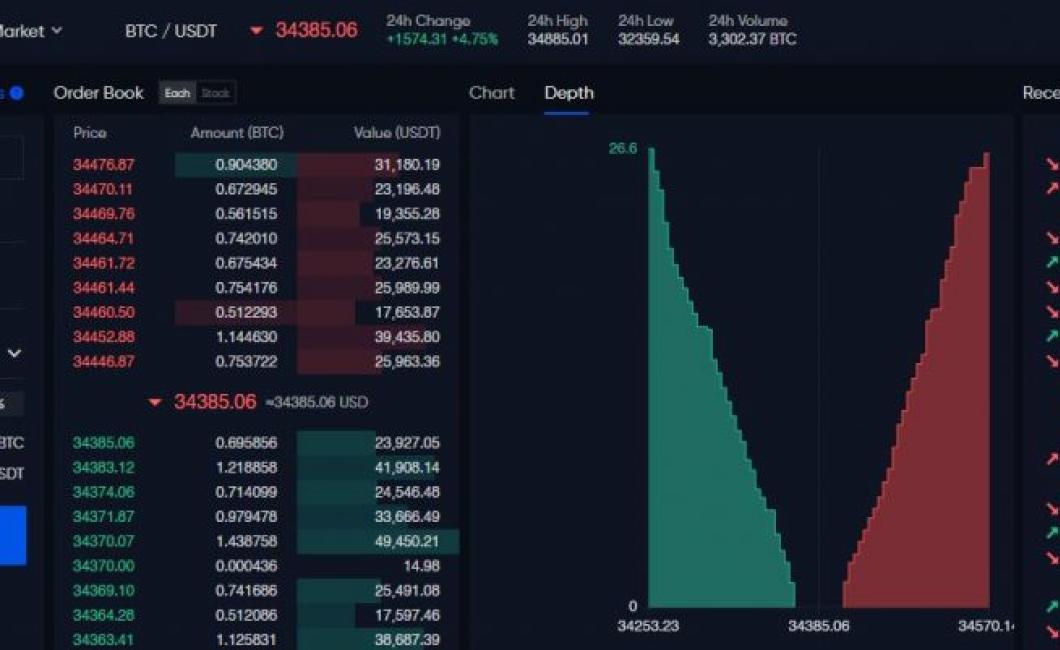

Buy walls in depth charts crypto.

If you're looking to get involved in the world of cryptocurrency, one of the first things you'll need to do is find a reputable exchange to buy walls in depth charts crypto. Luckily, we've done the research for you and compiled a list of the best exchanges out there.

Why You Shouldn't Ignore Wall Street's Take on Crypto

No one knows exactly what the future of cryptocurrencies holds, but as long as Wall Street remains bullish on the space, you should continue to invest.

Wall Street's opinion is important, because it sets the tone for the rest of the market. If Wall Street is bullish on a particular asset, then other investors will likely follow suit. Conversely, if Wall Street is bearish, then the majority of investors will likely sell off their holdings.

Cryptocurrencies have been volatile in recent months, but that's to be expected given their young market status. As long as the trend continues and the underlying technology remains sound, you should continue to invest in this growing sector.

Why You Shouldn't Only Listen to Wall Street on Crypto

When it comes to investing in cryptocurrency, it's important to remember that there are a variety of different opinions out there.

Some people believe that cryptocurrencies are the future, while others believe that they're nothing more than a scam.

Therefore, it's important to listen to a variety of opinions when it comes to cryptos.

Some of the most credible sources of information about cryptocurrencies are Wall Street analysts.

However, it's important to remember that these analysts are paid to provide positive commentary about the industry.

Therefore, it's important to take their comments with a grain of salt.

Additionally, it's important to remember that Wall Street is often inconsistent when it comes to its predictions about cryptocurrencies.

For example, one day they may believe that cryptos are a legitimate investment opportunity, while the next day they may say that they're a scam.

Therefore, it's important to do your own research when it comes to cryptocurrencies.

This is especially important if you're unsure about whether or not you should invest in them.

Instead of listening only to Wall Street, it's important to listen to a variety of sources of information in order to make an informed decision.

How do Wall Street Analysts Feel About Crypto?

Cryptocurrencies are typically seen as volatile investments, with analysts predicting that the market will go up and down in value. While there is some interest from Wall Street in cryptocurrencies, many believe that the market is still too young and speculative to be considered a serious investment option.

What Do Wall Street's Charts Say About Crypto?

Cryptocurrencies are highly volatile and can experience large swings in value over short periods of time. Many people consider cryptocurrencies to be a high-risk investment.

Cryptocurrencies are not regulated by a government or financial institution, which may increase their risk. Cryptocurrencies are also vulnerable to cyberattacks.

Some Wall Street analysts have begun to invest in cryptocurrencies, but this is still a relatively small part of their overall investment strategy.

What is Wall Street's Overall Take On Crypto?

There is no one definitive answer to this question, as the opinions of Wall Street analysts and investors vary greatly. Some believe that cryptocurrencies are a legitimate investment opportunity, while others view them as a risky and speculative investment.

Why You Should Pay Attention to Wall Street's Analysis of Crypto

Cryptocurrencies are a new and rapidly growing asset class. As such, there is a lot of speculation and hype surrounding them. This makes it difficult for Wall Street to provide objective analysis of cryptocurrencies.

However, some Wall Street firms have started to offer analysis of cryptocurrencies. This analysis can help you understand the risks and rewards of investing in cryptocurrencies.

Keep in mind that Wall Street's analysis is not always accurate. However, it can be a useful guide to help you decide whether or not to invest in cryptocurrencies.

What Wall Street's Depth Charts Tell Us About Crypto

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often divided into two categories: digital currencies and virtual currencies. Digital currencies are based on blockchain technology, which is a distributed ledger that allows for secure, transparent and tamper-proof transactions. Virtual currencies are not based on blockchain technology, but are instead based on a virtual currency that uses cryptography to secure its transactions.

What Wall Street Is Saying About Crypto In Their Depth Charts

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an unknown person or group of people who called themselves Satoshi Nakamoto. Bitcoin is unique in that there are a finite number of them: 21 million. They can be traded on decentralized exchanges and can also be used to purchase goods and services.

Other popular cryptocurrencies include Ethereum, Ripple, and Litecoin. Ethereum is notable for its smart contracts feature, which allows for automated, self-executing transactions. Ripple is popular for its ability to move money quickly and cheaply across the globe. Litecoin is known for its high level of security and its ability to handle large transactions.

Wall Street Weighs In On Crypto: What The Depth Charts Show

Cryptocurrencies have been on the rise in recent months, with prices of some digital assets soaring into the stratosphere. But while the market is still in its early stages, some experts believe that the bubble could burst at any time.

One measure of the cryptocurrency market’s depth is the total value of all outstanding digital assets. According to a recent report by CoinMarketCap, the total value of all cryptocurrencies is now more than $280 billion.

However, while this is a significant figure, it is not as high as it was at the beginning of the year. In January, the total value of cryptocurrencies was more than $4.5 trillion.

Many experts believe that the market is still in its early stages and that it could burst at any time. This is partly due to concerns about the legitimacy of cryptocurrencies and their ability to withstand regulatory scrutiny.

But while the market is still in its early stages, some experts believe that there are a number of potential applications for cryptocurrencies. These applications include payments systems, digital asset exchanges, and even digital currencies themselves.

Cryptocurrencies have been on the rise in recent months, with prices of some digital assets soaring into the stratosphere. But while the market is still in its early stages, some experts believe that the bubble could burst at any time.