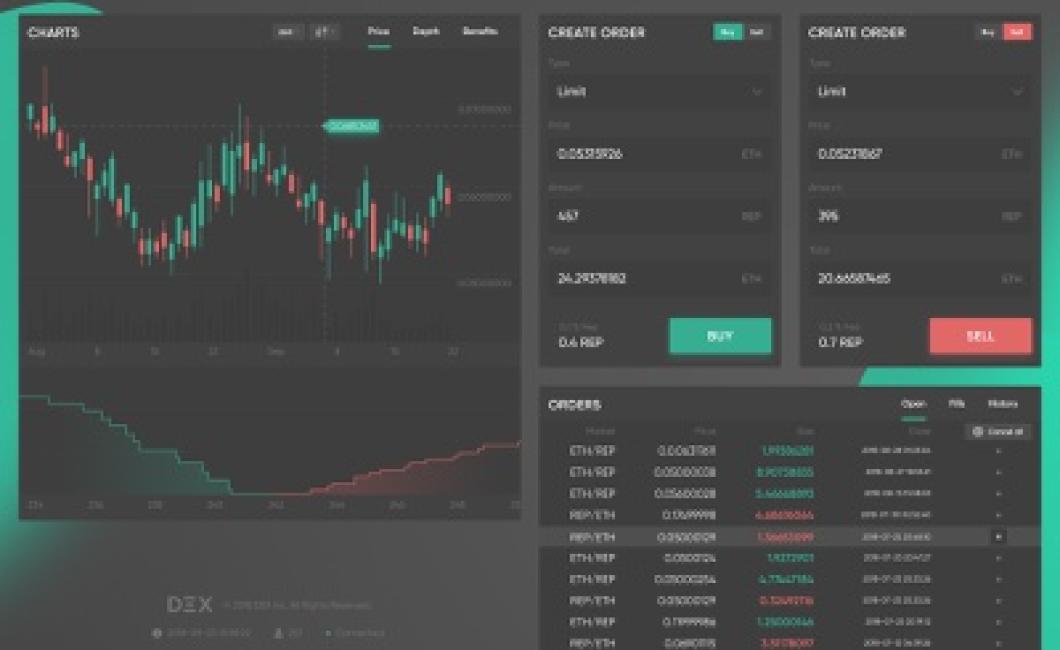

Rep Crypto Charts

The article discusses various crypto charts and their meaning for investors. It covers topics such as market capitalization, price trends, and trading volume.

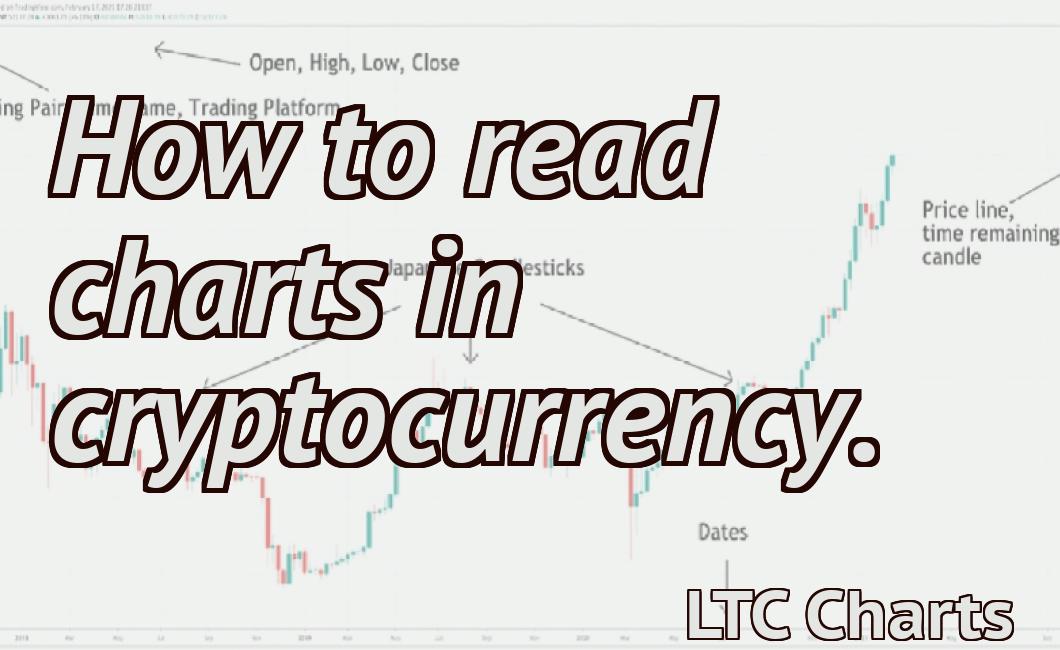

How to read crypto charts like a pro

Cryptocurrencies are all about speculation and investing. So, before you start reading cryptocurrency charts, it’s important to have a clear understanding of what those charts are supposed to tell you.

Cryptocurrency charts are comprised of a bunch of different indicators, and it can be hard to understand which ones are most important. But, with a little practice, you can start to read cryptocurrency charts like a pro.

The first step is to understand what each indicator is measuring. Some of the most common indicators used in cryptocurrency charts are:

Volume: This is a measure of how much buying and selling is happening on the market. When more people are buying and selling, the price of a cryptocurrency is likely to go up.

This is a measure of how much buying and selling is happening on the market. When more people are buying and selling, the price of a cryptocurrency is likely to go up. Price: This is simply the price of a cryptocurrency at any given moment.

This is simply the price of a cryptocurrency at any given moment. Bullish or bearish: These indicators show whether the price of a cryptocurrency is going up or down. A bull market is when the price is going up, and a bear market is when the price is going down.

These indicators show whether the price of a cryptocurrency is going up or down. A bull market is when the price is going up, and a bear market is when the price is going down. RSI (Relative Strength Index): This indicator shows how much demand there is for a cryptocurrency relative to the supply. When the RSI is high, it shows that there is strong demand for the cryptocurrency, and when the RSI is low, it shows that there is little demand for the cryptocurrency.

These are just a few of the most common indicators used in cryptocurrency charts. And, as you start to become more comfortable with reading cryptocurrency charts, you’ll be able to add other indicators to your analysis.

Once you have a basic understanding of what each indicator is measuring, you can start to look for patterns in the data. Patterns can help you understand what’s happening in the world of cryptocurrencies, and they can also help you make profitable investments.

So, next time you see a cryptocurrency chart, take a minute to understand what’s going on behind the numbers. And, if you ever feel lost or unsure about what to look for in a cryptocurrency chart, don’t hesitate to ask a friend or online community for help.

The most important crypto charts every trader should know

Crypto charts are a great way to keep track of the market and make informed decisions. Here are the most important crypto charts every trader should know:

1. Bitcoin chart

This is the most important chart for any crypto trader. It shows the price of bitcoin over time. You can use this to track how the market is changing, and to see how prices have fluctuated over the past few days or weeks.

2. Ethereum chart

Ethereum is another popular cryptocurrency, and its chart is also important. It shows the price of ether over time, and you can use it to see how the market is changing, and to track how prices have fluctuated over the past few days or weeks.

3. Dash chart

Dash is another popular cryptocurrency, and its chart is also important. It shows the price of dash over time, and you can use it to see how the market is changing, and to track how prices have fluctuated over the past few days or weeks.

4. Litecoin chart

Litecoin is another popular cryptocurrency, and its chart is also important. It shows the price of litecoin over time, and you can use it to see how the market is changing, and to track how prices have fluctuated over the past few days or weeks.

5. Bitcoin cash chart

Bitcoin cash is another popular cryptocurrency, and its chart is also important. It shows the price of bitcoin cash over time, and you can use it to see how the market is changing, and to track how prices have fluctuated over the past few days or weeks.

A beginner's guide to reading crypto charts

Cryptocurrencies are a type of digital asset that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To track the price of cryptocurrencies, investors use cryptocurrency charts. Cryptocurrency charts display the price of a cryptocurrency over time. Cryptocurrency charts can be divided into two main categories: technical analysis and fundamental analysis.

Technical analysis is the use of charts and other indicators to predict the future price of a cryptocurrency. Technical analysts look at past data to predict future trends, and then use that information to make trading recommendations.

Fundamental analysis is the study of a cryptocurrency's underlying mechanics, such as its supply, circulation, and price history. Fundamental analysts look at a cryptocurrency's long-term potential and how it might be affected by external factors, such as regulatory changes.

The most popular crypto charting tools

Cryptocurrency is a digital asset and a payment system invented by Satoshi Nakamoto. Cryptocurrencies are unique in that there are a finite number of them: 21 million. Bitcoin is the first and most well-known cryptocurrency.

The most useful crypto charting indicators

The most useful crypto charting indicators are the ones that allow you to identify patterns and trends in the data.

Some of the most popular crypto charting indicators include:

1. Price over time

This is one of the most important crypto charting indicators because it allows you to see how prices have changed over time.

2. Volumes over time

This is another important crypto charting indicator because it tells you how much money is being traded on a daily, weekly, or monthly basis.

3. Price action

This is another important crypto charting indicator because it shows whether prices are moving up or down.

4. RSI (relative strength index)

This is a popular crypto charting indicator that shows how much momentum the market has.

How to create your own crypto charts

To create a crypto chart, you will need:

-An online charting service such as CoinMarketCap.com.

-A cryptocurrency wallet to store your coins in.

-Your coins' public address (this is the address where others can send you coins).

-Your private address (this is the address where you will keep your coins).

-Your wallet's passphrase (this is the password to your wallet).

1. Open your online charting service and sign in.

2. Under "Charts" in the top left corner, click on "Cryptocurrencies."

3. Under "Cryptocurrencies," select the cryptocurrency you want to chart.

4. Under "Data Sources," find and click on your coin's public address.

5. Copy the public address and paste it into the "Public Address" field in your cryptocurrency charting service.

6. Under "Data Sources," find and click on your coin's private address.

7. Paste your private address into the "Private Address" field in your cryptocurrency charting service.

8. Under "Settings," find and click on "Cryptocurrency Chart Settings."

9. In the "Cryptocurrency Chart Settings" window, under "Chart Type," select " candle ."

10. Under "Settings," find and click on " candle chart settings."

11. In the " candle chart settings" window, under " candle type," select "Price."

12. Under "Settings," find and click on " candlestick chart settings."

13. In the " candlestick chart settings" window, under " Candlestick Type," select "Open/Close."

14. Under "Settings," find and click on " Patterns ."

15. In the " Patterns " window, under "Patterns to Show," select the coins you want to include in your chart.

16. Click on "Save Settings."

The benefits of using crypto charts

Cryptocurrency charts can be a useful tool for investors and traders. They can help you to track the prices of specific cryptocurrencies, and to understand the overall trends in the market.

Cryptocurrencies are often volatile, and their prices can change rapidly. Cryptocurrency charts can help you to stay informed about these changes, and to make informed decisions about your investments.

Cryptocurrency charts can also be a useful tool for traders. They can help you to identify patterns in the market, and to make profitable investments.

Cryptocurrency charts can also be a useful tool for investors. They can help you to understand the overall trends in the market, and to make informed decisions about your investments.

The drawbacks of using crypto charts

Cryptocurrencies are not regulated by any financial authority and their prices are highly volatile. This makes it difficult to use them as a means of investment.

Another downside of using crypto charts is that they do not provide a clear picture of the market conditions. This makes it difficult to make informed investment decisions.

Why you should start using crypto charts

Crypto charts can provide valuable information about the performance of various cryptocurrencies. By understanding how different cryptocurrencies are performing, you can make informed investment decisions.

Cryptocurrencies are volatile, and it can be difficult to predict their long-term performance. Crypto charts can help you understand how individual cryptocurrencies are performing over time, and help you make more informed investment decisions.