Crypto Trader Charts

This article discusses the various charts that can be used by crypto traders to help them make informed decisions about when to buy and sell digital assets. It covers different types of charts, including candlestick, bar, and line charts, and explains how each one can be used to identify key trends and patterns. The article also includes a section on technical indicators, which can be used in conjunction with charts to provide even more information about market conditions.

How to read crypto charts for beginners

Crypto charts are visual representations of the price movement of digital assets. They can be helpful in identifying trends and predicting prices.

To understand crypto charts, you first need to understand how digital currencies work. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrency charts are divided into three main categories: day, week, and month.

Cryptocurrency charts are usually generated using trading platforms such as TradingView or CoinMarketCap. They show the current price of a cryptocurrency, the 24-hour volume, and the percentage change from the previous day.

To use crypto charts, you first need to understand the following concepts:

Cryptocurrency: a digital or virtual token that uses cryptography to secure its transactions and to control the creation of new units

Digital asset: any asset that is represented in digital form

Cryptocurrency market: the collective of all cryptocurrency markets

Digital asset market: the collective of all digital asset markets

Day: a 24-hour period starting at midnight UTC

Week: a seven-day period starting on Monday morning UTC

Month: a 30-day period starting on the first day of the month

The ultimate guide to reading crypto charts

When you’re reading crypto charts, it’s important to have an understanding of what they are and how they work.

Crypto charts are visual representations of the price of a cryptocurrency over time. They can be used to help you make better investment decisions.

Here is a guide to understanding crypto charts:

What is a crypto chart?

A crypto chart is a visual representation of the price of a cryptocurrency over time.

How do crypto charts work?

Crypto charts use a variety of data sources to produce their visuals. These sources can include:

– Exchange data

– Prices on various markets

– Mining data

– Social media activity

Cryptocurrencies are unique in that their prices are highly volatile and often move in opposite directions. This makes it difficult to predict their future movements.

Crypto charts are designed to help you make informed investment decisions. They can show you how well a cryptocurrency is performing against its peers, and how its prices have responded to different events.

How to read a crypto chart

To read a crypto chart, you first need to understand the different types of data it uses. Then, you need to understand how those data sources interact. Finally, you need to use that knowledge to interpret the chart’s contents.

Types of data used in crypto charts

Crypto charts use a variety of data sources to produce their visuals. These sources can include:

– Exchange data

– Prices on various markets

– Mining data

– Social media activity

Each of these data sources has its own strengths and weaknesses.

Exchange data

Exchange data is the most common type of data used in crypto charts. It provides a snapshot of the current market conditions.

Prices on various markets

Prices on various markets are another common source of data used in crypto charts. They provide a snapshot of the current market conditions across a range of currencies and exchanges.

Mining data

Mining data is another common source of data used in crypto charts. It provides a snapshot of the current mining conditions for a cryptocurrency. This data can be helpful in predicting how quickly a cryptocurrency will reach its target value.

Social media activity

Social media activity is another common source of data used in crypto charts. It provides a snapshot of the popularity of a cryptocurrency among its online community.

How to use crypto chart data

To use crypto chart data, you first need to understand how it works. Then, you need to use that information to interpret the chart’s contents.

Understanding how crypto chart data works

Crypto chart data is designed to help you make informed investment decisions. It can show you how well a cryptocurrency is performing against its peers, and how its prices have responded to different events.

However, crypto chart data is highly volatile and often moves in opposite directions. This makes it difficult to predict its future movements.

Therefore, it’s important to approach crypto chart analysis with caution. Only use crypto chart data as part of an overall investment strategy.

Interpreting crypto chart data

To interpret a crypto chart, you first need to understand how the different data sources interact. Each data source has its own strengths and weaknesses.

For example, exchange data provides a snapshot of the current market conditions. However, it’s limited in scope – it only covers a single exchange or market.

Price on various markets can help you fill in the gaps left by exchange data. It covers a wider range of currencies and exchanges, making it more reliable. Additionally, it’s updated more frequently than exchange data.

Mining data can also be helpful in interpreting a crypto chart. It can help you predict how quickly a cryptocurrency will reach its target value. Additionally, mining data can indicate which cryptocurrencies are most profitable to mine.

Social media activity can also be helpful in interpreting a crypto chart. It provides a snapshot of the popularity of a cryptocurrency among its online community. This information can be helpful in identifying which cryptocurrencies are gaining traction among investors.

A beginner's guide to understanding crypto charts

Cryptocurrencies are a digital asset class that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The most important crypto chart patterns for traders

There are a number of important crypto chart patterns for traders to be aware of. Some of the most popular include the head and shoulder pattern, the inverse head and shoulder pattern, and the triangle pattern.

The head and shoulder pattern is a bullish pattern that consists of two consecutive up trends. The pattern is often identified by the prices forming an upward-pointing head, followed by a downward-pointing shoulder.

The inverse head and shoulder pattern is a bearish pattern that consists of two consecutive down trends. The pattern is often identified by the prices forming an upward-pointing shoulder, followed by a downward-pointing head.

The triangle pattern is another popular bullish pattern that consists of three consecutive up trends. The pattern is often identified by the prices forming a triangle, with the apex at the highest point of the triangle and the two lower points intersecting at a lower price.

How to use candlestick charts to trade cryptocurrency

Candlestick charts are a popular way to trade cryptocurrencies. They show the price of a cryptocurrency over time, and can be used to identify patterns in the market.

To use candlestick charts to trade cryptocurrencies:

1. Set up a trading account with a cryptocurrency exchange.

2. Deposit your chosen cryptocurrency into your account.

3. Buy or sell cryptocurrencies at the appropriate price point on the exchange.

4. Watch the candlestick chart to see if there are any patterns that you can exploit.

How to read crypto order books and charts

Crypto exchanges offer different ways of reading order books and charts. In general, there are three main ways to read order books and charts:

1. Use a depth chart to see the total outstanding orders of a particular coin at each price point.

2. Use a balance sheet to see how much a particular coin is worth at each price point.

3. Use a volume chart to see how much a particular coin has been traded at each price point.

Using a depth chart to see the total outstanding orders of a particular coin at each price point is the most basic way to read order books and charts. This information can be helpful in determining where the demand for a coin is located. For example, if you are interested in buying Bitcoin, you would want to look at the depth chart to see where the demand is located.

Using a balance sheet to see how much a particular coin is worth at each price point is another way to read order books and charts. This information can be helpful in determining whether or not it is a good time to buy a particular coin. For example, if you are looking to buy Bitcoin, you would want to look at the balance sheet to see how much Bitcoin is worth at each price point.

Using a volume chart to see how much a particular coin has been traded at each price point is another way to read order books and charts. This information can be helpful in determining whether or not it is a good time to buy a particular coin. For example, if you are looking to buy Bitcoin, you would want to look at the volume chart to see how much Bitcoin has been traded at each price point.

Trading cryptocurrency: A beginner's guide to reading charts

Charts are an important tool for traders and investors. They can help you to understand the market, predict future movements, and make informed decisions.

Before you can read a chart, you need to understand some basic concepts. These include:

1. Time period: A chart shows the price movement of a particular asset over a specific time period.

2. Chart type: There are two main types of charts: price charts and time charts.

3. Chart indicators: Charts often include indicators, which show how the market is performing.

4. Chart patterns: Patterns can indicate the direction of the market, and can be useful for predicting future movements.

5. Trading signals: When you see a trading signal, it means that the market is about to move in a particular direction.

Now that you understand the basics of charts, let's look at some common chart types and how to use them.

Price charts

Price charts show the price movement of an asset over a period of time. They're usually divided into two categories: moving averages and candlesticks.

Moving averages are a type of charting indicator that smooths out the fluctuations in the price data. They show you the average price over a certain period of time.

candlesticks are a type of charting indicator that shows the change in price over a period of time. They consist of a body (the candle), a wick (the line that represents the candle's height), and the closing price (the point at which the candle was set).

Time charts

Time charts show the cumulative price movement over a specific time period. This can be helpful for understanding longer-term trends.

Chart types

There are two main types of charts: price charts and time charts.

Price charts show the price movement of an asset over a period of time. They're usually divided into two categories: moving averages and candlesticks.

Moving averages are a type of charting indicator that smooths out the fluctuations in the price data. They show you the average price over a certain period of time.

Candlesticks are a type of charting indicator that shows the change in price over a period of time. They consist of a body (the candle), a wick (the line that represents the candle's height), and the closing price (the point at which the candle was set).

Time charts show the cumulative price movement over a specific time period. This can be helpful for understanding longer-term trends.

Top 5 things every crypto trader must know about charts

1. Charting is an important part of any trading strategy.

2. There are a variety of different types of charts available, and each can be used for different purposes.

3. A chart can provide an overview of a market, help you identify trends, and help you determine when to buy or sell.

4. When interpreting charts, it is important to keep in mind the technical indicators that are associated with the specific chart type.

5. It is also important to be aware of the risks associated with trading cryptocurrency markets, and to take appropriate precautions to protect yourself

How to read and trade cryptocurrency price charts

Cryptocurrency price charts are a useful tool for understanding the current value of a cryptocurrency and for making trading decisions.

To read a cryptocurrency price chart, you first need to understand how to read a candlestick chart. Candlestick charts are a type of technical analysis chart that displays the price of a cryptocurrency over time.

A candlestick is a visual representation of the change in price over a given period of time. A candlestick is composed of two parts: the body and the tail. The body is the part of the candlestick that shows the open and close prices, and the tail is the part of the candlestick that shows the change in price over the given period of time.

To read a cryptocurrency price chart, you first need to understand how to read a candlestick chart. Candlestick charts are a type of technical analysis chart that displays the price of a cryptocurrency over time.

A candlestick is a visual representation of the change in price over a given period of time. A candlestick is composed of two parts: the body and the tail. The body is the part of the candlestick that shows the open and close prices, and the tail is the part of the candlestick that shows the change in price over the given period of time.

To read a cryptocurrency price chart, you first need to understand how to read a candlestick chart. Candlestick charts are a type of technical analysis chart that displays the price of a cryptocurrency over time.

A candlestick is a visual representation of the change in price over a given period of time. A candlestick is composed of two parts: the body and the tail. The body is the part of the candlestick that shows the open and close prices, and the tail is the part of the candlestick that shows the change in price over the given period of time.

The most important thing to remember when reading a cryptocurrency price chart is to look for patterns. Patterns can help you identify opportunities for buying or selling cryptocurrencies.

For example, if you see a pattern of prices increasing or decreasing over time, this may be an indication that a price rally or bear market is about to start or end.

You can also use patterns to predict future movements in the price of cryptocurrencies. For example, if you see a pattern of prices increasing gradually over time, this may be an indication that the price of the cryptocurrency is about to increase significantly.

If you see a pattern of prices dropping gradually over time, this may be an indication that the price of the cryptocurrency is about to decrease significantly.

A complete guide to understanding and reading crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

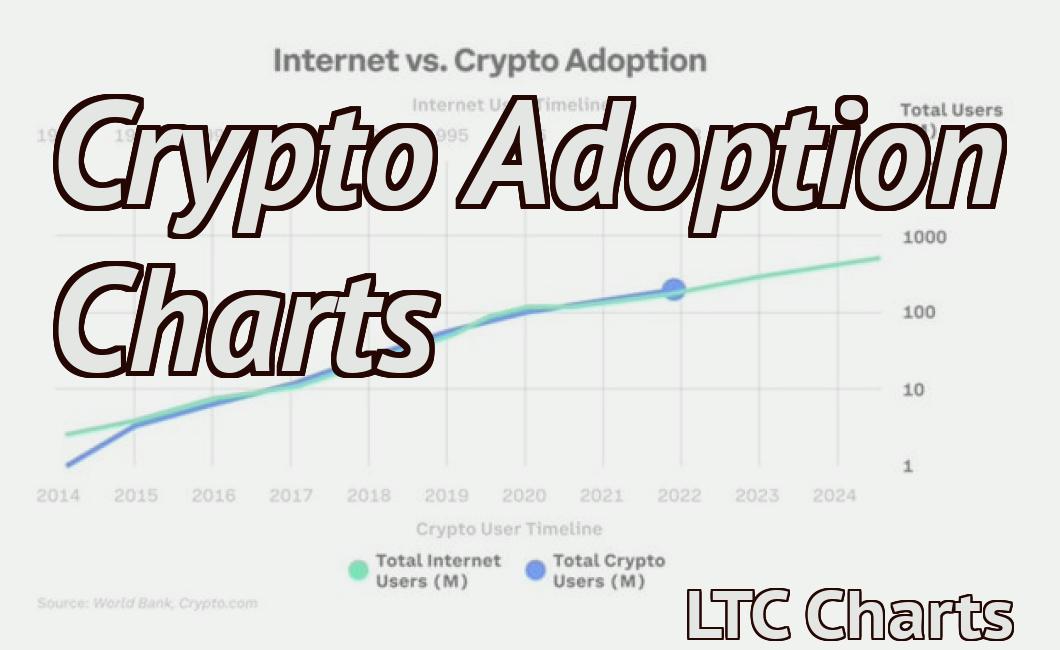

Cryptocurrency charts are used to track the performance of a cryptocurrency over time. The charts show the price of a cryptocurrency over time and can also show the number of transactions that have taken place.

When you are looking at a cryptocurrency chart, you will first need to identify the cryptocurrency that you are interested in. Bitcoin, Ethereum, Litecoin, and other cryptocurrencies are all represented on different types of charts. After you have identified the cryptocurrency, you will need to find the chart that is specific to that cryptocurrency.

Once you have found the chart, you will need to understand how to read it. The first thing that you will need to look at is the chart itself. The chart will show the price of the cryptocurrency over time. You will also be able to see the number of transactions that have taken place.

After you have looked at the chart, you will need to look at the indicators. The indicators are lines that are used to show the trend of the cryptocurrency. The indicators will change over time, so you will need to pay close attention to them.

The next thing that you will need to look at is the technical indicators. The technical indicators are used to help you figure out how the cryptocurrency is doing. The technical indicators will show you how much volatility there is in the cryptocurrency.

The last thing that you will need to look at is the candle chart. The candle chart is used to show how the price of the cryptocurrency is changing over time. The candle chart will show you how many candles have been created over the course of the day.

The ultimate guide to reading and trading cryptocurrency charts

Cryptocurrency charts are a powerful tool for understanding the market, and for trading. However, not all charts are created equal, and knowing how to read and trade them can be a daunting task. This guide will teach you everything you need to know to effectively read and trade cryptocurrency charts.

First, let’s look at what a cryptocurrency chart is. A cryptocurrency chart is a graphical representation of price data over time. It shows the price of a cryptocurrency over a given period of time, usually 24 or 48 hours. The vertical axis shows the price of the cryptocurrency, while the horizontal axis shows the time period.

The first thing you need to do when looking at a cryptocurrency chart is to understand the terminology. On most charts, the leftmost column is called the “time frame” or “time scale”, and it shows the number of hours or days represented by the chart. The next column to the left is called the “horizontal axis”, and it shows the price of the cryptocurrency over that time frame. The next column is called the “volume” or “volume scale”, and it shows the number of transactions that occurred during that time period. The last column is called the “price” or “price scale”, and it shows the price of the cryptocurrency at that point in time.

Now that you know what a cryptocurrency chart is, let’s look at how to read and trade them. The first step is to understand how to read a chart. On most charts, the leftmost column is always the “time frame” or “time scale”, and it shows the number of hours or days represented by the chart. The next column to the left is always the “horizontal axis”, and it shows the price of the cryptocurrency over that time frame. The next column is always the “volume” or “volume scale”, and it shows the number of transactions that occurred during that time period. The last column is always the “price” or “price scale”, and it shows the price of the cryptocurrency at that point in time.

Now that you know how to read a cryptocurrency chart, the next step is to understand how to trade it. The first thing you need to do is to understand how to read a candlestick chart. A candlestick chart is a type of chart that shows the price of a cryptocurrency over a given period of time. It shows the open, high, low, and close prices for a given period of time. The open price is the price at which the order was placed, the high price is the highest price recorded during that period, the low price is the lowest price recorded during that period, and the close price is the price at which the order was cancelled or filled.

The next step is to understand how to trade a cryptocurrency chart. The first thing you need to do is to understand how to trade a candlestick chart. A candlestick chart is a type of chart that shows the price of a cryptocurrency over a given period of time. It shows the open, high, low, and close prices for a given period of time. The open price is the price at which the order was placed, the high price is the highest price recorded during that period, the low price is the lowest price recorded during that period, and the close price is the price at which the order was cancelled or filled.

The next step is to understand how to trade a cryptocurrency chart. The first thing you need to do is to understand how to trade a candlestick chart. A candlestick chart is a type of chart that shows the price of a cryptocurrency over a given period of time. It shows the open, high, low, and close prices for a given period of time. The open price is the price at which the order was placed, the high price is the highest price recorded during that period, the low price is the lowest price recorded during that period, and the close price is the price at which the order was cancelled or filled.

Once you have learned how to read and trade cryptocurrency charts, you are ready to start trading cryptocurrencies.

How to read crypto charts like a pro

Cryptocurrency charts are a great way to get an overview of the market and make informed decisions. Here are some tips to help you read crypto charts like a pro:

1. Look at the overall trend

The first step is to look at the overall trend. This will give you an idea of how the market is moving and how volatile it is. Try to stay aware of the big picture so that you can make informed decisions.

2. Check the price action

Once you have an idea of the overall trend, it’s important to check the price action. This will give you an idea of where the market is heading and whether or not there are any potential opportunities.

3. Watch for trends

Once you have a good understanding of the market, it’s important to watch for trends. This will help you identify any patterns or signals that might indicate a potential investment opportunity.

4. Don’t get overwhelmed

Cryptocurrencies are highly volatile, so it’s important to do your own research before making any investments. Don’t get overwhelmed by the charts; instead, focus on understanding the market and making sure you’re making informed decisions.