Understanding Candlestick Charts Crypto

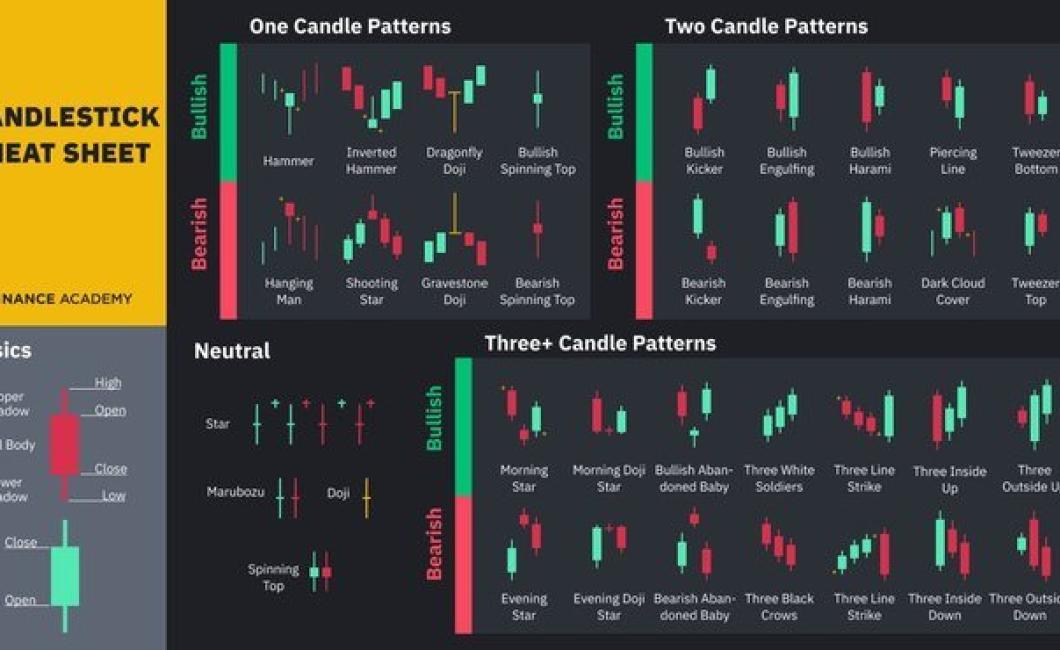

Candlestick charts are one of the most popular ways to visualize data in the cryptocurrency market. They offer a clear and concise way to see price action, and can be used to spot trends and reversals. In this article, we'll take a look at what candlestick charts are, how they're constructed, and some of the most important patterns to look for.

How to read candlestick charts in cryptocurrency trading

When looking at candlestick charts, you will notice that they are divided into two main groups: open and close. The open candlestick chart shows the prices at the beginning of the trading day, and the close candlestick chart shows the prices at the end of the trading day.

The height of the candlesticks shows the change in price, and the color of the candlestick indicates the type of signal it is. For example, a green candle indicates a buy signal, and a red candle indicates a sell signal.

When looking at a candlestick chart, you should always remember the following things:

1. The open and close prices are important

2. The height of the candlesticks shows the change in price

3. The color of the candlestick indicates the type of signal

What do candlestick charts represent in cryptocurrency trading?

Candlestick charts are a graphical representation of price movements over time. They show the highest and lowest points of a given session, as well as the open, close, and volume levels for each. They can be helpful in identifying patterns in price movement and can be used to make informed trading decisions.

The basics of cryptocurrency candlestick charting

Cryptocurrency candlestick charting is a technical analysis technique used to analyze price movements of a cryptocurrency. Candlestick charts are visual representations of price movement and can be used to identify patterns and signals.

Candlestick charts are made up of two types of bars: the open and the close. The open bar shows the price at the start of the bar, and the close bar shows the price at the end of the bar. The size of the candlestick and the color of the bar indicate the size of the change in price.

Candlestick charts can be used to identify patterns and signals, such as buy or sell signals. When you see a candlestick with an open below the close and a high above the open, this is usually a sell signal. When you see a candlestick with an open above the close and a low below the open, this is usually a buy signal.

Candlestick charting for cryptocurrency trading beginners

Candlestick charting is a technical analysis technique that uses charts to display the price of assets over time. Cryptocurrency traders can use candlestick charting to identify patterns in the prices of cryptocurrencies.

To use candlestick charting, you first need to find a cryptocurrency exchange that offers candlestick charting. Once you have found an exchange, open the platform and look for the candlestick charting section.

To create a candlestick chart, first find the time frame that you want to analyze. For example, you might want to look at the prices of cryptocurrencies over the past day, week, or month.

Next, find the currencies that you want to track. You can filter the list of currencies by market cap, currency code, or price.

Finally, find the candles that you want to analyze. To create a candle, first find the bar that you want to start at. Then, find the closing price for that bar. Finally, find the high and low prices for that bar.

Once you have created your candlestick chart, you can begin to identify patterns in the prices of cryptocurrencies. For example, you might see that cryptocurrencies tend to rise and fall in accordance with the economic news. You can also look for patterns in the Candle Stick Chart Patterns section of the exchange’s website.

How to interpret cryptocurrency candlestick charts

Cryptocurrency candlestick charts are a visual representation of price action over time. Candlestick charts are used to identify changes in price, and can be used to identify trends and reversals.

Candlesticks are created by drawing a line above (or below) the previous candlestick's price, and then drawing another line above (or below) the new candlestick's price. The height of the candlestick indicates the volume of trading activity for that particular candle.

The body of the candlestick shows the price movement over the time period shown, and the color of the candlestick corresponds to the main trading asset for that particular cryptocurrency. For example, blue candlesticks indicate Ethereum trading activity, and green candlesticks indicate Bitcoin trading activity.

When interpreting cryptocurrency candlestick charts, it is important to note the following:

1. Bitcoin and Ethereum are the only two cryptocurrencies that are currently represented on candlestick charts.

2. Cryptocurrencies that are not currently represented on candlestick charts may be added in the future.

3. Cryptocurrencies that are not traded on major exchanges may have different candlestick patterns, and should therefore be interpreted with caution.

What do green and red candlesticks mean in cryptocurrency trading?

The green candlestick means that the price of a cryptocurrency is increasing, and the red candlestick means that the price of a cryptocurrency is decreasing.

What is a bullish or bearish trend in cryptocurrency trading?

A bullish trend occurs when the price of a cryptocurrency rises, while a bearish trend occurs when it falls.

How to identify support and resistance levels using candlestick charts in cryptocurrency trading

Identifying support and resistance levels in cryptocurrency trading can be a useful tool for determining when to buy or sell a cryptocurrency. Candlestick charts are a popular way to display price data and can be used to identify support and resistance levels.

A support level is a price point at which buyers are willing to continue buying cryptocurrency, while a resistance level is a price point at which sellers are willing to continue selling cryptocurrency. When the price of a cryptocurrency is near a support or resistance level, the market may be indicating that there is strong support or resistance for the currency at that price point.

To identify support and resistance levels in cryptocurrency trading, first find the nearest price point on the candlestick chart that is below the current price of the cryptocurrency and above the price of the cryptocurrency's previous low. Next, find the nearest price point on the candlestick chart that is below the current price of the cryptocurrency and above the price of the cryptocurrency's previous high. Finally, find the intersection of these two price points to determine the support and resistance levels for the cryptocurrency.

What are common candlestick patterns in cryptocurrency trading?

Common candlestick patterns in cryptocurrency trading include:

1) A buy signal followed by a strong rally.

2) A buy signal followed by a weak rally.

3) A sell signal followed by a strong rally.

4) A sell signal followed by a weak rally.

How can candlestick charting help you make better trades in cryptocurrency markets?

Candlestick charting is a technical analysis tool that can help traders make better trades in cryptocurrency markets. Candlestick charts display the price action of a cryptocurrency over time, and can help traders identify patterns and signals. By understanding the patterns and signals that Candlestick charting can reveal, traders can improve their trading skills and make more informed decisions when trading cryptocurrencies.

Get started with candlestick charting for cryptocurrency trading

Candlestick charting is a technical analysis tool that can be used to analyze the behavior of a cryptocurrency’s price over time. Candlestick charts are made up of short, vertical bars that indicate the price of a cryptocurrency over a given period of time.

To start using candlestick charting for cryptocurrency trading, first make a list of the coins you’d like to trade. Next, open a charting platform and find the cryptocurrency you’d like to track. Once you have the cryptocurrency chart open, click on the “candlestick” icon in the upper right-hand corner of the chart. This will open the Candlestick Charting window.

To begin candlestick charting, first find the “candlesticks” tab at the top of the Candlestick Charting window. This tab will display all of the candlesticks that have been created for the selected cryptocurrency over the past 60 seconds. To add a new candlestick, click on the “+” button in the bottom-left corner of the Candlestick Charting window. This will add a new candlestick to the chart. To delete a candlestick, select it and click on the “-” button in the bottom-left corner of the Candlestick Charting window.

To analyze a candlestick, first click on the “info” button in the bottom-right corner of the Candlestick Charting window. This will open the Candlestick Info window. This window will show you important information about the selected candlestick, including the date, time, and price. To view more information about a specific candlestick, click on the “details” button next to that candlestick. This will open the Candlestick Details window, which will list all of the data points associated with that candlestick.

Candlestick charting is a valuable tool for cryptocurrency traders. By using candlestick charting, you can quickly identify patterns in the price of a cryptocurrency over time. Additionally, candlestick charting can help you identify opportunities to buy and sell cryptocurrencies.