Where can I find crypto candlestick charts?

If you are looking for a place to find crypto candlestick charts, a good place to start is on the website of a major exchange such as Coinbase or Binance. These exchanges usually have very good charting tools that you can use to track the prices of different cryptocurrencies. Another option is to use a dedicated website such as CryptoCharts.io, which offers a wide range of different charting options for many different cryptocurrencies.

How to Read Crypto Candlestick Charts

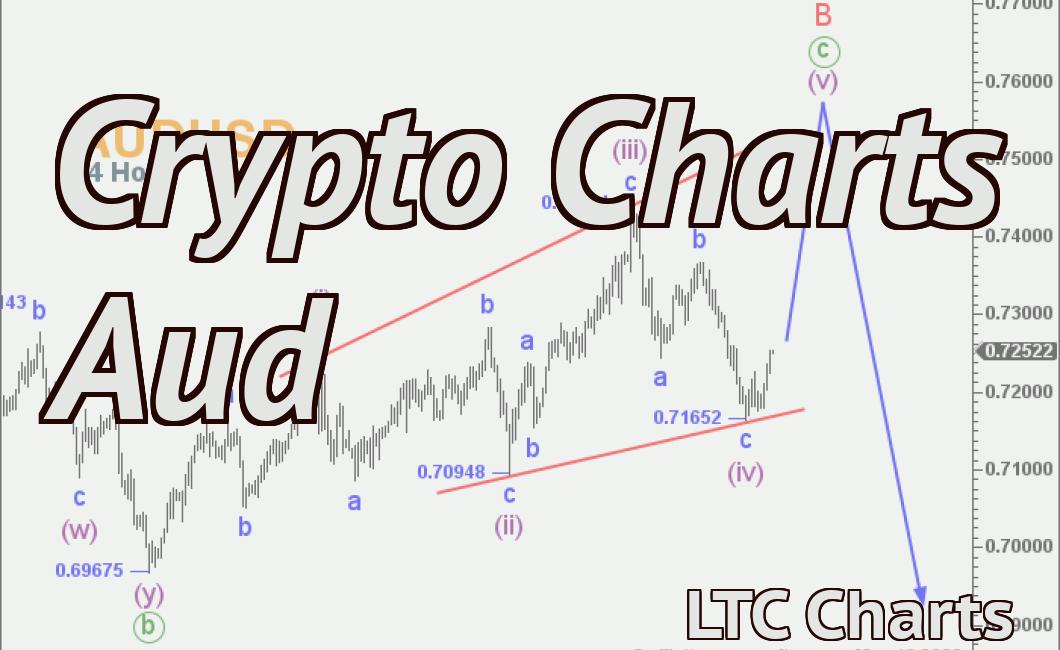

A crypto candlestick chart is a graphical representation of cryptocurrency prices. It shows the price movement of a cryptocurrency over a given time period, usually 24 hours.

The vertical axis shows the price of the cryptocurrency, while the horizontal axis shows the time period. Each candlestick is composed of two parts: the open and the close. The open is the price at which the candlestick was opened, and the close is the price at which the candlestick was closed.

The color of each candlestick corresponds to the main cryptocurrencies: green for Bitcoin, blue for Ethereum, and red for Ripple.

3 Best Crypto Candlestick Charting Websites

1. CoinMarketCap

CoinMarketCap is one of the most popular crypto candlestick charting websites. It allows users to track the prices of cryptocurrencies and tokens across various exchanges and provides detailed information about each asset.

2. CoinGecko

CoinGecko is another popular crypto candlestick charting website. It provides detailed information about the prices of cryptocurrencies and tokens across various exchanges. Additionally, it also provides information about the market capitalization of each asset.

3. Cryptocurrency News

Cryptocurrency News is a news website that provides updates about the latest developments in the cryptocurrency industry. It also provides detailed information about the prices of cryptocurrencies and tokens across various exchanges.

Free Crypto Candlestick Charts - Where to Find Them

The first place to look for crypto candlestick charts is on popular cryptocurrency exchanges. Some exchanges offer their own dedicated charts, while others embed charts from third-party providers.

Some popular exchanges include Binance, Coinbase, and Bittrex.

Another place to find crypto candlestick charts is on crypto news websites. Many of these websites include their own dedicated charts, while others embed charts from third-party providers.

Some popular crypto news websites include Coin Telegraph, Coindesk, and CCN.

The Benefits of Using Candlestick Charts for Cryptocurrency Trading

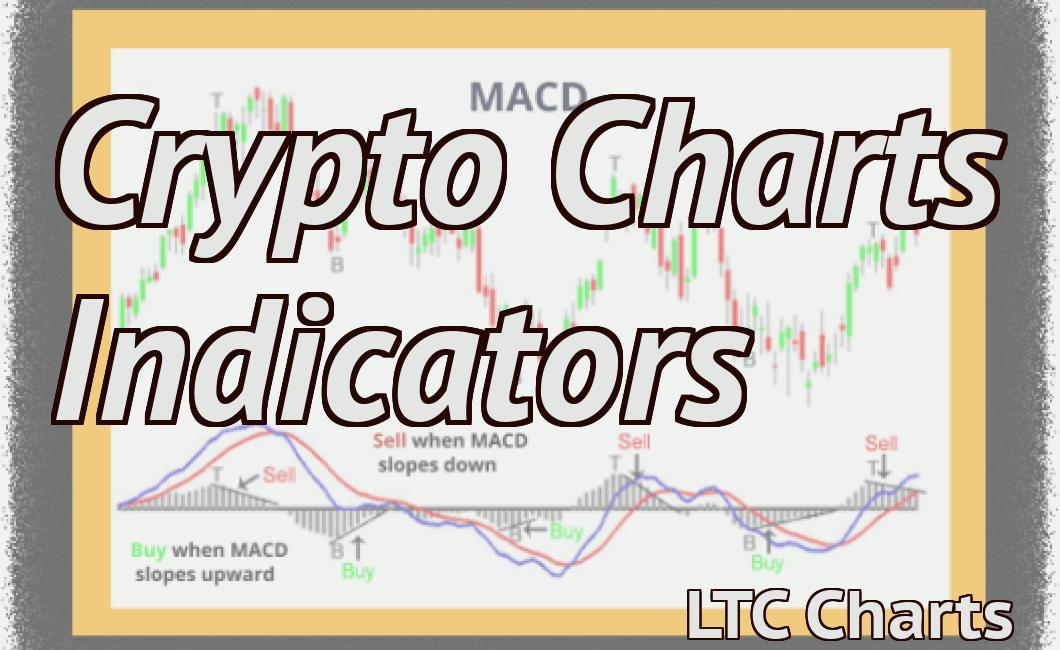

There are many benefits to using candlestick charts for cryptocurrency trading. They are easy to use, provide a visual representation of price action, and can be combined with other technical indicators to help make informed trading decisions.

Candlestick charts are a visual representation of price action. The colors of the candlesticks represent the prices at specific points in time. On a candlestick chart, the open, high, low, and close prices are represented by the color of the candlestick.

The main benefits of using candlestick charts for cryptocurrency trading are:

1. Candlestick charts are easy to use.

2. Candlestick charts provide a visual representation of price action.

3. Candlestick charts can be combined with other technical indicators to help make informed trading decisions.

How to Use Candlestick Charts to Trade Cryptocurrency

Candlestick charts are a type of technical analysis chart that is used to trade cryptocurrencies.

When you are using candlestick charts to trade cryptocurrencies, you need to first understand what they are and how they work. Candlestick charts are made up of two types of bars: the open and the close. The open bar represents the price of a security at the beginning of the trading day, and the close bar represents the price of that security at the end of the trading day.

Candlestick charts are divided into four quadrants. The left side of the chart represents prices that are lower than the open price, and the right side represents prices that are higher than the open price. The middle section of the chart represents prices that are in between the open and close prices.

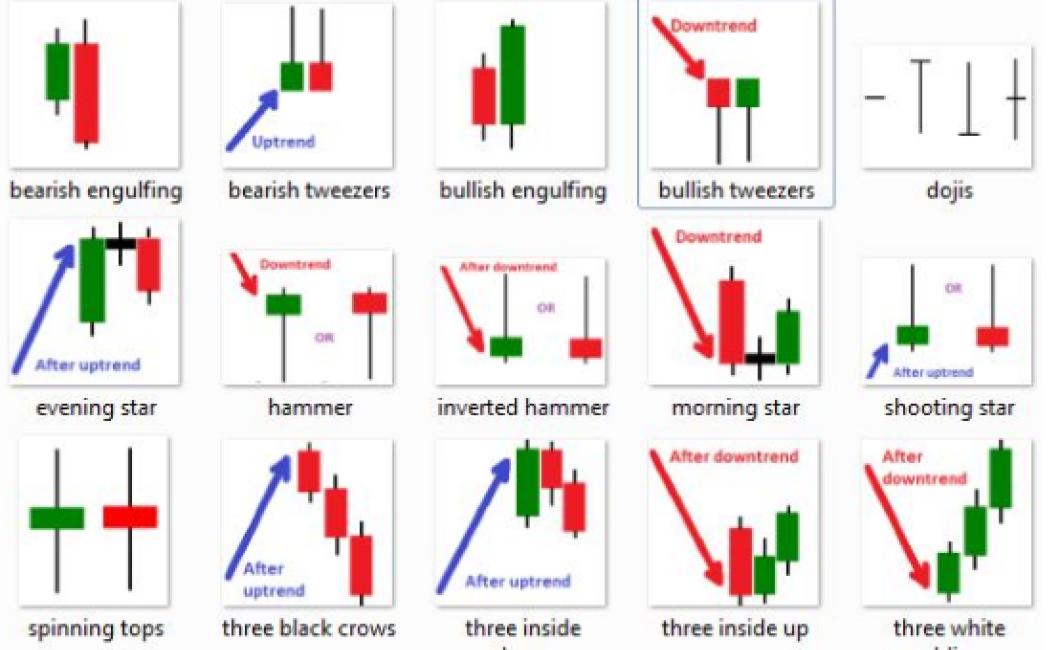

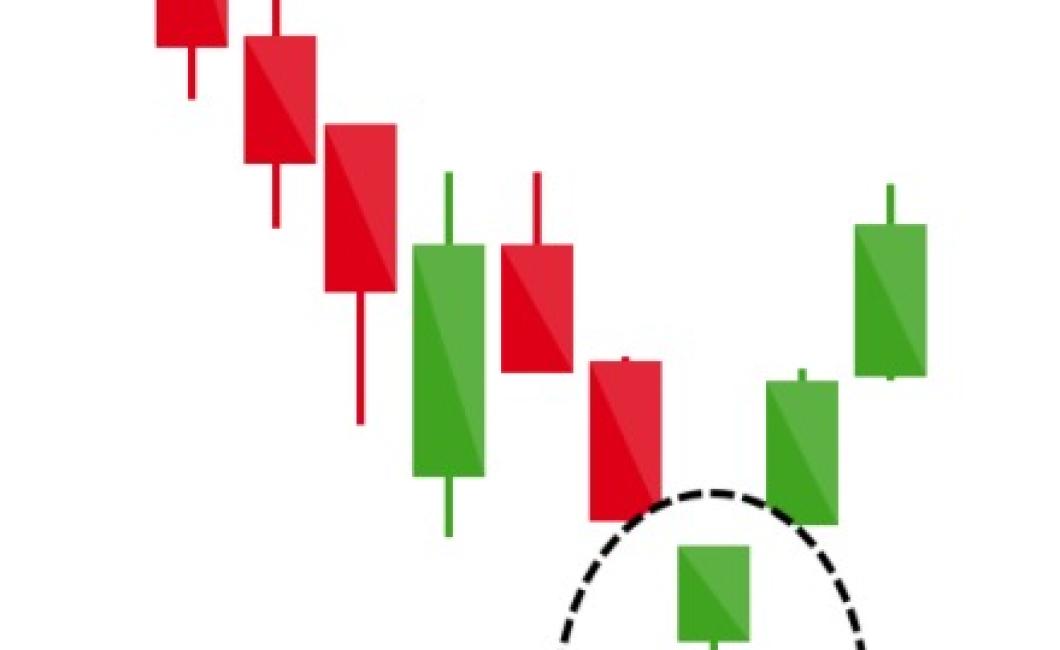

When you are looking to buy or sell a cryptocurrency, you will want to look for patterns in the candlestick charts. Patterns can include:

Bullish Patterns: These patterns indicate that the price of a cryptocurrency is going up. When a bull pattern is formed, the open and close prices are usually higher than the middle section of the chart.

These patterns indicate that the price of a cryptocurrency is going up. When a bull pattern is formed, the open and close prices are usually higher than the middle section of the chart. Bearish Patterns: These patterns indicate that the price of a cryptocurrency is going down. When a bear pattern is formed, the open and close prices are usually lower than the middle section of the chart.

These patterns indicate that the price of a cryptocurrency is going down. When a bear pattern is formed, the open and close prices are usually lower than the middle section of the chart. Range Patterns: Range patterns indicate that there is uncertainty about the direction of the price of a cryptocurrency. When a range pattern is formed, the open and close prices are within a certain range, but they can be different from one another.

Range patterns indicate that there is uncertainty about the direction of the price of a cryptocurrency. When a range pattern is formed, the open and close prices are within a certain range, but they can be different from one another. Doji Patterns: Doji patterns are a type of Japanese candlestick pattern. They indicate that there is indecision about the future direction of the price of a cryptocurrency.

Candlestick charts can also be used to predict future prices. When you see a pattern on a candlestick chart, you can use that information to make predictions about what the future price of a cryptocurrency will be.

The Different Types of Crypto Candlestick Charts

There are many types of crypto candlestick charts, but the most popular ones are the bullish and bearish candlestick charts.

Bullish Candlestick Chart

A bullish candlestick chart is used to show whether the price of a cryptocurrency is rising or falling. The colors used in a bullish candlestick chart are green for up and red for down.

Bearish Candlestick Chart

A bearish candlestick chart is used to show whether the price of a cryptocurrency is falling or rising. The colors used in a bearish candlestick chart are blue for up and black for down.

How to Create a Crypto Candlestick Chart

A crypto candlestick chart is a graphical representation of the performance of a cryptocurrency over a given period of time. Candlestick charts are often used to visualize price movements, and can be used to identify patterns in price movement.

To create a crypto candlestick chart, first open a charting platform of your choice. Next, select the " candles " chart type. Once the chart is open, select the " Candlestick Chart " tab.

To create a candlestick chart, first select the " candles " chart type.

Next, select the " Candlestick Chart " tab.

On the Candlestick Chart tab, click on the " Create New Candle Chart " button.

On the Candlestick Chart Creation wizard, enter the following information:

Candlestick Name: The name of the candlestick chart.

The name of the candlestick chart. Date Range: The date range for which you want to produce the candlestick chart.

The date range for which you want to produce the candlestick chart. Timeframe: The timeframe for which you want to produce the candlestick chart.

The timeframe for which you want to produce the candlestick chart. Type: The type of data you want to visualize in the candlestick chart (price, volume, etc.).

The type of data you want to visualize in the candlestick chart (price, volume, etc.). Colors: The colors for the candles.

The colors for the candles. Stroke Width: The width of the stroke used to draw the lines in the candlestick chart.

The width of the stroke used to draw the lines in the candlestick chart. Line Style: The style of the line used to draw the candles in the candlestick chart.

The style of the line used to draw the candles in the candlestick chart. Axes: If you want to add axes to your chart, select " Yes ". If you do not want to add axes, select " No ".

If you want to add axes to your chart, select " ". If you do not want to add axes, select " ". Package: If you want to include a legend in your candlestick chart, select " Yes ". If you do not want a legend, select " No ".

Click on the " Create New Candle Chart " button to create your new crypto candlestick chart.

The Advantages of Using Candlestick Charts for Cryptocurrency

Candlestick charts are a popular way to visualize and analyze cryptocurrency prices. They provide a visual representation of how the price of a particular cryptocurrency is changing over time. They are also useful for detecting trends and for timing trades.

One of the main advantages of using candlestick charts is that they are easy to understand. Candlestick charts are made up of two types of bars: the open and close bars. The open bar shows the price at the start of the chart and the close bar shows the price at the end of the chart. The colored candlesticks that make up the chart indicate how much the price has changed between these bars.

Candlestick charts are also useful for identifying opportunities. If you are looking to buy or sell a cryptocurrency, you can use candlestick charts to determine when the price is at its highest or lowest point. This information can help you make informed decisions about whether or not to buy or sell.

Finally, candlestick charts are useful for timing trades. You can use them to determine when it is best to buy or sell a cryptocurrency. By timing your trades in this way, you can maximize your profits.