Book Reading Charts Crypto

This article discusses book reading charts that can be used to track cryptocurrency prices. The article includes a link to a Google Sheets template that can be used to create a chart.

book reading charts crypto: The Top 5 Books to Read If You Want to Learn About Cryptocurrency

Cryptocurrency is a new and rapidly growing field. If you want to learn more about it, these are the five books you should read.

1. Bitcoin: A New Era of Cryptocurrency by Paul Vigna and Michael J. Casey

This book is the seminal work on Bitcoin and cryptocurrency in general. It provides a comprehensive overview of Bitcoin, its history, and the technology that makes it work.

2. Mastering Bitcoin: Unlocking Digital Cryptocurrencies by Andreas Antonopoulos

This book is by one of the most well-known and trusted voices in the Bitcoin community. It teaches you how to use Bitcoin and other digital currencies for your own benefit.

3. The Mind of Bitcoin: How a Decentralized Virtual Currency Is Changing Money, Business, and the World by Andreas Antonopoulos

This book expands on the ideas presented in Mastering Bitcoin. It explores the philosophical underpinnings of Bitcoin and how they have influenced the development of cryptocurrency.

4. The Internet of Money: How Bitcoin, Blockchain, and Other Cryptocurrencies Are Changing Banking, Finance, and the Global Economy by Don Tapscott and Anthony D. Williams

This book provides a comprehensive overview of how cryptocurrencies are changing the way we use money. It discusses the history of Bitcoin and other cryptocurrencies, as well as their potential future applications.

5. Mastering Ethereum: Building Smart Contracts and Decentralized Applications by Vlad Zamfir, Gavin Wood, and Joseph Lubin

This book teaches you how to build decentralized applications (dapps) using Ethereum. It covers topics such as smart contracts, dapp security, and scaling Ethereum applications.

book reading charts crypto: A Beginner's Guide to Reading Cryptocurrency Charts

Cryptocurrency charts are a great way to get an overview of the current performance of a cryptocurrency. By understanding the charts, you can make informed investment decisions.

There are a variety of different types of cryptocurrency charts, so it can be hard to know which one to use. To help you get started, we have created a beginner's guide to reading cryptocurrency charts.

Types of Cryptocurrency Charts

Before you can understand cryptocurrency charts, you need to understand what they are measuring. Cryptocurrency charts typically show the price of a cryptocurrency over a given period of time.

There are two main types of cryptocurrency charts: horizontal and vertical.

Horizontal cryptocurrency charts show the price of a cryptocurrency over a period of time. The x-axis shows the date and the y-axis shows the price.

Vertical cryptocurrency charts show the value of a cryptocurrency over a period of time. The x-axis shows the date and the y-axis shows the value of a cryptocurrency.

Understanding Cryptocurrency Chart Patterns

Cryptocurrency chart patterns are indicators of how the market is behaving. They can help you make informed investment decisions.

Some common cryptocurrency chart patterns include:

A head-and-shoulders pattern is when the price rises sharply and then falls again.

A double bottom is when the price falls sharply and then rises again.

A bull flag is when the price is rising rapidly and has formed a flag pattern.

A bear flag is when the price is falling rapidly and has formed a flag pattern.

Understanding Cryptocurrency Volatility

Cryptocurrency volatility is the degree to which the price of a cryptocurrency changes over time. It is measured in percentage terms.

There are three main types of volatility:

Bull markets are when the price of a cryptocurrency rises rapidly.

Bear markets are when the price of a cryptocurrency falls rapidly.

Range markets are when the price of a cryptocurrency remains relatively stable.

book reading charts crypto: How to Use Candlestick Charts to Trade Cryptocurrency

Candlestick charts are a great way to understand what's going on in the market, and they can also be used to trade cryptocurrencies.

Here's how to use candlestick charts to trade cryptocurrency:

1. Open a chart for the cryptocurrency you want to trade.

2. Find the candlestick charting indicator you want to use.

3. Look for the candle that corresponds to the price you're interested in.

4. Compare the candle's open and close prices to see what kind of movement occurred.

5. Based on that information, decide whether to buy or sell.

book reading charts crypto: How to Read Cryptocurrency Order Books

Reading cryptocurrency order books can provide insights into the behavior of buyers and sellers of digital assets. These books can help you identify trends and patterns in the market.

To read a cryptocurrency order book, you will need to gather the following information:

The date of the book

The time of the book

The price of a digital asset at the time of the book

The size of the order book

Once you have this information, you can use it to analyze the order book.

Here are some tips for reading cryptocurrency order books:

Look at the size of the order book. The larger the order book, the more liquid the market is. This means that there are more buyers and sellers of the asset, which allows you to track prices more accurately.

Look at the price and volume of digital assets. If a digital asset is trading at a high price and volume, it likely has strong demand. Conversely, if a digital asset is trading at a low price and volume, it likely has weak demand.

Look for trends. For example, if you see a large number of buy orders at a low price, this may be an indication that the price of the digital asset will soon rise. Conversely, if you see a large number of sell orders at a high price, this may be an indication that the price of the digital asset will soon fall.

book reading charts crypto: Technical Analysis for Cryptocurrency Trading

Cryptocurrency trading can be a very exciting and profitable activity. However, it is important to understand the basics of technical analysis before you start trading. This reading chart provides an overview of how traders use technical analysis to make decisions about buying and selling cryptocurrencies.

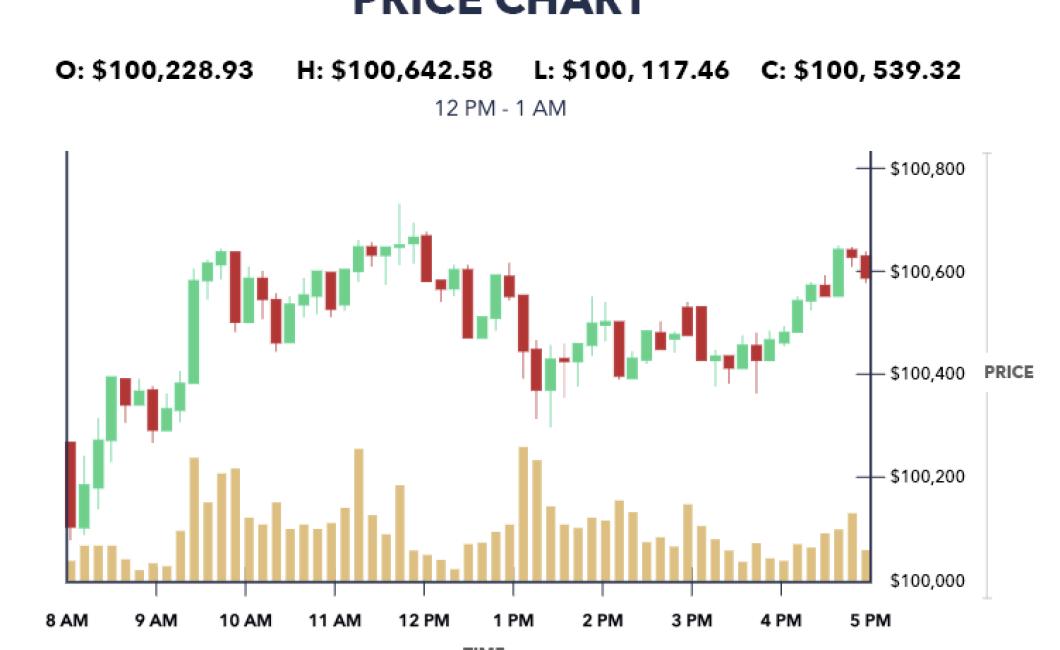

The first thing to look at is the price chart. This shows the price of a cryptocurrency over time. You will notice that the price often goes up and down.

The next thing to look at is the technical indicators. These are charts that show how the price is behaving. You will see things like the RSI (Relative Strength Index) and the MACD (Moving Average Convergence Divergence).

The last thing to look at is the chart analysis. This includes things like trend lines and Fibonacci retracement levels. These can help you decide whether you should buy or sell a cryptocurrency.

book reading charts crypto: How to Read Cryptocurrency Price Charts

Cryptocurrency price charts are a great way to track the prices of various digital currencies. This guide will show you how to read cryptocurrency price charts.

The first thing to understand is that cryptocurrency price charts are not linear. This means that the prices of cryptocurrencies do not always move in a straight line.

Second, it's important to remember that cryptocurrency prices are often volatile. This means that the prices of cryptocurrencies can go up or down a lot over short periods of time.

Finally, it's important to remember that cryptocurrency prices are not always accurate. This means that they may not always reflect the actual values of the cryptocurrencies.

book reading charts crypto: The Different Types of Cryptocurrency Charts

Cryptocurrency trading is a rapidly growing industry, but it can be difficult to know what to look for when making investment decisions. To help you make informed decisions, we’ve created cryptocurrency reading charts for each type of currency.

Bitcoin Trading Charts

Bitcoin trading charts are a great way to get an overview of the market. You can see how much money people are spending on and selling bitcoin, and what sort of trends are happening.

Ethereum Trading Charts

Ethereum trading charts are similar to bitcoin trading charts, but they show how much ether is being traded. This is important because ether is used to pay for services on the Ethereum network.

Litecoin Trading Charts

Litecoin trading charts are similar to Ethereum trading charts, but they show how much Litecoin is being traded. Litecoin is a more powerful version of bitcoin, and is used as a currency on the Litecoin network.

Cryptocurrency Price Charts

Cryptocurrency price charts are a good way to see how the value of a cryptocurrency is changing over time. You can see how the value of a cryptocurrency has changed over the past day, week, month, or year.

Cryptocurrency Charting Tools

There are a number of cryptocurrency charting tools available online. These tools help you view all the different cryptocurrencies in one place, and make it easier to track your investments.

book reading charts crypto: What do All Those Lines on a Cryptocurrency Chart Mean?

Cryptocurrency charts are a visual representation of the price of a cryptocurrency over time. They can be used to track the performance of a cryptocurrency, and can give investors an idea of how profitable or risky it may be to invest in a particular coin.

book reading charts crypto: How to Spot Trends in Cryptocurrency Charts

Cryptocurrency charts are a great way to spot trends in the market. Here are a few tips to help you spot trends in cryptocurrency charts:

1. Look at the overall trend of the market. Are prices increasing or decreasing? Are there any specific coins or tokens that are performing well?

2. Look at the price chart for individual coins and tokens. Are prices increasing or decreasing more than average? Are there any specific coins or tokens that are performing well?

3. Look at the volume chart for individual coins and tokens. Are prices increasing or decreasing more than average? Are there any specific coins or tokens that are performing well?

4. Look at the market capitalization chart for individual coins and tokens. Are prices increasing or decreasing more than average? Are there any specific coins or tokens that are performing well?

book reading charts crypto: Understanding Support and Resistance in Cryptocurrency Charts

Cryptocurrency charts are a great way to analyze and understand the price movement of a particular cryptocurrency. By understanding support and resistance levels, you can better predict any potential price changes.

Here is a list of key concepts to keep in mind when reading cryptocurrency charts:

Support and Resistance:

Support and resistance are two important concepts to understand when looking at cryptocurrency charts. Support refers to a level of price where buyers are still interested in buying into the cryptocurrency, while resistance refers to a level of price where sellers are still willing to sell the cryptocurrency.

When looking at cryptocurrency charts, it is important to keep in mind the overall trend of the market. If the market is trending up, then support levels will be higher than resistance levels. Conversely, if the market is trending down, then resistance levels will be higher than support levels.

Volume:

Volume is another important factor to consider when analyzing cryptocurrency charts. Volume is used to measure how active the market is and how much interest there is in the particular cryptocurrency. When volume is high, it indicates that there is a lot of interest in the particular cryptocurrency. Conversely, when volume is low, it indicates that there is not much interest in the cryptocurrency.

book reading charts crypto: Using Fibonacci Retracements in Cryptocurrency Trading

A Fibonacci retracement is a technical analysis tool that uses ratios to identify potential support and resistance levels in the market. Fibonacci retracements can be used in conjunction with other technical analysis tools to make better investment decisions.

The Fibonacci retracement tool was developed by Fibonacci, a mathematician who lived in the 12th century. He studied the growth of plants and developed the Fibonacci sequence, which describes the relationship between consecutive numbers. The Fibonacci retracement tool is based on this sequence.

A Fibonacci retracement is a technical analysis tool that uses ratios to identify potential support and resistance levels in the market.

Fibonacci retracements can be used in conjunction with other technical analysis tools to make better investment decisions.

The Fibonacci retracement tool is based on the Fibonacci sequence, which describes the relationship between consecutive numbers. The Fibonacci sequence begins with the number 0 and goes up to 1, 1.5, 2, 3, 5, 8, 13, and so on. The next number in the sequence is the sum of the previous two numbers. For example, the Fibonacci retracement for the stock market index S&P 500 is 38.2%. This means that the next level of support (38.2%) is the level where the S&P 500 dropped from its highest point (February 26, 2018) to its current level (March 9, 2018). The next level of resistance (62.8%) is the level where the S&P 500 increased from its lowest point (February 26, 2018) to its current level.