What affects crypto prices?

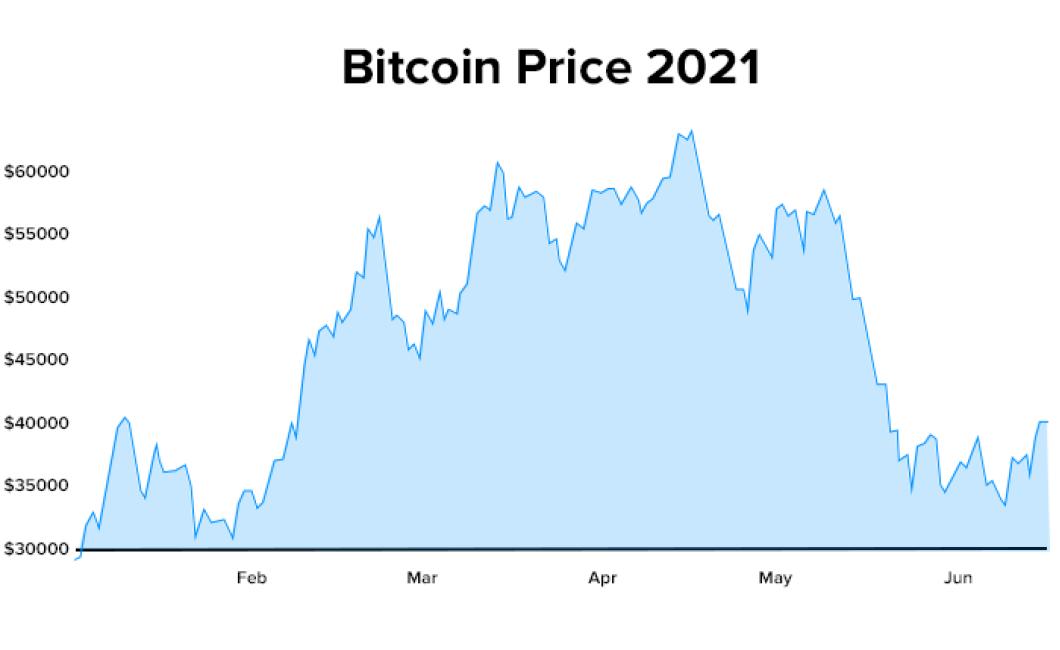

Crypto prices are affected by a variety of factors, including global economic conditions, news and events, regulations, and more.

The forces that move crypto prices.

There are a few factors that can influence the price of cryptocurrencies. Some of these factors include:

1) Supply and Demand: The number of coins available on the market, and the demand for those coins, affects the price of cryptocurrencies. When more coins are available, the price of those coins will go down, while when there is less coin availability, the price of those coins will go up.

2) News and Announcements: When a major company or government announces that they are going to start using or investing in cryptocurrencies, this can affect the price of those currencies.

3) Regulations: Cryptocurrencies are still somewhat new, and as a result, governments are still trying to figure out how to regulate them. This can lead to uncertainty in the market, and consequently, a decrease in the price of cryptocurrencies.

How news, events, and uncertainty affect crypto prices.

Cryptocurrencies are highly volatile and can be influenced by a variety of news events and uncertainties. For example, if a major financial institution announces that it will not allow customers to purchase or trade cryptocurrencies, this could depress prices. Conversely, if a major country announces that it plans to legalize and regulate cryptocurrencies, this could raise prices.

The role of whales in affecting crypto prices.

Whales play a significant role in the price of cryptocurrencies, as they are often responsible for driving prices up or down. Cryptocurrencies are highly volatile, and can swing widely in price in a short period of time. This is attributable to the large number of people who are interested in buying and selling them, and the limited supply of each currency.

Whales are typically very wealthy individuals or organizations, who are able to invest in a large number of cryptocurrencies. They are also often very bullish on the potential for these currencies, and may attempt to drive up the price by buying large quantities. If the price of a cryptocurrency rises too high, whales may sell off their holdings, causing the price to fall. Conversely, if the price of a cryptocurrency is falling, whales may purchase large quantities in an effort to drive the price up.

FUD and other price-moving factors in the crypto world.

In the crypto world, FUD (fear, uncertainty, and doubt) is a term used to describe any situation or event that causes investors to sell their cryptocurrencies and/or related assets.

Some of the most common FUD factors in the crypto world include worries about regulatory changes, security issues, and the possibility of a widespread market crash.

How technical analysis can help you understand crypto prices.

Technical analysis is a method of analyzing prices that uses indicators to predict future movements. Technical analysts look for patterns in price movements and use that information to make predictions about future prices. This can help you understand the current state of the market and make informed decisions about whether to buy or sell cryptocurrencies.

What affects crypto prices?

Cryptocurrencies are traded on decentralized exchanges and can be bought and sold with fiat currencies. Cryptocurrencies are influenced by a range of factors, including political and economic events, media coverage, and technical analysis.