Crypto Portfolio Charts

If you're serious about cryptocurrency, then you need to track your portfolio. Crypto Portfolio Charts is the best way to do that. It's a free and easy-to-use tool that lets you see how your portfolio is performing.

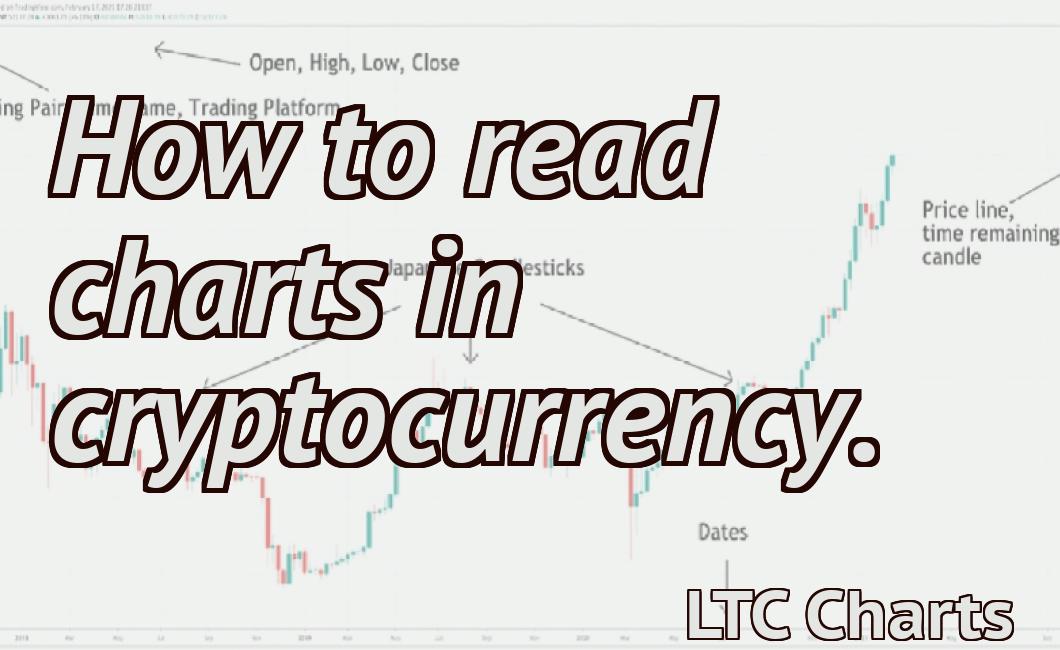

How to read crypto portfolio charts

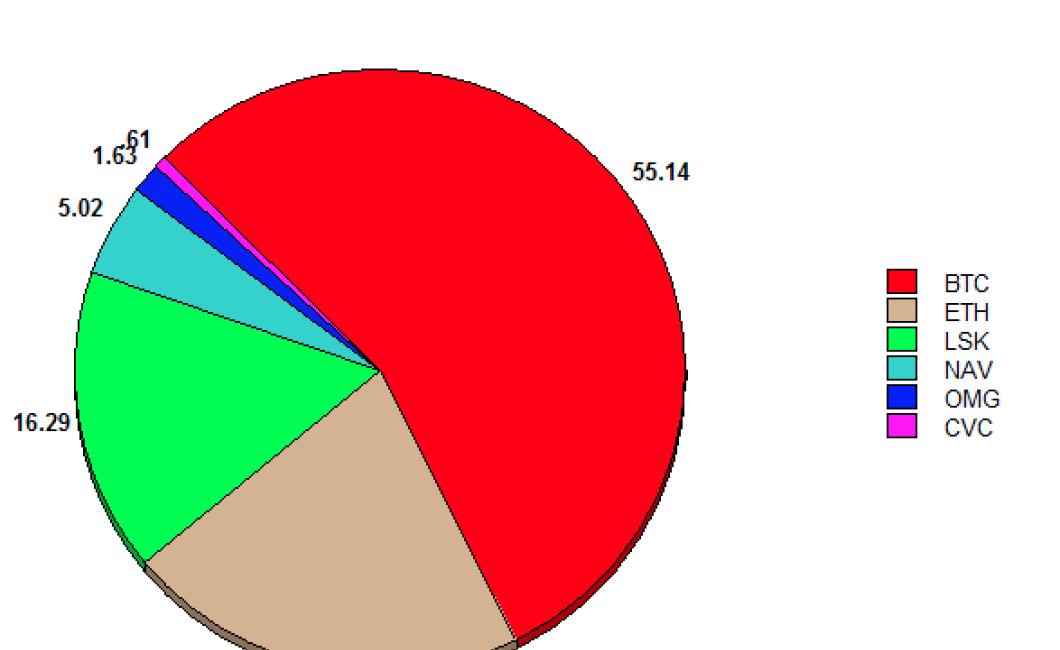

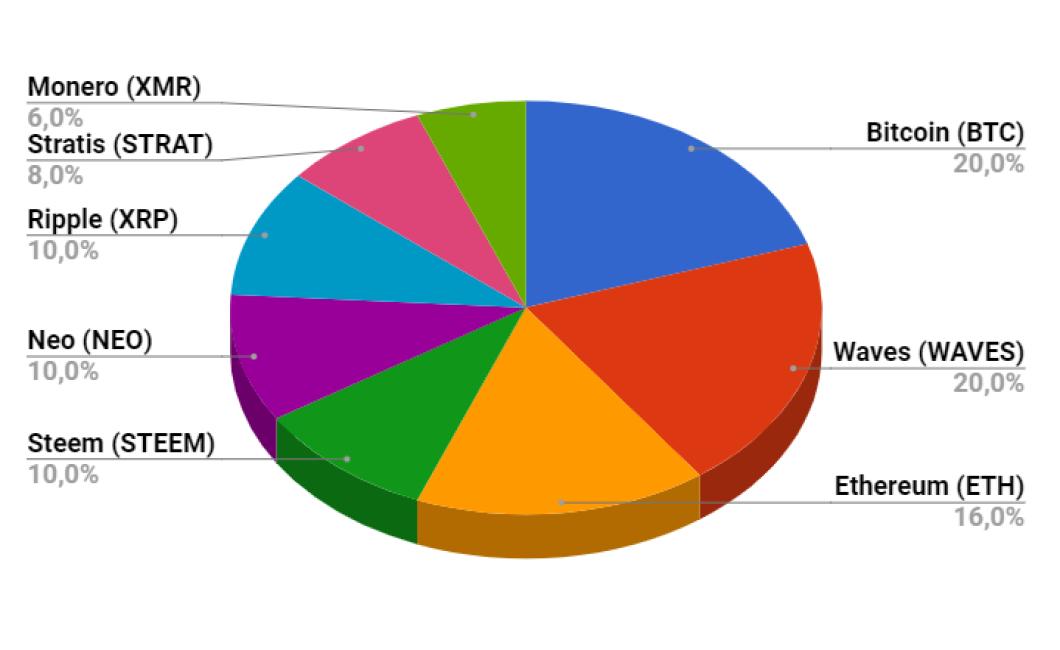

Crypto portfolio charts show the percentage of a cryptocurrency's value represented by each respective asset. This can be used to track the health of a portfolio, determine when to sell assets, and more.

To read a crypto portfolio chart, start by locating the asset you want to focus on. For example, if you are looking at the Bitcoin (BTC) chart, you would locate the BTC asset on the chart. Next, you would look at the X-axis to see how much of the total value of the asset is represented by Bitcoin. The Y-axis shows the percentage of the total value represented by Bitcoin.

For example, on the BTC chart, you would see that as of August 1, 2018, Bitcoin accounted for 44.9% of the total value of the asset. This means that if you had invested $10,000 in Bitcoin on August 1, 2018, you would have $5,400 remaining after investing in all other assets.

What do crypto portfolio charts mean?

A crypto portfolio chart is a graphical representation of a person's cryptocurrency holdings. It can show the value of a person's cryptocurrency holdings over time, and can be used to track the progress of a person's investment portfolio.

How to use crypto portfolio charts

Crypto portfolio charts are a great way to help you track your cryptocurrency investments.

To create a crypto portfolio chart, open a charting platform like CoinMarketCap and click on the "Cryptocurrencies" tab.

Then, click on the "Portfolio" tab and select the "All cryptocurrencies" portfolio.

Next, you will need to select the cryptocurrencies you want to include in your chart.

To do this, click on the "Select coins" button and select the cryptocurrency you want to include in your chart.

Once you've selected the cryptocurrencies you want to include, you will need to specify the date range for your chart.

To do this, click on the "Select date range" button and select the date range you want to include in your chart.

Finally, you will need to specify the indicators you want to use for your chart.

To do this, click on the "Select indicators" button and select the indicators you want to use for your chart.

Once you've specified the indicators you want to use, click on the "Create" button and your crypto portfolio chart will be created.

What information do crypto portfolio charts provide?

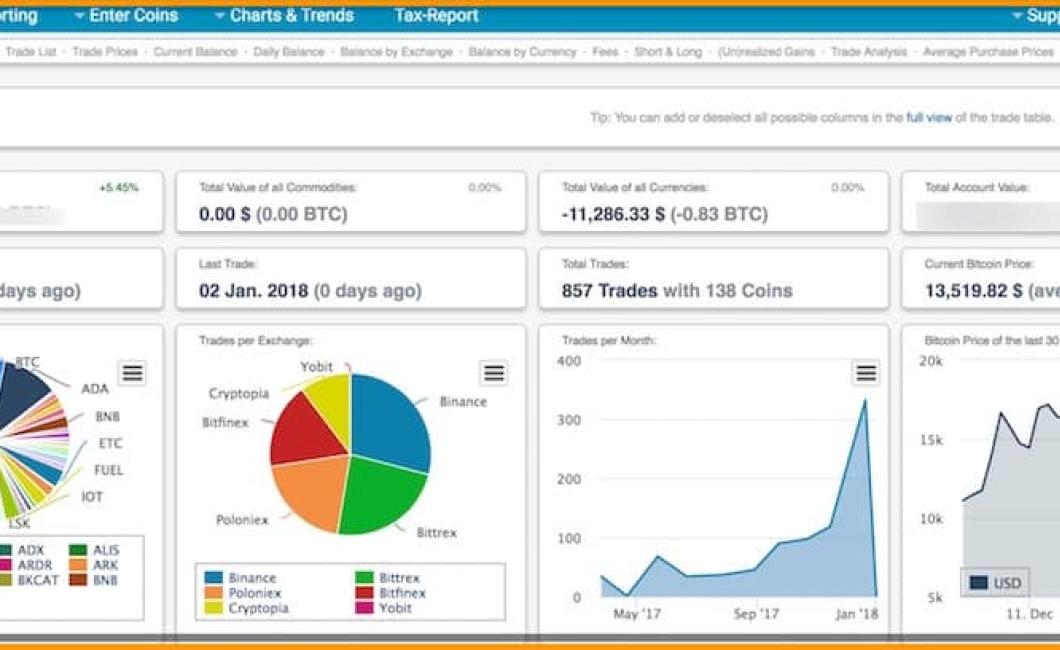

Crypto portfolio charts provide an overview of a portfolio's performance over time. They can show the value of a portfolio at different points in time, as well as the percentage of change from one point to another.

How can crypto portfolio charts help investors?

Crypto portfolio charts can help investors track their investments and make better decisions. By seeing how a crypto portfolio is performing over time, investors can identify which coins are doing well and which ones are struggling.

What are the benefits of using crypto portfolio charts?

There are a number of benefits to using crypto portfolio charts. For starters, they can help investors stay up-to-date on their portfolios in a quick and easy way. Additionally, crypto portfolio charts can help investors make informed investment decisions by providing them with real-time data on their holdings.

How do crypto portfolio chart patterns aid investors?

Crypto portfolio chart patterns can help investors identify opportunities and avoid potential losses. Patterns can also help identify when a cryptocurrency is overvalued or undervalued.

What is the difference between good and bad crypto portfolio charts?

A good crypto portfolio chart will display a clear trend over time and highlight key points such as the highest and lowest points. A bad crypto portfolio chart may not display a clear trend, and may not highlight key points.

How to pick the right crypto portfolio chart for your needs

There is no one-size-fits-all answer to this question, as the best crypto portfolio chart for a specific individual will vary depending on their investment goals, risk tolerance, and other personal factors. However, some tips on how to pick the right portfolio chart for your needs include:

1. Consider your investment goals

The first step in choosing the right portfolio chart is understanding your investment goals. Are you looking to invest in a wide variety of cryptocurrencies, or are you focused on a specific type of coin? If you want to invest in a wide range of coins, a diversified portfolio chart may be the best option for you. On the other hand, if you are only interested in investing in a few specific types of coins, a more concentrated portfolio may be more suitable.

2. Consider your risk tolerance

Next, consider your risk tolerance. Some people are more risk averse than others, and may want to invest in a more conservative portfolio that limits their exposure to potential losses. Other people may be more willing to take risks and invest in more volatile coins, which may offer greater potential for gains but also greater potential for losses.

3. Consider your investment timeframe

Finally, consider your investment timeframe. Some people want to invest for short-term gains, while others may want to invest for long-term gains. A longer-term portfolio may be better suited for someone who wants to hold onto their coins for a longer period of time. On the other hand, a shorter-term portfolio may be better suited for someone who wants tomediate their gains or take advantage of short-term price fluctuations.

Take these tips into account when choosing your own crypto portfolio chart, and you should be able to find a chart that is tailored specifically to your own needs.

The ultimate guide to reading crypto portfolio charts

When you are trying to understand a crypto portfolio chart, there are a few things you should keep in mind.

1. The Y-axis is usually the price of the currency over time, while the X-axis shows how much of the total supply of the currency is currently in circulation.

2. The height of the lines on the chart show how much money has been made or lost since the last point on the chart was made.

3. The color of the lines can help you to see whether a currency is going up or down.

4. The trend line is a line that shows whether a currency is trending up or down.

5. The Fibonacci retracement levels can be used to help you to identify whether a currency is overbought or oversold.

How to make the most out of crypto portfolio charts

Crypto portfolio charts are a great way to keep track of your investments and see how they're performing. Here are a few tips to maximize the benefits of using crypto portfolio charts:

1. Stay organized

One of the most important things you can do to make the most out of your crypto portfolio charts is to stay organized. Keeping track of your investments can be tricky, so having a system in place will help you stay on top of your progress.

2. Track your performance

One of the best ways to learn about your investments is to track their performance. By tracking your gains and losses, you'll be able to see exactly how your investments are doing and make informed decisions based on that information.

3. Use charts to your advantage

One of the great things about using crypto portfolio charts is that they can be used to your advantage. For example, you can use them to track your overall investment strategy and see how it's working. Charts can also be helpful in spotting trends and making informed decisions based on that information.

Get the most out of your investment with crypto portfolio charts

Crypto portfolio charts can be a helpful way to track your investments and see how they’re performing. They can also help you understand the overall trend of your investments, and help you make better investment decisions.

Here are some tips for getting the most out of your crypto portfolio charts:

1. Make sure you have the right charting software.

Different cryptocurrency portfolio charts will require different charting software to create. Some popular options include Coinigy and TradingView.

2. Use a variety of indicators.

Some common indicators used to track cryptocurrency investments include RSI (relative strength index), MACD (moving average convergence divergence), and Gann Fan charts.

3. Compare your investments over time.

Cryptocurrency portfolio charts can be a good way to track your investments over time. This can help you see how your investments are performing relative to one another, and can give you an idea of the overall trend of your portfolio.