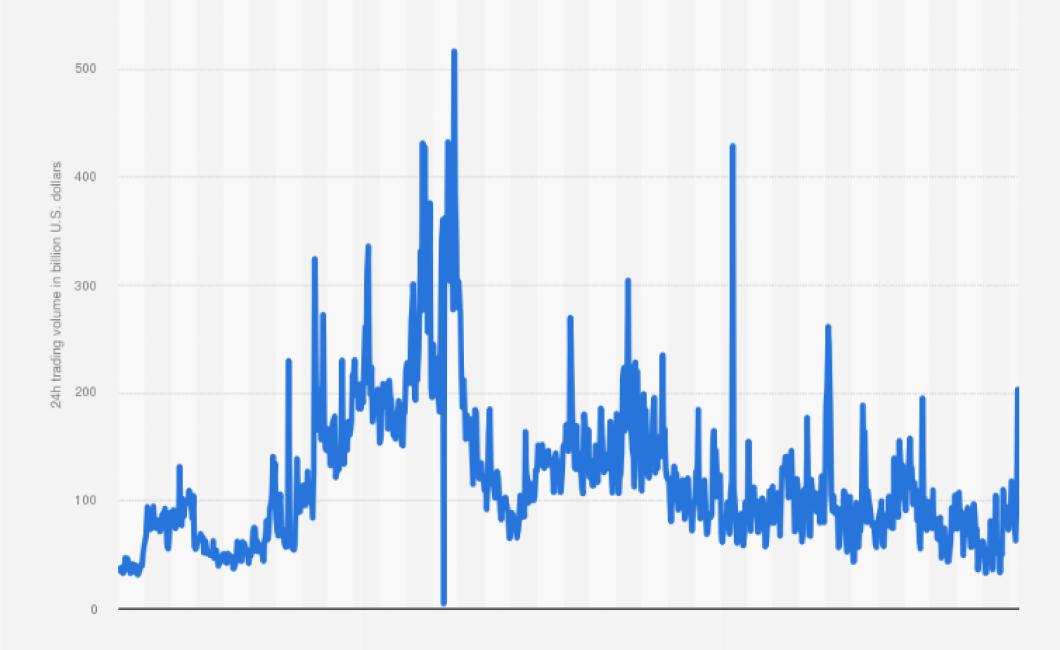

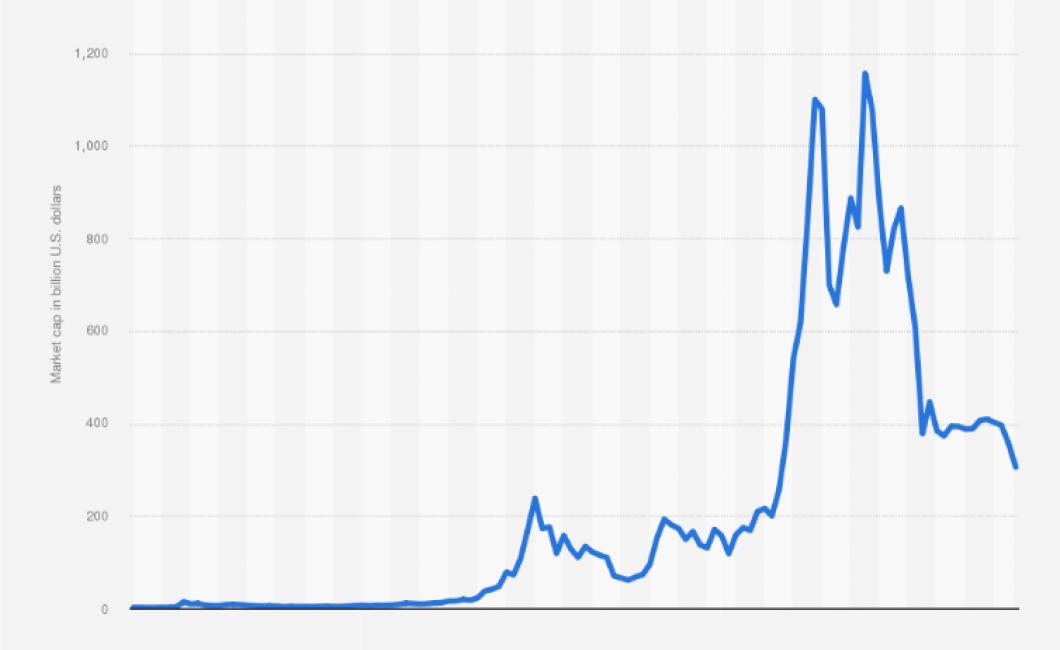

1 year cryptocurrency charts

The article provides charts detailing the performance of various cryptocurrencies over the course of one year.

Bitcoin vs Ethereum: The Battle for Supremacy in the Crypto Currency World

Bitcoin and Ethereum are two of the most popular cryptocurrencies in the world. While they both have their own strengths and weaknesses, they are currently vying for supremacy in the crypto currency world.

Bitcoin

Bitcoin is the first and most well-known cryptocurrency, and it is still the most popular. Bitcoin is based on a blockchain technology, which makes it highly secure and tamper-proof. Bitcoin also has the advantage of being easy to use, with a wide range of merchants now accepting it as a form of payment.

However, Bitcoin has two main drawbacks. Firstly, it is not very stable, with its value fluctuating a lot. Secondly, Bitcoin is not accessible to a large number of people, due to its high fees and long processing times.

Ethereum

Ethereum is based on a different blockchain technology than Bitcoin, and it offers a number of advantages over Bitcoin. Firstly, Ethereum is much more stable than Bitcoin. Secondly, Ethereum is much more accessible to a wider range of people. Thirdly, Ethereum has a much lower transaction fees than Bitcoin.

Ethereum also has some disadvantages. Firstly, Ethereum is not as easy to use as Bitcoin. Secondly, Ethereum is not as secure as Bitcoin.

Bitcoin's Rollercoaster Ride: The Good, the Bad and the Ugly of Crypto Currencies

Bitcoin's rollercoaster ride: The good, the bad and the ugly of crypto currencies

Could Litecoin Be Bitcoin's Savior? Why This Crypto Currency is on the Rise

Litecoin is the silver to Bitcoin's gold. While Bitcoin is the first and most well-known cryptocurrency, Litecoin has been growing in popularity thanks to its faster transaction times and lighter weight than Bitcoin.

Ripple: The Underdog of Crypto Currencies That Could Topple Bitcoin

Ripple has been on the rise in recent months and could soon take over as the world’s most popular cryptocurrency. Here’s why.

1. Ripple has a strong partnership network

Ripple has a strong partnership network, which means that it is able to reach out to a large number of banks and other institutions. This allows it to gain a greater foothold in the market and solidify its position as the leading cryptocurrency.

2. The Ripple network is scalable

The Ripple network is scalable, which means that it can handle a large number of transactions. This makes it a more versatile option than Bitcoin, which is limited in terms of how many transactions it can process per day.

3. Ripple is more affordable than Bitcoin

Ripple is more affordable than Bitcoin. This is because it doesn’t have a high price tag like Bitcoin does. This makes it more accessible for users, especially those who are not familiar with cryptocurrency investing.

4. Ripple has a greater liquidity than Bitcoin

Ripple has a greater liquidity than Bitcoin. This means that it is easier for users to buy and sell the currency. This makes it a more stable option than Bitcoin, which is known for its volatility.

Monero: The Dark Horse of Crypto Currencies You Should Know About

Bitcoin is the first and most well-known cryptocurrency, but there are others you should know about.

1. Monero: Monero is a cryptocurrency that is unlike any other. It is a stealth currency, meaning that it is not traceable through the blockchain. This makes it an attractive option for people who want to keep their transactions private.

2. Ethereum: Ethereum is a popular cryptocurrency that uses blockchain technology to facilitate transactions. It is also decentralized, meaning that there is no central authority that can control or manipulate the network.

3. Zcash: Zcash is a cryptocurrency that uses blockchain technology to conceal the identities of its users. This makes it an attractive option for people who want to keep their transactions secret.

4. Dash: Dash is a popular cryptocurrency that uses blockchain technology to facilitate transactions. It is also decentralized, meaning that there is no central authority that can control or manipulate the network.

What is an Initial Coin Offering (ICO)? Why These Crypto Fundraisers are Causing Controversy

An Initial Coin Offering (ICO) is a type of crowdfunding where a company sells tokens in exchange for Bitcoin or Ethereum. These tokens can then be used to purchase products or services from the company.

Some people view ICOs as a way for companies to raise money without having to go through traditional channels. Others see them as a way for scammers to take advantage of unsuspecting people.

The SEC has been relatively active when it comes to ICOs. In March of 2018, the SEC announced that it was investigating several ICOs for potential securities fraud.

Is Bitcoin a Bubble? Why Some Experts Think So and What That Means for Crypto Currencies

Bitcoin is a digital asset and a payment system invented by an unknown person or group of people under the name Satoshi Nakamoto. Bitcoin is unique in that there are a finite number of them: 21 million. They are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services.

Some experts think that Bitcoin may be a bubble, meaning that its price may ultimately fall. If this happens, it could have negative consequences for the cryptocurrency, including lost value of investments and decreased adoption. If you're concerned about the potential for a Bitcoin bubble, keep in mind that there's no guarantee it will happen, and even if it does, there's no guarantee that it will cause significant damage.

Can Ethereum's Smart Contracts Usher in a New Era of Decentralized Applications?

At present, smart contracts are used to execute transactions on the Ethereum blockchain. However, they are not limited to this function. As developers continue to build on Ethereum, they may find other uses for smart contracts that go beyond just transaction execution. This could herald in a new era of decentralized applications (dApps), which are applications that run on a network without a central authority.

One potential use for smart contracts that goes beyond transaction execution is as a platform for creating decentralized applications. For example, developers could create a dApp that allows users to buy and sell goods and services. The dApp would be built on the Ethereum blockchain, and it would use smart contracts to execute the transactions.

Another potential use for smart contracts is as a platform for executing peer-to-peer contracts. For example, two parties could use smart contracts to agree to a deal, and the contract would be executed automatically when the conditions are met. This could be used, for example, to automate the process of trading assets.

Overall, smart contracts are a powerful tool that can be used to create decentralized applications and peer-to-peer contracts. As developers continue to build on Ethereum, they may find even more uses for smart contracts.

How Do Crypto Currencies Work? A Beginner's Guide to Bitcoin, Ethereum and Beyond

Bitcoin, Ethereum and other cryptos are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

What is Blockchain Technology? Why It's Poised to Change the World of Business Forever

Blockchain technology is a distributed database that allows for secure, tamper-proof transactions. It was first developed as a way to track bitcoin transactions, but has since been used to create secure records of everything from property ownership to medical records.

The potential benefits of blockchain technology are vast. For businesses, it could streamline operations by removing the need for middlemen. For consumers, it could make transactions more secure and transparent. And for governments, it could help to reduce corruption and prevent money laundering.

There are still some significant hurdles to overcome before blockchain technology can truly revolutionize the world of business, but its potential is undeniable.

The Future of Money? Why Cryptocurrency May Be Here to Stay

Given the current state of money and its many inefficiencies, it’s no wonder that cryptocurrencies are heating up in popularity. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin offer a number of benefits that may make them the future of money. Here are five reasons why cryptocurrencies may be here to stay:

1. Cryptocurrencies are secure: Unlike traditional currencies that are subject to theft and fraud, cryptocurrencies are secure because they are not controlled by any one party. This means that they are not susceptible to government or financial institution manipulation.

2. Cryptocurrencies are transparent: Cryptocurrencies are transparent because all transactions are publicly recorded on a blockchain. This makes them immune to financial fraud and corruption.

3. Cryptocurrencies are divisible: Unlike traditional currencies, which are measured in units of weight or volume, cryptocurrencies are divisible down to the smallest unit. This makes them more practical for use in transactions.

4. Cryptocurrencies are efficient: Cryptocurrencies are efficient because they allow for rapid and easy transactions. This is superior to traditional payment systems, which can take hours or days to process a transaction.

5. Cryptocurrencies are global: Cryptocurrencies are global because they can be used in any country. This makes them more accessible and convenient for users.