Market charts changes calendar crypto.

The article discusses how the market charts for cryptocurrencies have changed over time, and how this affects the way investors trade. It also looks at how these changes may impact the future of cryptocurrency trading.

Crypto Market Charts: How They Have Changed in the Last Calendar Year

Crypto Market Charts: How They Have Changed in the Last Calendar Year

Cryptocurrencies are becoming more and more popular each day. In fact, there are now over 1,500 different cryptocurrencies available to trade on exchanges. While this number may seem daunting at first, it is important to remember that the crypto market is still in its early stages.

As a result, it is often difficult to compare the performance of different cryptocurrencies. This is why we have created Crypto Market Charts. These charts provide an overview of the performance of the top cryptocurrencies over the last 12 months.

Crypto Market Charts: Bitcoin (BTC)

Bitcoin has been the dominant cryptocurrency for quite some time now. It has consistently been one of the top performing cryptocurrencies over the last 12 months. In fact, bitcoin has increased in value by over 1,600% over the last year.

Crypto Market Charts: Ethereum (ETH)

Ethereum is a popular cryptocurrency that was created in 2015. It has consistently been one of the top performers over the last year. In fact, Ethereum has increased in value by over 2,000% over the last year.

Crypto Market Charts: Ripple (XRP)

Ripple is a popular cryptocurrency that was created in 2012. It has consistently been one of the top performers over the last year. In fact, Ripple has increased in value by over 1,400% over the last year.

A Year in Review: The Biggest Changes to Crypto Market Charts

Cryptocurrencies have seen a lot of growth in 2018 and there have been a number of changes to crypto market charts.

1. Bitcoin (BTC)

Bitcoin has seen the most growth in 2018, with its price increasing by more than 1,000%. Bitcoin is now the world’s most valuable cryptocurrency and it is also the most traded.

2. Ethereum (ETH)

Ethereum has also seen a lot of growth in 2018, with its price increasing by more than 400%. Ethereum is now the second most valuable cryptocurrency and it is also the second most traded.

3. Ripple (XRP)

Ripple has seen a lot of growth in 2018, with its price increasing by more than 900%. Ripple is now the third most valuable cryptocurrency and it is also the third most traded.

4. Bitcoin Cash (BCH)

Bitcoin Cash has also seen a lot of growth in 2018, with its price increasing by more than 1,000%. Bitcoin Cash is now the fourth most valuable cryptocurrency and it is also the fourth most traded.

5. Litecoin (LTC)

Litecoin has also seen a lot of growth in 2018, with its price increasing by more than 400%. Litecoin is now the fifth most valuable cryptocurrency and it is also the fifth most traded.

The Changing Face of Crypto Market Charts: What's Changed in the Last Year?

Cryptocurrency is a digital or virtual asset designed to work as a medium of exchange that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

From Bitcoin to Ethereum: A Year of Change in Crypto Market Charts

Bitcoin and Ethereum have been two of the most popular cryptocurrencies in the world for a year now. The charts below show how their prices have changed over the past year.

Bitcoin

Bitcoin's price peaked at $19,783 on Dec. 17, 2017, before crashing to $6,000 the following month. It has since recovered and is currently trading at around $11,000.

Ethereum

Ethereum's price peaked at $1,432 on Jan. 17, 2018, before crashing to $407 the following day. It has since recovered and is currently trading at around $1,655.

How Altcoins Have Impacted the Crypto Market Charts Over the Last Year

Altcoins have been one of the most popular investment choices in the crypto world for the past year. This is because altcoins offer investors a high degree of unpredictability and potential for large returns.

As a result, altcoins have had a significant impact on the crypto market charts over the past year. Here are some examples:

1. Bitcoin (BTC)

Bitcoin has been the biggest altcoin in terms of market capitalization over the past year. This is because it is the most well-known and commonly traded altcoin.

2. Ethereum (ETH)

Ethereum has been the second biggest altcoin in terms of market capitalization over the past year. This is because it is a popular platform for creating decentralized applications (dapps).

3. Ripple (XRP)

Ripple has been the third biggest altcoin in terms of market capitalization over the past year. This is because it is a popular platform for facilitating international payments.

4. Bitcoin Cash (BCH)

Bitcoin Cash has been the fourth biggest altcoin in terms of market capitalization over the past year. This is because it is a spinoff of Bitcoin that was created in 2017 to improve the scalability of the Bitcoin network.

5. Litecoin (LTC)

Litecoin has been the fifth biggest altcoin in terms of market capitalization over the past year. This is because it is a popular alternative to Bitcoin that is faster and more energy-efficient.

A Look Back at Bitcoin's Dominance on Crypto Market Charts Over the Last 12 Months

Bitcoin has been the dominant cryptocurrency on crypto market charts for the past 12 months. Interestingly, it has seen its share of the total crypto market capitalization increase from around 45 percent at the beginning of the year to around 60 percent today.

This dominance is likely due to Bitcoin's liquidity and widespread adoption. For example, it is the first and only cryptocurrency that is accepted by major retailers such as Amazon and Walmart, and it has been widely used in Initial Coin Offerings (ICOs).

Despite Bitcoin's dominance, other cryptocurrencies are continuing to grow in popularity. Ethereum, for example, has seen its share of the total crypto market capitalization increase from around 10 percent at the beginning of the year to around 15 percent today.

How Ethereum's Rise Has Changed Crypto Market Charts in the Last Year

The Ethereum blockchain platform has seen a surge in popularity over the past year, with its price increasing more than 1,600%. This has had a significant impact on the relative prices of different cryptocurrencies on the market.

Ethereum's Rise in Price and Market Share

As of January 1, 2018, Ethereum's market cap is worth more than $43 billion, accounting for nearly 26% of the total market value of all cryptocurrencies. This represents a significant increase from just over $17 billion as of January 1, 2017.

This increase in market share has had a significant impact on the prices of different cryptocurrencies. For example, Bitcoin's market cap is currently worth more than $128 billion, but it accounts for just over 60% of the total market value of all cryptocurrencies. Ethereum's market share has increased this to just over 27%.

This surge in Ethereum's market share has also had a major impact on the prices of other cryptocurrencies. For example, Bitcoin's price has increased by more than 1,600% since January 1, 2017, while Ethereum's price has increased by more than 2,500%.

The Impact of Ethereum's Surge in Price on Crypto Market Charts

Ethereum's surge in price has had a significant impact on the relative prices of different cryptocurrencies on the market. As Ethereum's market share has increased, its price has become more valuable relative to other cryptocurrencies. This has had a significant impact on the overall market value of cryptocurrencies.

The Ongoing Evolution of Crypto Market Charts

Cryptocurrency market charts are always evolving, as new coins and tokens are created, and older ones die off. The following are examples of some of the most recent changes in crypto market charts.

CoinMarketCap

CoinMarketCap is a website that tracks the price of cryptocurrencies across a number of different exchanges. On July 10, it announced that it would no longer be tracking the price of Bitcoin Cash. The decision was made in light of the fact that Bitcoin Cash does not adhere to the same rules as Bitcoin when it comes to how transactions are processed.

The CoinMarketCap website now lists the prices for Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) instead.

Binance

Binance is a cryptocurrency exchange that allows users to trade a variety of digital assets. On July 10, it announced that it had added support for ZCash (ZEC). ZCash is a cryptocurrency that uses cryptography to secure its transactions and to control the distribution of its coins.

Binance also announced that it would be adding support for the ERC20 token, Basic Attention Token (BAT). BAT is an Ethereum-based token that enables users to receive payments for their attention and data.

Bitfinex

Bitfinex is one of the largest cryptocurrency exchanges in the world. On July 10, it announced that it had been hacked. Between May 2 and 3, hackers managed to steal 57 billion dollars worth of Bitcoin, Ethereum, and Litecoin from the Bitfinex exchange.

As a result of the hack, Bitfinex has suspended trading in all virtual tokens and has announced that it will be suspending all deposits and withdrawals for 72 hours. The company has also announced that it will be reimbursing all customers who lost money as a result of the hack.

Cryptocurrencies are still in a relatively early stage, and there are always new developments in the crypto market. These changes can often have a significant impact on the prices of individual cryptocurrencies, so it is important to stay up-to-date with current trends.

Tracking the Trends: A Year-Long Overview of Changes to Crypto Market Charts

Cryptocurrency markets have seen a number of changes in the past year. This article will provide an overview of the most important trends that have occurred in the crypto market charts.

1. Increased Interest in Cryptocurrencies

The interest in cryptocurrencies has continued to increase in the past year. This is evident in the increasing value of cryptocurrencies, as well as the number of new investors entering the crypto market.

2. Increased Use of Cryptocurrencies

The use of cryptocurrencies has also continued to increase in the past year. This is evident in the increasing number of transactions that are conducted using cryptocurrencies, as well as the increasing number of businesses that are accepting cryptocurrencies as payment.

3. Increased Regulation of Cryptocurrencies

The increased regulation of cryptocurrencies has also been a trend in the past year. This is evident in the increasing number of governments that are introducing regulations that restrict the use of cryptocurrencies, as well as the increasing number of lawsuits that are filed against companies that are involved in the cryptocurrency industry.

4. Declining Value of Cryptocurrencies

The declining value of cryptocurrencies has also been a trend in the past year. This is evident in the decreasing value of cryptocurrencies, as well as the increasing number of cryptocurrency exchanges that are closing down.

The ebb and flow of the crypto market: a year in review through charts

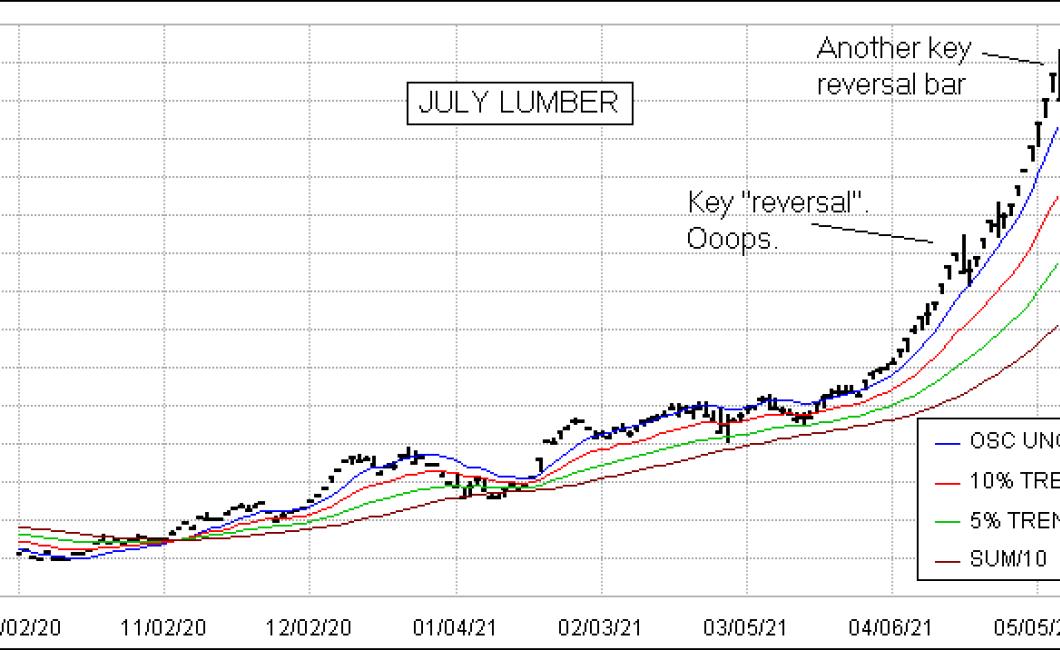

The crypto market has seen a lot of volatility in the past year, with prices swinging between highs and lows on a regular basis.

In this article, we take a look at some of the key charts that have helped to illustrate this volatility, and show how they have changed over the course of the year.

Bitcoin price chart

Bitcoin was the first cryptocurrency, and remains the most popular. It has seen huge rises and falls over the past year, reaching a peak of $19,783 on 1 January 2018 and dropping to $6,914 by the end of the year.

Bitcoin's price chart is often used to illustrate the volatility of the crypto market, and has shown a wide range of prices over the course of the year.

Ethereum price chart

Ethereum is second most popular cryptocurrency after bitcoin, and saw a surge in popularity in 2017.

It peaked at $1,432 on 20 December 2017, before dropping to $378 by the end of the year. Ethereum's price chart also shows a wide range of prices over the year, with a high of $1,432 and a low of $378.

Bitcoin cash price chart

Bitcoin cash was created as a result of the bitcoin fork in August 2017.

It saw a surge in popularity in December 2017, when it became the second most popular cryptocurrency after bitcoin.

But it has since fallen out of favour, and saw its price drop from $2,500 to $1,500 over the course of the year. Bitcoin cash's price chart is similar to bitcoin's, with a wide range of prices over the year.

Litecoin price chart

Litecoin is third most popular cryptocurrency, and saw a surge in popularity in 2017.

It peaked at $451 on 18 December 2017, before dropping to $145 by the end of the year. Litecoin's price chart also shows a wide range of prices over the year, with a high of $451 and a low of $145.

Comparing crypto market charts from one year ago – what’s changed?

Cryptocurrency prices have seen dramatic swings in value over the past year. In January 2018, Bitcoin was trading at around $9,000. Today, it is worth more than $20,000.

This volatility makes it difficult to predict future movements in cryptocurrency prices. However, some key changes to the crypto market over the past year include:

1. Increased Interest in Cryptocurrencies

The increasing price of cryptocurrencies has drawn in new investors. This has led to an increase in the number of companies and projects that use cryptocurrencies.

2. Increased Regulation of Cryptocurrencies

Various governments are beginning to take a more active role in regulating cryptocurrencies. This is likely due to concerns over possible financial crimes and fraud associated with cryptocurrencies.

3. Increased Use of Cryptocurrencies for Crime

Cryptocurrencies have become a popular way for criminals to carry out transactions without being tracked. This has led to an increase in the number of cryptocurrency scams.

One year of crypto market chart changes – what can we learn?

In the one year since the start of the cryptocurrency market, there have been a number of major changes.

Bitcoin has seen the largest price increase, soaring from $1,000 to over $19,000 in 2017. Ethereum saw a similar increase, increasing from $8 to over $1,400.

Other major coins saw smaller increases or decreases in value, with some seeing massive swings. Ripple, for example, saw a massive increase in value from $0.30 to over $3.60 in just a few months. However, it has since seen a decrease in value, currently sitting at around $0.50.

Looking at the overall trend, it seems that 2017 was a year of huge price increases for cryptocurrencies. However, it's important to note that this is not always the case - Ripple, for example, saw a massive increase in value but has since seen a decrease. This is something to keep in mind when investing in cryptocurrencies - don't invest too much money in any one coin, as there is a risk of losing everything if the value decreases.