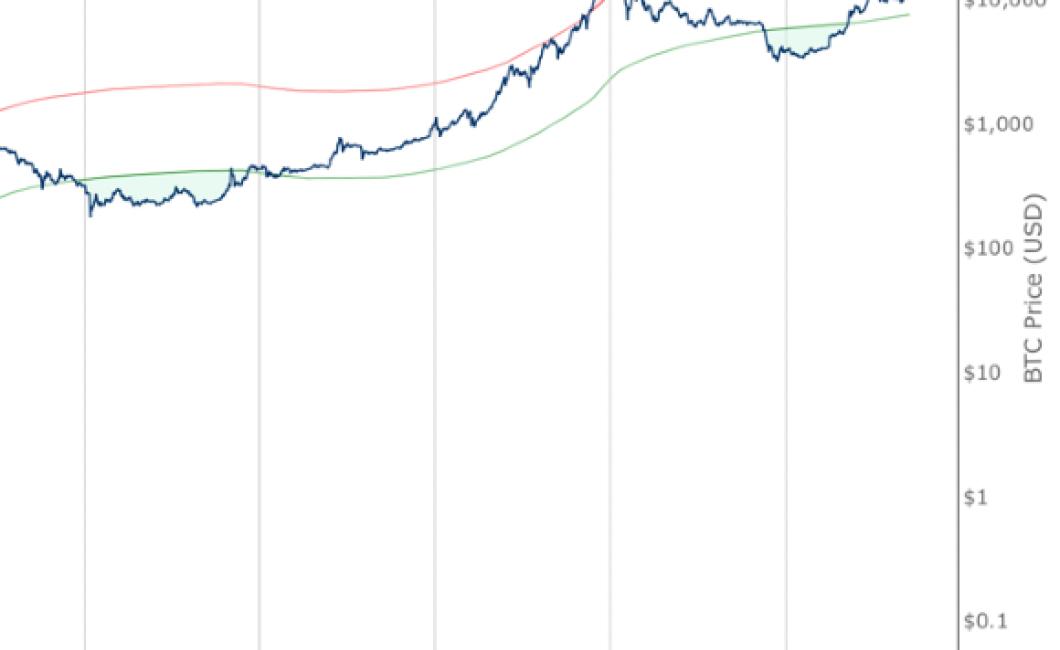

Crypto Market Weekly Charts

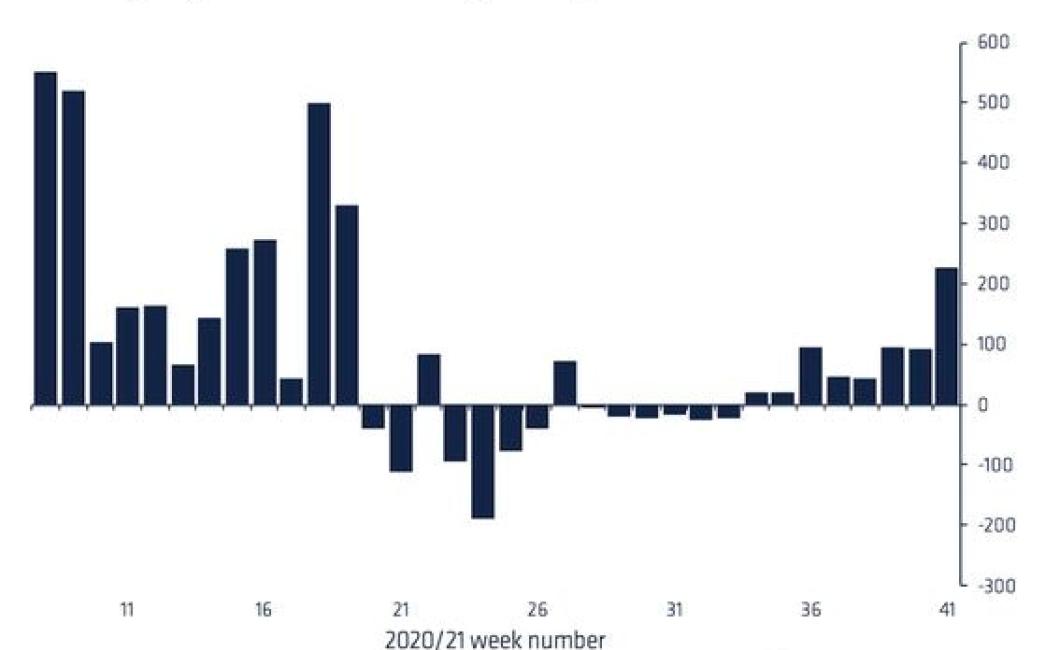

The past week was a big one for the crypto markets, with Bitcoin and Ethereum both seeing significant gains. Here's a look at the charts for the week.

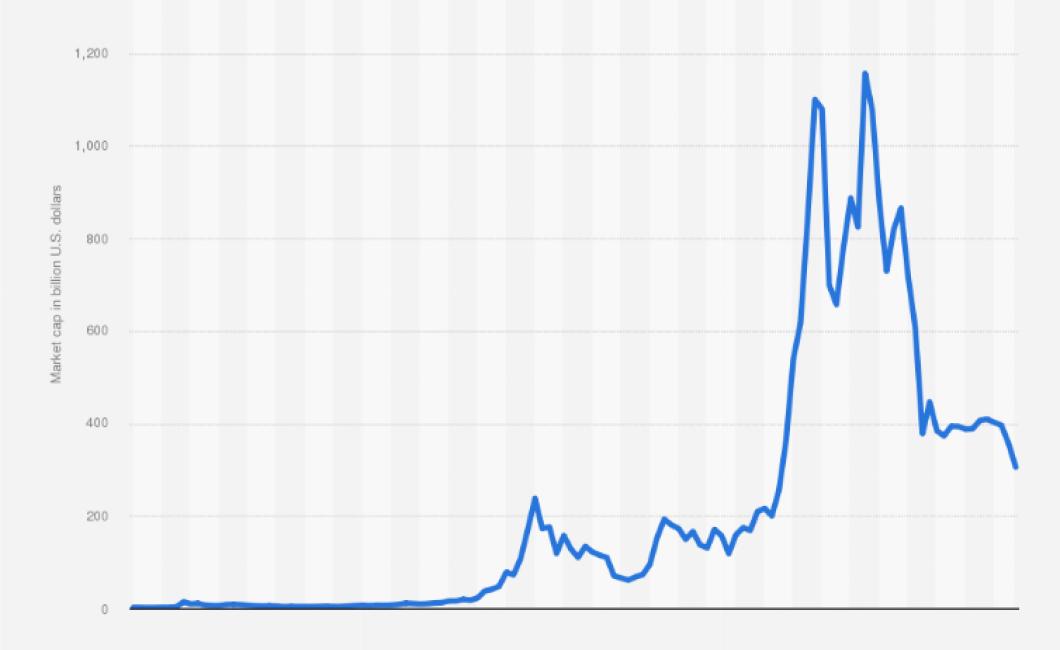

Bitcoin and Ethereum continue to dominate the market

Bitcoin and Ethereum continue to dominate the market, according to CoinMarketCap data.

As of this writing, Bitcoin has a market cap of $161.8 billion, while Ethereum has a market cap of $103.7 billion. These figures represent a combined 85.4% share of the total cryptocurrency market cap.

Bitcoin and Ethereum are also the two largest cryptocurrencies by market value. Bitcoin is worth more than Ethereum by a margin of $32.4 billion.

However, Bitcoin’s share of the total cryptocurrency market is decreasing, while Ethereum’s share is increasing. This could be due to growing interest in Ethereum as well as other cryptocurrencies.

Litecoin remains a strong competitor in the market

Litecoin is still a strong competitor in the market. Despite the recent price decline, Litecoin remains the fifth most valuable cryptocurrency with a market capitalization of over $11 billion.

Litecoin also has a strong developer community, which is likely to continue developing new features and applications for the cryptocurrency. This could help Litecoin to remain a strong competitor in the market.

Monero is on the rise as a potential privacy-centric coin

As cryptocurrencies continue to gain in popularity, it is no surprise that more and more options are being offered for those looking for a more private option. One such option is Monero, which is quickly gaining a reputation as a potential privacy-centric coin.

One of the main benefits of Monero is that it uses a unique algorithm that makes it difficult to track transactions. Additionally, Monero also features an anonymous network that makes it difficult for anyone to track user activity.

Overall, these features make Monero a potential choice for those looking for a more private option when it comes to cryptocurrency.

Ripple continues to make headway in the banking sector

Ripple, the blockchain startup, continues to make headway in the banking sector. The company announced a deal with the world’s largest commercial bank, Santander, to provide its xRapid platform. Santander is one of the largest banks in the world and is also one of Ripple’s earliest partners.

xRapid is a platform that allows banks to quickly and easily transfer money across borders. xRapid uses Ripple’s blockchain technology to create a more efficient and cost-effective way for banks to move money.

xRapid has already been tested by several banks, including Santander and Western Union. The platform is now being rolled out to other banks around the world.

This deal is another indication of the growing popularity of Ripple. The company has already partnerships with some of the world’s most important banks, and this deal will help them to expand their reach even further.

Dash remains a top choice for those looking for fast transactions

Bitcoin, Litecoin, and Ethereum are all popular cryptocurrencies that use blockchain technology to facilitate fast and secure transactions. While Dash is not as widely known as these other cryptocurrencies, it is still a top choice for those looking for fast transactions.

Bitcoin Cash continues to offer an alternative to Bitcoin

Bitcoin Cash is still a viable option for those looking for an alternative to Bitcoin. In fact, it continues to grow in popularity, with more and more people becoming aware of its existence. This is likely due to the fact that Bitcoin Cash offers many benefits over Bitcoin, including faster transactions and lower fees.

Ethereum Classic is still going strong despite recent forks

Ethereum Classic (ETC) is still going strong despite recent forks. The cryptocurrency has seen a surge in value in the past few weeks, reaching a new all-time high of $15.92 on October 12.

The current price increase can be attributed to a number of factors, including the recent Ethereum Constantinople hard fork. This fork increased the block size from 1MB to 2MB, which has been seen as a positive development by many ETC supporters.

Another reason for the ETC price surge is the recent listing of the cryptocurrency on Binance. This move has attracted a lot of new investors, as well as increasing visibility and liquidity for ETC.

Despite these positive developments, some Ethereum Classic supporters remain concerned about the long-term viability of the cryptocurrency. They argue that the network is not scalable enough to handle future growth, and that there are currently too few active nodes.

Overall, however, Ethereum Classic appears to be holding up well in the face of recent market volatility. The cryptocurrency is currently trading at $15.92, up significantly from its previous all-time low of $4.68.

Zcash is gaining popularity as a privacy-focused coin

Zcash is gaining popularity as a privacy-focused coin. The coin is based on the blockchain technology and offers users the ability to keep their transactions confidential. Zcash also has a unique feature called “zero-knowledge proofs,” which allows users to verify the validity of a transaction without revealing any information about the sender or the recipient.

Dogecoin remains a popular choice among meme-lovers

Dogecoin is still a popular choice among meme-lovers. The currency was created as a joke in 2013, but it soon became popular for its funny images and slogans. Today, Dogecoin is used to buy goods and services online, and some people even use it as an alternative currency.