Technical Charts For Crypto

If you're looking for technical charts for crypto, look no further! In this article, we'll show you where to find the best ones. We'll also explain what they mean and how to use them to make better trading decisions.

How to Use Technical Charts for Crypto Trading

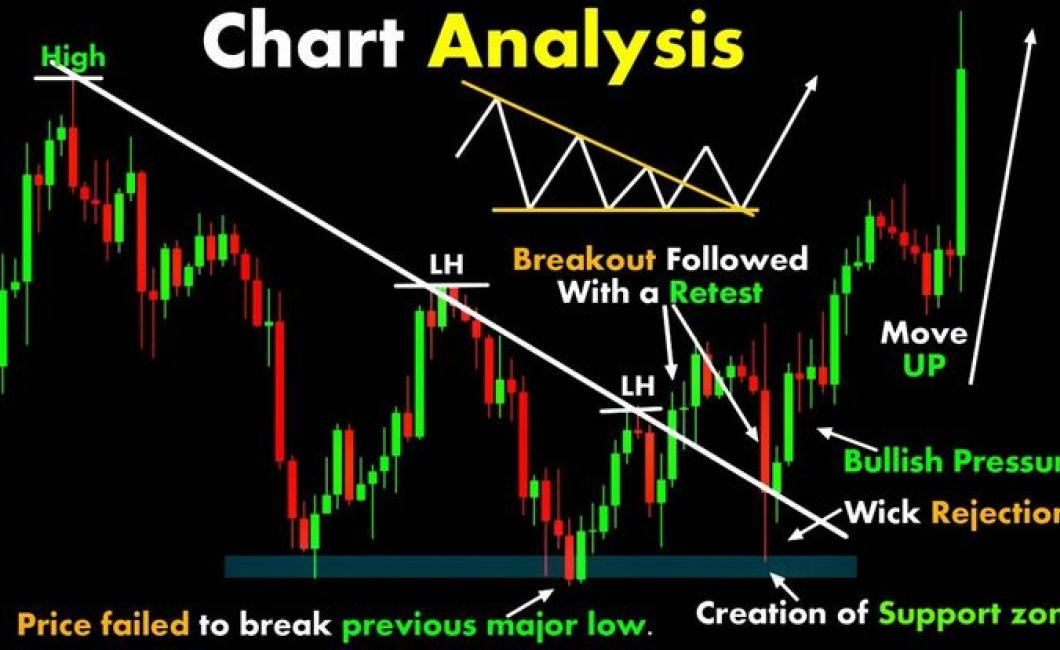

Technical charts are a great way to help traders make informed decisions about how to trade crypto. Technical analysis is the practice of using charts and other indicators to identify trends and predict future prices.

When trading cryptocurrencies, it is important to keep an eye on the following technical indicators:

1) Support and Resistance Levels

Support and resistance levels are important indicators of where the market is likely to find stability. When a price moves below a support level, it is likely to rebound soon. Conversely, when a price moves above a resistance level, it is likely to fall soon.

2) The 100 Day Moving Average

The 100 day moving average is a popular technical indicator that helps identify trends. When an asset moves above or below the 100 day moving average, it is indicative of a trend.

3) The MACD

The MACD is a popular technical indicator that helps identify trends. When the MACD line moves above the Signal Line, it is indicative of a bullish trend. When the MACD line moves below the Signal Line, it is indicative of a bearish trend.

3 Important Technical Charts for Crypto Traders

Crypto Trading Technical Charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin (BTC) is the first and most well-known cryptocurrency. Bitcoin is traded on open exchanges and used as a means of payment for goods and services. Over time, there have been numerous other cryptocurrencies created, such as Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Many online merchants now accept cryptocurrencies as payment.

What do Technical Charts for Cryptocurrency Mean?

Technical charts for cryptocurrencies are used to provide a snapshot of the current state of the market. Charting tools allow traders and investors to see the price and volume of different cryptocurrencies, as well as their trends.

How to Read Technical Charts for Cryptocurrencies

The best way to read technical charts for cryptocurrencies is to identify key indicators and look for changes over time. For example, if you are looking at the price of Bitcoin, you would want to watch the price over time, and look for changes in volume and market volatility.

Trading Cryptocurrency with Technical Charts

Technical charts can be a great way to help traders make informed decisions about whether or not to trade cryptocurrencies.

Chart analysis can help traders understand the current price trend, the volume of transactions, and other important technical indicators.

When trading cryptocurrencies, it is important to pay attention to the following technical indicators:

1) The trend line – This is a graphical representation of the recent price movement. If the trend line is rising, then the price is likely increasing. If the trend line is falling, then the price is likely decreasing.

2) The support and resistance levels – These are determined by the highest and lowest prices reached during the recent price movement. If the price falls below the support level, then buyers may start to emerge and the price may rise again. If the price rises above the resistance level, then sellers may start to emerge and the price may fall again.

3) The volume of transactions – This indicator can help traders determine whether or not there is strong demand for cryptocurrencies. If the volume of transactions is high, then it may be a good time to invest in cryptocurrencies.

4) The MACD – This indicator helps traders identify whether or not the price is moving in a positive or negative direction. If the MACD is in a positive or bullish direction, then the price is likely increasing. If the MACD is in a negative or bearish direction, then the price is likely decreasing.

Analyzing Cryptocurrency with Technical Charts

Cryptocurrency prices are often highly volatile and can be quite unpredictable. This can make it difficult to make informed investment decisions. In order to help make sense of cryptocurrency prices and chart trends, it is helpful to use technical charts.

When analyzing cryptocurrency prices using technical charts, it is important to take into account several factors. These include:

1) Supply and Demand: Cryptocurrency prices are determined by the demand and supply of coins. When there is a high demand for a cryptocurrency, the price will be higher. Conversely, when there is a low demand for a cryptocurrency, the price will be lower.

2) Volume: The volume of a cryptocurrency marketplace is another important factor to consider when analyzing cryptocurrency prices. High volume indicates that there is a high level of interest in that particular cryptocurrency. Low volume may indicate that there is less interest in a particular cryptocurrency.

3) Technical Analysis: Technical analysts use charts and indicators to predict future trends in the market. They may look for patterns such as support and resistance levels, Fibonacci retracements, and trend lines.

4) News Events: News events can have a significant impact on cryptocurrency prices. For example, if a major company announces plans to start accepting bitcoin as payment, this could cause a surge in demand for bitcoin and other cryptocurrencies.

Technical charts can be a helpful tool for understanding cryptocurrency prices. However, it is important to remember that they are only one factor that should be taken into account when making investment decisions.

Using Technical Charts to Trade Bitcoin

Technical analysis is a method traders use to analyze the price movements of assets in order to predict future trends. Technical charts can help traders identify patterns and signals that can help them make informed trading decisions.

One of the most popular technical analysis tools is the candlestick chart. Candlestick charts are used to display the price movement of assets over time. They are also used to identify patterns and signals that can help traders make informed trading decisions.

Another popular technical analysis tool is the moving average. Moving averages are used to identify short-term trends and can be used to predict future price movements.

Using Technical Charts to Trade Ethereum

Technical analysis is a method of trading whereby traders study charts and indicators to predict future price movements. Technical charts can be helpful in determining the direction of a cryptocurrency's price movement, and can be used to make informed trading decisions.

Ethereum's price is highly volatile, and can often be affected by a variety of factors including news events, technical analysis, and global market conditions. As such, it is important to use caution when trading Ethereum, and to ensure that your trading strategy is based on sound technical analysis.

To help you trade Ethereum effectively, we recommend using our technical analysis tools. Our Ethereum price charts provide a detailed view of Ethereum's price history, and allow you to see how the currency's prices have been affected by various factors. Additionally, our Ethereum price indicators provide real-time information on the currency's current market conditions.