has changed over time.

When trading cryptocurrencies, it is important to keep an eye on the price. This can be difficult to do if you are only looking at a single cryptocurrency's price. Crypto charts allow you to look at the prices of multiple cryptocurrencies at the same time. This allows you to see how the prices of different cryptocurrencies are related to each other.

Crypto charts can also help you make decisions about when to buy and sell cryptocurrencies. By looking at the price of a cryptocurrency over time, you can see how the price has changed. This can help you decide when to buy a cryptocurrency and when to sell it.

Crypto charts can also help you track your investment. By looking at the price of a cryptocurrency over time, you can see how much money you have made or lost. This can help you track your progress and make better investment decisions.

Tips for Reading and Analyzing Crypto Charts

Crypto charts are an important part of understanding the cryptocurrency market. When analyzing a crypto chart, it is important to pay attention to the following:

1. The price of the cryptocurrency over time

2. The volume of the cryptocurrency over time

3. The trend of the cryptocurrency over time

4. The technical indicators of the cryptocurrency over time

5. The overall sentiment of the cryptocurrency over time

How to Read Crypto Charts like a Pro

Crypto charts are an important part of any trader’s arsenal. By understanding how to read crypto charts, you can make informed investment decisions and become a well-informed trader.

When looking at crypto charts, it is important to understand the different types of indicators and how they are used. The following are the most common types of crypto charts and their corresponding indicators:

1. Candlestick Chart

The candlestick chart is a popular type of chart used to track price movements. It is made up of a series of candle shapes that indicate the price movement over a specific period of time.

The most common indicator used on candlestick charts is the candle body, which shows the open, high, low and close prices for a particular period. Other indicators that can be used on candlestick charts include the engulfing bar, the Bollinger Bands and the Relative Strength Index (RSI).

2. Line Chart

A line chart is a type of chart that plots the price of a security over time. The line chart can be used to identify trends and reversals in price.

The most common indicator used on line charts is the average price, which is calculated by adding up the prices for a particular period and dividing that number by the number of occurrences. Other indicators that can be used on line charts include the moving average and the stochastic oscillator.

3. Point Chart

A point chart is a type of chart that plots the price of a security at specific intervals. The point chart is useful for seeing short-term changes in price.

The most common indicator used on point charts is the price cap, which is the maximum price that a security has ever traded at. Other indicators that can be used on point charts include the moving average and the RSI.

4. Bar Chart

A bar chart is a type of chart that plots the volume of a security over time. The bar chart can be used to identify trends and reversals in volume.

The most common indicator used on bar charts is the volume indicator, which is calculated by taking the total number of shares traded and dividing that number by the total number of hours that have been recorded. Other indicators that can be used on bar charts include the moving average and the RSI.

Unlocking the Secrets of the Crypto Charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Today, there are over 1,500 different cryptocurrencies in circulation.

Cryptocurrencies are not backed by any physical assets and are instead based on a trust model. Their value is determined by how much people believe they will be worth in the future. Because there is no central authority that regulates cryptocurrencies, their price is highly volatile.

To understand how cryptocurrencies work, it is important to understand their underlying technology. Cryptocurrencies use blockchain, a distributed database that allows for secure, transparent and tamper-proof transactions. Transactions are verified by network nodes and then recorded in a public ledger. Cryptocurrencies are unique in that they use blockchain to create a digital asset that can be traded and used in transactions.

Cryptocurrencies are also unique in that they are digital tokens. This means that they are not tied to a specific physical asset or currency. Instead, they are digital representations of an asset or currency. This makes them unique in that they can be transferred between users without the need for a third party.

Cryptocurrencies are still relatively new and there is a lot of uncertainty surrounding them. Because of this, it is important to do your research before investing in them. If you are interested in learning more about cryptocurrencies, be sure to check out our cryptocurrency guide.