Stock Charts Crypto

Stock charts for crypto show the trading activity for various cryptocurrencies on different exchanges. The charts can be used to track price movements and identify trends.

How to Read Stock Charts for Crypto Success

There are a few things you should keep in mind when reading stock charts for crypto success.

First and foremost, always remember to do your own research before investing in any kind of cryptocurrency. This includes stock charts!

Secondly, pay attention to the technical indicators on the chart. These can give you an idea of how a particular cryptocurrency is performing.

And finally, don't forget to stay patient. Cryptocurrencies are still in their early stages and there are a lot of risks involved. So don't get too excited if a particular coin goes up in price quickly – there's always the potential for it to crash back down again later on.

3 Simple Tips for Interpreting Stock Charts for Crypto Trading

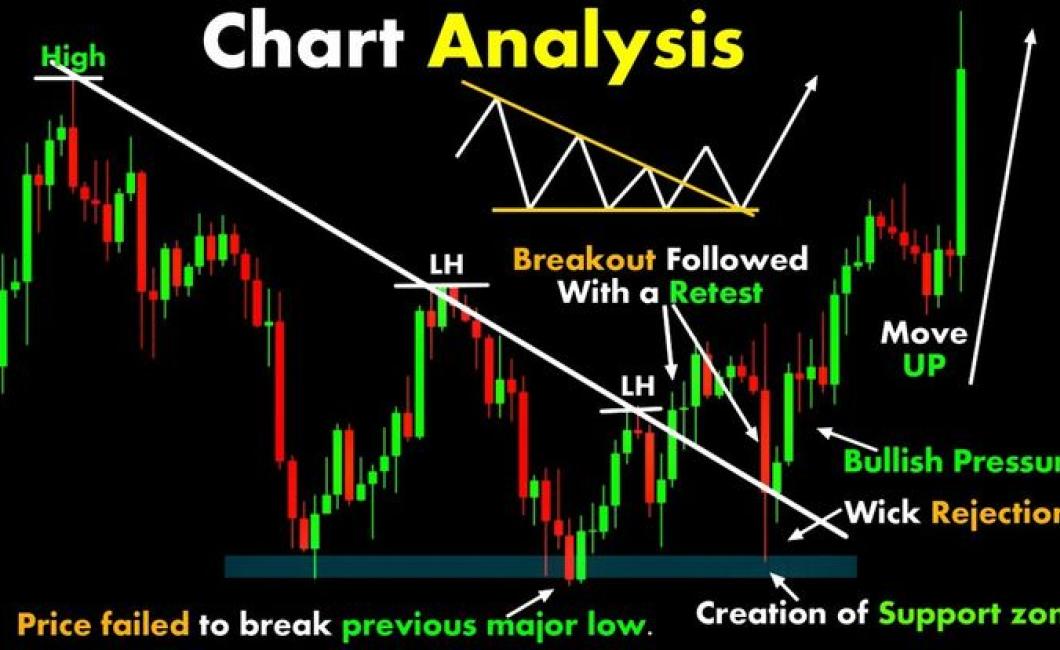

1. Use technical analysis to identify trends and patterns.

2. Look for indicators that support or contradict the trend.

3. Use charts to determine when to buy or sell.

Secrets to reading stock charts like a pro – with crypto trading in mind

Cryptocurrency trading has made stock charts more complex than ever. Here are some tips to help you read them like a pro:

1. Pay attention to volume. High volume indicates that investors are buying and selling shares, which means they believe the stock is worth buying. Low volume indicates that investors are selling shares, which means they believe the stock is worth selling.

2. Look for clusters of green and red. When stocks are moving sharply in either direction, they often move within close proximity to each other on the chart. This means that there’s likely something important happening that warrants attention.

3. Watch the trendlines. A trendline is a line on a stock chart that shows the direction of the trend. When a stock is moving up or down, it will usually follow a trendline in that direction. If the stock breaks the trendline, that means it’s likely headed in a different direction.

4. Check the indicators. Many stock charts include indicators that show how the stock is performing relative to other stocks in the same category. You can use these indicators to help determine whether the stock is over or undervalued.

How to trade crypto using stock charts like a boss

Step 1: Create an account on a cryptocurrency exchange

The first step is to create an account on a cryptocurrency exchange. There are a number of options available, so find one that is suited to your needs. Popular exchanges include Binance, Coinbase, and Bitfinex.

Step 2: Deposit your fiat currency

Once you have created an account on the exchange, the next step is to deposit your fiat currency. This can be done using either a bank transfer or a debit/credit card.

Step 3: Trade crypto using stock charts

Now that you have your funds deposited and your account set up, the next step is to trade crypto using stock charts.

To start off, find a cryptocurrency that you want to trade. For example, if you are trading Bitcoin, you would look for Bitcoin charts.

Next, find a stock that you want to use as a reference point. For example, if you are trading Bitcoin against the US dollar, you would look for the US dollar charts.

Finally, use the stock chart to find the appropriate price for your cryptocurrency. For example, if you are trading Bitcoin against the US dollar, you would look for the US dollar price at which Bitcoin was trading at the time that you opened the trade.

Stock charting for crypto trading – what works, and what doesn't

Cryptocurrency trading can be a very profitable investment, but it's also a very risky one. There are a number of different ways to track cryptocurrency prices, and each has its own benefits and drawbacks.

Some popular methods for tracking cryptocurrency prices include:

1. CoinMarketCap

CoinMarketCap is one of the most popular sources of cryptocurrency market data. It provides real-time prices for a wide range of cryptocurrencies, as well as detailed historical data. CoinMarketCap is useful for tracking overall cryptocurrency prices and for identifying trends.

However, CoinMarketCap is not the only source of cryptocurrency market data. Additionally, some exchanges offer their own separate market data feeds. So, if you're interested in tracking prices for a specific cryptocurrency, you'll need to look for an exchange that offers that data.

2. TradingView

TradingView is another popular source of cryptocurrency market data. It provides live charts and data analysis for a wide range of cryptos. TradingView is useful for tracking individual cryptocurrencies and for gauging short-term price trends.

However, TradingView does not provide real-time prices for all cryptocurrencies. So, if you're interested in tracking prices for a specific cryptocurrency, you'll need to look for an exchange that offers that data.

3. Coinigy

Coinigy is another popular source of cryptocurrency market data. It provides live charts and data analysis for a wide range of cryptos, as well as detailed historical data. Coinigy is useful for tracking overall cryptocurrency prices and for identifying trends.

However, Coinigy is not the only source of cryptocurrency market data. Additionally, some exchanges offer their own separate market data feeds. So, if you're interested in tracking prices for a specific cryptocurrency, you'll need to look for an exchange that offers that data.

4. TradingCrates

TradingCrates is a new platform that provides live charts and data analysis for a range of cryptos. TradingCrates is useful for tracking individual cryptocurrencies and for gauging short-term price trends.

However, TradingCrates does not provide real-time prices for all cryptocurrencies. So, if you're interested in tracking prices for a specific cryptocurrency, you'll need to look for an exchange that offers that data.

How to make money from crypto trading by reading stock charts

If you want to make money from cryptocurrency trading, it's important to have a basic understanding of stock charts. When you're looking at a stock chart, you're looking at a visual representation of the performance of a particular company over time.

To start trading cryptocurrency, you'll first need to purchase some Bitcoin or Ethereum. Once you have your coins, you can start trading them on various exchanges. To make money from cryptocurrency trading, it's important to track the prices of the coins you're trading and to understand how they're moving overall.

To track prices, you can use a trading platform like CoinMarketCap.com. This website will show you the prices of different cryptocurrencies across a number of different exchanges. You can also use this information to try and predict which coins will be worth more in the future.

Finally, it's important to remember that cryptocurrency trading is a highly speculative market. This means that there's a high risk of losing your money if you don't make careful decisions. If you want to make money from cryptocurrency trading, be sure to do your research and make sure you understand the risks involved.

2 essential tips for reading stock charts when trading cryptocurrency

1. Understand what you are looking at. A good place to start is understanding the technical indicators used in stock charts. These can help you to identify trends and understand how the market is behaving.

2. Use chart patterns. Chart patterns are visual indicators that can help you to identify buying or selling opportunities. They can be identified by looking for specific patterns that repeat themselves over time.

3. Use volume to your advantage. When trading cryptocurrencies, volume is important. This refers to the amount of shares traded per unit of time. When the volume is high, it is often a sign that the market is active and that there are good buying and selling opportunities.

4. Use technical analysis to help you make informed decisions. Technical analysis is the use of charts and other data to make informed investment decisions. It can help you to identify potential trends and price movements.

How to read stock charts – an amateur's guide to crypto trading success

Cryptocurrencies are a volatile investment and can be very dangerous to invest in without proper knowledge and understanding. This guide is for those who want to learn how to read stock charts and trade cryptocurrencies.

Before you start trading, it is important to have a general understanding of what a stock chart is and how it works. A stock chart is a graphical representation of the performance of a company's stock. It shows the price of the stock over a period of time and can help you identify trends and patterns.

When you're looking at a stock chart, you need to pay attention to the following:

1. The Y-Axis: The Y-Axis shows the price of the stock over time.

2. The X-Axis: The X-Axis shows the percentage change in the stock price over time.

3. The Line: The Line shows the trend of the stock over time.

4. The Candles: The Candles show how many stocks are above or below the Line.

5. The Volume: The Volume shows how much money has been exchanged in the stock market over time.

6. The Supply and Demand: The Supply and Demand shows how much supply and demand there is for the stock.

7. The Histogram: The Histogram shows how distribution of the stocks in the market is.

8. The Support and Resistance Levels: The Support and Resistance Levels show where the stock price is expected to go in the future.

9. The Percentage Gain or Loss: The Percentage Gain or Loss shows how much the stock has increased or decreased compared to its original value.

10. The Open, High, Low, and Close: The Open, High, Low, and Close show when the stock opened, highest price it reached, lowest price it reached, and the closing price of the stock.

Now that you know what a stock chart is and how to use it, it's time to learn how to trade stocks. When you're trading stocks, you need to pay attention to the following:

1.The Price: The Price is what you're buying or selling the stock for.

2.The Volume: The Volume is how many units of the stock have been traded.

3.The Moving Averages: The Moving Averages show where the price is likely to go in the short-term.

4.The Bollinger Bands: The Bollinger Bands show where the price is likely to go in the medium-term.

5.The Relative Strength Index (RSI): The RSI shows how strong the current trend is.

6.The Commodity Channel Index (CCI): The CCI shows how much pressure there is on the commodity prices.

7.The Stochastic Oscillator: The Stochastic Oscillator shows how much noise is in the market.

8.The Fibonacci Retracement Levels: The Fibonacci Retracement Levels show where the stock has been in the past and where it is expected to go in the future.

9.The Stop Loss Order: The Stop Loss Order lets you sell the stock if it reaches a certain price.

10.The Take Profit Order: The Take Profit Order lets you buy the stock if it reaches a certain price.