How To Mark Date On Crypto Charts

If you're new to the world of cryptocurrency, you may be wondering how to mark the date on crypto charts. There are a few different ways to do this, and which one you use will likely depend on the exchange or wallet you're using. Here's a quick guide to help you get started.

How to Read Crypto Charts

Cryptocurrency charts are a valuable tool for traders and investors. By understanding how to read crypto charts, you'll be able to make informed decisions about where to invest and trade.

Cryptocurrency charts are made up of a series of lines that represent the price of a cryptocurrency over time. The height of each line represents the price of the cryptocurrency at a certain point in time.

The color of each line on a crypto chart indicates whether the price is increasing, decreasing, or staying the same. The direction of the line also indicates whether the price is rising, falling, or staying the same.

Cryptocurrencies can be volatile, so it's important to keep an eye on the trend of each cryptocurrency's price. If you see a cryptocurrency's price start to drop, it's important to sell your holdings before they lose all value.

If you're new to trading or investing in cryptocurrencies, it's important to be aware of the risks associated with these markets. Make sure to do your research before investing in any digital assets.

How to Use Technical Analysis for Crypto Trading

Technical analysis is a form of analysis that looks at historical price patterns to predict future prices. It is often used by traders to help make informed decisions about where to invest in digital currencies and other securities.

There are a few key steps that you need to take to use technical analysis for cryptocurrency trading.

1. Understand the Technical Indicators

The first step is to understand the various technical indicators that are available. These indicators can help you identify trends, assess risks, and make informed investment decisions.

Some of the most common technical indicators used for cryptocurrency trading include the Bollinger Bands, the MACD, and the RSI.

2. Analyze the Price Patterns

Once you have identified the relevant technical indicators, the next step is to analyze the price patterns. This involves looking at how prices have changed over time and identifying any patterns.

You can use this information to make informed investment decisions and to forecast future prices.

3. Use the Data to Make Decisions

Finally, you need to use the data to make informed decisions about where to invest in cryptocurrency and other securities. This involves assessing the risks involved and making an informed decision about whether to buy or sell.

The Most Important Crypto Chart Patterns

If you're looking to make money trading cryptocurrencies, then you need to be aware of crypto chart patterns. Crypto chart patterns are identified by technical traders and can provide valuable clues about the health of a cryptocurrency's price.

Here are the most important crypto chart patterns:

1. bullish candlestick pattern: A bullish candlestick pattern indicates that the price of a cryptocurrency is rising. This pattern is made up of two candlesticks: the first one is filled with green or blue colors, which indicates an increase in price. The second candle is usually smaller and has a red or black color, which confirms the trend.

2. bearish candlestick pattern: A bearish candlestick pattern indicates that the price of a cryptocurrency is dropping. This pattern is made up of two candlesticks: the first one is filled with red or black colors, which confirms the trend. The second candle is usually smaller and has a green or blue color, which indicates a decrease in price.

3.hammer pattern: The hammer pattern is a technical indicator that indicates that the price of a cryptocurrency is about to increase significantly. This pattern is made up of two consecutive hammer candles, which indicate an increase in price.

4. HODLing: HODLing is a term used to describe the act of holding a cryptocurrency rather than selling it. HODLing indicates that a cryptocurrency investor believes that the price of the cryptocurrency will rise in the future.

How to Spot Trends in Crypto Charts

The first step in spotting trends in crypto charts is to identify the key indicators that you are interested in tracking. Some of the most important indicators to watch for include:

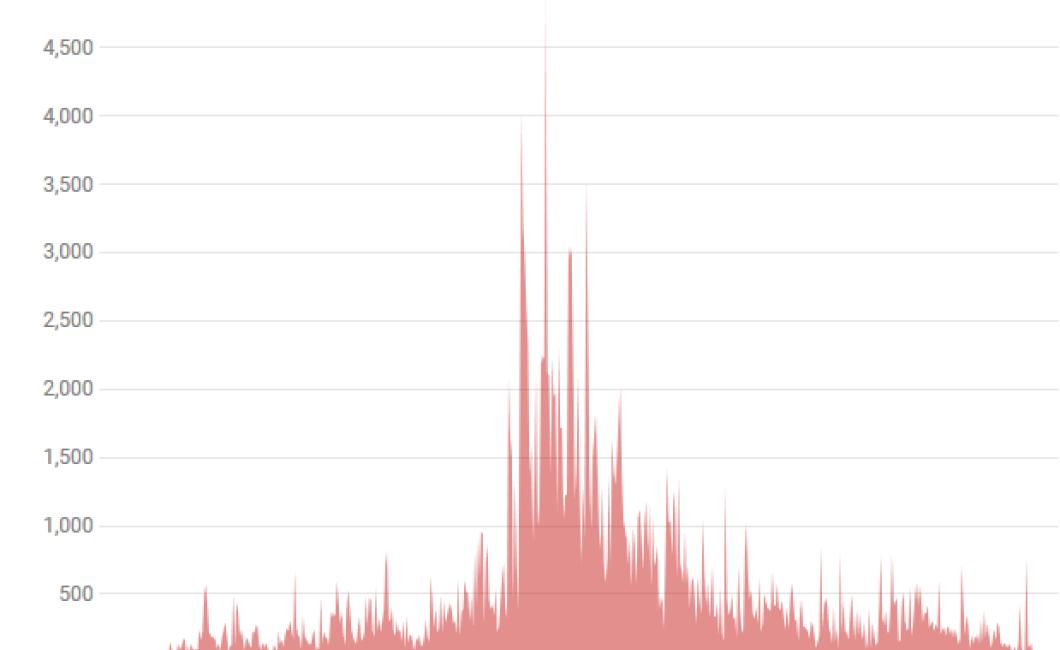

1. Volume: This is one of the most important indicators to watch for because it shows how active the market is. The higher the volume, the more active the market is.

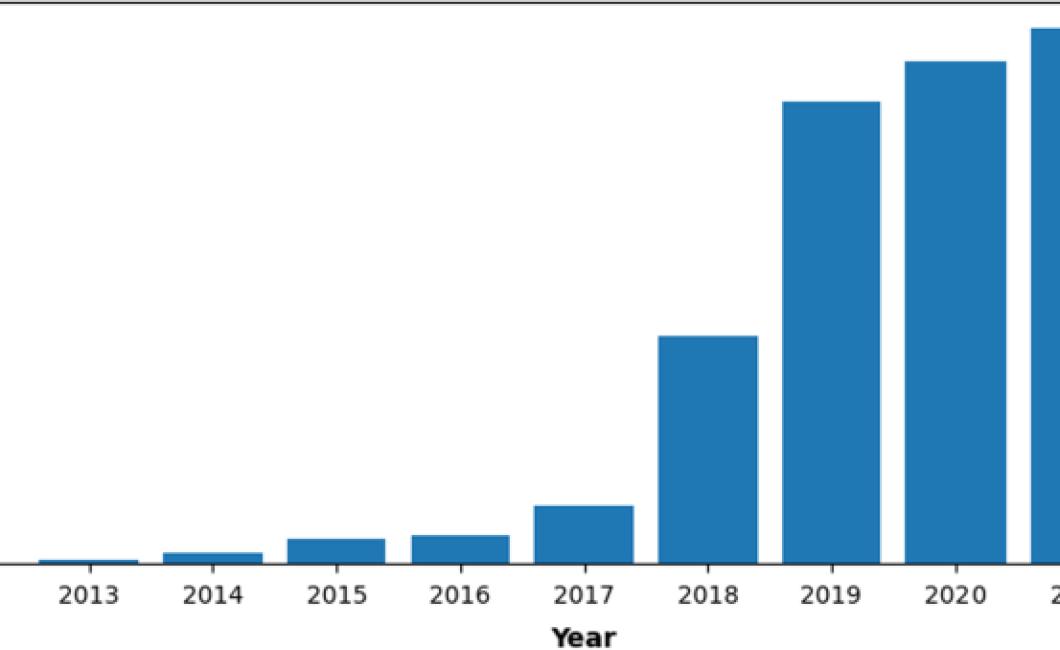

2. Price: The price of a cryptocurrency is typically a good indicator of its overall health. If the price is dropping, it may be a sign that the market is in decline. Conversely, if the price is rising rapidly, it may be a sign that the market is experiencing an uptrend.

3. Momentum: This indicator measures how much the price has risen or fallen over a certain period of time. If the momentum is positive, this means that the price has increased over that time period. If the momentum is negative, this means that the price has decreased over that time period.

4. Supply and Demand: Supply and demand are important because they determine how strong the demand for a cryptocurrency is. If there is high demand for a cryptocurrency, this will drive up the price. Conversely, if there is low demand for a cryptocurrency, this will drive down the price.

5. Technical Indicators: Technical indicators are indicators that are used to measure how a cryptocurrency is performing technically. Some of the most popular technical indicators include the Bollinger Bands, MACD, and RSI.

How to Find Support and Resistance Levels in Crypto Charts

To find support and resistance levels in crypto charts, you will need to understand the charting tools and how they work.

The first step is to identify the trend. In order to do this, you will need to look at the chart and see if there is a clear upward or downward trend. If there is, then you can use that trend to help you identify support and resistance levels.

If the trend is not clear, then you will need to look at the overall market conditions. This includes looking at price action, volume, and other indicators. If these conditions are supportive of the trend, then you can use that as support. If not, then you can use that as resistance.

Once you have identified support and resistance levels, you will need to place buy and sell orders at those levels. This will help you gain control over the price of the asset and ensure that you make profits.

Trading Cryptocurrencies with Japanese Candlesticks

Japanese candlesticks are used to track the prices of cryptocurrencies. They are an efficient way to monitor price movements.

To use Japanese candlesticks, open a trading account with a Japanese exchange and deposit funds into it. Import the Japanese candlestick chart into your trading platform.

Start by buying the cryptocurrency at the bottom of the candlestick. Sell the cryptocurrency at the top of the candlestick. Repeat this process until you have sold all of your holdings.