Best Time Frame To Analyze Crypto Charts

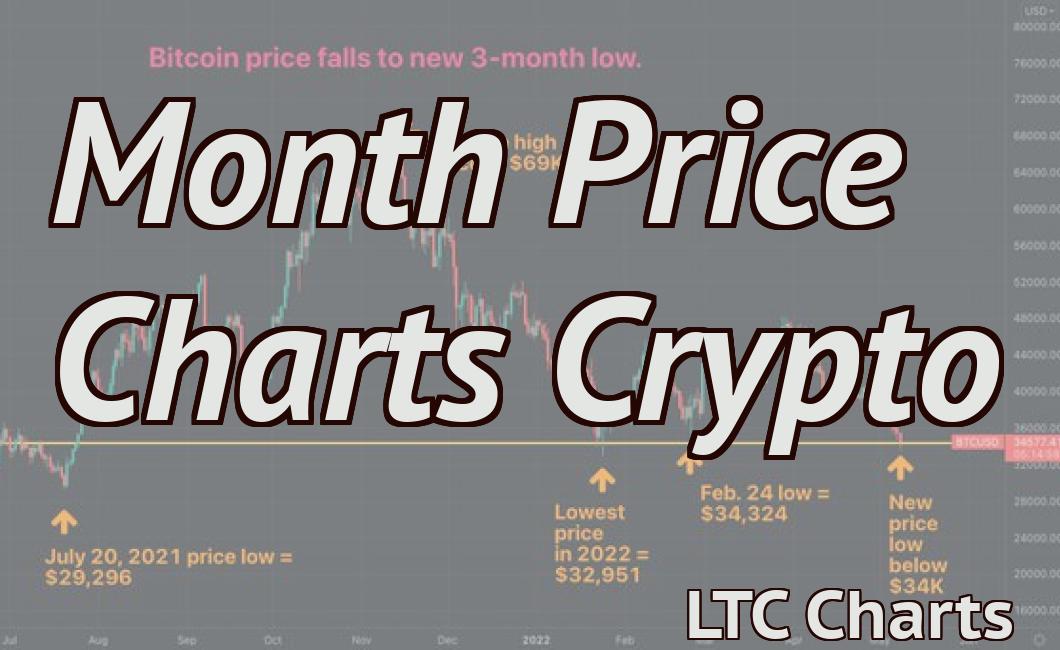

If you are new to the cryptocurrency market, you might be wondering what is the best time frame to analyze crypto charts. The answer is it depends on what you are looking for. If you want to find long-term trends, then you should look at monthly or even yearly charts. However, if you are looking for short-term opportunities, then you should focus on daily or even hourly charts.

The Benefits of Analyzing Crypto Charts within a shorter Time Frame

Cryptocurrencies are decentralized, digital assets that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they use decentralized control as opposed to centralized management.

Cryptocurrencies are often traded on cryptocurrency exchanges and can also be used to purchase goods and services.

Cryptocurrencies are not subject to government or financial institution control and their value is based on supply and demand.

Cryptocurrencies are often more volatile than traditional assets and can be more risky for investors.

Cryptocurrencies have been in a bull market for the past several years, with the value of Bitcoin reaching over $19,000 per coin in December 2017. However, there is a risk that the market could decline, and investors should be aware of these risks when investing in cryptocurrencies.

Achieving Better Results by Analyzing Crypto Charts within a shorter Time Frame

If you want to achieve better results with your cryptocurrency investment, it is important to analyze charts within a shorter time frame. For example, if you want to know whether or not a particular cryptocurrency is heading down, it is important to look at its chart within the last few days. By doing so, you will be able to make an informed decision about whether or not to sell your holdings.

Likewise, if you are looking to buy a cryptocurrency, it is important to look at its chart within the last few weeks. This way, you will be able to see if the price is heading up or down, and whether or not it is a good time to buy.

How to Optimize your Analysis of Crypto Charts by Adjusting the Time Frame

Cryptocurrencies are not a one-time investment. They are a long-term investment that can be optimized over time.

To optimize your analysis of crypto charts, you should adjust the time frame.

For example, if you are looking at a 1-day chart, you might want to adjust the time frame to 3 or 6 hours. This will give you a better perspective on how the market is moving overall.

You should also adjust the time frame if you are looking at a weekly chart. For example, if you are looking at a weekly chart for a cryptocurrency that is trading in the $10 range, you might want to adjust the time frame to 1 month. This will give you a better perspective on how the market is moving over a longer period of time.

Why a Shorter Time Frame is Better for Analyzing Crypto Charts

A shorter time frame is generally better for analyzing crypto charts. This is because it allows for more frequent updates which can give you a more accurate understanding of the current state of the market. Additionally, it can help you stay ahead of the curve and make better decisions about when to buy or sell.

How to Improve your Analysis of Crypto Charts by Viewing them in a shorter Time Frame

There are a few ways to improve your analysis of crypto charts. One way is to view them in a shorter time frame. For example, you could look at a 1-hour, 3-hour, or 6-hour time frame. This will allow you to see how the price of a cryptocurrency is changing over a shorter period of time.

Another way to improve your analysis of crypto charts is to use a different cryptocurrency tracker. For example, you could use CoinMarketCap or Coinigy to track different cryptocurrencies. This will help you to see how the prices of different cryptocurrencies are related to each other.

The Advantages of Using a shorter Time Frame when Analyzing Crypto Charts

There are a few key advantages to using a shorter time frame when analyzing crypto charts.

1. Shorter time frames make it easier to identify trends and patterns.

2. It is easier to detect short-term price movements.

3. It is easier to spot market opportunities.

4. It is easier to identify market manipulation.

5. It is easier to get an overview of the overall market situation.

6. It is easier to spot market trends.

7. It is easier to identify market leadership positions.

8. It is easier to spot market reversals.

9. It is easier to identify market bottlenecks.

10. It is easier to predict future market movements.

maximizing the Potential of your Analysis by Using a shorter Time Frame for Crypto Chart Analysis

There is no one-size-fits-all answer to this question, as the optimal time frame for crypto chart analysis will vary depending on the specific circumstances and goals of the analysis. However, some general tips for maximizing the potential of your analysis by using a shorter time frame for crypto chart analysis include:

1. Keeping track of recent price movements.

2. focusing on important indicators.

3. maintaining a close eye on market sentiment.

How to get the most out of your Crypto Chart Analysis by Viewing them in a shorter Time Frame

Cryptocurrency charts can be a great way to see how the market is performing over time, but they can also be misleading if you don’t look at them in a shorter time frame.

For example, if you’re looking at a three-month cryptocurrency chart, you might not notice that the market has been going down for the past two months. If you look at the chart in a shorter time frame, you might see that the market has been dropping for a longer period of time and that there is a potential opportunity to buy.

Similarly, if you’re looking at a six-month cryptocurrency chart, you might see that the market has been trending up for the past four months. If you look at the chart in a shorter time frame, you might see that the market has been increasing for a longer period of time and that there is a potential opportunity to sell.