Crypto prices are haywire.

Cryptocurrency prices are all over the place, with no clear trend. This can make it difficult to predict what will happen next, and can lead to big losses if you're not careful.

Crypto Prices Haywire: Why the sudden surge?

Cryptocurrencies have seen a sudden surge in prices this week. Bitcoin, Ethereum and other cryptocurrencies have all seen their prices skyrocket in value.

There are a few reasons why the prices of cryptocurrencies have spiked recently.

First, there was a rumor that the US Securities and Exchange Commission (SEC) was planning to approve a bitcoin exchange-traded fund (ETF). This would allow everyday investors to buy into bitcoin and other cryptocurrencies.

Second, Japan announced that it would be legalizing cryptocurrency trading. This would make cryptocurrency trading much more mainstream.

And finally, there was a rumor that The BlackRock Group, one of the biggest investment firms in the world, was planning to start trading cryptocurrencies. This would add even more legitimacy to cryptocurrencies.

Crypto Prices Haywire: Is this the new normal?

Cryptocurrencies have seen wild price swings in recent months, with some coins doubling or even tripling in value in a matter of days. Is this the new normal for cryptocurrency markets?

Crypto Prices Haywire: How to profit from the volatility

Cryptocurrencies are famously volatile, meaning their prices can change rapidly and often. This volatility can be a boon for investors, provided they know how to take advantage of it. Here are four tips for profit from crypto volatility.

1. Trade regularly

One of the keys to making money from crypto volatility is to trade frequently. This means buying and selling cryptocurrencies on a regular basis in order to capitalize on short-term changes in price.

2. Stay invested

Another key to making money from crypto volatility is to stay invested. This means having a long-term view and not giving into fear or greed. Staying invested will help you avoid sudden and dramatic losses, but it will also allow you to benefit from long-term price increases.

3. Don’t overreact

One of the dangers of crypto volatility is that it can lead to overreactions. When the price of a cryptocurrency starts to drop, many people will rush to sell, causing the price to drop even further. It’s important to remember that this kind of volatility is always temporary, and that the price of cryptocurrencies will eventually stabilize.

4. Know your risks

Finally, it’s important to understand the risks involved in trading cryptocurrencies. While there are occasional opportunities to make big profits, there are also risks associated with trading cryptocurrencies, including the risk of losing all your money. Before investing any money in cryptocurrencies, it’s important to do your own research and understand the risks involved.

Crypto Prices Haywire: What does this mean for the future of crypto?

Cryptocurrencies are famously volatile, meaning their prices can fluctuate greatly in short periods of time. This is especially true for new cryptocurrencies, which may experience huge price swings in their early days as speculators invest in them.

While crypto prices are often volatile, this does not always mean that the underlying technology or cryptocurrencies themselves are unstable or fraudulent. In some cases, a cryptocurrency's price may be affected by news events or political events.

Overall, though, crypto prices are notoriously volatile and should not be relied upon as a reliable indicator of the future of the technology or the underlying cryptocurrencies.

Crypto Prices Haywire: The good, the bad, and the ugly

The Crypto market has seen wild swings in prices over the past few weeks. Prices have surged and dipped in a seemingly never-ending cycle. This volatility has been dubbed “the crypto Haywire” by many.

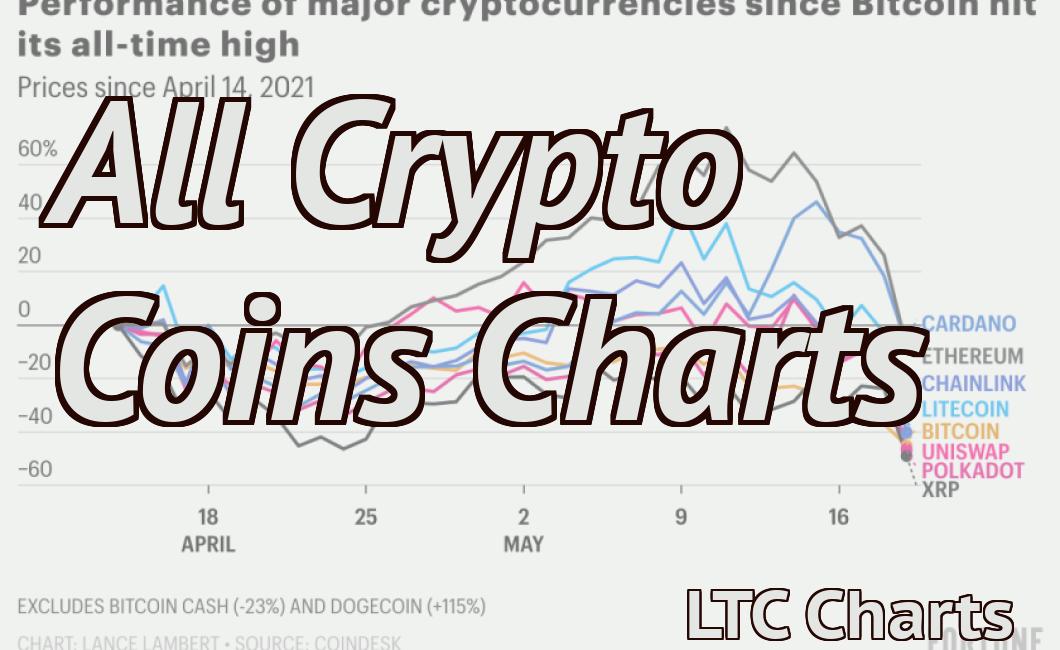

The good news is that the total value of all cryptocurrencies has hit an all-time high. The bad news is that the price of some of the most popular cryptocurrencies has plummeted by almost 90%.

Here are the three most important things you need to know about the crypto Haywire:

1. The Crypto Haywire is a result of a combination of factors

The crypto Haywire is the result of a combination of factors:

1) Increased investor interest: More people are starting to invest in cryptocurrencies, which has led to an increase in demand.

2) Increased demand for cryptos from speculative investors: Some people are buying cryptos for the sake of buying them, without any real intention of using them. This increased demand has pushed prices up.

3) Weakness in the fiat currency markets: Some people are investing in cryptocurrencies in order to hedge their bets against the risk of a weakening fiat currency. When the fiat currency markets start to weaken, this increases the risk of Bitcoin and other cryptocurrencies losing value.

2. It's important to stay aware of the risks involved

Although the crypto Haywire is exciting and exciting, it's important to remember that there are also risks involved.

1) The crypto Haywire is volatile: The prices of cryptocurrencies can swing wildly in a short period of time, which can be dangerous for those who are not prepared for it.

2) Cryptocurrencies are not backed by anything: Cryptocurrencies are not backed by anything, which means that they are not subject to the same rules as conventional currencies. This means that they can be subject to sudden and dramatic price changes, which can be risky for those who invest in them.

3) Cryptocurrencies are not regulated: Cryptocurrencies are not regulated by any authority, meaning that there is no guarantee that they will be safe to invest in. This means that there is a higher risk of fraud and theft.

Crypto Prices Haywire: How to protect your investments

As cryptocurrencies continue to be plagued by wild price swings and market volatility, many people are asking: What can I do to protect my investments?

The first step is to understand the basics of cryptocurrency investing. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are not regulated by governments or banks, so they are not subject to the same financial rules and regulations as traditional currencies. This makes them susceptible to rapid price swings and volatility.

So how can you protect your investments in cryptocurrencies?

The simplest way to protect your cryptocurrency holdings is to only invest what you can afford to lose. Don’t put all your eggs in one basket. diversify your portfolio across a variety of cryptocurrencies and digital assets.

Another way to protect your investments is to use a cryptocurrency wallet. A cryptocurrency wallet is a digital platform that stores your cryptocurrencies. Cryptocurrency wallets allow you to access your funds and make transactions.

Some people also choose to invest in cryptocurrency hedge funds. A cryptocurrency hedge fund is a collective investment vehicle that invests in cryptocurrencies and other digital assets.

Finally, don’t forget to stay informed about the latest news and events related to cryptocurrencies. Stay up to date on industry developments and make sure you understand the risks involved before you invest.

Crypto Prices Haywire: The experts weigh in

Crypto prices are haywire. Bitcoin is down over 10% on the day, while other cryptocurrencies are down by double digits. What’s going on?

Experts have their theories.

Some say that the sell-off is due to fears of a regulatory crackdown by the U.S. Securities and Exchange Commission (SEC). Earlier this week, the SEC sent subpoenas to several cryptocurrency exchanges, hinting at a possible regulatory crackdown.

Others say that the sell-off is due to technical issues with some of the major cryptocurrencies. For example, Bitcoin Cash has been struggling with a major fork, and this has caused some people to sell off their BCH tokens.

Whatever the reason, it’s clear that the crypto market is volatile and that prices can change quickly. So if you’re thinking of investing in cryptocurrencies, be sure to do your research first!

Crypto Prices Haywire: What you need to know

Cryptocurrencies are a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Since then, there have been dozens of other cryptocurrencies created, each with different features. Bitcoin is not the only cryptocurrency available, but it is by far the most popular.

Cryptocurrencies are not regulated by the government, and they are not subject to the same financial rules as traditional currencies. This means that you cannot use them to purchase goods and services.

What is causing the volatility in cryptocurrency prices?

Cryptocurrencies are highly volatile because there is no central authority that can guarantee their value. Bitcoin, for example, has experienced massive price fluctuations in recent years.

Some of the factors that contribute to cryptocurrency volatility include:

1. Limited supply: Cryptocurrencies are limited in number, and this scarcity factor has contributed to increased demand and higher prices.

2. Rapid growth: Cryptocurrencies have experienced rapid growth in popularity in recent years, which has led to increased demand and higher prices.

3. Volatility: Cryptocurrencies are highly volatile, which makes them risky and difficult to invest in longterm. This volatility can also lead to price swings on a daily basis.

How can I invest in cryptocurrencies?

There is no one-size-fits-all answer to this question, as the best way to invest in cryptocurrencies depends on your individual circumstances and goals. However, some tips on how to invest in cryptocurrencies include:

1. Do your research: Before investing in cryptocurrencies, do your research and figure out what kind of cryptocurrencies are available and what their risks and rewards are.

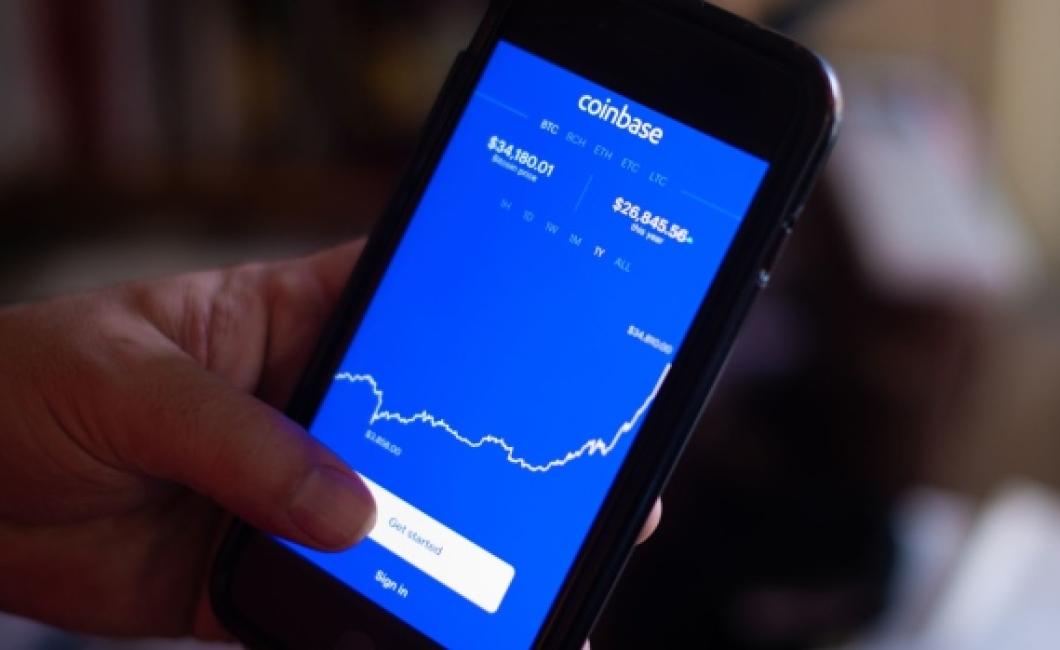

2. Use a reputable cryptocurrency exchange: Use a reputable cryptocurrency exchange to buy and sell cryptocurrencies. Make sure to choose an exchange that is safe and user-friendly.

3. Store your cryptocurrencies securely: Store your cryptocurrencies securely offline (in a physical wallet) or on a secure online platform.