How to read crypto charts.

In order to read crypto charts, one must first understand the basics of technical analysis. Technical analysis is a method of evaluating securities by analyzing the statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a security's intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity. There are many different types of crypto charts, but they all provide the same basic information. The most important elements of a chart are the price and volume bars. The price bar shows the coin's price at certain intervals, while the volume bar shows the amount of coins that were traded during that interval. Other elements of a chart may include indicators, which are mathematical calculations based on price and volume data. Indicators can be used to identify trends, predict future prices, or confirm other aspects of technical analysis. Charts can be viewed on their own or in conjunction with other data, such as news headlines or social media activity. When viewing a chart, it is important to remember that past performance does not guarantee future results. However, technical analysis can be a helpful tool for identifying opportunities in the cryptocurrency market.

How to Use Charts to Trade Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To trade cryptocurrencies, you need a digital wallet to store the tokens and a trading platform. You can buy and sell cryptocurrencies on various exchanges.

To use a chart to trade cryptocurrencies, first find an appropriate cryptocurrency chart. Charts can be found on various websites and platforms, including TradingView and CoinMarketCap.

Next, find the appropriate time frame for the chart. For most charts, you will want to look at daily, weekly, or monthly charts.

Next, find the appropriate cryptocurrency pair for the chart. For example, if you are looking at a chart for Bitcoin, you would look for the Bitcoin/USD chart.

Finally, find the appropriate indicator for the chart. Most cryptocurrency charts include indicators to help you track the price of the cryptocurrency.

Charting Your Cryptocurrency Strategy

Your cryptocurrency strategy should include your overall investment goals, your risk tolerance, your investment horizon, and your preferred cryptocurrency investment method.

To begin, it's important to understand your overall investment goals. Cryptocurrencies are unique and volatile instruments, so it's important to decide whether you're looking to make short-term or long-term investments.

If you have a short-term investment goal, then you may be happy with a strategy that focuses on buying and holding cryptocurrencies. This type of strategy is relatively safe and can provide you with steady returns over time.

If you have a long-term investment goal, then you may want to consider investing in cryptocurrencies through a trading or mining strategy. This type of strategy is riskier, but can offer the potential for greater returns.

Next, it's important to consider your risk tolerance. Some cryptocurrencies are much more risky than others, so you'll need to decide how much risk you're willing to take on.

If you're comfortable with a higher level of risk, then you may want to invest in cryptocurrencies through a trading or mining strategy. These strategies tend to be more speculative, but can also offer higher returns.

If you're not comfortable with a high level of risk, then you may want to invest in cryptocurrencies through a buying and holding strategy. This strategy is relatively safe, but may not offer as high of a return.

Finally, it's important to decide your investment horizon. Some cryptocurrencies have a short lifespan, so you may want to consider investing in those that have a longer lifespan.

Cryptocurrencies with a longer lifespan are typically more stable and have a higher potential for returns. However, they may also be more volatile, so it's important to carefully weigh the risks and rewards of investing in these types of cryptocurrencies.

Overall, your cryptocurrency strategy should include your overall investment goals, your risk tolerance, your investment horizon, and your preferred cryptocurrency investment method.

How to Read Candlestick Charts for Crypto Trading

Candlestick charts are used to analyze the price movements of assets. They are composed of two types of bars: the open and the close. The open bar is the first bar of the chart and the close bar is the last bar of the chart.

The body of the candlestick chart is composed of four different parts: the body, the shadows, the tails, and theicks. The body is made up of the height of the candle, the width of the candle, and the color of the candle. The shadows are created by the candles that are either above or below the candlestick. The tails are created by the candles that are to the right of the candlestick and theicks are created by the candles that are to the left of the candlestick.

How To Analyze Cryptocurrency Charts For Beginners

Cryptocurrency charts are a great way to get an overview of the market conditions and to identify opportunities for investment.

There are a few things you need to keep in mind when analyzing cryptocurrency charts:

1. The main exchanges where cryptocurrencies are traded are usually the most active and provide the most up-to-date information. However, not all exchanges provide the same level of data. Try to find an exchange that offers detailed charts and analysis.

2. Cryptocurrencies are volatile, and prices can change rapidly. Make sure to keep a close eye on prices and don’t invest more than you can afford to lose.

3. Don’t rely exclusively on cryptocurrency charts to make investment decisions. Always do your own research before investing in any cryptocurrency or other financial product.

5 Tips For Reading Crypto Charts Like A Pro

1. Use a cryptocurrency tracking app

This one is obvious, but a great way to get a better understanding of the crypto markets is to use a cryptocurrency tracking app. This will allow you to keep track of all the latest movements and trends in the markets, making it easier for you to make informed decisions.

2. Don’t be afraid to dive in and out of the markets

It can be tempting to stay glued to your computer all day long, watching the prices of cryptocurrencies change minute by minute. However, it’s important to remember that the markets are incredibly volatile, and it’s easy to lose money if you don’t have a strategy.

3. Pay attention to news events

Cryptocurrencies are often correlated with major news events, so it’s important to keep an eye on what’s happening in the world of finance. This will allow you to get a better understanding of how the markets are reacting to specific events, and you may be able to make some profitable trades as a result.

4. Know your risks

Before you invest any money in the cryptocurrency markets, it’s important to understand the risks involved. Cryptocurrencies are extremely volatile, and there’s a high chance that you could lose all of your money if you don’t have a well-developed investment strategy.

5. Do your research

Finally, it’s important to do your research before investing in any cryptocurrency. Make sure to read up on the different coins available, and try to figure out what features stand out most to you. Only then can you start to develop an investment plan that suits your specific needs.

How to read crypto charts and make informed decisions

Crypto charts are a great way to track the performance of a cryptocurrency over time. However, before you start trading or investing in cryptocurrencies, it is important to understand how to read crypto charts and make informed decisions.

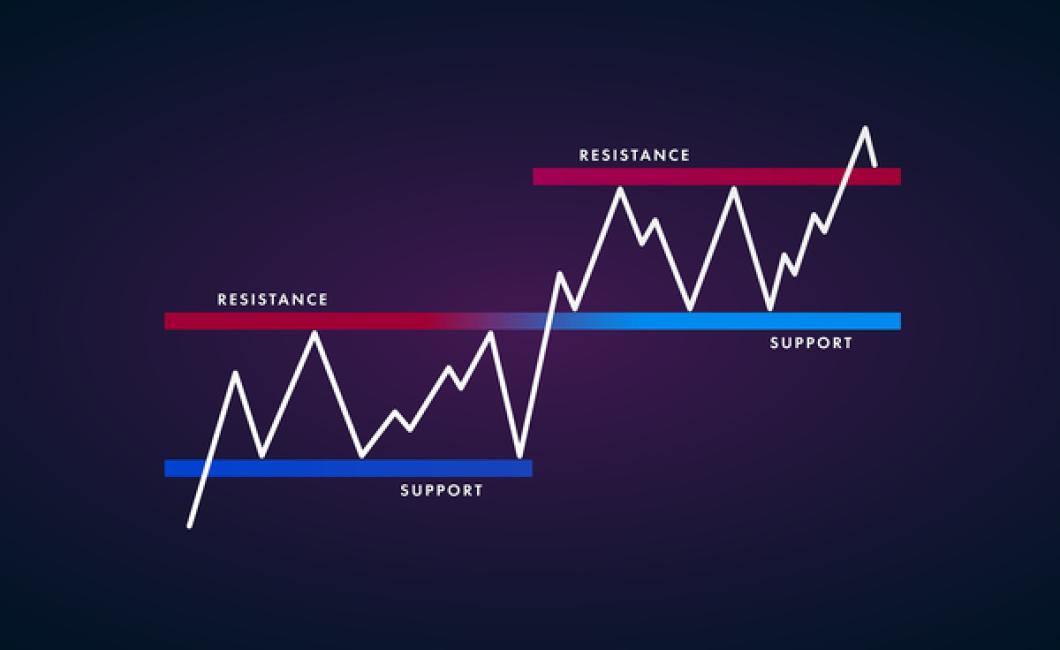

When looking at a crypto chart, the first thing you will want to do is to identify the support and resistance levels. These are the lines on the chart that indicate where the price of a cryptocurrency is likely to stay in the short and long run.

If the price of a cryptocurrency is below the support level, it is likely that the price will decrease in the short run. Conversely, if the price of a cryptocurrency is above the resistance level, it is likely that the price will increase in the short run.

Next, you will want to look at the trend. If the trend is up, it is likely that the price of a cryptocurrency will continue to increase in the short run. Conversely, if the trend is down, it is likely that the price of a cryptocurrency will decrease in the short run.

Finally, you will want to look at the indicators on the chart. These are lines that show how many people are buying or selling a cryptocurrency. If the indicators are pointing up, it is likely that the demand for a cryptocurrency is high. Conversely, if the indicators are pointing down, it is likely that the demand for a cryptocurrency is low.

Tips for reading cryptocurrency charts

There are a few things you can do to read cryptocurrency charts effectively:

1. Make sure you understand the basic concepts of charting. This will help you understand what is happening on the charts and how it relates to the price of the cryptocurrency.

2. Use technical indicators to help you identify trends. These indicators can help you predict where the price of the cryptocurrency is likely to go in the future.

3. Compare different cryptocurrency charts to see which one provides the most informative information. You may find that one cryptocurrency chart is better than another for tracking specific factors, such as price or volume.

Guidelines for reading cryptocurrency charts

Cryptocurrency charts are a great way to understand how the market is reacting to different events. However, there are a few guidelines that you should always follow when interpreting cryptocurrency charts.

1. Always keep in mind the current market conditions.

Before analyzing any cryptocurrency chart, it is important to understand the current market conditions. This will help you to better understand how the prices of different cryptocurrencies are reacting to various events.

2. Don’t overreact to short-term fluctuations.

When looking at cryptocurrency charts, it is important to avoid overreacting to short-term fluctuations. This means that you should not become too emotionally involved in the charts and instead focus on the long-term trends.

3. Be patient.

While it is important to be aware of short-term fluctuations, it is also important to be patient. This means that you should not try to trade the markets based on short-term trends. Instead, you should focus on building a long-term portfolio of cryptocurrencies.

How to interpret cryptocurrency charts

Cryptocurrency charts are used to track the movements of a digital asset over time. They typically display a series of plotted points on a graph, with each point representing a transaction or trade that has taken place for that particular asset.

Cryptocurrency charts can be used to ascertain the value of an asset, as well as to track its performance over time. By examining the trend of the chart, traders can get an idea of which direction the asset is likely to move in next.

Cryptocurrency charts can also be used to identify potential opportunities and to make informed investment decisions. By studying the behavior of a particular asset, traders can identify patterns that may indicate when prices are likely to fluctuate.

What do the crypto charts mean?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

How to read cryptocurrency trading charts

Cryptocurrency trading charts are used to help traders analyze the performance of a cryptocurrency over a given period of time. Trading charts display the prices of a cryptocurrency over a given period of time, along with other information such as volume and open interest.

To read a cryptocurrency trading chart, first find the cryptocurrency you are interested in. Then, find the chart that corresponds to that cryptocurrency. The chart will display the prices of the cryptocurrency over a given period of time. On the chart, you will also find other information, such as volume and open interest.

To use the chart, first find the price you are interested in. Then, find the corresponding point on the chart. This point will show you the current price of the cryptocurrency at that particular moment. Next, look for the lines that parallel the point you found. These lines will show you the direction in which the price of the cryptocurrency is moving. Finally, use these lines to predict where the price of the cryptocurrency might go next.

How to make sense of cryptocurrency charts

Cryptocurrency charts can be very confusing, so it is important to take some time to understand what they are showing.

A cryptocurrency chart is a visual representation of how valuable a cryptocurrency is over time. It shows how much money people have invested in the currency, as well as how much the currency has increased or decreased in value.

Cryptocurrencies are often traded on different exchanges, and their prices can change quickly. So, it is important to look at a cryptocurrency chart for a longer period of time to get a more accurate picture of the currency's value.

Here are some things to keep in mind when looking at cryptocurrency charts:

1. A cryptocurrency's value can increase or decrease rapidly.

2. It is important to look at a cryptocurrency chart for a longer period of time to get a more accurate picture of the currency's value.

3. Cryptocurrencies are often traded on different exchanges, and their prices can change quickly.